Chinese-owned brands’ passenger vehicle exports expected to reach 4.5 million in 2024

Wednesday, 20 November 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

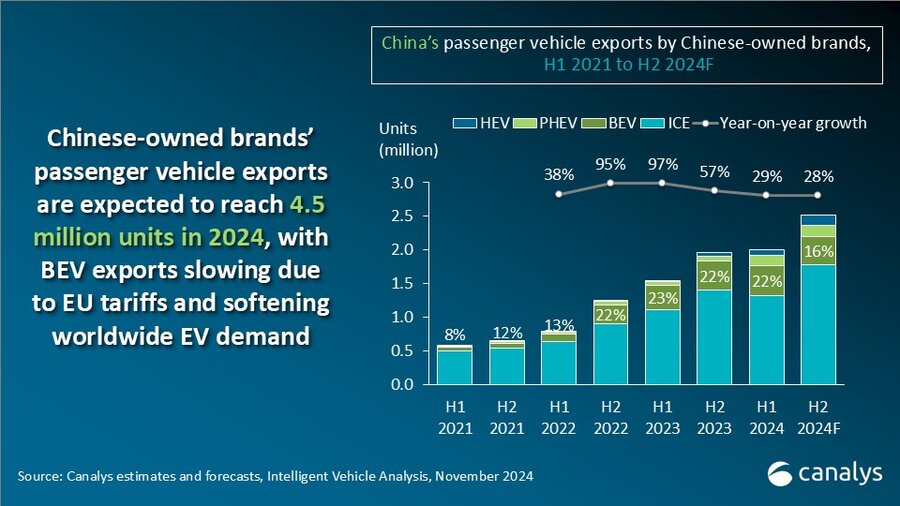

According to Canalys forecasts, passenger vehicle exports by Chinese-owned brands will reach 2.5 million units in the second half of 2024, resulting in a total of 4.5 million units for full-year 2024, which translates to a growth rate of 29%. The European Union’s tariffs and falling EV demand are slowing the growth of Chinese battery electric vehicle (BEV) exports to 9% (860,000 units). As a result, the share of BEV exports will fall from 22.5% in 2023 to 19.0% in 2024. The share of plug-in hybrid and hybrid electric vehicle (PHEV and HEV) exports will exceed 10% for the first time in three years, reaching 310,000 and 240,000 units, respectively. Latin America and Europe are the key regions driving the export growth of PHEVs and HEVs by Chinese brands.

Internal combustion engine (ICE) passenger vehicle exports are expected to remain strong, recording a growth rate of 24% in 2024 to reach 3.1 million units. Chinese OEMs have shown significant improvements in the competitiveness of their ICE vehicles. “This progress has contributed to the success of MG, Chery and Great Wall Motors – the top three ICE vehicle exporters – in overseas markets. Notably, Chery and Great Wall Motors have seized the opportunity to fill the gap left by international brands that have quit Russia. Dongfeng Motor and GAC are emerging Chinese OEMs that have accelerated their global expansion. These two OEMs’ export volumes are expected to grow by four and two times, respectively, which is expected to account for up to 10% of the Chinese-owned brands’ total export volume in 2024,” said Alvin Liu, Senior Analyst at Canalys.

