The road ahead for 5G smartphones

17 June 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

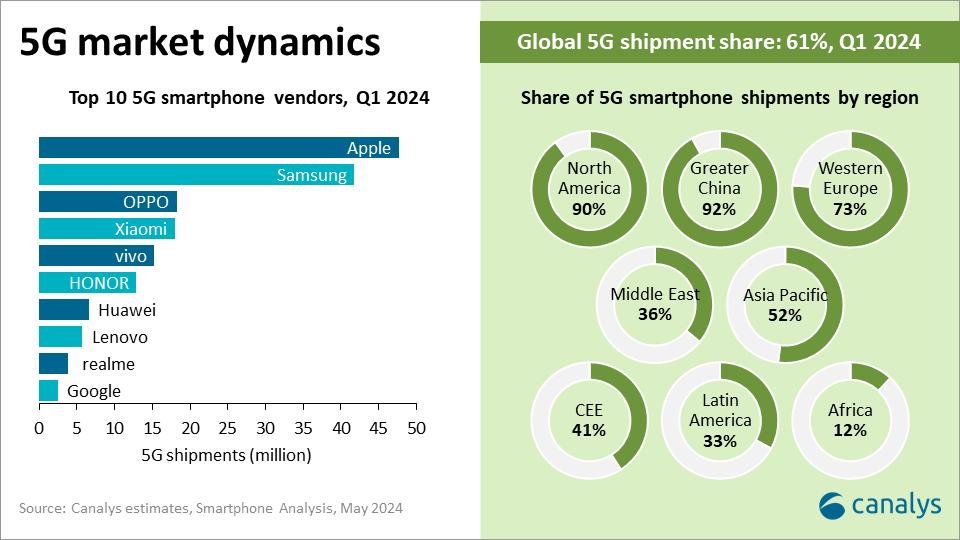

5G smartphone shipments are projected to increase to account for 67% of all shipments in 2024 as the 5G smartphone market matures. But growth has been slowing since the proportion of 5G shipments passed 50% in 2022. Regionally, the development of 5G remains uneven. There are still persistent challenges regarding consumer demand and component supply, which affect device vendors’ strategies. But as the smartphone industry enters another cycle of component price hikes, vendors are again re-evaluating the potential of 5G smartphones in underpenetrated markets and trying to decide on the best time to release devices.

In markets such as North America, Greater China and most parts of Europe, the share of 5G smartphone shipments has reached high levels, while Latin America and Africa remain predominantly 4G. Asia Pacific shows significant disparities: the 5G smartphone market is rapidly developing in East Asia, Southeast Asia and India, while the market potential for 5G in most of South Asia remains limited. Markets with high 5G smartphone penetration are typically those where:

Even with favorable conditions in local markets, the penetration rate of 5G smartphones eventually depends on consumer demand for 5G services and market supply. More importantly, 5G smartphone penetration hinges on how smartphone vendors balance demand and supply costs in their 5G product strategies.

5G is no longer the leading feature on smartphones as the 5G smartphone market gradually matures. It is now down to the daily user experience of 5G smartphones and how they compare to 4G models to drive organic demand. After five years of officially commercializing 5G networks, the primary obstacles to 5G adoption are still network coverage, user experience and the cost of 5G tariffs. Despite 5G deployment claims in quite a few markets, coverage remains insufficient compared with 4G networks. Furthermore, lowering 5G package fees is a challenge for operators, which are still trying to recoup their expenditure on 5G infrastructure. So in markets lacking 5G network coverage and where 5G data costs are distinctly higher than 4G, demand for 5G smartphones remains weak, particularly among mobile users who spend less on mobile data.

