Global smart personal audio market up 10.6% in Q2 2024, driven by open-form earphones

Monday, 19 August 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

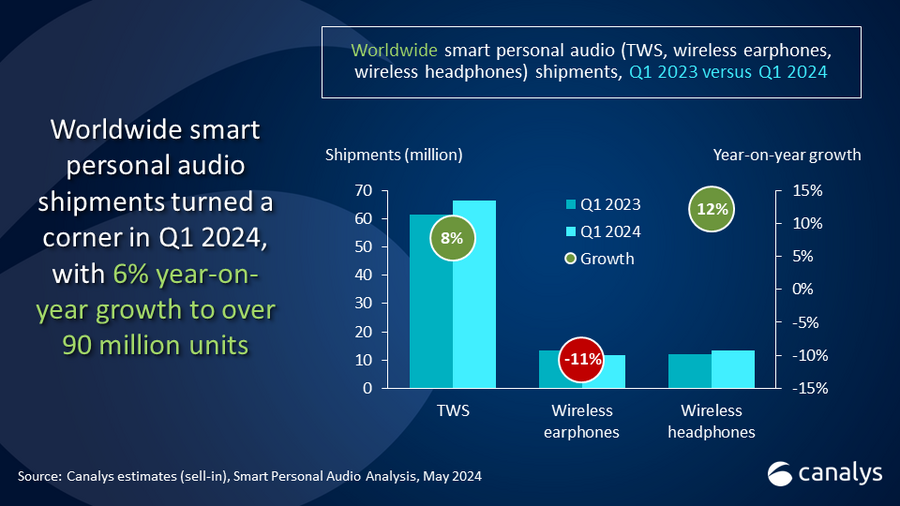

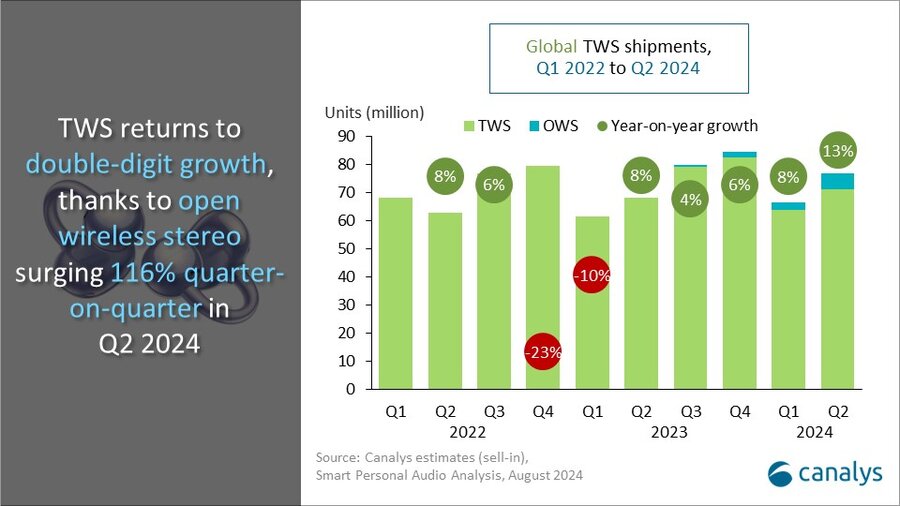

According to the latest Canalys research, the smart personal audio market (including TWS, wireless earphones and wireless headphones) rebounded strongly in Q2 2024, with notable gains across several segments. Total shipments reached 106 million units, up 10.6% year-on-year, the highest number of second-quarter shipments in history. Both TWS and wireless headphones were growth drivers, reaching 77 million and 15 million units, respectively.

TWS remains the leader of the global smart personal audio market in Q2 2024, solidifying a commanding 72.6% market share with 12.6% annual growth. Despite the traditional TWS segment’s slowdown, leading vendors have adeptly navigated the challenge by strategically pricing models under US$50. For the first time, the sub-US$50 price segment accounted for more than 50% of the market this quarter.

“Vendors are actively looking to add novelty features to stand out from the intensifying competition with homogenous characteristics and price war,” said Cynthia Chen, Research Manager at Canalys. “Huawei’s Lipstick 2, designed as a lipstick, features premium materials and fashionable attributes to appeal to female audiences. JBL has added a display in earphone cases to enable users to check the notification directly to reduce phone dependence and enhance interaction with the earphone which is positioned as a stand-alone device. On the other hand, a few players are looking to boost AI use cases by integrating AI assistant features into their latest launches, such as Nothing and iFlytek. Although it is still early to see if the AI features will drive usage and user experience, these emerging vendors hope to win over consumer mindshare by leveraging the AI trend.”

