Strong global smart personal audio performance as shipments increase 15%

Monday, 18 November 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

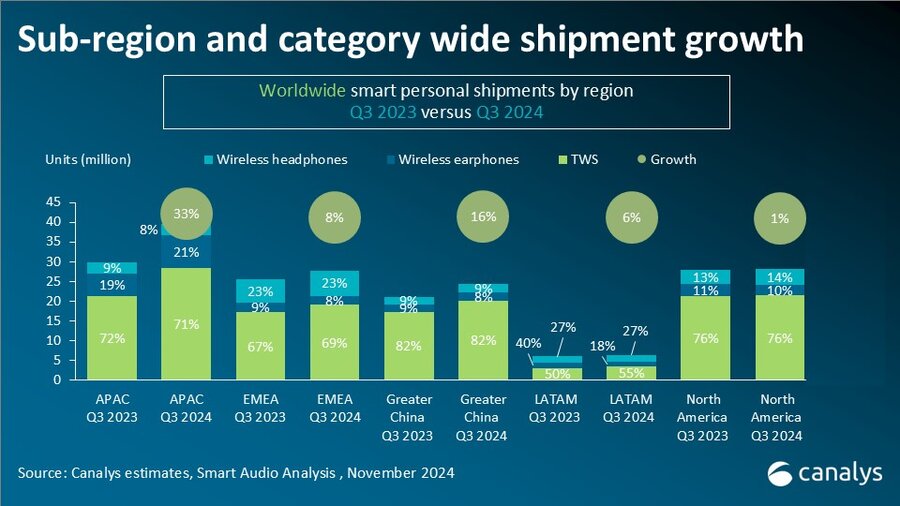

In Q3 2024, according to the latest Canalys research, the global smart personal audio market experienced a significant rebound, with total shipments reaching 126 million units, reflecting a 15% year-on-year growth. This marks the third consecutive quarter of growth, signaling a sustained recovery from challenges faced in 2023. Growth was broad-based, with each major sub-region posting gains. Double-digit growth was recorded across all major product categories, underscoring a favorable outlook for the global market, with emerging open-form factor devices and mid-size vendors contributing significantly to this positive momentum.

“The Indian market played a crucial role in boosting both APAC and global growth, with a 51% rise in shipments, adding approximately 9 million units compared to Q3 2023,” states Canalys Research Analyst, Jack Leathem. “This surge was fueled by a 47% increase in TWS device shipments and an impressive 65% jump in wireless earphones, led by brands such as boAt and OnePlus. boAt responded to growing consumer demand by reintroducing older, yet popular, wireless earphone models as inventory levels fell. And both boAt and OnePlus introduced a flurry of new, increasingly capable devices, focusing on enhanced audio quality and advanced features including Active Noise Cancellation (ANC). As a result, ANC-enabled devices reached a new peak, now comprising 21% of the India overall market, with 52% of OnePlus shipments including ANC capabilities. This shift reflects a new phase in the Indian market, where consumers increasingly seek higher-performance devices with advanced features.”

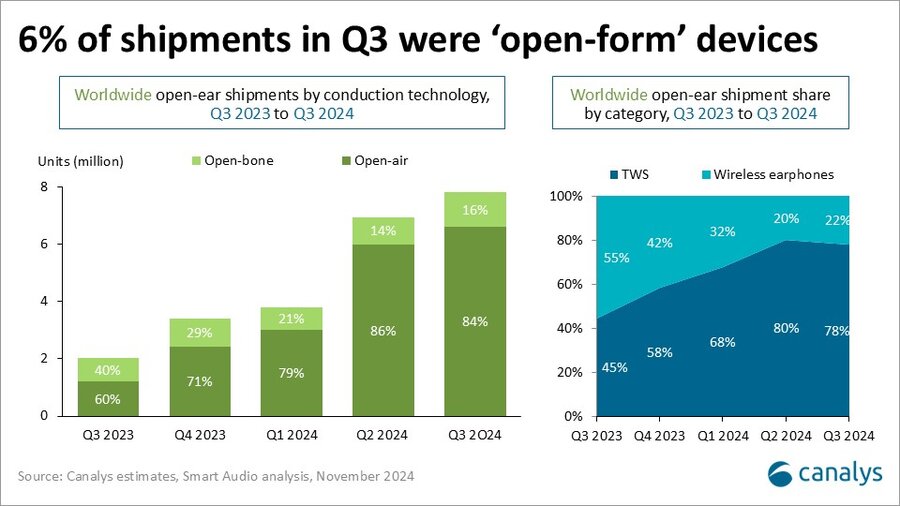

“The open-form factor device segment was a standout growth area in Q3 2024, aligning with the rise in global health and fitness trends,” says Canalys Research Manager, Cynthia Chen. “Demand for open-form factor TWS and wireless earphones surged, with shipments in this category nearly tripling year-on-year to represent 6% of the total market. Open Wireless Stereo (OWS) devices were key drivers of this growth, led by specialist brands such as Shokz and Sanag. In addition, major vendors have also entered this niche, aiming to capture new consumer demographics.”

