Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Is sustainability still a top priority for the IT ecosystem in 2024?

Informed by insights from over 650 partners globally, Canalys’ 2024 Sustainable Ecosystems Survey reveals partners’ approaches to sustainability and ESG in today’s era of AI.

Earlier this month, we published the results of our annual Global Sustainable Ecosystems Survey, reflecting 656 responses from partners in 57 markets. Digging deeper into the results reveals the channel’s attitudes toward the opportunities, challenges and driving forces shaping partners’ sustainability strategies today. Overall, there are certainly reasons for optimism – but uncertainty remains over AI’s role in the ESG conversation.

Climate-conscious customers drive up the IT sustainability revenue opportunity

For most players in the IT space, 2024 is about recovery from the market decline – and naturally partners are prioritizing their reliable business areas, including managed services and hardware reselling, bolstered by the PC market’s return to growth. As such, for most partners, sustainability is not the top priority for 2024, but it remains high on the channel’s agenda – partly driven by the growing business opportunity.

In 2024, 50% of partners worldwide said that they expect to generate revenue from sustainability solutions this year – up three percentage points from 47% last year. Though 2023’s survey results revealed that over half of EMEA and APAC partners expected sustainability revenue last year, the global increase can be, in part, attributed to growth in the Americas, with regulatory pressure notably building in the US.

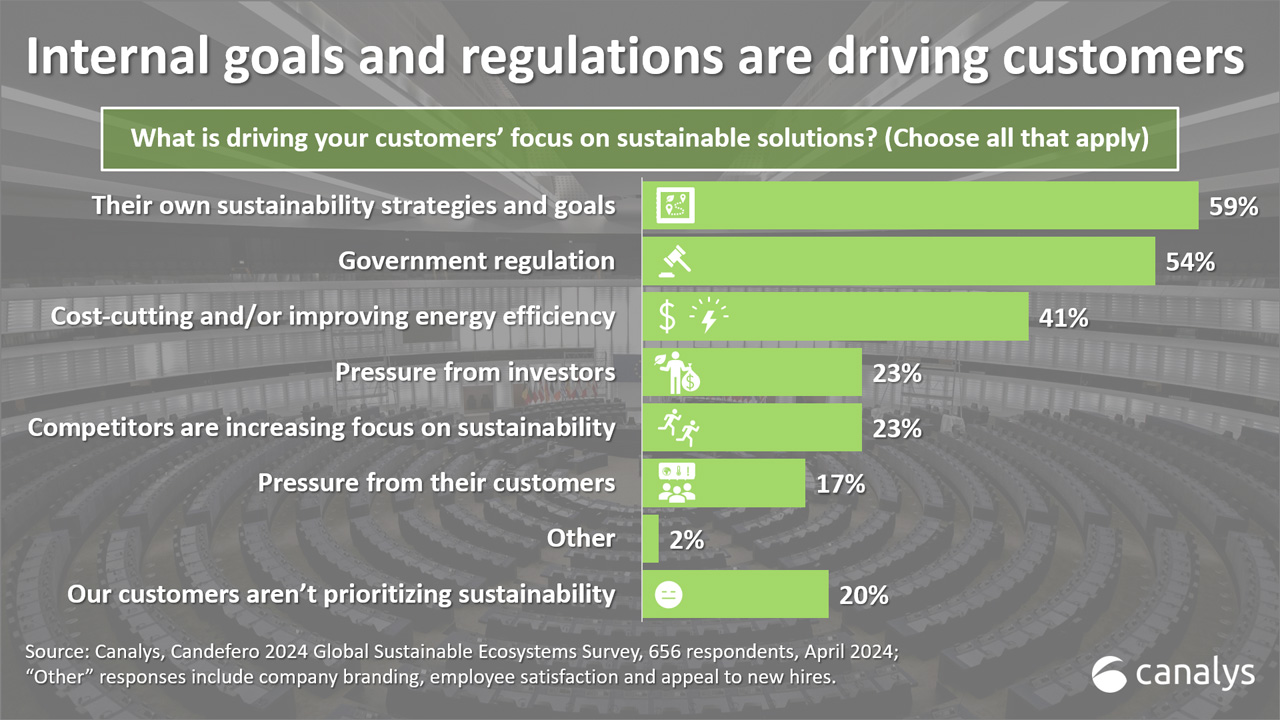

But 59% of partners state that customers’ own goals are the top driver behind their interest in sustainable IT solutions (up 12 percentage points from 2023), with companies’ alignment with the Science Based Targets initiative skyrocketing across industries. Following customers’ own sustainability targets, the second and third top action drivers were regulatory pressures and efforts to cut costs by improving energy efficiency.

Regulations are getting real, but is the channel ready to disclose emissions data?

In 2024, 54% of partners globally say that governmental regulations are pushing their customers to pursue sustainable IT solutions – up seven percentage points from 2023. This comes as no surprise, as the ESG regulation landscape has since grown ever more complex, with large companies in the EU, Singapore, Australia and California required to report emissions (both upstream and downstream) across all three scopes in the next few years. The US Securities and Exchange Commission will also require listed companies to disclose scope 1 and 2 emissions through a phased approach, though scope 3 requirements were controversially stripped from the final law.

