Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

AI set to dominate US federal market spending and discourse in 2025

The US federal IT market landscape is evolving rapidly, with major federal agencies announcing new IT service contracts totaling US$13 billion in April and May. As agencies turn to the channel for support amid looming cloud migration deadlines and acceleration in AI spending, there is a notable rise in IT spend captured by channel partners, indicating a strong 2025 for the channel.

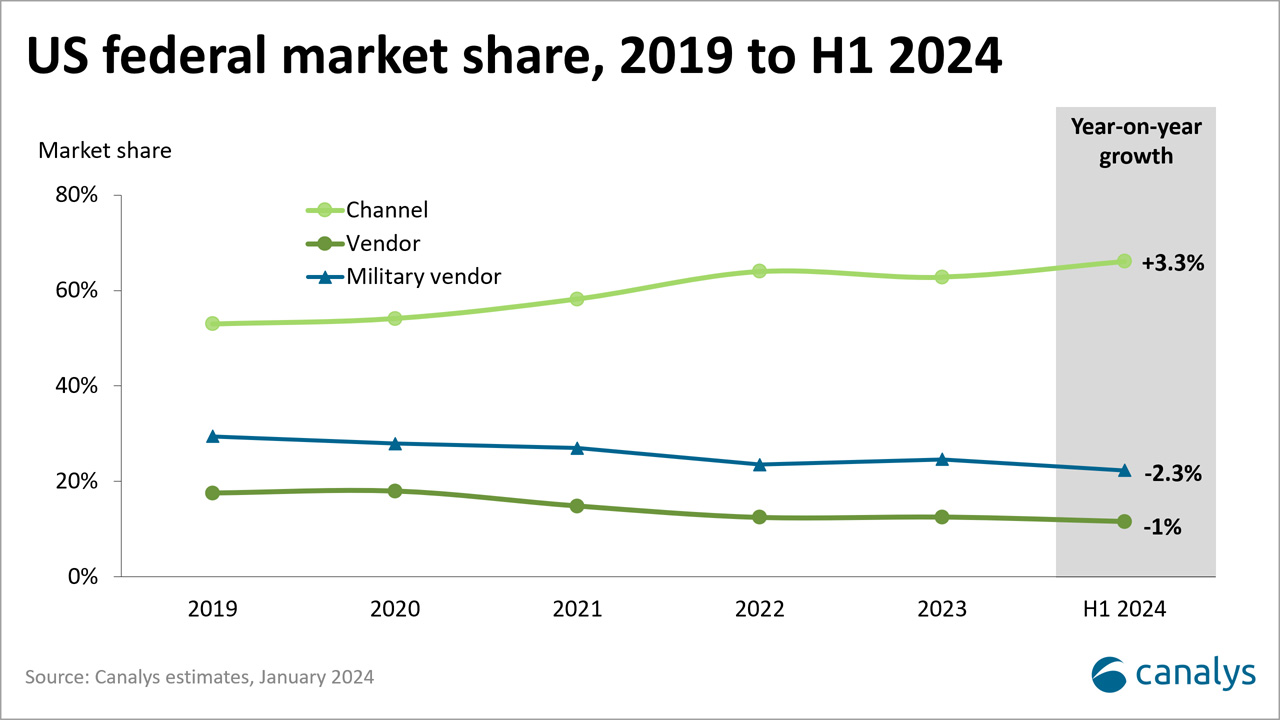

In April and May of this year, US$13 billion of new IT services contracts were announced by major federal agencies, including the US Army, Office of Federal Student Aid, Federal Aviation Administration and FBI. With looming cloud migration deadlines in September, federal agencies are increasingly looking to the channel for the necessary support and expertise. This trend is reflected in the rising share of IT spend captured by channel partners. In H2 2023, they captured 62.8% of total federal IT spend, which grew to 66.1% in H1 2024. Furthermore, over the last five years, the channel’s average growth rate as a share of the total IT spend was 2.1%. In H1 alone, the channel’s growth has almost doubled that average.

US federal agencies are usually slow to adopt new technologies. It’s been over a decade since FedRAMP was created to enable agencies to migrate to the cloud, and yet several agencies are scrambling to meet the end-of-September deadline. While the deadline for cloud migration is set for the end of the government’s fiscal year, agencies that have already completed migration are discovering the need for continued support services. Most agencies prefer large-scale, long-term deals with predictable refresh cycles that are simple to expense, which is a barrier to rapid change.

The total IT budget for federal civilian agencies in 2025 will be US$75.13 billion, which is only a 1% increase over last year’s budget. When spending plans are broken down, cybersecurity and AI are the two clear topics of emphasis. Since President Biden’s market-shifting executive order on zero trust in 2021, the federal IT budget has emphasized cybersecurity. It will continue to be a key market driver in 2025, as cybersecurity accounts for 16.4%, or US$12.3 billion, of the budget. There is a large opportunity for MSPs in particular, as many federal civilian agencies look to outsource services.

With FedRAMP’s recent overhaul, many cloud solutions are getting approved for government use for the first time, presenting a large opportunity for cloud partners. In May, Google achieved FedRAMP high authorization on over 100 additional services, opening up Google Cloud’s entire suite for agency use. Google is not the only company increasing its presence on the FedRAMP marketplace: as of June, there are 138 services currently in process for FedRAMP approval. Prominent cloud providers with solutions currently in the FedRAMP approval process include Cloudera, Appian, Cisco, Darktrace, Lumen, Splunk, Palantir and Trend Micro.