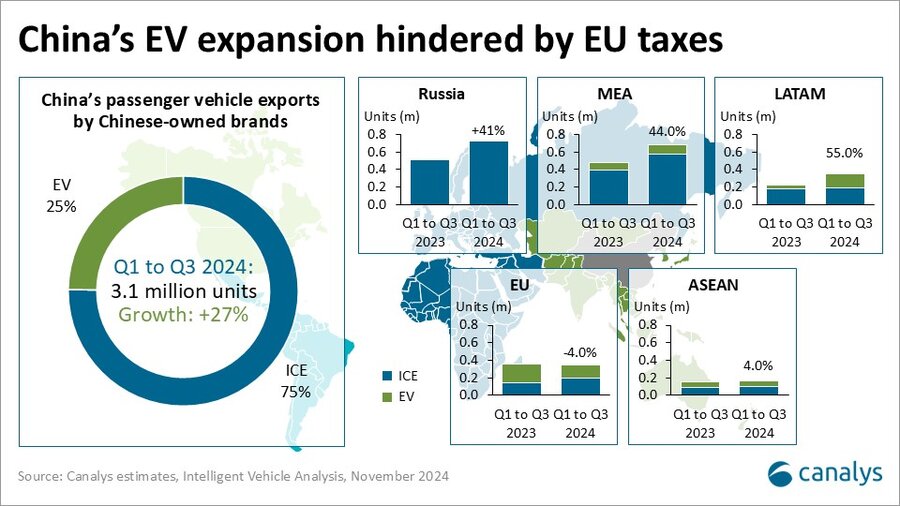

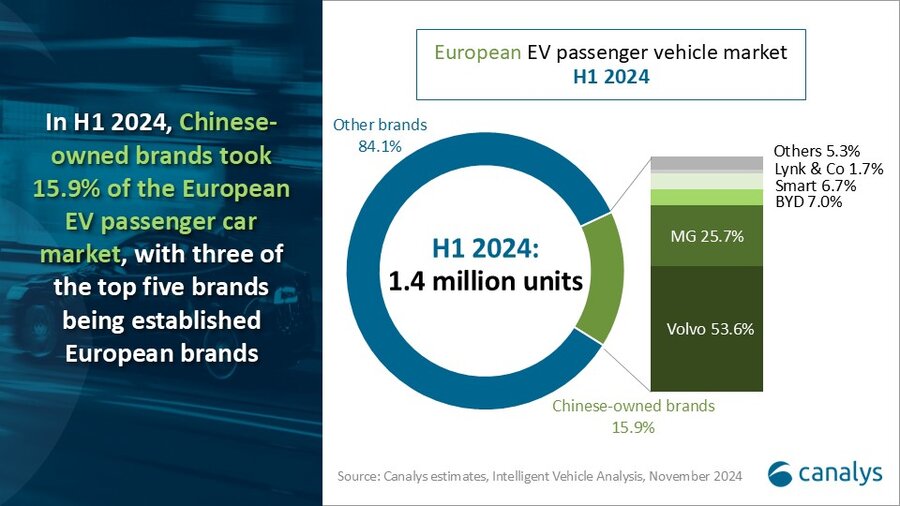

According to Canalys estimates, China’s passenger vehicle export volume by Chinese-owned brands grew 27% from Q1 to Q3 2024 to 3.1 million units. Europe stood out as the only region where export volumes declined, by 4%, due to the EU’s increased tariffs on Chinese EVs. Together with the increase in exports to other regions, the EU fell from being the biggest Chinese vehicle export market in 2023 to the fourth largest in 2024.

Despite exports falling and EV demand waning, the EU still constitutes the largest share of Chinese EV exports, at 28.4%. “Reduced demand for EVs and political uncertainties in Europe have slowed Chinese OEMs’ regional investments. Nevertheless, Europe remains a core market for Chinese OEMs’ globalization efforts,” said Liu. “Chinese OEMs are rapidly diversifying their product lines by introducing HEVs to skirt the tariffs and address local consumer needs for more efficient vehicles. SAIC Motor is a clear example – it introduced hybrid versions of its MG3 and MG ZS models, aiming to challenge Japanese brands’ HEV position in Europe.”

Despite rapid growth in export volumes, Chinese OEMs continue to face various uncertainties in the global market. For several OEMs, weak channel and product localization capabilities have led to significant disparities in sales performance and inventory levels across overseas markets. “Channel management and localization capabilities are vital to Chinese carmakers as they face export restrictions while exploring local production and integrating into the local supply chain ecosystem,” said Liu.

Chinese OEMs have achieved global leadership in electrification and SDV technologies. But the competitive edge in ADAS and digital cockpit technologies has yet to materialize fully. Chinese OEMs should view export markets pragmatically, carefully assessing the feasibility of replicating the Chinese market’s success globally. Though Japanese and Korean carmakers are losing market share in China, their globalization strategies remain strong and competitive and will pose a threat to Chinese OEMs.

The EU-China EV tariff dispute is a significant setback to the global electrification of the automotive industry. “Chinese and European automakers could benefit from sharing expertise, investing in joint research and development, and establishing a level playing field for innovation. But geopolitical tensions and diverging interests are hindering progress. If the dispute escalates, the EU risks weakening the development of a competitive EV ecosystem, thus losing its leading position in the global automotive and green energy markets,” said Canalys Principal Analyst Jason Low. “Nevertheless, China remains open, providing opportunities for collaboration in EV technology and supply chains. We expect both regions will collaborate closely to find a lasting solution, as numerous opportunities for cooperation exist.”

For more information, please contact:

Jason Low: jason.low@canalys.com

Alvin Liu: alvin.liu@canalys.com

Gain detailed insights into the transformation of the global automotive market with Canalys’ industry-leading Intelligent Vehicle Analysis service. We focus on critical aspects, from brand analysis to model evaluation. With our specialized research on electric vehicles (EVs), new energy vehicles and intelligent vehicles, Canalys provides insightful data about car connectivity, convenience, driver assistance and safety features. The Canalys Intelligent Vehicle Analysis Service goes beyond the typical market research product. It is a tailored solution designed to empower businesses with the tools they need to make informed decisions and stay competitive in the rapidly changing automotive landscape.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.