Smart personal audio shipments grow 6% in Q1 2024 to surpass 90 million units

Tuesday, 4 June 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

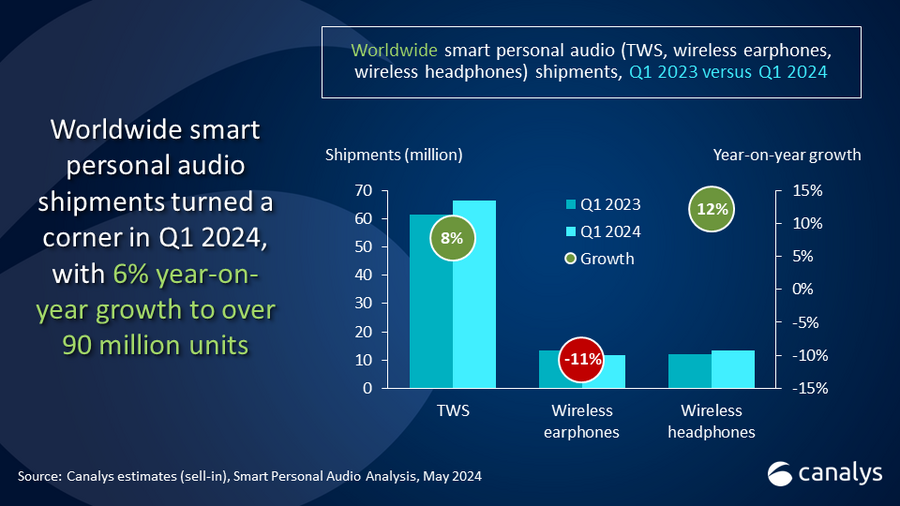

The worldwide smart personal audio market showed signs of recovery in the first quarter of 2024, with shipments up 6% year on year to over 90 million units, according to the latest Canalys estimates. This resurgence was primarily driven by True Wireless Stereo (TWS) and wireless headphones, shipments of which were up 8% and 12%, respectively. Major players are actively seeking new development opportunities in various market segments, injecting renewed vitality into the industry.

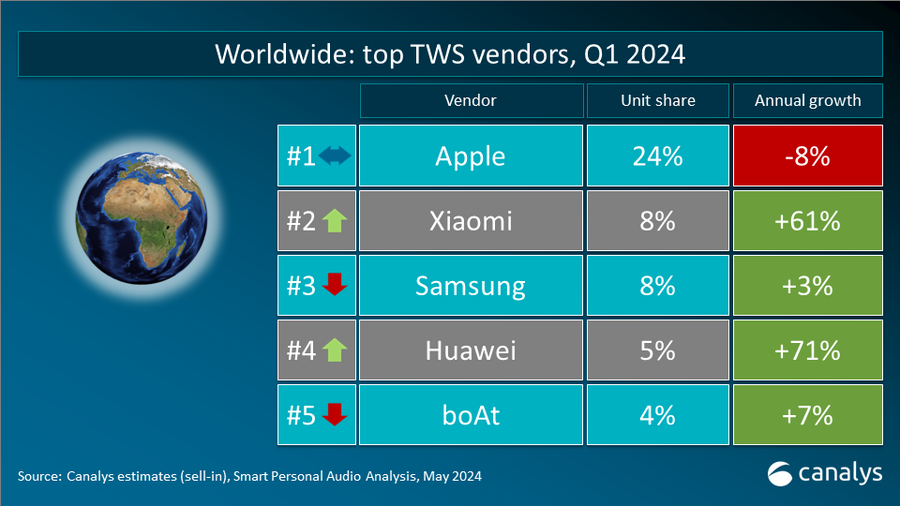

As a key segment within the smart personal audio market, TWS maintained stable shipment volumes despite challenges such as limited product differentiation and high consumer awareness. Canalys Research Analyst Jack Leathem said, “The TWS market has plateaued as consumer familiarity grows, leading vendors to rely more on pricing strategies for growth.” For example, Xiaomi has increased its market share by entering the mid-to-low-end segment with products priced as low as US$15, successfully surpassing Samsung to become the second-largest player, with growth of 61%. Meanwhile, Huawei launched its first sub-US$30 product and expanded its presence in overseas markets, achieving remarkable 71% growth. Samsung has maintained its competitiveness by integrating high-end Active Noise Cancelling (ANC) features into entry-level products. With the TWS market saturation, vendors are turning to the emerging Open Wearable Stereo (OWS) market for new opportunities.

The OWS market, typically in the form of open-design TWS, is rapidly emerging as a so-far unexplored market with little competition and tremendous growth potential. According to Canalys estimates, this segment showed strong double-digit quarterly growth in the first quarter of 2024, capturing significant interest from numerous vendors. This growth momentum is anticipated to remain strong in the near term. But this flourishing market faces challenges, including domination of the high-end segment by top brands and inconsistent quality in entry-level white-label products, leading to a mixed user experience that will hinder widespread adoption. “While affordable products may attract early consumer interest, poor user experiences will lead to negative perceptions, affecting broader acceptance of the category,” said Canalys Research Analyst Claire Qin. “The OWS market is a game-changer. For players to succeed, they must focus on earning genuine consumer trust and fostering deep brand loyalty.”

