Decoding Mainland China's AI trends and potential in smartphones

05 January 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

AI as a key market differentiator

Chinese smartphone vendors are turning to AI as a crucial strategy to stand out in the competitive market. With Huawei's resurgence in the market, the focus is on securing market share and investing in new distinguishing features, with AI taking center stage in this transformation.

AI empowers a more intelligent ecosystem

Chinese vendors, especially those with strong horizontal integration capabilities, are strategically implementing AI into smartphones and across a broader spectrum of products. This includes PCs, wearables, hearables, TVs and even automobiles. The rationale is to build a resilient and interconnected ecosystem where AI plays a crucial role in enhancing the functionality and connectivity of these devices.

New catalyst needed for premium segment growth

Additionally, as Chinese vendors pivot toward a high-end strategy, the market needs a fresh driver beyond technologies like foldable screens and 5G. AI, particularly in the context of processing generative AI models on devices, emerges as a powerful catalyst. It is expected to stimulate a new wave of replacement demands and propel the ASP of devices. This strategic shift toward AI integration is also closely tied to premiumization, making it a driving force in the high-end.

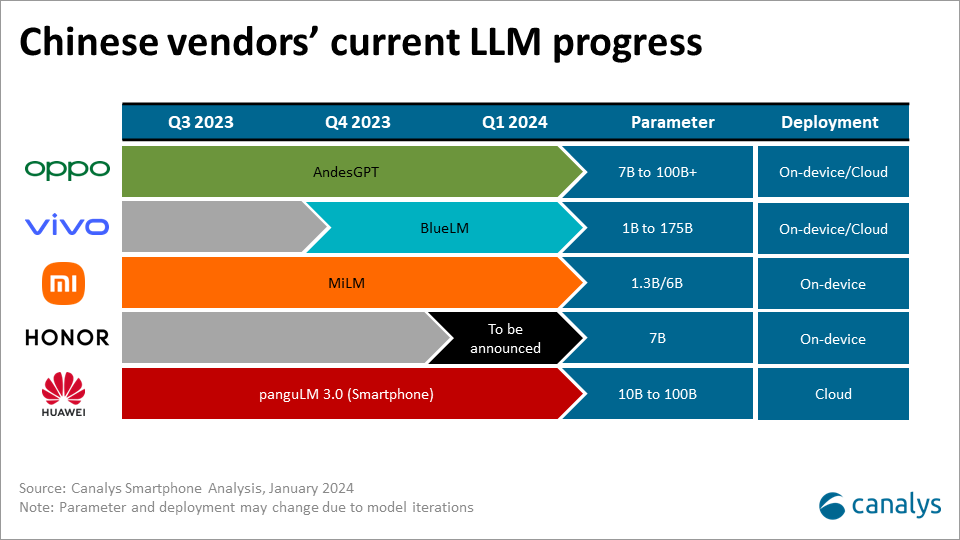

Recently, Chinese smartphone vendors have been proactively investing in in-house LLM developments. Below are several LLMs launched by Chinese vendors which will be integrated into their smartphones. Together with the SoC iterations and aggressive DRAM upgrades in the market, Chinese vendors are increasingly focusing on the on-device AI capability within a hybrid deployment paradigm.

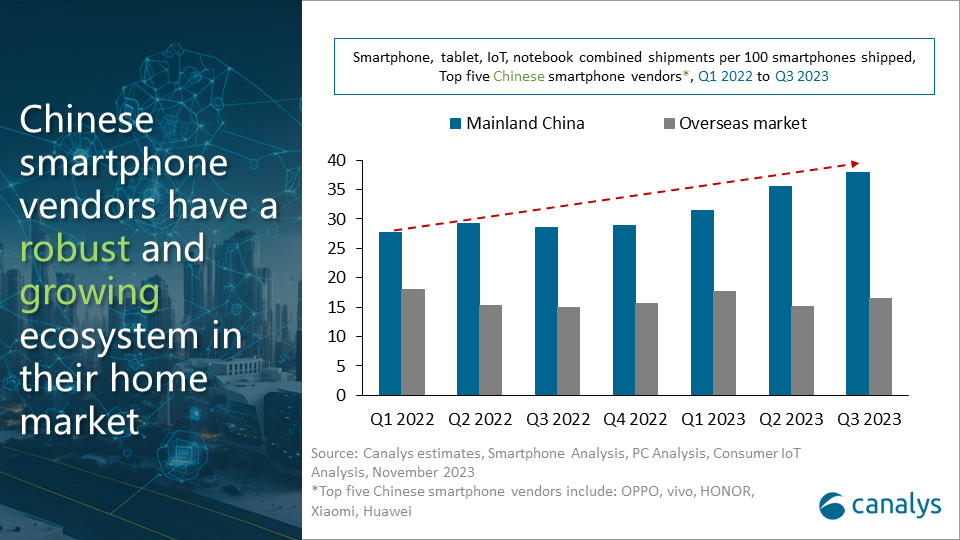

Ecosystem strength in the home market makes AI more powerful for local vendors

Increased attach rate as well as a broader product matrix empowers AI use cases for Chinese smartphone vendors in their home market. Xiaomi, through its MIJIA ecosystem, and Huawei, with HarmonyOS Connect, both have significant user bases in Mainland China. This extends beyond wearables and tablets, which they also offer in the overseas market, to home appliances and even automobiles aided by third parties. The integration of AI will achieve higher usability by addressing a wider range of use cases and ensuring a seamless cross-device experience.

