Middle Eastern smartphone market to grow in low single digits in 2025 amid macroeconomic headwinds

25 November 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

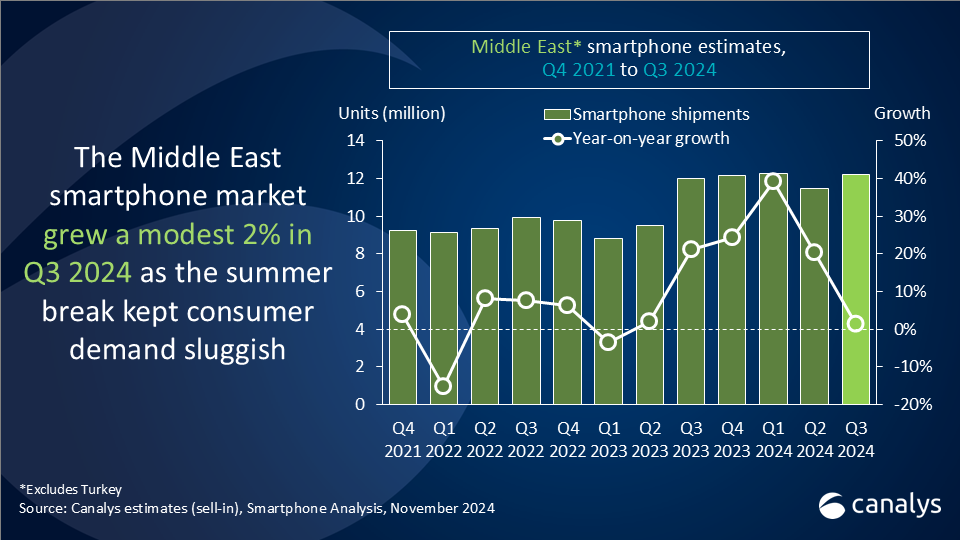

Canalys’ latest research reveals that the Middle Eastern smartphone market (excluding Turkey) grew a modest 2% year on year in Q3 2024, with shipments reaching 12.2 million units. This was mainly due to declining oil prices, escalating geopolitical tensions and the summer break when expatriates went on vacation, resulting in slowed demand across key markets. Despite these challenges, the long-term potential remains robust as vendors invest in local operations for sustained growth.

In Q3 2024, the Middle East smartphone market encountered headwinds due to the summer slowdown when expatriates departed for vacation, despite retail promotions and new product launches. Saudi Arabia, the region's largest market, saw a 1% decline as high inflation in housing, food and hospitality curbed consumer spending, limiting market growth despite aggressive “Kingdom’s National Day” discounts from retailers. Conversely, the UAE experienced a strong 16% year-on-year growth, spurred by events like Dubai Summer Surprises (DSS) and robust back-to-school promotions from retailers such as Sharaf DG and Emax. These promotions, combined with bundled offers and split-payment plans, boosted demand, while the UAE’s thriving tourism and entertainment sectors enhanced consumer confidence.

Iraq, one of the fastest-growing markets until Q2 2024, saw a 3% decline due to higher device ASPs, driven by increased procurement costs in US dollars. However, the government’s plan for a manufacturing plant in Erbil aims to support local production. Qatar’s market softened by 1% while Kuwait posted a 5% increase in demand, with its affluent population driving sustained growth.