Mainland China remains the leader in open-form factor shipments, contributing 59% of the global share, although Shokz has expanded notably in North America and Western Europe, and these regions now account for 39% of Shokz’s shipment, up from 31% last year. This shift highlights the growing global appeal of open-form factor devices, particularly as consumers increasingly prioritize audio solutions suited for active, outdoor lifestyles.

“Chinese audio brands are rapidly expanding in international markets, reflecting a strategic pivot towards overseas markets to drive shipments and bolster brand recognition amid intense domestic competition. These brands are capturing share by launching entry-level products that appeal to consumers of white-box competitors,” says Chen, underscoring this shift as part of a larger trend towards enhanced product quality. However, as these brands establish a stable market share, their next challenge will be to transition their focus to developing higher quality and more innovative offerings, a shift essential for sustaining competitiveness in the mid-to-long term.

“As the smart personal audio market becomes increasingly competitive, vendors must focus on technological innovation and distinctive design to differentiate themselves,” says Leathem. “To stand out in this crowded market, vendors should prioritize advancements in core audio technologies such as ANC and spatial audio, while also introducing visually striking features. For example, some JBL models now offer touchscreen charging cases, offering a unique interactive experience to enhance usability. It is also worth exploring bold color choices, translucent casings, and brand collaborations to attract consumers and strengthen market positions, which are essential for capturing consumer attention and strengthening footholds in new and established markets.”

|

Worldwide smart personal audio shipments and growth Q3 2024 |

||||||

|

Vendor |

Q3 2024 |

Q3 2024 |

Q3 2023 |

Q3 2023 |

Annual |

|

|

Apple* |

21.3 |

16.9% |

23.4 |

21.3% |

-9.2% |

|

|

Samsung* |

11.0 |

8.7% |

9.2 |

8.4% |

19.4% |

|

|

Boat |

10.4 |

8.2% |

6.5 |

5.9% |

59.6% |

|

|

Xiaomi |

7.1 |

5.7% |

4.3 |

3.9% |

64.5% |

|

|

Sony |

5.6 |

4.4% |

5.2 |

4.7% |

7.3% |

|

|

Others |

70.8 |

56.1% |

61.4 |

55.8% |

15.3% |

|

|

Total |

126.2 |

100.0% |

110.1 |

100.0% |

14.6% |

|

|

|

|

|

||||

|

*Apple includes Beats; Samsung includes Harman subsidiaries Note: percentages may not add up to 100% due to rounding |

|

|

||||

|

Worldwide TWS shipments and growth Q3 2024 |

|||||

|

Vendor |

Q3 2024 |

Q3 2024 |

Q3 2023 |

Q3 2023 |

Annual |

|

Apple* |

19.8 |

21.4% |

21.8 |

27.3% |

-9.3% |

|

Samsung* |

8.3 |

9.0% |

6.7 |

8.3% |

25.1% |

|

boAt |

7.6 |

8.2% |

5.2 |

6.5% |

45.5% |

|

Xiaomi |

6.9 |

7.5% |

4.1 |

5.2% |

66.5% |

|

Huawei |

3.7 |

4.0% |

2.4 |

3.0% |

55.2% |

|

Others |

46.0 |

49.9% |

39.7 |

49.7% |

15.9% |

|

Total |

92.3 |

100.0% |

79.9 |

100.0% |

15.5% |

|

|

|

|

|||

|

*Apple includes Beats; Samsung includes Harman subsidiaries Note: percentages may not add up to 100% due to rounding |

|

||||

For more information, please contact:

Cynthia Chen: cynthia_chen@canalys.com

Jack Leathem: jack_leathem@canalys.com

Canalys’ Smart Personal Audio Analysis is a service that provides qualitative and quantitative insights into the market for smart personal audio devices. It guides vendors and partners to make the right decisions on value propositions, choose the right channel partners and sell on the appropriate platforms to engage in different markets worldwide.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.