Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

IT spending to expand 8% in 2025, partner-delivered IT to account for 70%

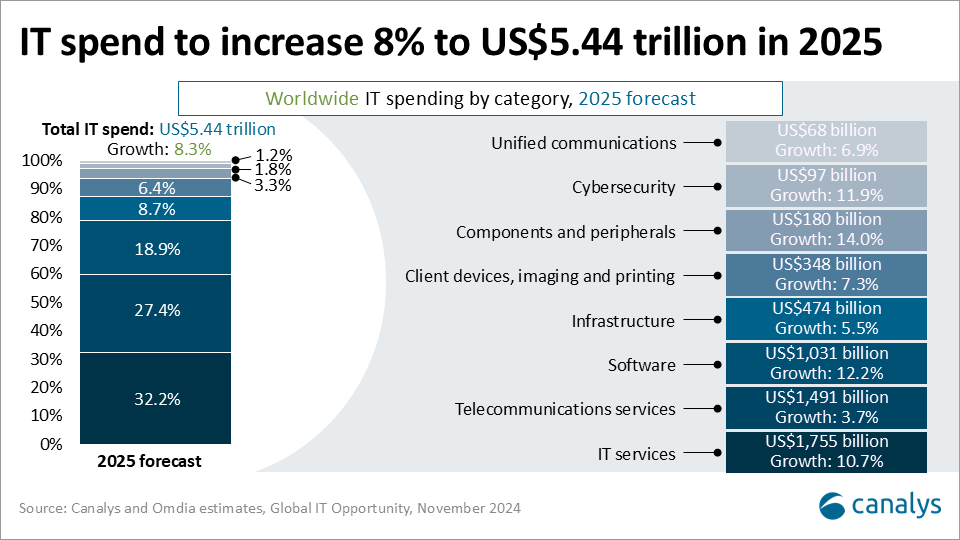

Canalys’ November IT Opportunity update predicts an 8.3% growth in worldwide IT spending in 2025, reaching US$5.44 trillion. This is despite the emergence of new economic and political uncertainties following the 2024 global elections super-cycle. A new era of AI transformation will begin which will create long-term growth opportunities for channel partners.

IT spending to expand 8% in 2025, partner-delivered IT to account for 70%

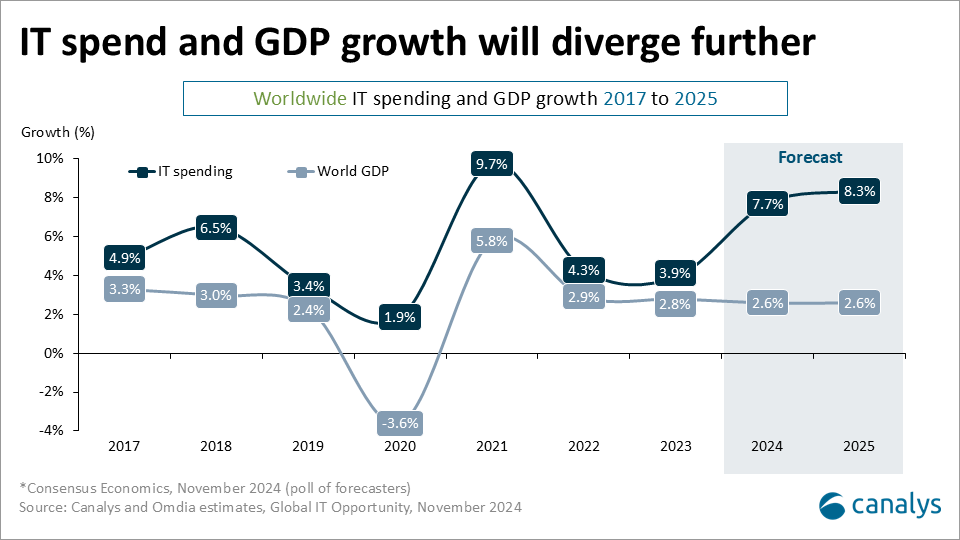

2025 will be a year of robust growth for the tech industry, even as global economic and political conditions remain uncertain. Canalys' November IT Opportunity update predicts worldwide IT spending to expand 8.3% to US$5.44 trillion in 2025. This builds on the accelerated growth in 2024, which is currently projected to increase 7.7% and marks the strongest growth rate since the post-COVID technology boom of 2021. Partner-delivered IT will grow 7.1% to account for 70% of the total addressable IT market.

