Africa's smartphone expansion slows, projected at 1% for 2025

Friday, 22 November 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

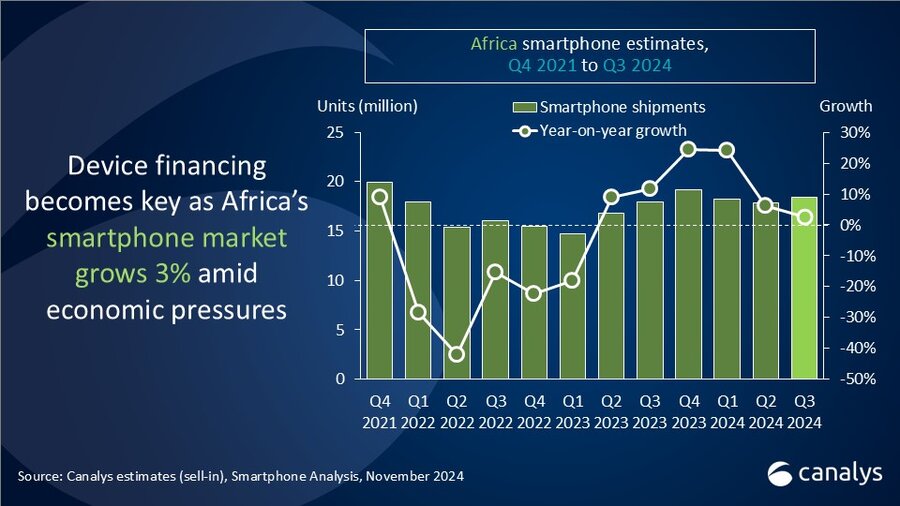

Canalys’ latest research reveals that Africa's smartphone market grew by 3% year on year in Q3 2024, reaching 18.4 million units, reflecting resilience amid a complex economic landscape. While stabilizing currencies and easing price pressures have provided relief in certain regions, challenges such as inflation, energy volatility and subdued consumer demand persist. Rising operational costs, infrastructure gaps and food inflation further weigh on growth prospects. The future of Africa's smartphone market hinges on the ability of governments and vendors to tackle these structural hurdles. Canalys projects a cautious 1% growth in smartphone shipments for 2025, emphasizing the need for sustained efforts to unlock the market's potential.

Egypt leads Africa with double-digit shipment growth amid regional challenges

Egypt led Africa’s smartphone market with an impressive double-digit 34% growth for the third consecutive quarter, strengthening its position as the region’s fastest-recovering market. The success stems from localized production, which has drastically reduced import reliance, slashing the smartphone import bill by 99% to US$1.65 million in H1 2024 from 2021. In contrast, Nigeria, the continent's second-largest market by volume, recorded a modest 1% growth as the Naira depreciated by 69.9% from January to September, but improved to 32.2% in August 2024, continuing to weigh on consumer demand. South Africa, after six quarters of double-digit growth, saw a sharp 10% decline in shipments as economic uncertainties dampened consumer spending, despite easing inflation and interest rate cuts. Similarly, Kenya’s smartphone shipments dropped by 10%, attributed to elevated fuel costs, production challenges and the economic fallout of anti-finance bill protests in June 2024. Morocco, once a fastest-growing market in North Africa, experienced a decline of 24% reeling from the hike in import taxes at the start of the year.

Vendors focus on affordability and local manufacturing to shape key regional strategies

“In Q3 2024, the smartphone market in Africa presented a mix of opportunities and challenges,” noted Manish Pravinkumar, Senior Analyst at Canalys. “Six consecutive quarters of shipment growth have been accompanied by ASP decline. The ASP of smartphones declined by 6% in Q3 2024. The surge in sub-US$100 smartphones, up by 35%, underscores affordability challenges across the region.”

TRANSSION cemented its leadership with a 50% market share and 8% growth, driven by iTel’s remarkable 34% surge and affordable offerings from Infinix and TECNO. Samsung faced a 30% decline, largely due to subdued demand in South Africa. Meanwhile, Xiaomi achieved 13% growth, leveraging products like the Redmi 14C in key markets like Nigeria and Egypt, despite a 10% ASP drop. realme gained traction with its “more value for less money” strategy, particularly among young consumers, with the realme Note 50 gaining popularity, helping to gain 101% growth. OPPO grew 22% growth with its impressive portfolio driven by A60 and A3 series. HONOR achieved remarkable growth of 287%, driven by initiatives such as the “YES Program” and “Code with HONOR” in South Africa, while also exploring potential manufacturing investments in select African countries to develop local talent and enhance product accessibility.

Africa's smartphone market faces volatile growth, hindered by structural challenges

“The future of Africa’s smartphone market holds immense potential, but significant hurdles remain,” added Pravinkumar. “Feature phones maintained a 55% share of total shipments as of Q3 2024, limiting smartphone expansion. High device taxes continue to hinder growth, posing a dilemma for policymakers between immediate revenue needs and the long-term benefits of broader smartphone adoption. Enhanced smartphone accessibility could drive the development of a robust digital economy, generating sustainable tax revenues over time. Despite these barriers, growing demand for affordable devices, expanding 4G network coverage and innovative financing models are expected to sustain growth. Canalys forecast a 1% CAGR for the region from 2024 to 2028, with 4G remaining the primary driver of new mobile subscriptions over the next five years.”

“Service providers in Sub-Saharan Africa are evolving into technology companies, integrating mobile money services to enhance financial inclusion and diversify revenues,” stated Pravinkumar. “As they phase out 2G and 3G networks, resources will shift toward expanding 4G and 5G adoption, paving the way for the next wave of connectivity. In the long term, success will depend on forging innovative partnerships among governments, vendors and service providers to balance immediate financial needs with long-term goals. By fostering collaboration, Africa can accelerate its digital transformation, laying the groundwork for a connected, inclusive and economically dynamic future.”

|

Africa Smartphone shipments and annual growth Canalys Smartphone Market Pulse: Q3 2024 |

|||||

|

Vendor |

Q3 2024 |

Q3 2024 |

Q3 2023 |

Q3 2023 |

Annual |

|

TRANSSION |

9.3 |

50% |

8.6 |

48% |

8% |

|

Samsung |

3.2 |

18% |

4.6 |

26% |

-30% |

|

Xiaomi |

2.2 |

12% |

1.9 |

11% |

13% |

|

realme |

1.1 |

6% |

0.6 |

3% |

101% |

|

OPPO |

1.0 |

5% |

0.8 |

4% |

22% |

|

Others |

1.6 |

9% |

1.5 |

8% |

9% |

|

Total |

18.4 |

100% |

17.9 |

100% |

3% |

|

|

|

|

|||

|

Note: Xiaomi estimates include sub-brand POCO and Redmi. TRANSSION includes Tecno, Infinix and iTel. Percentages may not add up to 100% due to rounding Source: Canalys Smartphone Analysis (sell-in shipments), November 2024 |

|

||||

For more information, please contact:

Manish Pravinkumar: manish_pravinkumar@canalys.com

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.