Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Six key takeaways from MadebyGoogle ’24 – the Google Pixel 9 series launch

Google held its MadebyGoogle ’24 event on 13 August, where it launched the Pixel 9 alongside the Pixel Watch 3, Pixel Buds Pro 2 and numerous Gemini updates.

Google held its MadebyGoogle ’24 event on 13 August, where it launched the Pixel 9 alongside the Pixel Watch 3, Pixel Buds Pro 2 and numerous Gemini updates. These are six Canalys analyst takeaways from the event:

Takeaway 1: Google was conservative when using the “AI” label, though it was mentioned regularly

AI has become a phrase that vendors are more cautious about using. A key part of this is that AI is close to becoming an overused buzzword, as happened with the metaverse. Machine learning algorithms will be important for the next stage of smartphone development, but the messaging to consumers must be more gradual. Currently, the AI label might more reflect that a premium has been added to products, rather than actual features that can be used straight away. Though it was consistently used through the keynote, AI was mentioned significantly less than at Google I/O earlier in the year, where the subject’s overuse became the main story afterward.

Takeaway 2: Live demonstrations help Google stand out from other vendors

Rick Osterloh started the keynote by saying, “There have been so many promises, so many coming soons,” referring directly to several smartphone launches from the last year. Consequently, Google focused on bringing feature demonstrations on stage to show what customers can experience straight away. But the big stand-out was that most of these were live. The live demonstrations added a little risk and entertainment but also highlighted confidence in the products. The few glitches that occurred might just increase the audience’s confidence in the authenticity of these live demos.

Most demonstrations in the smartphone market are prerecorded. Though it cuts the potential downside from a PR perspective, it can also make an audience member question how confident a vendor is in its products.

Takeaway 3: The focus on Android increases as Google plays diplomacy

Following an internal reorganization in Google earlier this year, the previously siloed Pixel and Android teams were merged. For Google, it will be important to show its commitment to other Android vendors while also accelerating the development of the platform. The Android focus took center stage for Google as it emphasized how Gemini is spreading across the portfolio. In addition, Google sought to highlight two Android vendors by using Samsung’s Galaxy S24 Ultra and Motorola’s Razr+ (2024) as the live demonstration devices. This is probably just the first of many similar diplomatic moves Google will use to assure commitment to Android.

Takeaway 4: Geographical expansion will be a key growth factor in 2024 and beyond