Large corporate customers, as well as many channel titans, are already feeling the tightened compliance pressure – and medium-sized businesses are also set to be affected soon. Overall, the survey results suggest that many partners remain unprepared for the upcoming wave (tsunami?) of ESG regulations. Worldwide, only 31% of partners now track scope 1 and 2 emissions, with just 23% of partners recording their scope 3 emissions as well.

These stats have risen from 22% and 21% respectively last year but, as it stands, there are clearly many partners (especially mid-market ones) unprepared for regulators’ new requirements for comprehensive and transparent emissions reporting.

The energy crisis may have eased, but AI creates a whole new challenge

In early 2023, 44% of partners globally said that improving energy efficiency to cut costs was a key driver for customers’ focus on sustainability in their IT spending. This dropped slightly to 41% in our 2024 survey – partly reflecting the de-escalation of the energy crisis, especially in Europe.

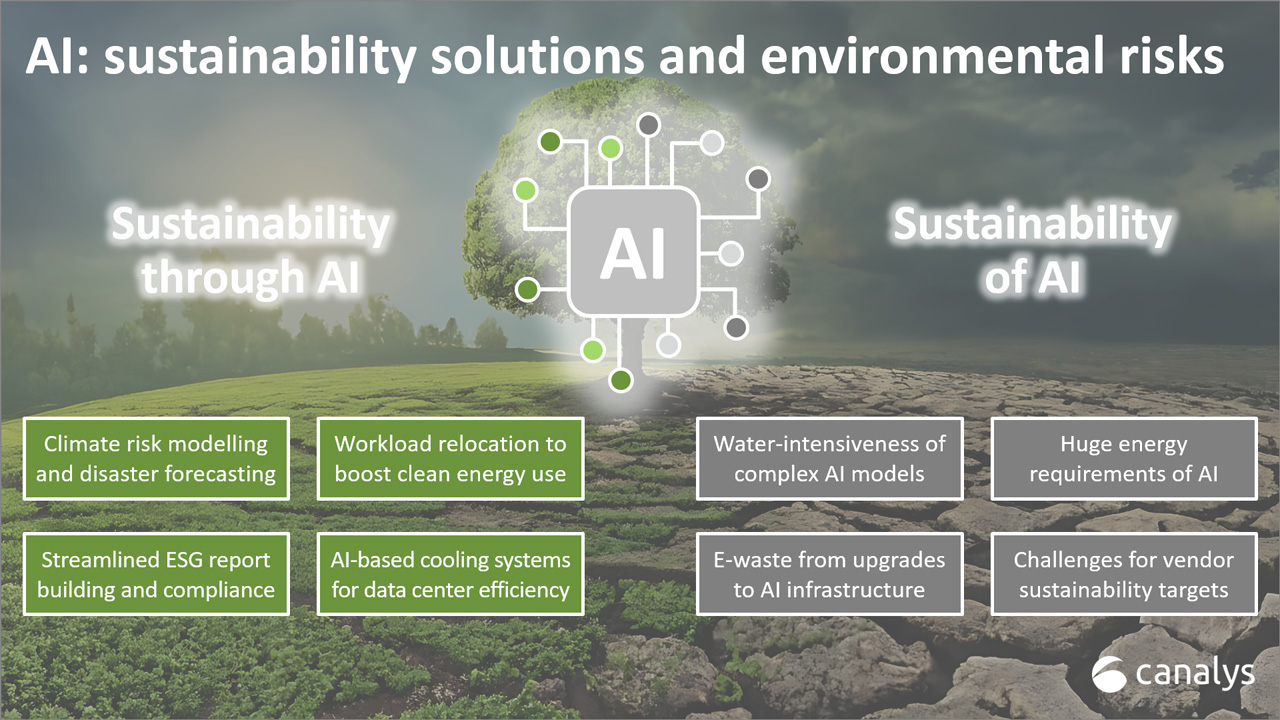

AI poses many issues for sustainability. There are certainly opportunities for AI to enable sustainability in the IT sector, for example, by shifting cloud workloads across regions to maximize renewable energy use. But the sustainability of AI itself is an equally important question, albeit an often neglected one, risking an explosion in data centers’ emissions and undermining efforts thus far to decarbonize IT.

At large, vendors have been keen to promote examples of what AI can do for sustainability, especially the hyperscalers. But, as it stands, vendors are slow to promote tangible AI use cases to support partners and their customers in advancing their sustainability efforts. Canalys expects sustainability to rise up the channel’s agenda again once the AI hype dissipates and the resource intensity of AI data centers becomes a wider concern. Being seen as an AI-first company has been a priority across the industry since the AI boom started, but maximizing the energy efficiency of AI must be the next step.

We’ll be delving deeper into the results of the Global Sustainable Ecosystems Survey in a dedicated webinar next week. Canalys’ sustainability analysts will explore the channel’s ESG progress so far and answer your top questions on what AI, e-waste and regulation really mean for sustainability at large.

Don’t miss out on 16 May 2024 at 1pm UTC – register today!