African smartphone market poised for 4% growth in 2024, despite economic instability

Wednesday, 12 June 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

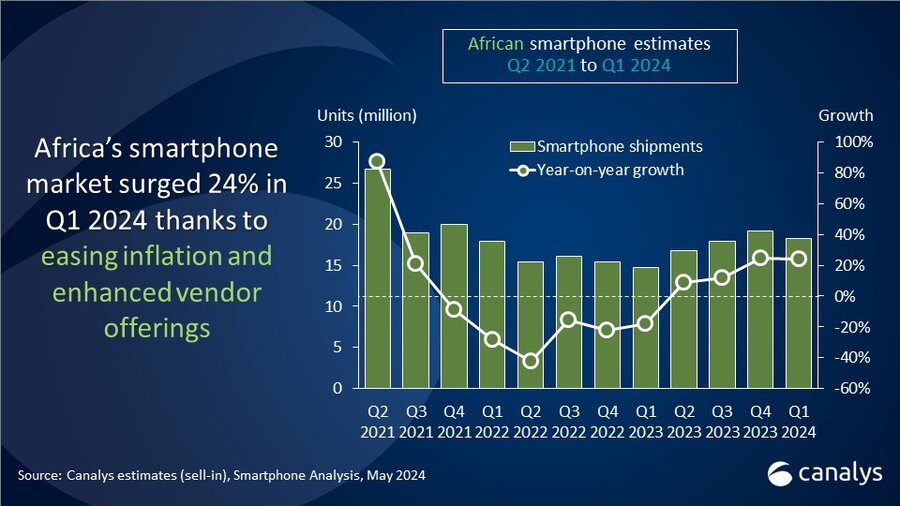

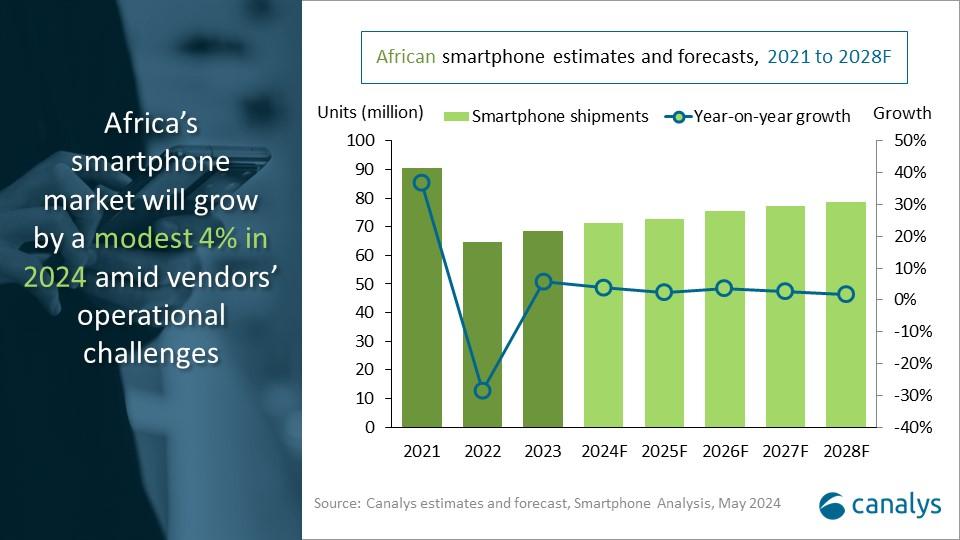

Canalys’ latest research reveals that the African smartphone market surged significantly in Q1 2024, by 24% year on year to reach 18.2 million units. This growth was fueled by new product launches from key vendors and easing inflation in most markets. This positions Africa as the third fastest-growing smartphone region worldwide for the quarter, with most countries experiencing accelerated economic growth compared with Q1 2023.