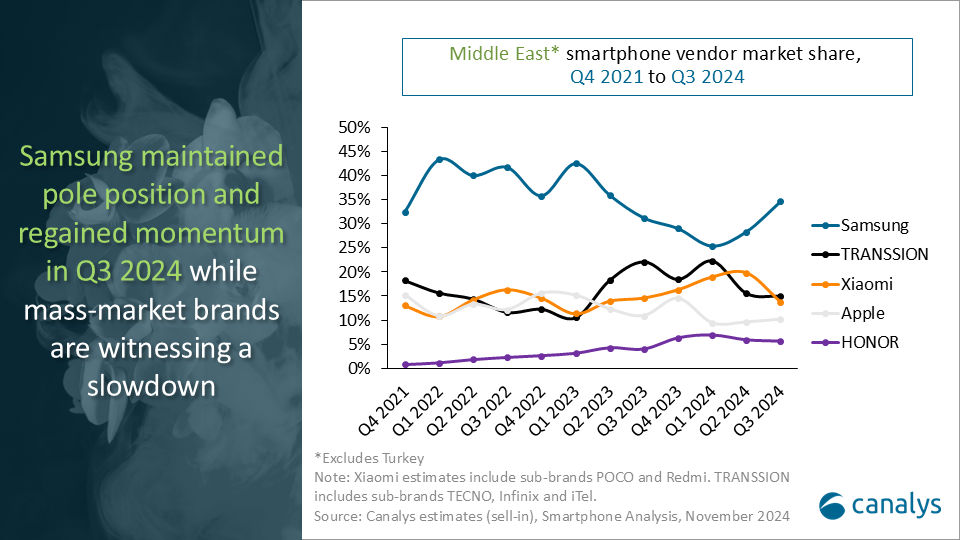

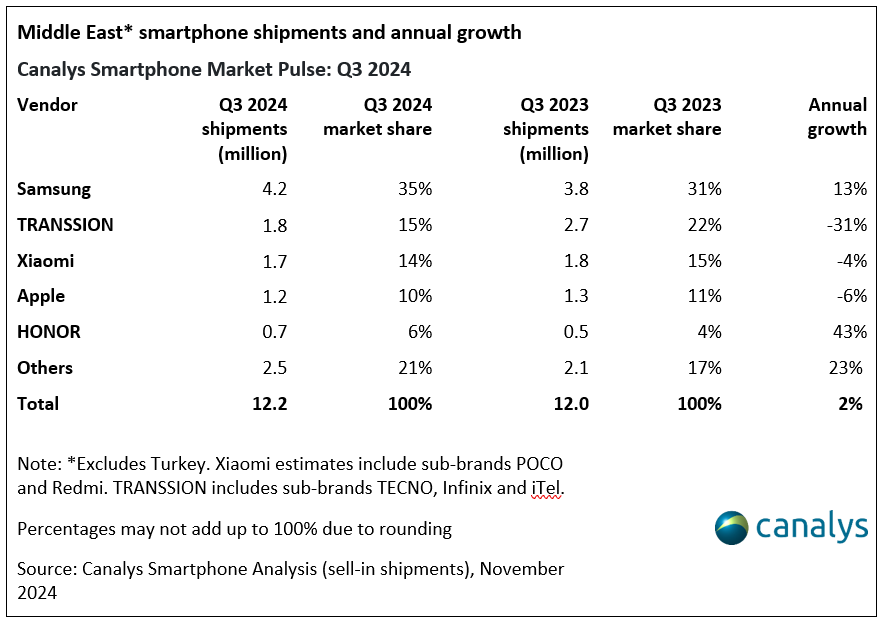

“Samsung has regained momentum while mass-market brands are experiencing a slowdown after a strong performance in the first half of the year,” noted Manish Pravinkumar, Senior Analyst at Canalys. “Samsung achieved a 13% growth in Q3 2024, fueled by strong demand for its A-series and S24 models, bolstered by competitive pricing and channel incentives. While Apple saw a 6% dip as consumers held off for the upcoming iPhone 16, demand for the iOS ecosystem remains robust as we approach year-end. Mass-market brands like TRANSSION and Xiaomi faced declines of 31% and 4%, respectively, with TRANSSION’s TECNO brand witnessing a notable 50% drop despite partnerships with the region's biggest retailer Lulu Hypermarkets. Infinix and iTel also experienced challenges, with declines of 14% and 24%, respectively. Xiaomi witnessed a drop despite the launch of the budget-friendly Redmi 14C, alongside facing challenges in gaining traction in the premium segment. Emerging brands HONOR and Motorola showed strong growth, increasing 43% and 61%, respectively. HONOR expanded its mid-range lineup and launched brand stores in Dubai to boost consumer engagement while Motorola's affordable 5G series drove strong volumes.”

“In 2025, the Middle East smartphone market is expected to grow modestly, driven by longer device replacement cycles, political complexities and economic fluctuations,” added Pravinkumar. “Canalys forecasts low-single-digit growth, with a slower pace of device upgrades while ASPs keep rising. High-growth markets such as Saudi Arabia, the UAE and Iraq are positioning the region as a key strategic hub for consumer electronics, attracting vendors to establish local manufacturing. To drive upgrades, vendors must adopt sustainability practices and deliver value-driven products while fostering strong relationships with local retailers to meet the nuanced needs of these markets. Vendors should innovate in sustainability, optimize hybrid retail experiences and respond dynamically to regional trends to capture long-term growth in this dynamic market.”

Download our latest report on key megatrends in the Middle East: https://canalys.com/resources/key-megatrends-shaping-the-middle-east-consumer-technology-arkets