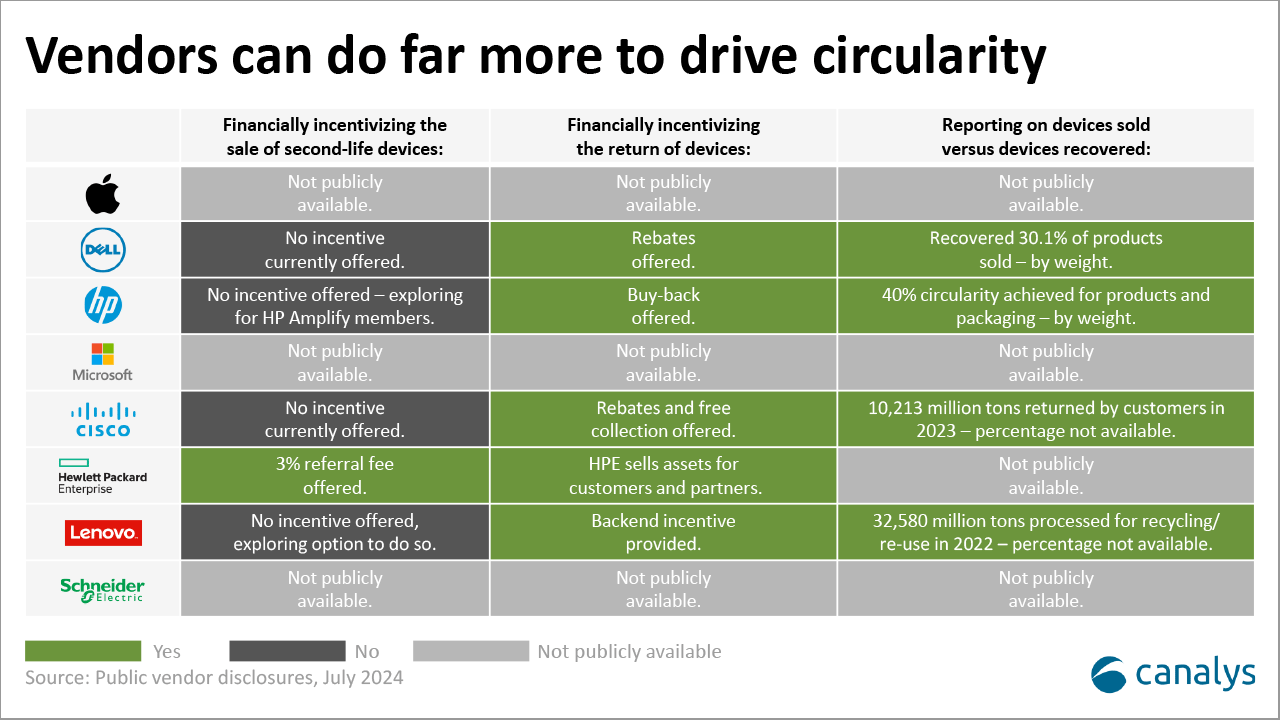

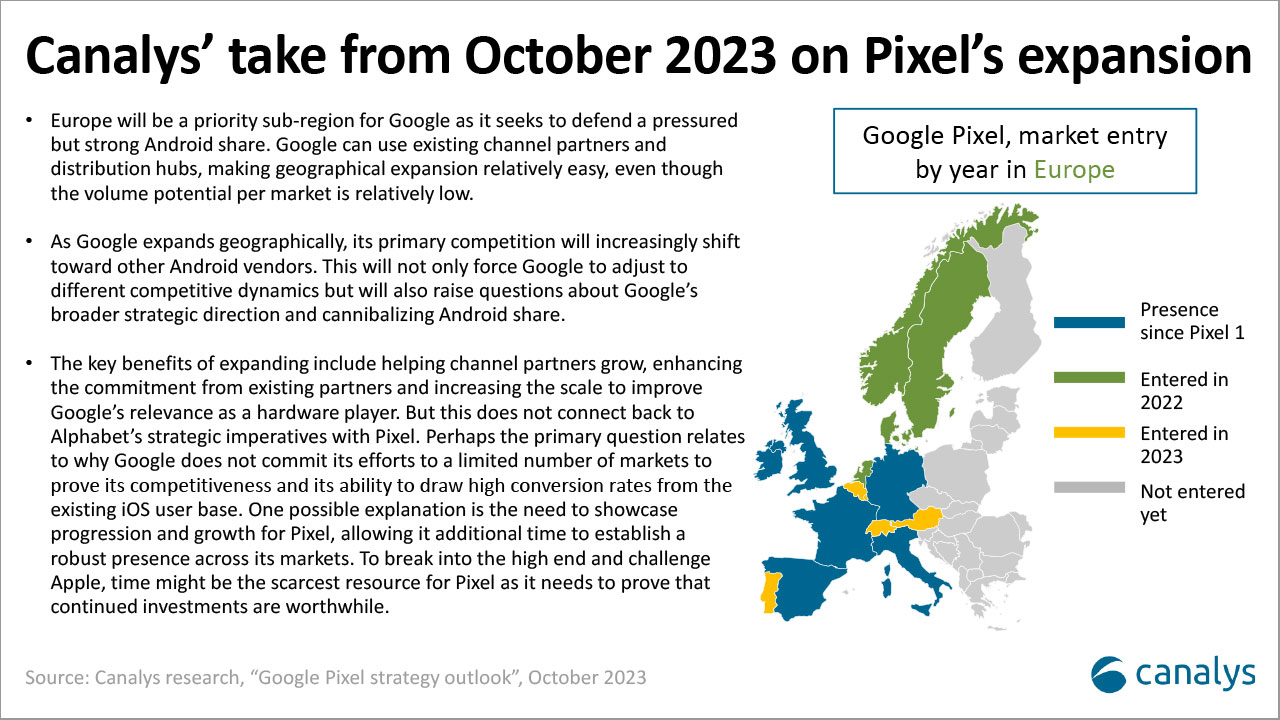

In 2023, Google’s smartphone shipments grew 41% year on year to 11.0 million units. Despite this growth, Google’s market share was only 1.0% of the global market, so expanding geographically will be an important part of Google’s growth strategy.

With the Pixel 9, Google expanded its market reach into nine new countries. Eight of these were in Central and Eastern Europe, and give Google an almost comprehensive European presence. Many of these are markets where distributors, operators, retailers and consumers have anticipated Google’s expansion for a while.

The last market was Malaysia, which is geographically next to Singapore, Google’s only current market in Southeast Asia. This should help simplify Google’s distribution and associated costs. In addition, Malaysia has a substantial telco channel, particularly for premium devices.

Takeaway 5: The Pixel 9 is a restyling but also puts on-device capability in focus

Interestingly, Google avoided focusing on specification upgrades, instead putting the focus on software and feature updates. Though this might have been underwhelming for dedicated Pixel fans, it reflects how important accelerating the Android ecosystem is alongside differentiating through software. The difference between cloud (Android and Gemini) and on-device (Pixel) AI was highlighted through the introduction of a few features that Google will hope are its new eye-catchers but that also validate its AI messaging.

Also, on the new Pixel 9 series specifically, Google did not just refresh its portfolio, it expanded it with new models, which will help target Apple’s high-end portfolio.

Takeaway 6: The success of the ecosystem upgrades will depend on the go-to-market strategy

The Pixel Watch 3 provided new upgrades, integrating new functionalities (connected through the smartphone), no pulse detection and comprehensive Fitbit integration into its wearable proposition.

But when it comes to selling wearables and TWS, Google’s greatest challenge lies in not devaluing these products. A significant share of Google’s previous smartwatch and TWS shipments were smartphone add-ons, bundles and promotions. Though it helps the overall sales proposition (and perhaps the ecosystem stickiness), it might reduce the likelihood of selling these products as stand-alone items in the future. Time will show whether this will change with the new generation of Pixel devices.