China’s PC market to contract 1% in 2024 before 12% rebound in 2025

Tuesday, 18 June 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

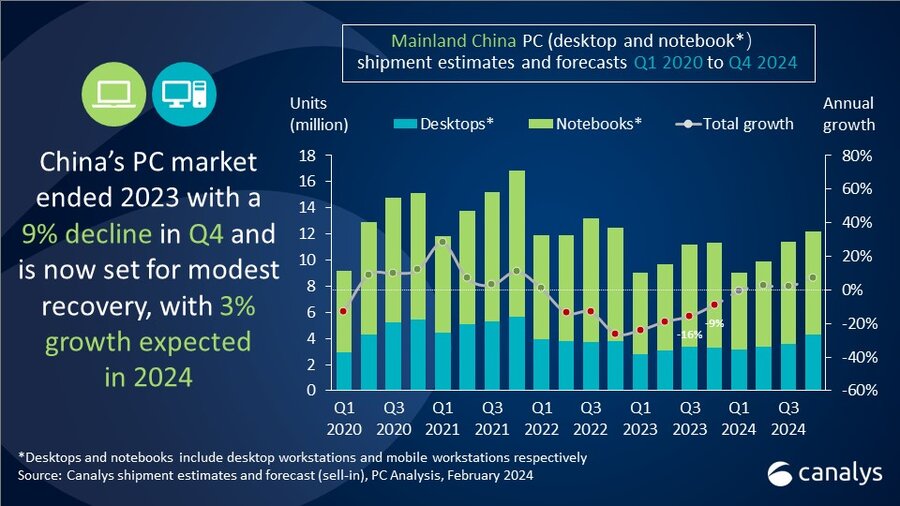

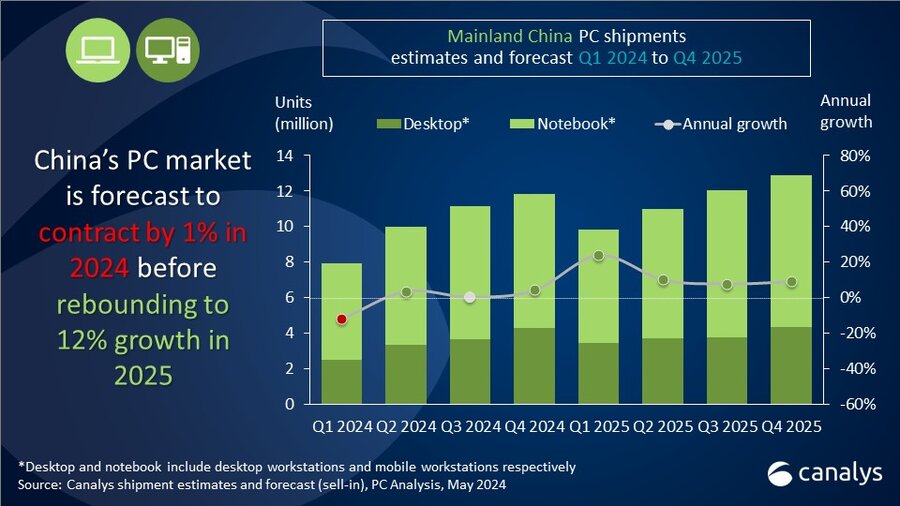

The PC (desktops, notebooks, and workstations) market in Mainland China is forecast to contract by 1% in 2024 according to the latest Canalys data. The first quarter of the year already saw a sharp decline, with shipments down 12%, in contrast to the global market which returned to growth. Desktop shipments are expected to perform well in 2024, growing 10% annually as they benefit from commercial sector refresh demand, especially from large state-held enterprises and local governments. Notebook shipments are set to drop 5%, as demand from consumers and the private sector is anticipated to remain cautious on short-term expenditure such as PCs.

China's PC market trajectory is diverging from global trends in its recovery journey. In Q1 2024, the commercial sector bore the brunt of the market downturn, undergoing a 19% decline due to weak IT spending by large enterprises. The decline in consumer shipments was milder, with shipments dropping 8%. However, despite the muted performance in 2024, significant local developments point to a stronger market in 2025, in which PC shipments are expected to grow 12%.

Xinchuang, the Chinese information and technology innovation industry, focuses on developing a domestic ecosystem across components, software, hardware and more. "The Xinchuang community's maturation over the years has resulted in clearer standards and rules, shaping robust ecosystem dynamics within the value chain, particularly in the chipset and software domains,” said Canalys Analyst Emma Xu. “This initiative is now poised to penetrate local governments and extend its reach into sectors such as finance, telecommunications, energy, healthcare, and education. Of central importance will be the role of AI capabilities in hardware and software. Industry stakeholders including OEMs, chipset manufacturers, software developers, and infrastructure providers must align their products and services with this emerging trend to remain competitive.”

