Edge power play: how telcos and partners will rule the future of connectivity

27 August 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Channel partners will be vital to the evolution of connectivity, where telcos seize control of the edge, by competing and cooperating with hyperscalers. New edge-based partners’ services and solutions will amplify the capabilities of telco edge clouds, driving a seismic shift across every industry.

Canalys estimates that the total addressable market for telecommunications will reach US$1.42 trillion in 2024, up 3.2% from 2023, and 91% of this expenditure will come via channel partners. Aiding this growth are telco edge deployments, whose strategic implementation addresses the technical computing demands of modern applications, such as GenAI and real-time analytics, and positions telcos and partners at the forefront of the next wave of digital transformation.

Omdia’s “Enterprise Edge Services Forecast, 2024–28” report by Andreas Olah, Senior Analyst, Digital Enterprise Services forecasts the global edge ICT services market will grow from US$138 billion in 2024 to US$283 billion by 2028, representing a 19.7% CAGR, with major contributions from telcos, hyper-scalers and partners such as systems integrators (SIs), consultants and independent software vendors (ISVs).

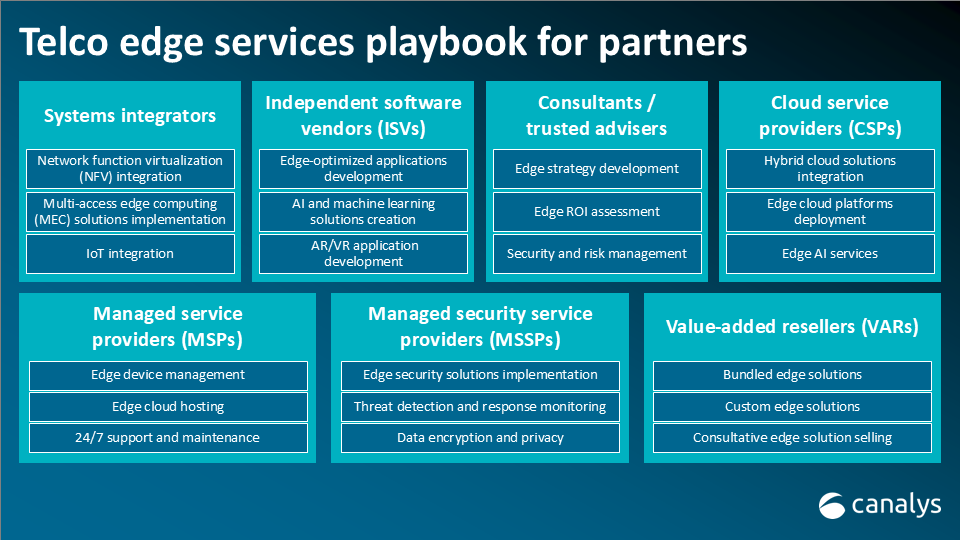

To capitalize on these new opportunities, partners must deliver innovative edge services, such as infrastructure deployment, network management, AI and analytics provisioning, IoT integration, security implementation and applications development, that enhance customer experiences and streamline operations.

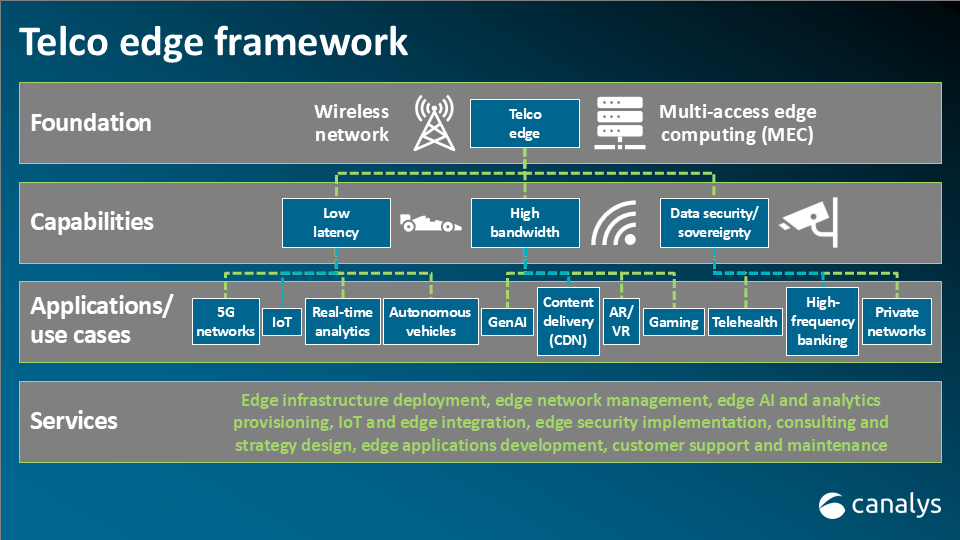

The processing of data at the telco edge is ideal for various applications because of the benefits it offers over centralized hyperscale cloud computing, including:

The proliferation of PCs and mobile devices continues to lead to surges in data traffic, warranting the deployment of more edge clouds to handle data processing closer to end-user devices. According to Ericsson, global mobile data traffic is estimated to reach 174 exabytes per month this year, up from 136 exabytes in 2023. To put that in perspective, someone once said that an exabyte (1,024 petabytes) is so large that “all words ever spoken or written by all humans that have ever lived in every language since the very beginning of mankind would fit on just 5 exabytes.” This heavy data traffic also brings sustainability into question.

