Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Increased distribution competition and emerging technology services to reshape federal market in 2025

The federal channel is expected to diversify in 2025 due to increased distributor competition and the rise of services tied to cybersecurity and AI.

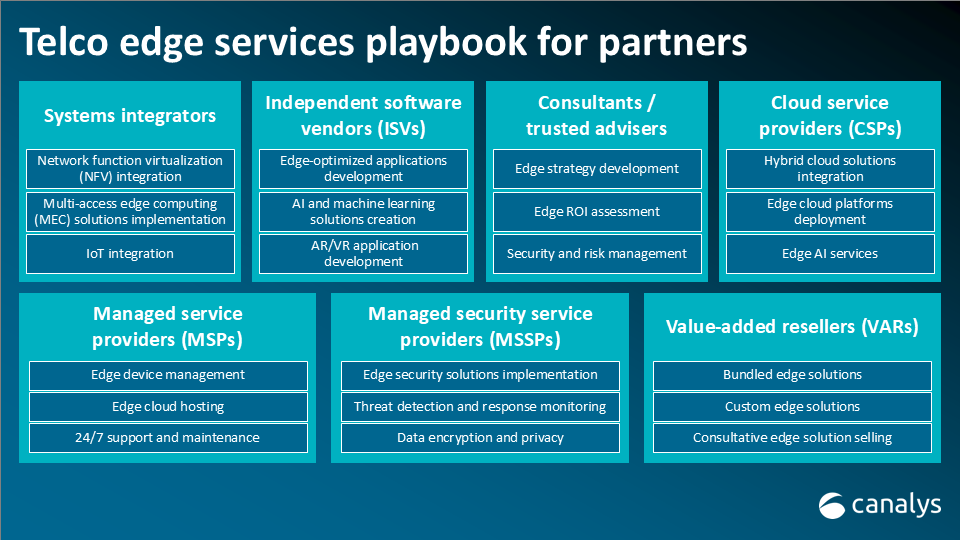

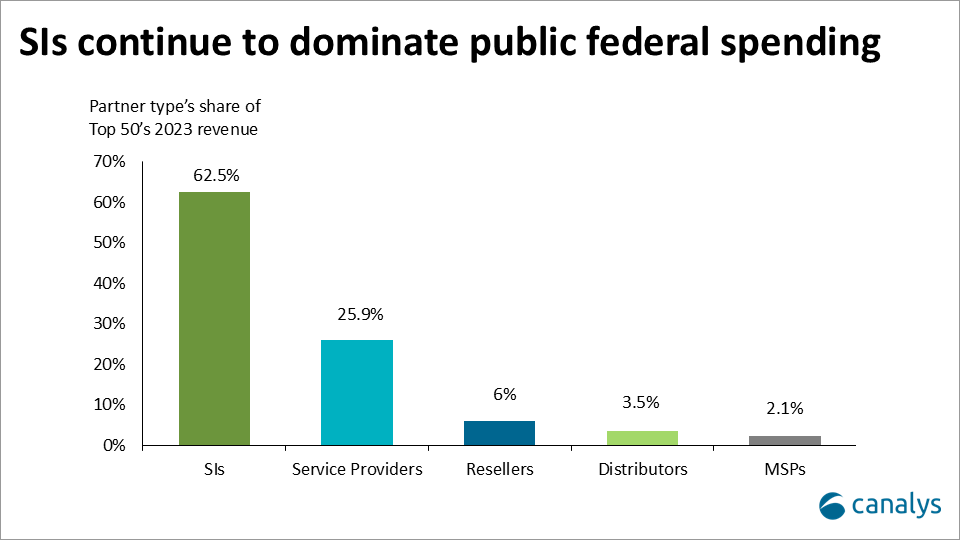

2025 will be a year of federal channel diversification. AI and cybersecurity are the only areas designated for significant growth by the 2025 IT budget and it is services partners and managed service providers that are best positioned to take advantage of the opportunity. Partners that specialize in services, as opposed to those that add services onto their system integration offerings, will realize the most growth as agencies turn their attention from migration towards continued management. In the 2024 federal fiscal year, service and managed service partners generated just 28% of the total revenue of the top 50 federal channel partners. Canalys expects that share to grow to above 30% in 2025 as agencies that recently met President Biden’s cloud migration deadline look for continued support post migration.

Canalys also predicts Systems Integrators (SIs), which historically represented 62.5% of the top 50’s revenue, will see market share decline to below 60% in 2025. Over the last two years, most agencies engaged in extensive technology modernization efforts as they migrated to the cloud, and they will not need the same level of extensive systems integrations until the next refresh cycle.

Carahsoft raid will reshape the world of federal distribution, regardless of legal outcomes

The largest shift in the federal channel in 2025 and beyond will occur in distribution.

On the morning of 24 September, the FBI raided the headquarters of Carahsoft, the distributor of choice for a significant number of IT vendors that sell to the federal government. Reports indicate Carahsoft and SAP are under investigation for price fixing. The FBI typically conducts raids only when criminal charges are being considered.

The timing of the raid was particularly unfortunate for Carahsoft, occurring just a week before the end of the fiscal year when agencies and partners often work overtime to finalize contracts. Q4 has always been the biggest quarter for the federal market because agencies have until 30 September to spend allotted budget for the year or lose it. It is unclear whether any business was lost due to disruptions caused by the raid.

