Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Canalys crowns Champions in the global RMM and PSA Leadership Matrix 2024

Four vendors have been crowned Champions in the 2024 Canalys RMM and PSA Leadership Matrix: ConnectWise, HaloPSA, N-able and NinjaOne. Two of these vendors, ConnectWise and N-able, retained their Champion status from the previous edition of the Canalys RMM and PSA Leadership Matrix – an impressive achievement.

Four vendors have been crowned Champions in the 2024 Canalys RMM and PSA Leadership Matrix: ConnectWise, HaloPSA, N-able and NinjaOne. Two of these vendors, ConnectWise and N-able, retained their Champion status from the previous edition of the Canalys RMM and PSA Leadership Matrix – an impressive achievement.

Canalys defines the four categories of partners in the Leadership Matrix

Champions demonstrated the highest levels of excellence in channel and technology capability over the last 12 months compared with their industry peers, as rated by channel partners and Canalys analysts. Other vendors are classified as:

- Contenders (those with high ratings based on channel performance, but declining or flat on last year).

- Scalers (those making improvements in partner sentiment but yet to achieve the highest levels of consistency in channel excellence).

- Foundation vendors, which have the lowest ratings and have also suffered a deterioration in partner sentiment over the last 12 months.

Canalys defines RMM as software that provides remote monitoring and management for endpoints. Professional Services Automation (PSA) is defined as software that allows a company to manage projects, billing, provisioning and other services related to a customer’s IT estate.

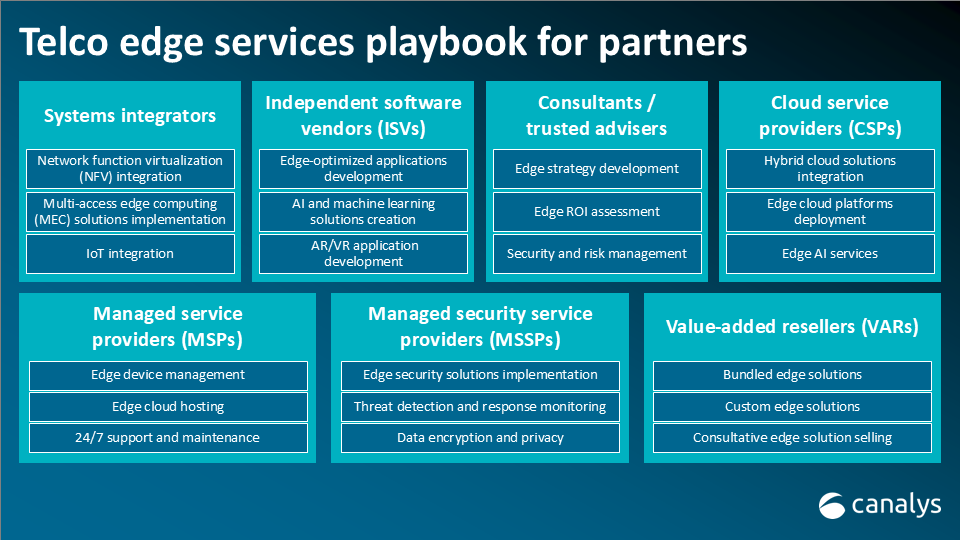

RMM and PSA continue to be central to most MSP business models worldwide

The growth and importance of RMM and PSA technologies to the expanding landscape of managed service providers (MSPs) in the channel in recent years mean these providers need to be able to assess RMM and PSA vendors’ strengths and weaknesses. As more data and workloads move to the cloud, and software moves to recurring revenue models, licensing, billing, patch management, feature integration and security are needed. But they are increasingly onerous for customers investing in digitalizing their businesses that do not have the capabilities and resources to manage the technological portion of that transformation.

RMM and PSA are undergoing significant change

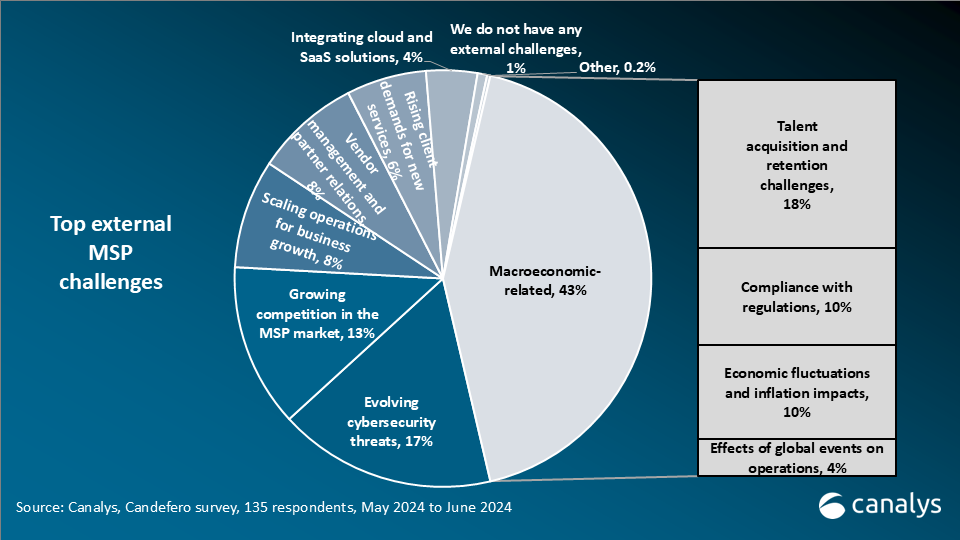

RMM and PSA are two technologies that form the central pillar of almost all MSPs globally, in some form or other, but these technologies and the vendors that provide them are under pressure. Platformization, AI, cyber-threats, regulation and the shifting ecosystem are creating massive challenges for partners and vendors alike. Vendors are looking at ways to maximize wallet share and change the unit economics of these technologies through bundling and platform plays, but many partners are wary of putting too much weight behind any one vendor. Yet partners are also under pressure to cut costs and improve profitability, with tool sprawl a specific area of scrutiny.

AI also plays a significant role as partners look for ways to automate certain tasks more natively, rather than spending time scripting and building their own automated workflows. Features such as ticketing and ticket resolution, billing, customer reporting, backups, and managed detection and response are all in the crosshairs for vendors trying to develop a competitive edge. Every vendor featured here is looking at ways to maximize automation across different features, but it is also complicated by the fact these vendors are hubs in the MSP ecosystem, and their third-party integration strategies are also vital to the development of that ecosystem. An RMM or PSA vendor cannot simply automate elements of partners' workflows by focusing solely on its own toolset but must also work out how to integrate other vendors’ automation into their products. All this complexity creates opportunities and threats for vendors but also for partners trying to decide which vendors to back in this race. It is very likely RMM and PSA will not look anything like they do today in a decade’s time.

For access to the full Leadership Matrix report or to discuss re-use of the image and distribution rights, please contact us.