Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

How much potential is in the information innovation PC market in Mainland China?

China’s government procurement policy prioritizing domestic processors and operating systems is accelerating the shift towards indigenous technology, with Canalys data indicating significant growth potential for local processors. As market dynamics evolve, international brands such as Dell and HP may need to strategize their market approaches in response to the country's increasing focus on domestic components beyond processors and operating systems.

China’s government procurement policy prioritizing domestic processors and operating systems is accelerating the shift towards indigenous technology, with Canalys data indicating significant growth potential for local processors. As market dynamics evolve, international brands such as Dell and HP may need to strategize their market approaches in response to the country's increasing focus on domestic components beyond processors and operating systems, as predicted by Canalys.

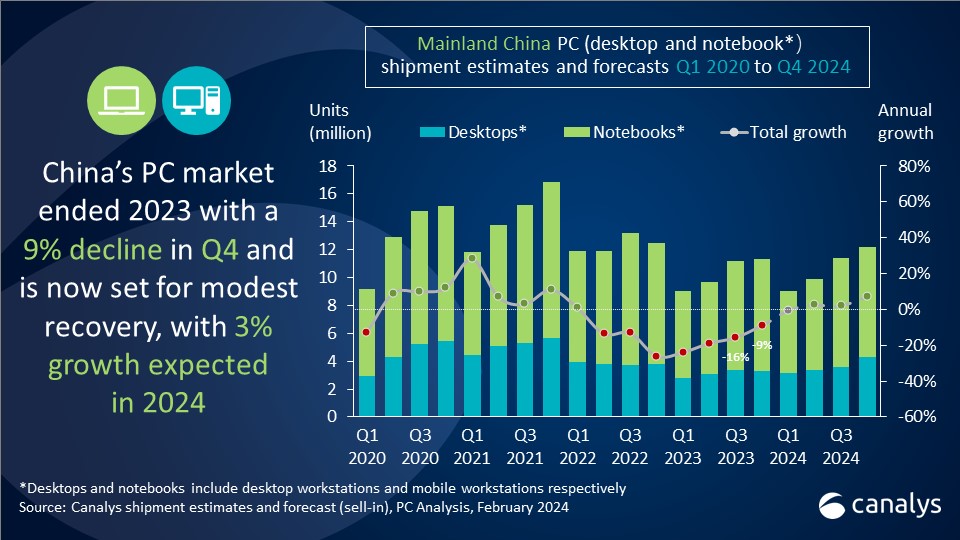

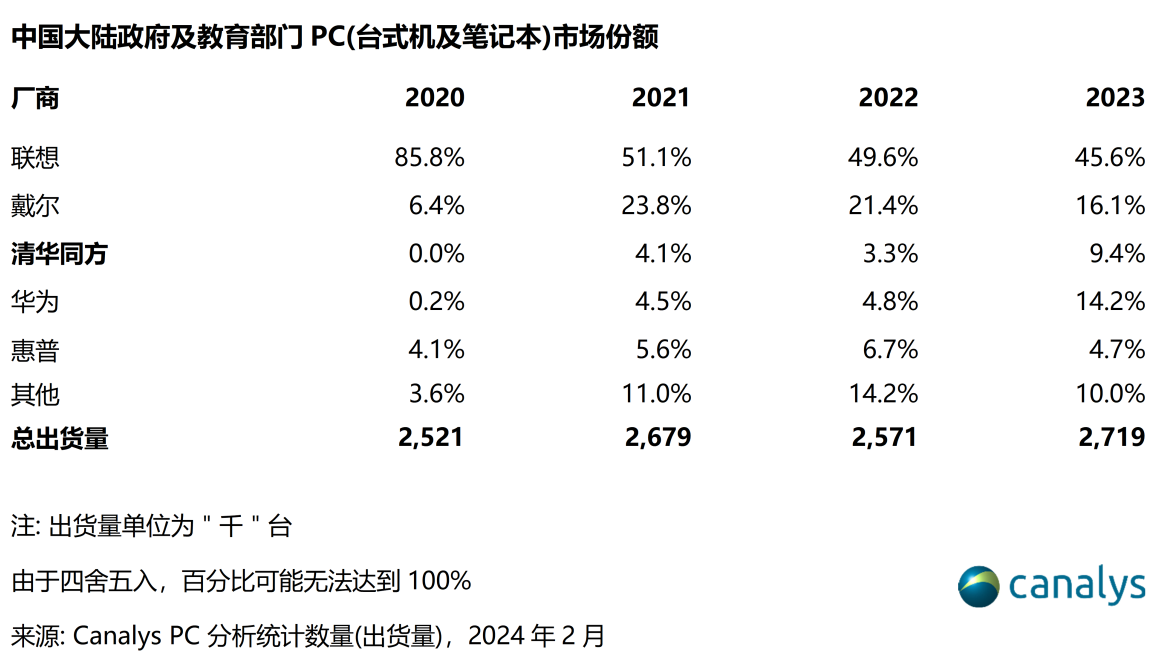

On 11 March 2024, China's Central Government Procurement Center issued a notice prioritizing the purchase of domestic processors and operating systems. This policy not only accelerates the procurement of Information Technology Application Innovation (ITAI) products but also signifies a deepening of technological self-reliance in China. According to Canalys, in 2023, the PC procurement by China's government and educational sectors reached 2.72 million units, accounting for 6% of the national shipment volume, with the vast majority still relying on solutions from Intel and AMD. This policy shift provides substantial growth opportunities for domestic processors.

In terms of PC OEM, Canalys data shows nearly 85% of government sector shares have shifted to Chinese brands led by Lenovo and Huawei, both having launched products meeting the requirements of the ITAI policy. The market share of international brands including Dell and HP has decreased from over 35% in 2021 to below 15%, indicating the trend towards autonomization has begun. In the Chinese mainland market, shipments by HP, Dell, Apple, and Acer account for an average of 10% or less. Therefore, even if future central procurement requirements further extend to brand restrictions, the additional impact on international brands will be quite limited.

Mainland China’s desktop and notebook market share in Government and Education segment |

||||||||

|

Vendor |

2020 |

2021 |

2022 |

2023 |

||||

|

Lenovo |

85.8% |

51.1% |

49.6% |

45.6% |

||||

|

Dell |

6.4% |

23.8% |

21.4% |

16.1% |

||||

|

Tongfang |

0.0% |

4.1% |

3.3% |

9.4% |

||||

|

