Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

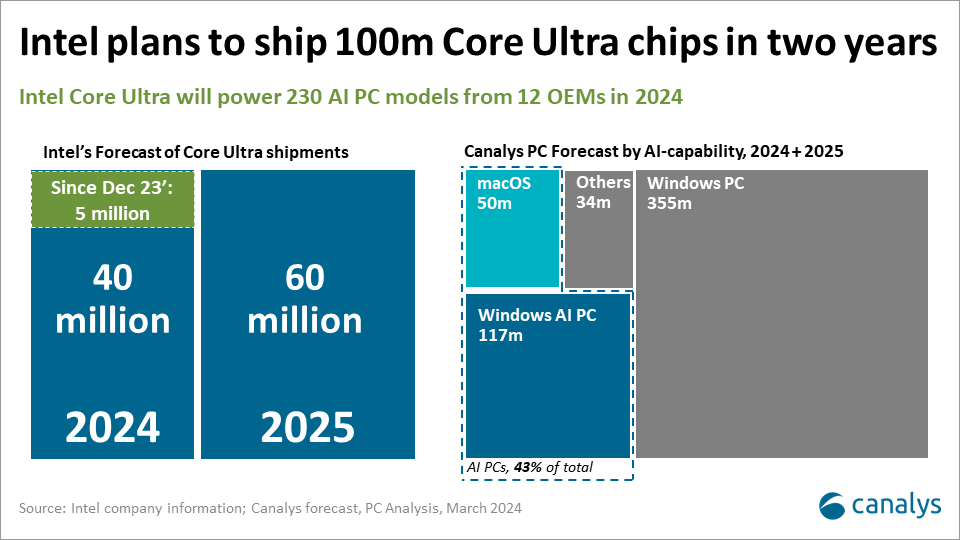

Intel’s strategy is to ship 100m AI PCs in two years

At the recent Intel Vision 2024 conference, the company laid out an ambitious plan to reignite a stagnant PC market ahead of what is set to be the largest refresh in decades. Evolving from a silicon company to a one-stop-shop systems company, Intel is telling customers they need AI everywhere to beat competitors.

AI is adding fuel to what is set to be the biggest PC refresh in decades, driven by the convergence of an installed base that has never been larger and older, looming software obsolescence of Windows 10, and the rapid advancement and growing demand for enterprise AI capabilities across client devices, edge infrastructure, and the data center. These factors are poised to ignite a surge in PC refresh activity over the next 24 months – with OEMs and silicon giants alike betting big on AI to spark urgency in their customers’ next upgrade cycle.

Ecosystem outreach and scale are Intel’s biggest advantages

To drive adoption of its AI-infused hardware, Intel has launched an AI PC Acceleration Program aimed at engaging hundreds of independent software vendors (ISVs), hardware vendors, and developers. The goal is to ensure robust software compatibility and optimized performance for the next generation of AI applications running on Intel processors.

The program will bring over 300 AI-centric features to market in 2024, predominantly focusing on collaboration and designer/creative tools, but also specialized tools to improve elements such as mobile device management and threat detection. Intel’s key advantage here is scale, eight-out-of-ten PCs being used today have an Intel chip. Its position as a market maker puts it in a better position for ecosystem collaboration, as these ISVs must prioritize what systems to optimize for first, they are much more likely to choose a partner with the lion’s share of the PC installed base and deep-rooted historical relationships in the industry. Intel views the program as a key driver of its goal to ship over 100 million Core Ultra chips in two years.

While this will certainly lead to a proliferation of AI workloads run locally on the PC, it has some limitations. Many features cater to mass market needs, including benefits AI can bring to collaborative apps. However, initial adoption may hinge on niche use cases that excite budget holders rather than the end-user, ones that demonstrate the value proposition around total cost of ownership, security, and manageability. Additionally, productivity-focused software providers, namely Microsoft, are still working on their own implementations of AI applications that are run on-device. Given that the average knowledge worker spends much of their time in Office 365 apps, AI PC adoption will significantly pick up once Microsoft integrates new features to be run partially on-device.