The results of the 2024 global elections super-cycle have brought about a new period of political uncertainty in every region. While the decisive outcome of the US presidential election has boosted financial markets in the short term, rising geopolitical tensions and a potential escalation in trade disputes could dampen growth prospects in 2025. However, IT spending and GDP growth are currently forecasted to diverge again next year, as investment in enabling, embedding and operationalizing AI accelerates.

Uncertainty clouds IT spending outlook

North America (+10.2%) will lead global IT spending in 2025, accounting for 40% of the total. The threat of higher tariffs on technology imports will boost spending in the short term, like in 2018, as projects are brought forward to avoid higher costs. The potential would also give greater impetus to AI and data center investments in the United States. Uncertainty will rise in Latin America (+7.0%) as concerns mount over rising public debt in Brazil, driven by social spending and trade disruption between Mexico and the United States.

IT spending per employee in Asia Pacific (+7.8%) will remain below the worldwide average in 2025, despite strong growth in India, and improving demand in Mainland China and Japan. Growth in EMEA (+6.4%) will remain subdued, especially in Western Europe, due to ongoing economic and political headwinds, as well as the threat of conflicts escalating further.

A new era of AI transformation will begin

Investment in AI-powered software, cybersecurity and AI-capable PCs will drive robust technology growth of 9.8% in 2025. However, the surge in AI infrastructure growth will moderate, particularly by hyperscalers after their unprecedented increase in server expenditure in 2024, though their spending will remain elevated. The shift in focus from operational efficiencies to longer-term strategic challenges and embedding AI across all business functions will re-accelerate IT services growth to 10.7%. Spending on telecom services will grow at a steadier 3.7%. The return on 5G investments will continue to weigh on service providers, though the emergence of 5G-advanced and deployment of AI-driven operations will unlock new service opportunities going forward.

Recovery in 2025 after tough years for the channel

While partner-delivered IT will grow at a slower pace than the overall market in 2025, partners will continue to play a vital role in influencing IT spending decisions across all regions. Following three years of declines and minimal growth, spending in key hardware categories is projected to rise again for partners, including PCs, networking, storage and servers. But these will remain cyclical, driven by installed base refreshes and upgrades. Cybersecurity, software and managed IT services will remain long-term growth engines for the channel. Those partners who are already heavily invested in these areas will maintain their growth trajectory.

Overall, 70% of customer spending on technology, IT services and telecom services will go through partners next year, down from 71% in 2024 and 73% in 2023. Partners missed out on the initial AI boom, with data center infrastructure buildouts going directly to ODM vendors. However, the next phase of investment in terms of edge, secure AI adoption and business transformation will create sustained growth opportunities for partners over the next decade.