Huawei |

0.2% |

4.5% |

4.8% |

14.2% |

||||

|

HP |

4.1% |

5.6% |

6.7% |

4.7% |

||||

|

Others |

3.6% |

11.0% |

14.2% |

10.0% |

||||

|

Total shipments |

2,521 |

2,679 |

2,571 |

2,719 |

||||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), February 2024 |

|

|||||||

The domestically produced processors listed in the notice include Loongson, Phytium, Zhaoxin, Huawei Kunpeng, Hygon, and Shenwei. In the current limited-scale information innovation market, competition is particularly fierce. Among these, Zhaoxin and Hygon have launched processors based on the x86 architecture, with Zhaoxin's patent licensing from VIA Electronics and Hygon's from AMD. Other suppliers mainly develop using ARM architecture. In the future, as the proportion of information innovation continues to rise, ARM-based CPUs are expected to also increase their market share in China. Although the current processors listed cannot compare in process and performance evaluation with the latest generation of processors from Intel and AMD, they are sufficient for document processing and basic official needs when paired with domestic software optimization for Tongxin UOS and Kylin operating systems. With policy support, it is foreseeable that the adoption rate among government procurement and some large state-owned enterprises will increase.

When it comes to operating systems, the domestic products include UnionTech UOS and Kylin, with the overall market share closely linked to the shipment of information innovation products. It is expected that, as the procurement proportion of these products increases, the operating systems will also develop in tandem. However, it should be noted Huawei has the potential to enter the market within the next year or so with Kunpeng processors bundled with HarmonyOS. Combining Huawei's existing ecosystems of smartphones, wearable devices, and automotive products could further intensify competition among domestic operating system brands.

For the ITAI market, potential development will primarily include absorbing the remaining procurement demands of the government and educational sectors, with some state-owned enterprises likely adjusting in response to government requirements. Currently, products equipped with processors on the procurement list account for just over 5% of shipments to government and educational sectors in Mainland China, indicating the information innovation market still has at least 20 times more room for development. For domestic brands such as Huawei and Tsinghua Tongfang, this represents a significant growth opportunity. For Dell and HP, it is crucial to closely monitor policy developments and appropriately shift towards the consumer market or compensate by capturing market shares in other international markets.