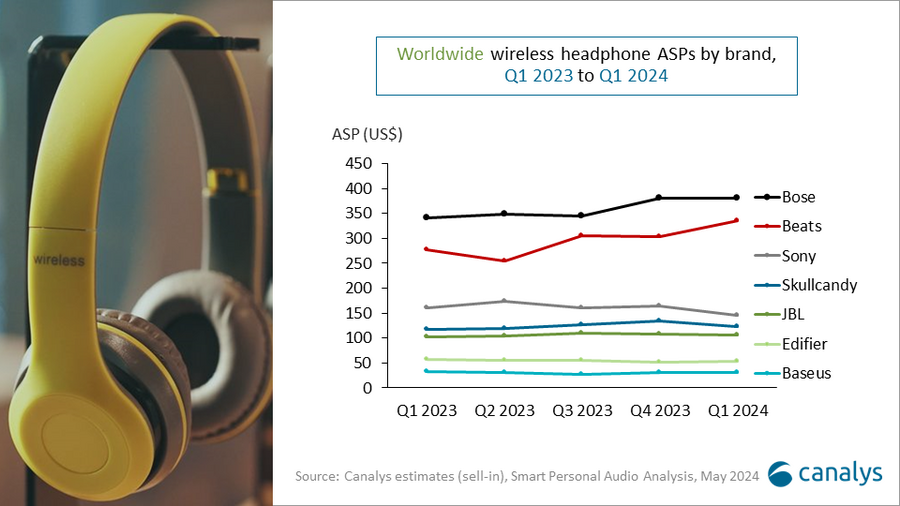

In the saturated TWS market, wireless headphones have become a focus for vendors seeking growth. Sony leads with significant gains in flagship and entry-level products, growing its market share by 17%. Samsung and Apple have strategically leveraged the JBL (Harman) and Beats brands to enhance exposure and engage collaborators to strengthen consumer connections, securing their top positions. Emerging players are making bold moves into the global market with feature-rich wireless headphones priced around US$60, offering a range of options that rival TWS in sound quality and dual-device connectivity. By delivering robust features and affordable prices, they entice consumers to explore the distinct form factors and user experiences of wireless headphones, enhancing their competitive edge.

“Despite the market being in the early stages of recovery with single-digit growth, players are actively seeking new opportunities by diversifying product lines and refining market segmentation,” said Canalys Research Manager Cynthia Chen. “They are enhancing product quality, optimizing positioning and ensuring continuous market development to address challenges. In a market ripe with potential, the drive to innovate and diversify is more important than ever. Companies that master product quality and market segmentation will lead the charge, transforming the smart personal audio landscape into a vibrant and dynamic space.”

|

Worldwide smart personal audio shipments and growth |

|||||

|

Vendor |

Q1 2024 |

Q1 2024 |

Q1 2023 |

Q1 2023 |

Annual |

|

Apple* |

17.4 |

19.0% |

18.6 |

21.5% |

-7% |

|

Samsung* |

7.1 |

7.7% |

7.2 |

8.3% |

-2% |

|

Xiaomi |

5.7 |

6.2% |

3.6 |

4.2% |

+57% |

|

boAt |

4.2 |

4.6% |

3.7 |

4.2% |

+16% |

|

Huawei |

3.5 |

3.8% |

2.1 |

2.4% |

+70% |

|

Others |

53.7 |

58.7% |

51.5 |

59.4% |

+4% |

|

Total |

91.6 |

100.0% |

86.7 |

100.0% |

+6% |

|

|

|

|

|||

|

*Apple includes Beats; Samsung includes Harman subsidiaries Note: percentages may not add up to 100% due to rounding |

|

||||

|

Worldwide TWS shipments and growth |

|||||

|

Vendor |

Q1 2024 |

Q1 2024 |

Q1 2023 |

Q1 2023 |

Annual |

|

Apple* |

16.2 |

24.4% |

17.6 |

28.6% |

-8% |

|

Xiaomi |

5.5 |

8.3% |

3.4 |

5.6% |

+61% |

|

Samsung* |

5.2 |

7.8% |

5.0 |

8.2% |

+3% |

|

Huawei |

3.4 |

5.1% |

2.0 |

3.2% |

+71% |

|

boAt |

2.9 |

4.4% |

2.8 |

4.5% |

+7% |

|

Others |

33.2 |

50.0% |

30.8 |

50.0% |

+8% |

|

Total |

66.4 |

100.0% |

61.6 |

100.0% |

+8% |

|

|

|

|

|||

|

*Apple includes Beats; Samsung includes Harman subsidiaries Note: percentages may not add up to 100% due to rounding |

|

||||

For more information, please contact:

Jack Leathem: jack_leathem@canalys.com

Cynthia Chen: cynthia_chen@canalys.com

Canalys’ Smart Personal Audio Analysis is a service that provides qualitative and quantitative insights into the market for smart personal audio devices. It guides vendors and partners to make the right decisions on value propositions, choose the right channel partners and sell on the appropriate platforms to engage in different markets worldwide.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.