Market trends to watch in 2025

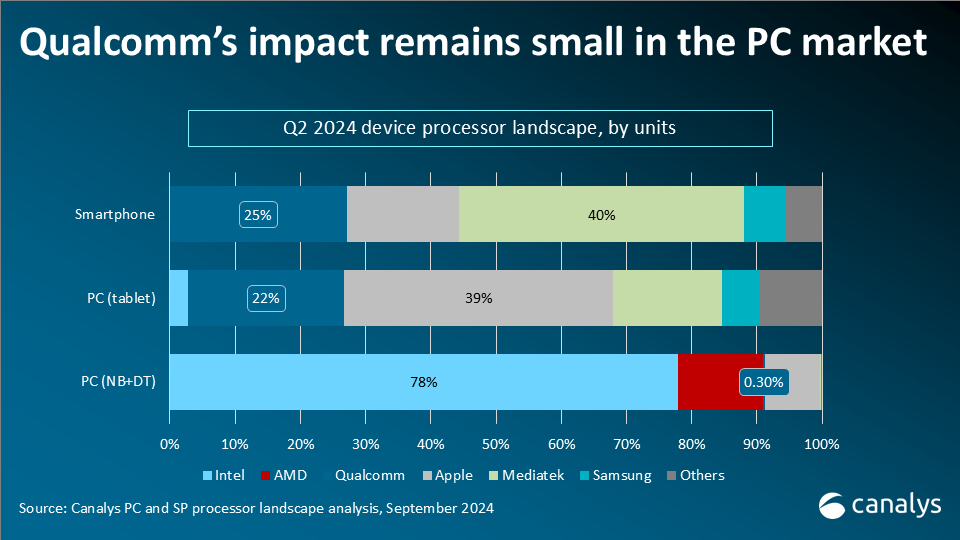

- PC growth will strengthen due to Windows 10's end-of-support and upgrades to premium-priced AI-capable PCs.

- Data center investment will continue but at a more moderate pace, with a focus on AI training efficiency and increasing buildout for AI inferencing.

- Network investment will rebound, as buying dynamics normalize after the boom and bust of the last three years. Data center switching for AI, especially 400G and 800G, and the start of the Wi-Fi 7 upgrade cycle will drive growth.

- Cybersecurity spending will re-accelerate, driven by a recovery in appliance shipments, platform adoption and securing AI for security.

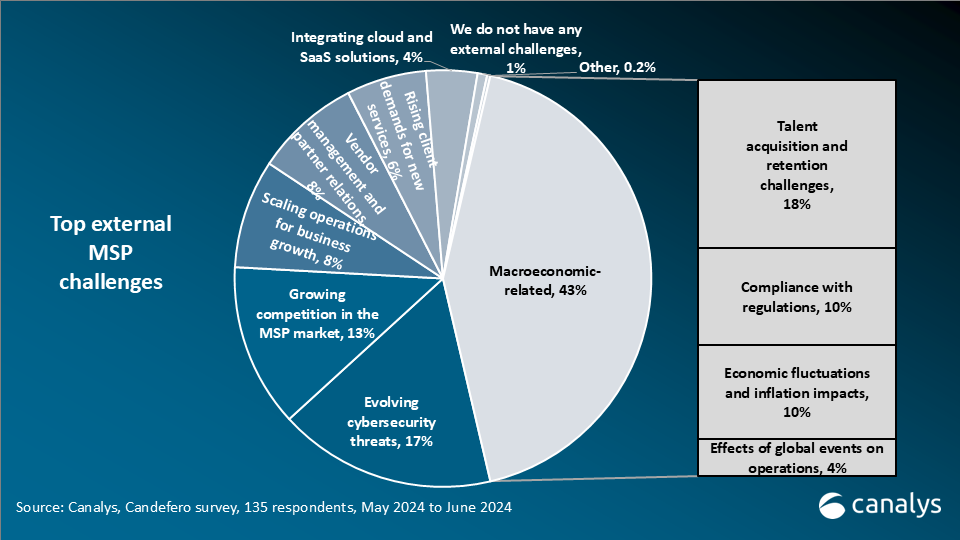

- Managed IT services growth will strengthen due to AI-driven automation, cybersecurity and compliance requirements, and multi-cloud management.

- Cloud infrastructure services growth will maintain momentum as customers increase spending commitments to refocus on infrastructure modernization and scale investment in hyperscaler AI offerings.

- IT consulting will drive AI adoption through change management, training and alignment with business goals. This will spur infrastructure modernization, data security and governance, and additional software opportunities.

The full and in-depth report is published in the Global IT Opportunity Analysis service. Contact us if you are interested in the detailed report or would like to speak to our analysts.