Historically, public sector customers have been reluctant to use hyperscaler marketplaces due to security concerns. But these marketplaces adhere to government regulations, and navigating agency contracting procedures can be time-consuming and complex. As the market consolidates and the hyperscalers grow, expect an increase in the use of their marketplaces as a procurement tool. This is an opportunity for distributors in particular, which will be able to offer agency customers support in navigating procurement through these marketplaces. Only three distributors made the top 50 federal channel partners by contract revenue last year. Marketplaces present a clear opportunity for more distributors to offer a differentiated service to their federal customers and drive the growth of their own federal businesses.

Over US$35 billion being considered for civilian agency AI projects

The US government’s commitment to AI is growing rapidly. In addition to the existing US$3.3 billion allocated for AI in the 2025 federal IT budget, Congress is now considering a significant additional investment. A bipartisan package proposes US$32 billion in discretionary spending for “AI innovation projects” across non-defense agencies. This would represent the first major attempt by Congress to fund widespread AI adoption throughout the civilian government. Even if the current package doesn’t pass due to political hurdles, significant AI investment is coming sooner rather than later. The bipartisan nature of the proposal and the high-profile politicians involved signal that AI has become a top priority for the government.

While the 2025 budget and the package being considered in Congress are the government’s first substantial investments into AI, multiple agencies have already been leveraging AI tools this past year without much oversight or guidance. This changed when the White House announced new AI rules for agencies through the Office of Management and Budget in March. All agencies have until 1 December to comply with the guidelines set in the memorandum.

Vendors and partners are already pivoting in anticipation of the massive increase in AI spending and legislation. Recently, Microsoft unveiled a novel generative AI model designed specifically for federal government agencies. It meets the government’s rigorous security protocols by being entirely offline, a huge pivot from the traditional online dataset learning models AI programs such as Gemini and ChatGPT follow. Booz Allen Hamilton, the largest federal partner by contract revenue in 2023, generated US$600 million in revenue last year from AI projects. This year, it is aiming to generate more than US$1 billion in AI revenue.

AI has also been a driver of deeper partnerships within the tech sector. Accenture Federal Services and Google Public Sector recently partnered to launch an “AI center of excellence”, which can support agencies with sensitive and classified workloads while also giving agencies access to new technologies, including Google’s AI-optimized infrastructure. This follows Accenture and Google’s 2023 partnership to establish a similar center of excellence for federal cybersecurity.

With the end-of-September cloud migration deadline fast approaching, the stage has been set for the next point of emphasis for federal agencies in their digital transformations: AI.

Increased competition and consolidation squeezing medium-sized federal partners

H1 2024 has seen an uptick in both acquisitions and partnerships, and this trend will continue throughout the year. As the government reaches its cybersecurity deadline and gears up to substantially invest in AI, the federal market is becoming increasingly competitive. Businesses that wish to succeed in this market will need to have services attached to their offerings.

The federal market has historically been dominated by a few large partners and that trend has continued this year. The top 10 channel partners generated 60.3% of all channel contract revenue last year, and the top 50 generated 96.7%. The federal government has a strong preference for very large, long-term deals with consulting and services attached, which means working with only the largest partners.

But many federal deals involve both small and large partners, particularly when it comes to services. Small businesses can earn numerous beneficial designations that increase their federal business opportunities, such as the Small Business Administration, Service-Disabled Veteran-Owned Small Business, Minority Owned Business Enterprise and Women-Owned Small Business certifications. Federal agencies have annual goals for awarding a certain percentage of their contracting dollars to small businesses, including those with Small Business Administration (SBA) certifications. So, while there’s no mandatory government-wide quota, there are significant incentives for federal agencies to do business with SBA-certified businesses. In May, the Interior Department announced a cloud migration and environment management deal with Accenture, SAIC, SMX and small business Zivaro. The Pentagon is also currently piloting a new IT contracting platform that’s being tested by 75 small businesses. Due to the government’s legislative priorities, small businesses will continue to do well in the federal space and benefit from the trends surrounding AI and cybersecurity.

The benefits available to smaller businesses and the continued domination of the top 10 federal partners leave medium-sized firms vulnerable to loss of market share or acquisition. In May, Accenture Federal Services, in the top seven of generated federal contract revenue last year, acquired Cognosante, which ranked thirty-seventh. Cognosante is an MSP that has a large federal health business, and Accenture is using the acquisition to launch a new federal health portfolio. This is just one example of a wider trend of larger firms looking to bolster their managed services offerings via the acquisition of MSPs with expertise within the federal sector.

Specific expertise is vital in the public sector: not only do partners need the necessary certifications to provide their solutions to federal customers, the same applies further down the public sector value chain. Educational institutions, as well as state and local governments, tend to follow the federal government’s precedent when it comes to IT implementation and best practices. These sectors are expected to spend roughly US$140 billion on IT this year, with 42.5% allocated specifically to services, largely surrounding AI and cybersecurity. This provides a clear scaling opportunity for partners looking to capture further revenue with their specialized public sector capabilities in an even larger total addressable market. At all levels of the public sector, it is clear that AI and cybersecurity services will drive spending in H2 2024 and beyond.