US PC market surged 3% in Q4 2023 ahead of swift recovery, expects 7% growth in 2024

15 March 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

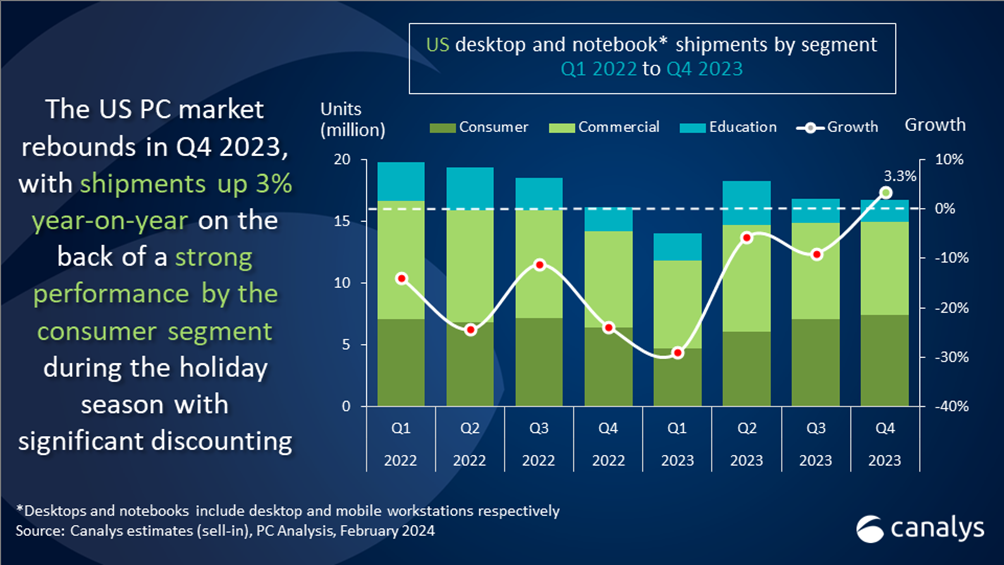

According to the latest Canalys data, PC shipments (desktops, notebooks and workstations) in the United States grew 3.3% year-on-year to 16.7 million units in Q4 2023. The consumer segment drove much of the growth during the holiday season with an impressive growth of 15.1% year-on-year. Commercial PC shipments experienced a minor decline of 2.2% year-on-year for the quarter, while the education segment witnessed a larger decline of 13.4%. This marks the beginning of several projected quarters of growth over the next two years, with 2024 and 2025 anticipated to be strong for the US PC market.

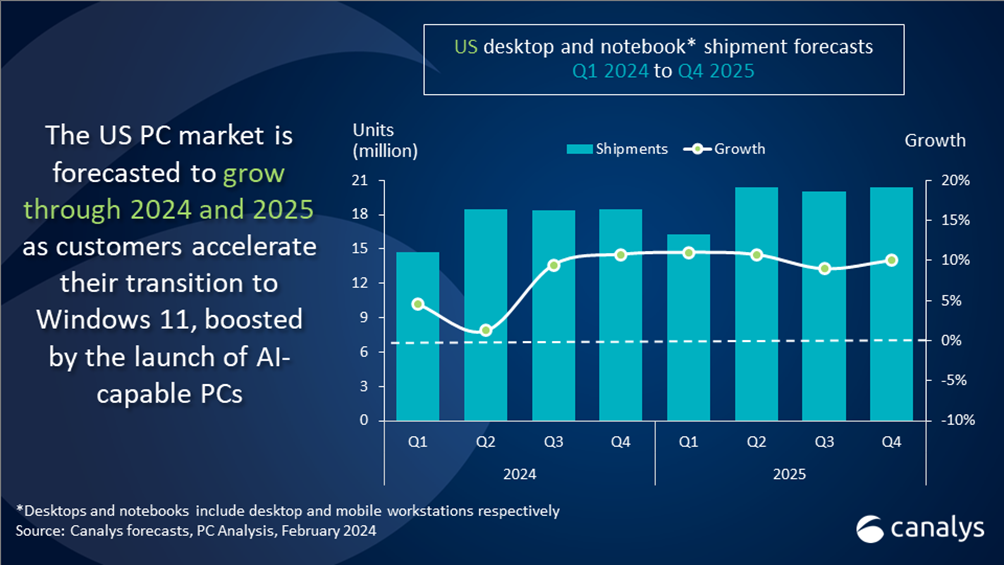

For the second consecutive quarter, the consumer segment showed the best performance in the US market. “Relatively robust seasonal spending was boosted by an extended promotion period and deep discounts throughout the quarter,” said Greg Davis, Analyst at Canalys. “Consumer sentiment around spending on consumer electronics improved following an extended period of lower prioritization for the category. Although PC procurement by businesses remained constrained, the magnitude of shipment declines narrowed. With Windows 11 PC refresh, the introduction of AI-capable PCs and new budgets being set, 2024 bodes well for the commercial sector, which is expected to produce strong growth both this year and next. Demand in the education sector in 2024 is also expected to be healthy, as final deployments funded by the Emergency Connectivity Fund (ECF) take place during the summer.”

The PC market is set for further improvement in the US as Canalys expects continued annual growth in 2024 and 2025 at 7% and 10%, respectively.

“The return of PC demand will be supported by a healthier macroeconomic situation from 2024 onward,” added Davis. “The inflation rate has started to ease in the US and interest rates are likely to be maintained or even reduced this year. The timing of this is important as businesses will look to invest in new and more expensive devices with the integration of AI capabilities into their operations. The US is expected to lead in the adoption of AI-capable PCs as products across a variety of device and CPU vendors are set to be made available in the market throughout 2024.”

|

US desktop and notebook shipments (market share and annual growth) Canalys PC Market Pulse: Q4 2023 |

|||||

|

Vendor |

Q4 2023 shipments |

Q4 2023 |

Q4 2022 |

Q4 2022 |

Annual |

|

HP |

4,662 |

27.9% |

4,579 |

28.3% |

1.8% |

|

Dell |

3,771 |

22.6% |

3,968 |

24.5% |

-5.0% |

|

Lenovo |

2,628 |

15.7% |

2,358 |

14.6% |

11.5% |

|

Apple |

2,401 |

14.4% |

2,053 |

12.7% |

16.9% |

|

Acer |

826 |

4.9% |

729 |

4.5% |

13.2% |

|

Others |

2,410 |

14.4% |

2,479 |

15.3% |

-2.8% |

|

Total |

16,698 |

100.0% |

16,167 |

100.0% |

3.3% |

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. |

|

||||