Regardless of the outcome of the raid, there is a high likelihood both vendors and government will begin to reevaluate the amount of business they conduct through Carahsoft. This news has deeply rattled the confidence of Carahsoft’s partner and vendor networks, and that of the government agencies they work with. This is not the first time Carahsoft has faced price-fixing allegations. In 2015, Carahsoft and VMware paid US$75.5 million to settle similar claims, but no FBI raid occurred that time. The current investigation regarding SAP is reviewing transactions back to 2014, and covering deals made with over 100 agencies.

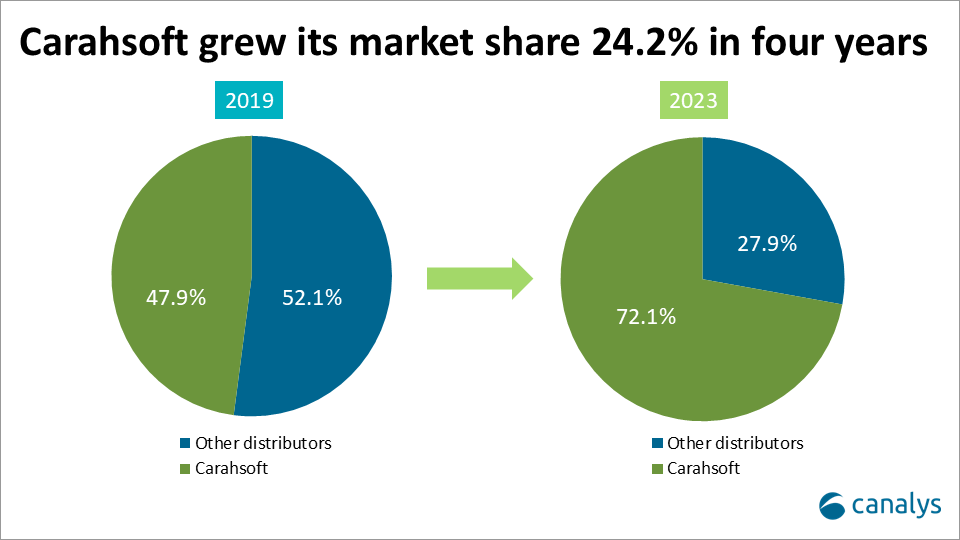

It will not be easy for agencies, partners and vendors to distance themselves from Carahsoft, even if they desire to. Last year, Carahsoft generated over US$1.38 billion in federal contracts, a sum over four times greater than the amount generated by the next-largest federal distributor, Arrow. Carahsoft’s dominance of the federal distributor market has increased dramatically over the last five years. In 2019, Carahsoft generated 47.9% of all federal distributor revenue. In 2023, that figure rose to an all-time high of 72.1%. Since 2019, Carahsoft has doubled its publicly-reported federal contract revenue, while all other distributors, on average, have seen a decline of 37%. This remarkable growth in market share has been driven by an increased number of preferred-distributor contracts with prominent vendors, most recently NetApp in September. Carahsoft also has an extensive partner network of resellers that see the majority, if not the totality, of sales through Carahsoft.

However, it is likely the outsized market share of Carahsoft is what will force the government to act. Federal agencies are risk-averse: they are governed by a highly complex system of policies and procedures that result in a preference for long-term stability and predictability. This is why agencies work primarily with the largest partners who are willing to sign incredibly long-term contracts, and why they are typically slow to adopt new technologies. In the face of Carahsoft’s legal issues, agencies will be forced to reconsider the risk of allowing 72.1% of all federal distribution to go through one company, even if no legal punishments are administered. In 2025, expect other distributors to gain market share on Carahsoft for the first time in over six years, particularly TD Synnex and Arrow, which are the next largest federal distributors after Carahsoft.

The federal market will continue to rely on distributors and resellers in 2025 and beyond

Despite the raid, a government-wide shift to direct sales is unlikely. Both IT vendors and agencies are deeply reliant on the federal channel. Civilian vendors rely on partners like Carahsoft to navigate the complex regulatory landscape and procurement systems for them because the vast majority of their business is not federal. Doing business with the federal government requires a lot of time, effort, and money, and civilian vendors see it as a better investment to go through government-specialized partners instead. Even if agencies sought to buy directly, they would likely face resistance from civilian IT vendors.

If there is any federal movement away from distributors, it will happen among military agencies. Military IT vendors are more willing to go direct because a greater proportion of their revenue comes from government sales than civilian IT vendors. They have historically always outperformed civilian IT vendors in direct sales. Military agencies have an even lower tolerance for risk and uncertainty than civilian agencies, and may respond to the news of the raid by increasingly going direct to vendors. However, distributors and resellers are quite entrenched in the military segment of the federal market: Carahsoft currently derives the majority of its revenue from non-public deals with military agencies. Existing protocols still incentivize military agencies to go through distributors, and agencies are slow to change. A wholesale overhaul of the procurement model and regulations would be necessary to reduce agency reliance on distributors and resellers, which is highly improbable, especially when other prominent IT distributors already exist as alternatives to Carahsoft.

Partners also play a crucial role in reducing administrative burdens for agencies by providing essential attached services for procured products. The federal government heavily relies on the channel, and that reliance has grown from 54% to 66% in the last five years. Carahsoft and other federal distributors have extensive partner networks of system integrators, managed service providers, and service providers, which together form an ecosystem that supports agencies through the procurement process and throughout the entire lifecycle of the purchased product. This is especially important given the emergence and accelerating adoption of emerging technologies. With the US$32 billion AI package currently under consideration by Congress and over US$15 billion in already-approved AI and cybersecurity spending in 2025, federal agencies are relying on channel partners to navigate the complexity for them more than ever before.