Although recent requirements are limited to processors and operating systems, Canalys predicts the demand for domestically produced components will continue to expand to include screens, memory, flash memory, and batteries. Currently, Chinese manufacturers hold a significant share of the screen and battery markets, making the transition relatively easy. However, leading technologies in memory and flash memory are still dominated by major suppliers from the US and South Korea. Domestic manufacturers that have ventured into manufacturing memory and flash memory and have captured a certain market share must navigate the challenges of being under US sanctions and other potential risks, possibly facing bottlenecks in future development and complicating supply chain management.

中国大陆个人电脑信创PC市场有多大潜力?

2024年3月11日,中央政府采购中心发布了《关于优先采购国产CPU及操作系统的通知》,这一政策不仅标志着信创(即信息技术应用创新,ITAI)产品采购的加速,也预示着国产技术自主化的深入的。Canalys数据显示,2023年中国政府及教育部门的PC采购量达到272万台,占到全国出货量的6%,其中绝大多数仍依赖于Intel和AMD的解决方案。这一政策变动为国产CPU提供巨大的增长空间。

在OEM的分布方面,政府部门已将近85%的采购需要转向以联想、华为为首的国产品牌。两家公司均已推出符合信创要求的产品。自2021年以来,戴尔、惠普等国际品牌的市场份额已从超过35%跌至15%以下,显示出自主化的趋势已然开始。中国大陆市场,惠普、戴尔、苹果和宏碁等品牌的平均出货量仅占总出货量的10%或更少。因此,即使未来政府采购的限制进一步扩大,对国际品牌的影响也将相当有限。

该通知中符合国产CPU条件的品牌包括龙芯、飞腾、兆芯、华为鲲鹏、海光及申威。在当前规模有限的信创市场中,竞争尤为激烈。其中,由兆芯和海光推出的基于x86架构的CPU,兆芯的专利授权来源于威盛电子,海光的则源自AMD。其他芯片厂商多以Arm架构为基础。随着未来持续推高信创比例,基于Arm的CPU在中国大陆的市场份额有望同步提升。虽然目前列出的CPU的制程和评测性能还无法与Intel及AMD的最新一代CPU相比,但配合国内软件对统信UOS、麒麟等操作系统的逐步优化,足以满足文书处理和基本公务需求。在政策的推动下,预计政府采购以及部分大型国企的采用率将有所增长。

在操作系统方面,目前国内的系统主要以统信UOS及麒麟为主,总市场占有率基本与信创产品的出货量挂钩。预计未来随着信创产品的采购比重上升,这些操作系统也将同步发展。然而,值得注意的是,不可排除未来华为在明年或后年推出鲲鹏CPU绑定HarmonyOS的产品进入市场。结合华为现有的手机、穿戴设备以及车载产品形成一套更完善的生态系统,有望进一步加剧国产操作系统之间的竞争。

对于信创市场而言,其潜在的市场发展将包括吸纳剩余的政府及教育部门的采购需求,并预计部分国企应政府要求也将有所转换。当前,中国大陆政府及教育部门所采购的产品中,搭载清单所列CPU的产品仅占总出货量5%,这表明信创市场仍有至少20倍以上的发展空间。对于华为及清华同方这样的国产品牌来说,是重要的发展机遇。对于戴尔及惠普等国际品牌而言,则需审慎观察其政策发展,并适当调整战略,可能转向消费市场或通过抢占其他国际市场份额来补偿。

虽然本次新增的要求仅限于CPU和操作系统,Canalys预计,国产化零部件的要求将持续扩及其他主要零部件,包括屏幕、内存、闪存及电池等。目前中国厂商在屏幕和电池已经占据相当大的份额,转换相对容易。然而,内存和闪存领先技术仍由美韩等主要厂商主导。尽管国内个别厂商已经开始投入闪存和内存的制造,并获得一定份额,但其必须应对美国的制裁或潜在的风险,以及未来发展可能会受到供应链方面的限制。