In the blog “Is sustainability still a top priority for the IT ecosystem in 2024?” by Canalys Analyst Ben Caddy, he noted that AI data is contributing to sustainability concerns due to its high energy use, and cutting costs was one of the top drivers for sustainable IT solutions. He stated that one method for improving data center efficiency to lower costs is by reallocating workloads to maximize renewable energy use, a resolution that could be applied to central and edge clouds.

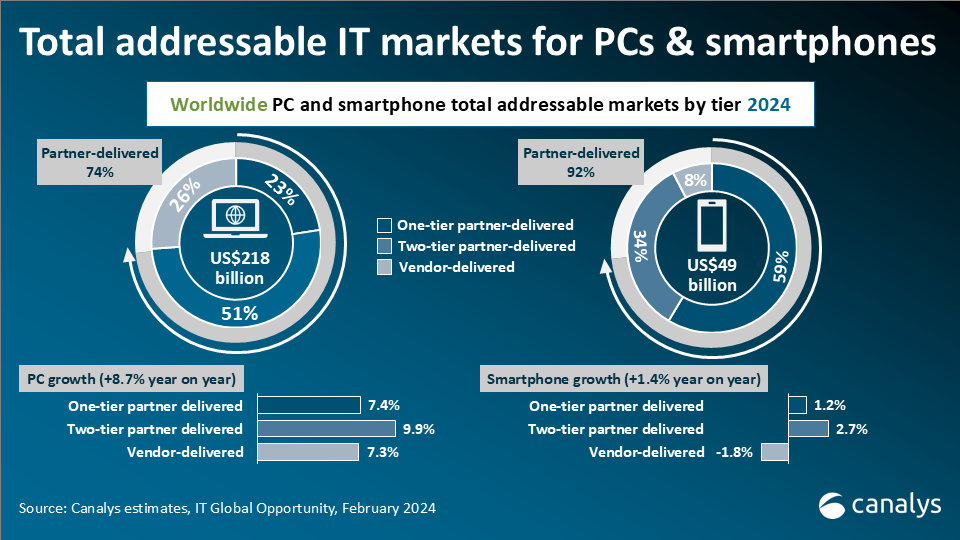

Canalys estimates that the 2024 total addressable markets for client computing devices (PCs) and smartphones will reach US$218 billion and US$49 billion, respectively. This equates to year-on-year growth for PCs of 8.7% and 1.4% for smartphones. These events will pay dividends for partners, given that 74% of PC and 92% of smartphone spend will flow through the channel in 2024.

The advent of smartphone and PC data processing closer to the end device is reinvigorating telco edge deployments and driving an urgent need for scalable solutions.

The trend of embedding AI chips in PCs and smartphones so that some computing can be performed locally, on-device, will enhance the role of telco edge clouds because:

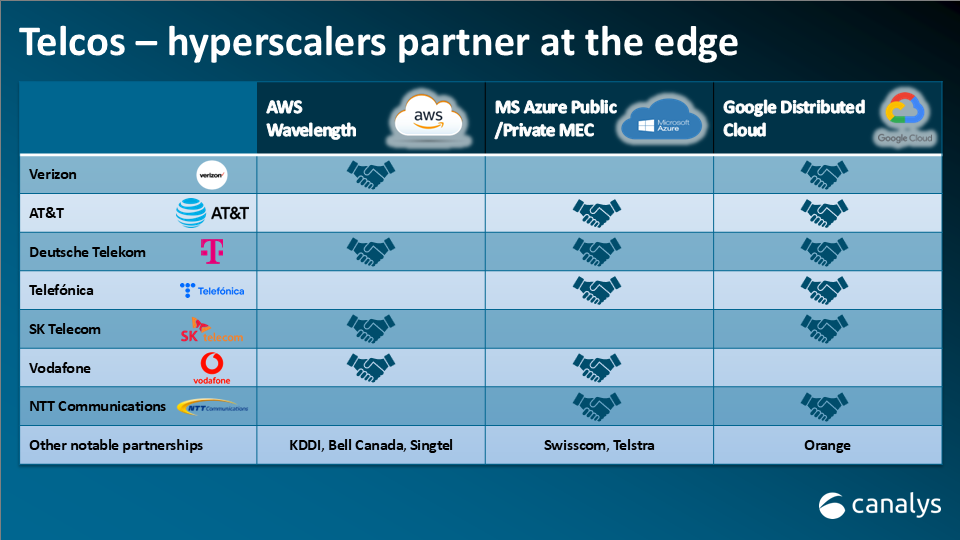

Hyperscalers are also exploiting opportunities at the edge and collaborating with telcos to do so.

Telcos are equipping their multi-access edge computing (MEC) sites with hyperscale cloud equipment, whereby the former manages connectivity, while the latter manages computing. The two entities usually collaborate using a joint go-to-market strategy where the benefits include:

The telco edge represents an opportunity for telcos and partners to capitalize on the explosion of data traffic from end-user devices and applications that demand low latency, high bandwidth and data sovereignty. Telco edge clouds are well-positioned to handle these requirements by offering the performance and agility that centralized clouds cannot efficiently. Hyperscalers are aware of this occurrence and extending their reach to the edge as well, yet telcos have the advantage with their already established networks located closer to end users. Regardless of who wins at the end, we will be monitoring this situation closely to see how it all plays out.