Affordable high-spec device drives on-device AI integration

Chinese vendors are expected to be the first movers to introduce AI-capable smartphones into lower price bands to foster penetration. Local vendors are driven to offer flagship-level hardware at highly competitive price points given the domestic competition, supply chain cost advantage and consumer preference over value-for-money devices. Models equipped with on-device AI capability, designed specifically for generative AI models, will provide a differentiated user experience. Local vendors will gain advantages as overseas vendors struggle to offer the same on-device AI experience within the mid-end segment due to performance restrictions.

Localized operation is the key to thriving AI applications

Local vendors with solid brand appeal, for example, Huawei, stand to gain a competitive advantage by forging close collaborations with local developers. Recently, Mainland China's software giants (such as Meituan and Alibaba) have been working proactively with Huawei to develop native apps specifically for the in-house HarmonyOS NEXT operating system which will be independent of Android's app ecosystem. The same case could happen when integrating Huawei's in-house generative AI models into third-party apps. This collaboration is poised to establish a competitive edge by delivering a differentiated and enhanced experience in AI-powered apps.

Chinese vendors have already started to build AI leadership by investing in R&D capabilities as well as kicking off incentive programs for third-party developers and we believe following the key initiatives outlined below can provide a clearer roadmap for capitalizing on the burgeoning AI-capable smartphone trend and its potential business benefits.

Precise positioning with a strategic focus

Vendors must adopt a more precise positioning strategy to win the AI race to distinguish themselves in a homogeneous market. Presently, most Chinese vendors act as fast followers, introducing chatbot features that, despite different names, essentially mirror one another. To establish a unique market presence, vendors must undergo a comprehensive assessment in a resource-based view. This evaluation is crucial for determining their optimal position as a technological leader or an ecosystem player. Such strategic positioning is essential for vendors to focus on cultivating the necessary capabilities that will pave the way toward a sustainable business model.

Sustainable business model

Chinese vendors still struggle to find a locally relevant monetization model for AI services, although they are fast followers to introduce chatbot-like AI apps powered by LLMs. In developed markets, some AI service providers, such as OpenAI, are shifting toward subscription models to monetize. However, the subscription model has not achieved widespread acceptance among Chinese consumers. For a horizontal comparison, the streaming industry provides a good example. For iQIYI (a streaming platform in Mainland China), only around 63% of its total revenue is derived from subscription services, while for Netflix, this proportion comes close to 100%. Therefore, a sustainable business model that does not rely solely on software service revenue becomes crucial for AI monetization in Mainland China.

The foundation of establishing a sustainable business model lies in the vendor's resources and capability. Some vendors already have a prominent ecosystem device install base in Mainland China, which serves as a valuable resource to amplify the power of AI. One possible monetization strategy for such vendors is to leverage AI integration to increase attach-rate as well as implement a growth strategy with new category expansion.

For vendors focusing specifically on smartphones, a possible method lies in stimulating replacement demands and improving product mix by upselling high-end models with distinctive on-device AI capabilities.

Engagement with third-party developers/hardware vendors to foster complementors

Some local vendors have already taken steps toward a thriving AI developer community. vivo has recently announced a CNY100 million (US$14 million) investment to help developers improve branding and operation and provide tech support when integrating BlueLM into their apps. Additionally, for vendors to outpace other competitors in the game, the next step could be finding a focus. An approach worth exploring involves prioritizing third-party developer participation, specifically motivating AI-powered apps that align with the three major use cases outlined in our previous pyramid model to win consumer mindshare quickly. To facilitate this, vendors should also simplify the integration process by adopting an open approach through sharing their AI platforms with SDKs and APIs along with detailed documentation and tutorials.

It is also crucial for ecosystem players to partner with third-party hardware vendors to fortify their ecosystem device offerings. A comprehensive ecosystem covering a wide range of products enhances user retention. It transforms each connected ecosystem device into a potential entry point for consumers, drawing them into the entire ecosystem. More significantly, the data gathered from diverse edge devices creates a multiplier effect, enabling vendors to refine their AI models. This, in turn, gives rise to new use cases that demand higher accuracy and reliability, propelling innovative use cases within the ecosystem.

Forward-thinking compliance framework

The government has showcased its intention to regulate the booming generative AI market toward a responsible development trajectory by releasing "Measures for the Administration of Generative AI Services". For vendors, compliance with the regulation necessitates security assessments and the filing of algorithms, potentially extending the time-to-market for new generative AI models.

These regulations have added a fresh layer of compliance requirements for those diving into generative AI. However, as the regulations are currently in the draft stage, they are poised to change. Therefore, for vendors, it is not just about checking off the boxes on existing rules. Vendors need to strategically aim how to construct an internally consistent and effective AI compliance framework. This means utilizing technology and having systematic and organizational perspectives to not only meet the current obligations but also proactively prepare for potential regulatory changes down the road. This foresight is crucial for vendors, helping them navigate through possible risks and unforeseen emergencies amid AI adoption.

Ensuring ethical AI and data privacy

Vendors will be able to mitigate compliance risks and safeguard their brand image by developing an ethical AI that produces responsible outputs and minimizes hallucinations. Moreover, consumers' growing emphasis on data privacy also amplifies the need for hardware-level data protection. While vendors like Samsung have already implemented hardware technologies such as Knox for data privacy, some Chinese vendors are also making strides with their latest flagship products. Nevertheless, substantial additional investments are imperative to fortify privacy measures and align with evolving consumer expectations.