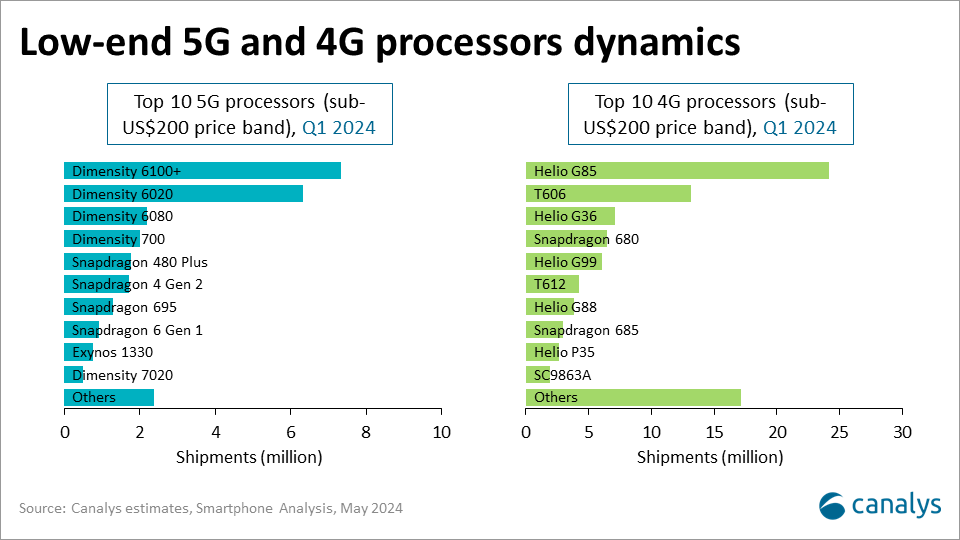

Supply is a more significant factor than demand during the early stages of 5G smartphone development, most importantly, the 5G SoC supply. Qualcomm and MediaTek’s high-end smartphone processor roadmaps and production lines have switched to 5G earlier than the endpoint devices. Therefore, all vendors have completed the product transition from 4G to 5G smartphones in their high-end portfolios in the early stage of 5G. A similar transition is now also happening in the mid-range smartphone segment, where the update and future iteration of 4G mid-range smartphone processors has almost stopped, and processor manufacturers, based on their strategies, are reducing the supply of 4G processors.