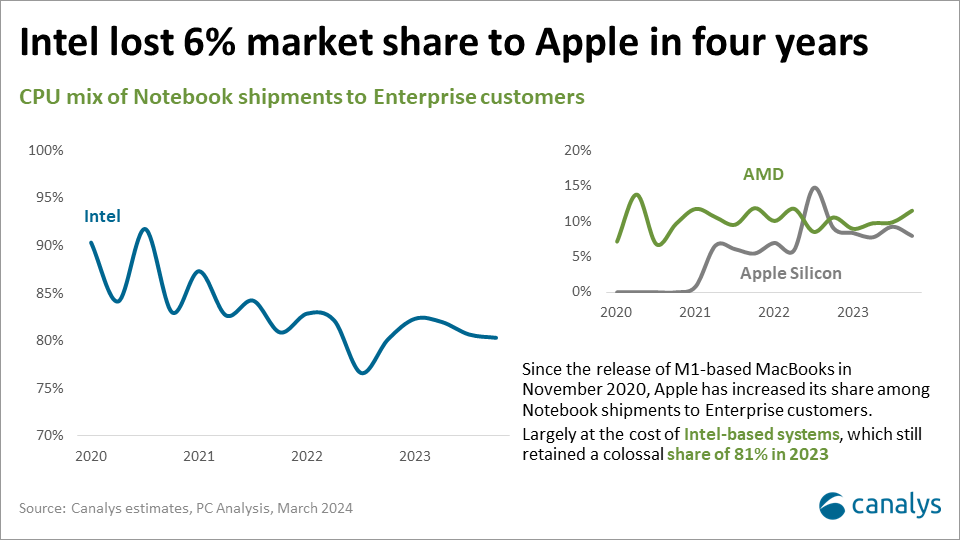

Intel's AI PC strategy comes after several years of market share losses in key battlegrounds. It has lost 6% market share in notebook shipments to enterprise customers since Apple began its transition away from Intel chips to its own silicon in 2020. AMD and Qualcomm have also been taking significant steps forward to compete with Intel in the commercial PC space. Despite the competition, Intel still has a strong presence, with eight-out-of-ten enterprise notebooks having an Intel chip while its share across other customer segments has remained more stable.

One-stop-shop to bring AI everywhere

Intel’s shift from a pure-play silicon provider to an end-to-end systems company holds significant implications not just for the PC market, but for the broader ecosystem of enterprises, developers, and consumers. Driving Intel’s AI PC strategy is a belief that open ecosystems and "small", customized language models will be the key to delivering transformative AI experiences. Beyond the AI PC, Intel is offering AI nodes and clusters as local solutions at the edge for enterprises and "super clusters" for data centers. At the heart of this offering will be Intel’s new Gaudi3 AI Accelerator, which will be the primary product for building AI at scale. In addition to creating cutting edge hardware for AI, Intel has also developed Retrieval Augmented Generation (RAG) to allow enterprises to apply AI models to their own data. Intel’s new Edge Platform in conjunction with the Gaudi3 AI Accelerator will provide a strong foundation for businesses looking to utilize their own data with AI models hosted in the edge or server.

Highlight the unmet and unarticulated needs customers

Intel's vision for the future of the PC is undoubtedly ambitious and forward-looking. By infusing AI capabilities throughout its hardware and software portfolio, the company is aiming to position the PC as a vital, strategic asset for enterprises navigating an ever-evolving computing landscape.

At the heart of Intel's strategy is an assumption that every business leader will want to integrate AI throughout their organization. Since most companies, particularly large enterprises, view AI as one of the most transformative technologies in a generation, it’s a pretty safe bet by Intel. However, there are inhibitors to adoption and potential post-sale pitfalls that must be addressed.

Great products should fulfill the unmet and unarticulated needs of customers. For now, the value creation possible with AI PCs is largely unarticulated by both customer and seller. Customers don’t know the specifics of what they can do and what the quantified benefits of deploying them are. So far, the PC industry at large has not been able to provide a sufficient answer to these questions.

To truly capitalize on the upcoming PC refresh supercycle, industry players and their partners must go beyond demonstrations of the performance and hardware capabilities of AI-capable PC offerings. Players must be able to articulate a clear and compelling value proposition that resonates with enterprises across industries – one that paints a vivid picture of how AI PCs can drive tangible business outcomes, streamline workflows, and unlock benefits to productivity and innovation while improving the PCs total cost of ownership, security, and manageability.