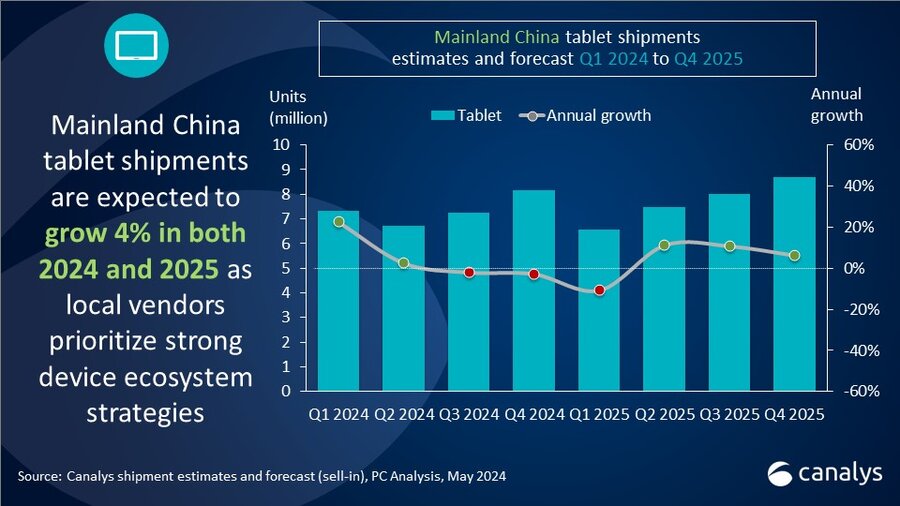

AI is a significant catalyst not only for the PC market but also for the burgeoning tablet segment. While notebooks and desktops dropped by 13% and 11% respectively, the tablet market surged by 22% in the first quarter, buoyed by enthusiastic demand for devices aimed at children and local smartphone vendors eyeing device ecosystem opportunities. Huawei has broadened its reach, covering lower-priced options with the MatePad SE series and premium options with the MatePad Pro series. Other vendors are driving adoption with new devices and applications supporting productivity, such as recording, translation, and note-taking. The education market is also a hotbed for competition and innovations, with vendors including IflyTek and Xuersi developing tailored AI models for learning applications.

“In an increasingly competitive landscape, innovation across hardware and software is crucial,” said Xu. “However, the vendors' capabilities to leverage these innovations and integrate them across device ecosystems to deliver compelling experiences and user benefits will be even more critical. For PC and tablet vendors alike, this will require identifying and capitalizing on localization opportunities and favorable AI innovation policies within the China market.”

|

People’s Republic of China (mainland) desktop and notebook forecast |

|||||

|

Canalys PC Forecast: 2023 to 2025 |

|||||

|

Segment |

2023 |

2024 shipments |

2025 shipments |

2024 |

2025 |

|

Consumer |

23,390 |

22,992 |

25,191 |

-2% |

10% |

|

Commercial |

15,066 |

15,355 |

17,714 |

2% |

15% |

|

Government |

2,144 |

1,997 |

2,196 |

-7% |

10% |

|

Education |

640 |

604 |

664 |

-6% |

10% |

|

Total |

41,240 |

40,948 |

45,766 |

-1% |

12% |

|

|

|

||||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. |

|

||||

|

Source: Canalys forecast, PC Analysis, May 2024 |

|

|

|||

|

People’s Republic of China (mainland) tablets forecast |

|||||

|

Canalys PC Forecast: 2023 to 2025 |

|||||

|

Segment |

2023 |

2024 shipments |

2025 shipments |

2024 annual growth |

2025 annual |

|

Consumer |

23,755 |

25,010 |

26,297 |

5% |

5% |

|

Commercial |

3,517 |

3,179 |

3,135 |

-10% |

-1% |

|

Government |

214 |

410 |

501 |

92% |

22% |

|

Education |

836 |

863 |

792 |

3% |

-8% |

|

Total |

28,322 |

29,462 |

30,726 |

4% |

4% |

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. |

|

||||

|

Source: Canalys forecast, PC Analysis, May 2024 |

|

|

|||

|

People’s Republic of China (mainland) desktop and notebook shipments (market share and annual growth) |

|||||

|

Canalys PC Market Pulse: Q1 2024 |

|||||

|

Vendor |

Q1 2024 shipments |

Q1 2024 market share |

Q1 2023 shipments |

Q1 2023 market share |

Annual |

|

Lenovo |

2,728 |

34% |

3,254 |

36% |

-16% |

|

Huawei |

956 |

12% |

952 |

11% |

0% |

|

HP |

690 |

9% |

903 |

10% |

-24% |

|

Asus |

623 |

8% |

699 |

8% |

-11% |

|

Apple |

475 |

6% |

603 |

7% |

-21% |

|

Others |

2,474 |

31% |

2,644 |

29% |

-6% |

|

Total |

7,946 |

100% |

9,055 |

100% |

-12% |

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. |

|

||||

|

Source: Canalys estimates (sell-in shipments), PC Analysis, May 2024 |

|||||

|

People’s Republic of China (mainland) tablets shipments and annual growth |

|||||

|

Canalys PC Market Pulse: Q1 2024 |

|||||

|

Vendor |

Q1 2024 shipments |

Q1 2024 market share |

Q1 2023 shipments |

Q1 2023 market share |

Annual |

|

Huawei |

2,141 |

29% |

1,137 |

19% |

88% |

|

Apple |

1,956 |

27% |

2,019 |

34% |

-3% |

|

Xiaomi |

913 |

12% |

679 |

11% |

35% |

|

HONOR |

650 |

9% |

701 |

12% |

-7% |

|

Lenovo |

640 |

9% |

637 |

11% |

0% |

|

Others |

1,045 |

14% |

823 |

14% |

27% |

|

Total |

7,345 |

100% |

5,996 |

100% |

22% |

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. |

|

||||

|

Source: Canalys estimates (sell-in shipments), PC Analysis, May 2024 |

|||||

For more information, please contact:

Emma Xu: emma_xu@canalys.com

Canalys' PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities in the market. Canalys PC shipment data is granular, guided by a strict methodology and broken down by market, vendor and channel, as well as additional splits, such as GPU, CPU, storage and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.