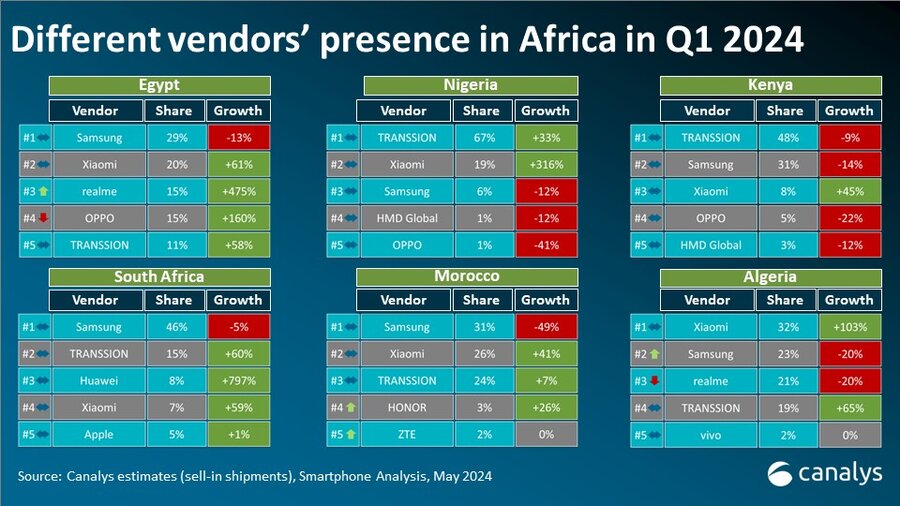

Sub-Saharan Africa’s smartphone market experienced rapid growth, with Nigeria at the forefront, growing by 42% year on year. Despite a fluctuating naira, demand remained strong, driven by telecom advancements, a robust financial sector and government initiatives, such as the Central Bank of Nigeria’s cashless policy. South Africa’s market grew 19%, fueled by demand in the prepaid segment, which holds a significant market share, reflecting a preference for affordable handsets amid high interest rates and load shedding. In contrast, Kenya saw a 7% decline in smartphone shipments due to higher import taxes and VAT. Also, efforts to promote locally assembled phones are challenged by higher retail prices. In North Africa, Egypt led with 39% growth, supported by a stable EGP and GCC funding. Algeria experienced a 16% rise due to strong consumption and investment, while Morocco saw a 17% decline due to a customs duty hike.

“The ultra-low-end segment (sub-US$100) is set to grow by 13% in 2024 as mass-market vendors enhance their offerings,” said Manish Pravinkumar, Senior Analyst at Canalys based in Dubai. “In Q1 2024, TRANSSION maintained strong momentum, driven by entry-level models and consumer upgrades from lower-ASP African markets. Notably, Xiaomi saw robust growth of 333% in the ultra-low-end segment, thanks to the Redmi Number series and A series models. Xiaomi’s consistent support amid fluctuating currencies and diminishing margins assisted this growth and will continue to boost channel confidence in the near future. At the same time, realme leveraged its new Note series and ‘more value for less money’ strategy to re-enter the entry-level segment. Despite suffering a small 1% decline, OPPO is expected to strengthen its entry-level portfolio to reach its pre-2022 shipment levels. On the other hand, Samsung’s low-end shipments declined in Q1, but it will look to rationalize model pricing in South Africa and Egypt to regain growth momentum.”

“Affordable handsets will empower Africans to actively participate in the digital economy, driving long-term growth for governments, telecom operators and smartphone vendors,” said Pravinkumar. “By 2025, 4G penetration is expected to reach nearly 75% of shipments supported by various initiatives from regional governments and telecom operators. Currently, Africa has the world’s highest feature phone penetration rate at 46%. But the shift to smartphones is expected to fuel continuous growth, with device financing schemes playing a vital role in driving further penetration. In the short term, Canalys expects a modest 4% growth in 2024 as vendors will face operational challenges due to exchange rate volatility, though inflationary pressures may ease in some markets. In the long run, sustainable market practices, such as local manufacturing, as seen in Egypt and potentially applicable to markets such as Nigeria, will be crucial for vendors. Additionally, aligning with government-led digitalization and consumer tech adoption initiatives will be vital for continued progress.”

|

African smartphone shipments and annual growth |

||||||

|

Vendor |

Q1 2024 |

Q1 2024 |

Q1 2023 |

Q1 2023 |

Annual

|

|

|

TRANSSION |

9.5 |

52% |

7.0 |

48% |

36% |

|

|

Samsung |

3.8 |

21% |

4.4 |

30% |

-14% |

|

|

Xiaomi |

1.9 |

11% |

0.9 |

6% |

115% |

|

|

realme |

0.6 |

4% |

0.4 |

3% |

56% |

|

|

OPPO |

0.6 |

3% |

0.6 |

4% |

-1% |

|

|

Others |

1.8 |

10% |

1.4 |

9% |

29% |

|

|

Total |

18.2 |

100% |

14.7 |

100% |

24% |

|

|

Note: Xiaomi estimates include sub-brand POCO and Redmi. TRANSSION includes TECNO, Infinix and itel. |

|

|||||

Check out Canalys’ latest complimentary report, Now and next for AI-capable smartphones report 2024.

For more information, please contact:

Manish Pravinkumar: manish_pravinkumar@canalys.com

Canalys's worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, and detailed analysis of storage, processors, memory, cameras and many other parameters. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.