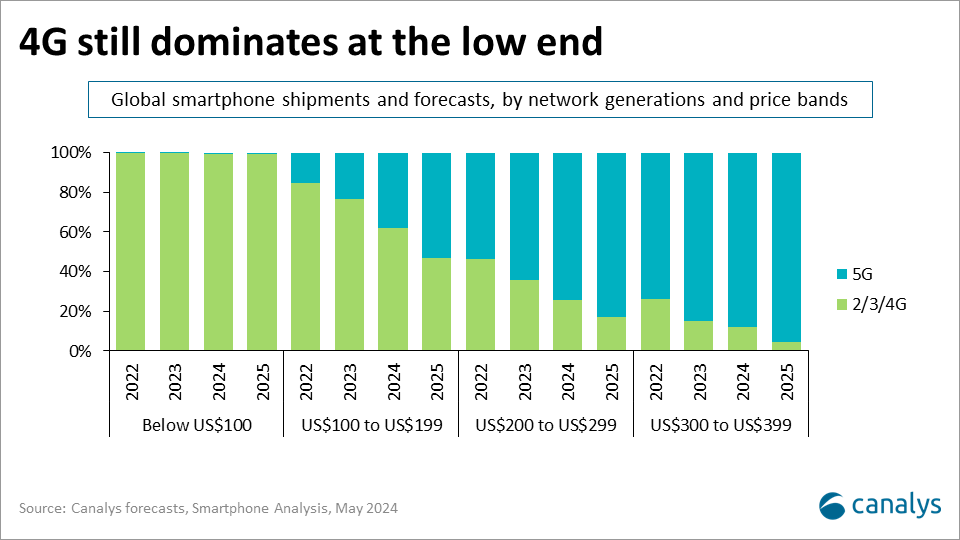

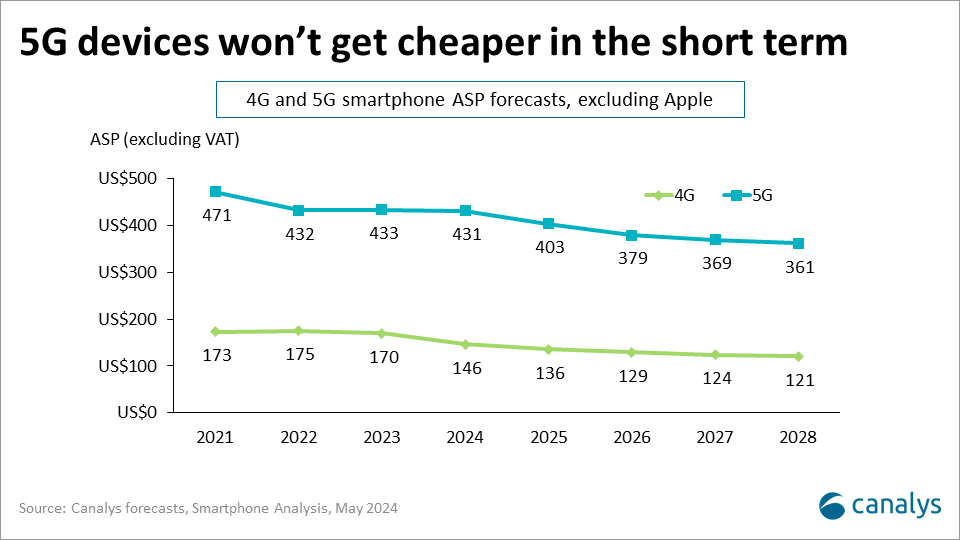

But for low-end price points, the SoC supply situation is the opposite. The supply of 4G processors remains sufficient, and device vendors have more options than with 5G processors. Due to factors such as IP (intellectual property), manufacturing processes, design and processor vendors’ strategies, low-end 5G processors still have an extra price difference of US$5 to US$10, or even higher, compared with low-end 4G processors. So, it is difficult for 5G processors to quickly replace 4G processors at the low end. Additionally, beyond the cost increase of 5G processors, 5G smartphones require additional components, such as 5G RF chips and more powerful ICs. Take a smartphone that’s US$150 retail price, adding 5G would add at least 10% to the bill of materials cost, which is a significant burden for low-end smartphones. In the short to medium term, the additional costs associated with 5G are unlikely to be reduced in the low-end smartphone segment.

Considering the additional costs of 5G over the past two years, vendors made a strategic tradeoff between 5G capabilities and other features, such as screen, camera, battery or memory sizes, in the mid-to-low-end segments to optimize hardware margins. This product strategy will likely continue for the rest of this year. Though given memory components have seen significant price increases since the end of 2023, it is no longer a viable option for vendors to make their products stand out in the US$100-to-US$299 price band using large memory sizes. In some of the target geographical markets, such as India, Brazil and Southeast Asia, 5G is again considered a valuable differentiator for new products in these mass-market price bands.

The 5G smartphone penetration bottleneck is in the US$100-to-US$299 price band, which won’t see rapid 5G adoption for one to two years, when the low-end 4G chipset supply starts to dwindle. For the sub-US$100 price band, apart from markets such as Mainland China, where supply chain efficiencies, local production, logistics and carrier incentives play a role for ultra-low-end 5G smartphones, there is little possibility of large-scale adoption of 5G smartphones in other markets.

Though the ASP of 5G smartphones has rapidly decreased since their initial launch, this trend has primarily been driven by the technology trickling down from flagship and high-end devices to the mid-end. There are a few key factors affecting 5G smartphone price trends:

Given the short-to-mid-term challenges in low-end 5G penetration and the varying regional market dynamics, smartphone vendors must take a flexible approach with their mid-to-low-end 5G product strategies to stay agile and competitive.