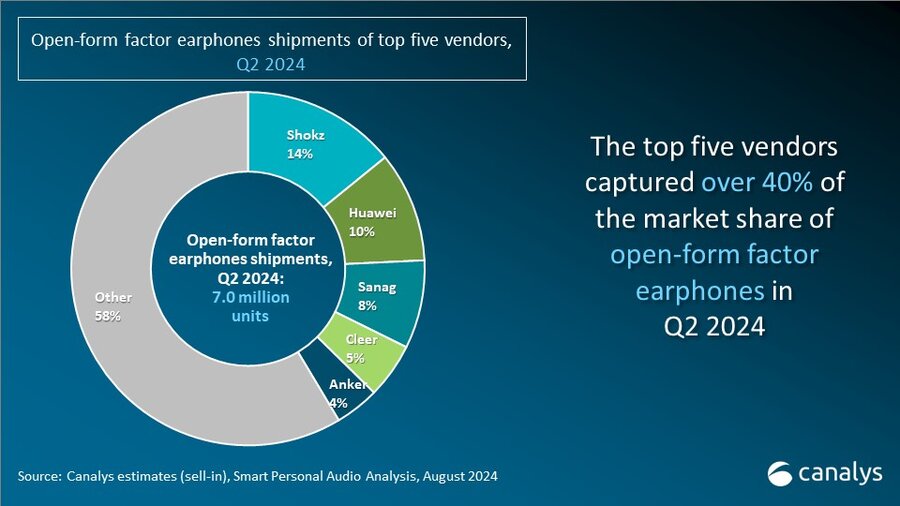

“Open-form factor emerges as a bright growth spot this quarter for both TWS and wireless earphone categories,” adds Chen. “High technical barriers have constrained the open-form factor. However, vendors manage to bring it out from the niche segment by offering consumers unique user experiences and affordable price points, which are exceptionally well-received given the form factor’s adaptability to various scenarios. Leading brands like Shokz are intensifying their focus on sports integration, while Huawei’s innovative clip-on designs enhance comfort and style. Both players hold over 10% of the market share in the open-form factor segment. As the novelty of the new form factor will start to diminish in the next 12 months as more vendors launch products in this segment, vendors need to focus on product quality and feature improvement beyond the form factor innovation.”

“Emerging players’ market expansion is fueling the segment’s recovery in Q2,” said Jack Leathem, Research Analyst at Canalys. “QCY, Baseus and Anker are making substantial inroads into the international market with their US$50 to US$100 mass-market products. They are disrupting the entry-level segment with seamless wireless connectivity and long battery life, quickly penetrating established retail channels. On the other hand, established audio vendors such as Bose and Sony dominate the high-end (US$350 and above) market. Having pulled out of low-end competition, they have refocused their strategies back to the high-end segment to differentiate themselves via premium sound quality. The market leadership in audio fidelity will help these vendors protect their high-end user bases from emerging players, allowing them to build sustainable revenue streams.”

“The audio market is becoming increasingly crowded as major vendors still see opportunities to expand their presence,” adds Chen. “Technological advancements enable branded vendors to offer high-quality, high-performance products at competitive prices, displacing white-label products, especially in emerging regions. Additionally, the shift from wired to wireless headphones, driven by improved connectivity and shifting consumer preferences, also establishes a strong growth foundation for the wireless audio sector. To compete in such a dynamic segment, vendors are keen to differentiate, but differentiation strategies must align with the vendor’s core business strategy, ensuring they resonate with target consumers and communicate the brand’s distinctive value proposition.”

|

Worldwide smart personal audio shipments and growth Q2 2024 |

|||||

|

Vendor |

Q2 2024 shipments (million) |

Q2 2024 |

Q2 2023 |

Q2 2023 |

Annual |

|

Apple* |

18.0 |

17.1% |

18.6 |

19.4% |

-3.0% |

|

Samsung* |

8.1 |

7.6% |

8.1 |

8.4% |

-0.3% |

|

Boat |

6.7 |

6.3% |

6.7 |

7.0% |

-0.2% |

|

Xiaomi |

5.2 |

4.9% |

3.7 |

3.9% |

40.4% |

|

Sony |

4.0 |

3.7% |

4.1 |

4.3% |

-4.2% |

|

Others |

63.9 |

60.4% |

54.5 |

57.0% |

17.2% |

|

Total |

105.8 |

100.0% |

95.7 |

100.0% |

10.6% |

|

|

|

|

|||

|

*Apple includes Beats; Samsung includes Harman subsidiaries Note: percentages may not add up to 100% due to rounding |

|

||||

|

Worldwide TWS shipments and growth Q2 2024 |

|||||

|

Vendor |

Q2 2024 shipments (million) |

Q2 2024 |

Q2 2023 |

Q2 2023 |

Annual |

|

Apple* |

16.8 |

21.9% |

17.8 |

26.1% |

-5.4% |

|

Samsung* |

6.0 |

7.8% |

6.0 |

8.8% |

-0.5% |

|

Xiaomi |

5.0 |

6.5% |

3.5 |

5.2% |

42.5% |

|

boAt |

4.7 |

6.1% |

4.6 |

6.7% |

2.8% |

|

Huawei |

3.7 |

4.8% |

2.3 |

3.4% |

59.5% |

|

Others |

40.5 |

52.8% |

34.0 |

49.8% |

19.4% |

|

Total |

76.7 |

100.0% |

68.2 |

100.0% |

12.6% |

|

|

|

|

|||

|

*Apple includes Beats; Samsung includes Harman subsidiaries Note: percentages may not add up to 100% due to rounding |

|

||||

For more information, please contact:

Cynthia Chen: cynthia_chen@canalys.com

Jack Leathem: jack_leathem@canalys.com

Canalys’ Smart Personal Audio Analysis is a service that provides qualitative and quantitative insights into the market for smart personal audio devices. It guides vendors and partners to make the right decisions on value propositions, choose the right channel partners and sell on the appropriate platforms to engage in different markets worldwide.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.