Canalys forecasts a 4% expansion in the global smartphone market in 2024, driven primarily by emerging market economies and renewed consumer spending. This growth is further bolstered by a revival in market conditions. The rebound manifests in two significant ways: firstly, it indicates a potential resurgence in markets previously impacted by supply shortages due to import controls, which impeded vendor shipments. Secondly, vendors and distributors have largely surmounted the challenges of high inventory issues that plagued the previous one to two years, returning to normal product release and shipping schedules. Channel partners are now motivated to replenish inventory levels, with these restocking efforts playing a crucial role in the market's substantial recovery in late 2023 and are anticipated to continue being a vital growth factor in 2024.

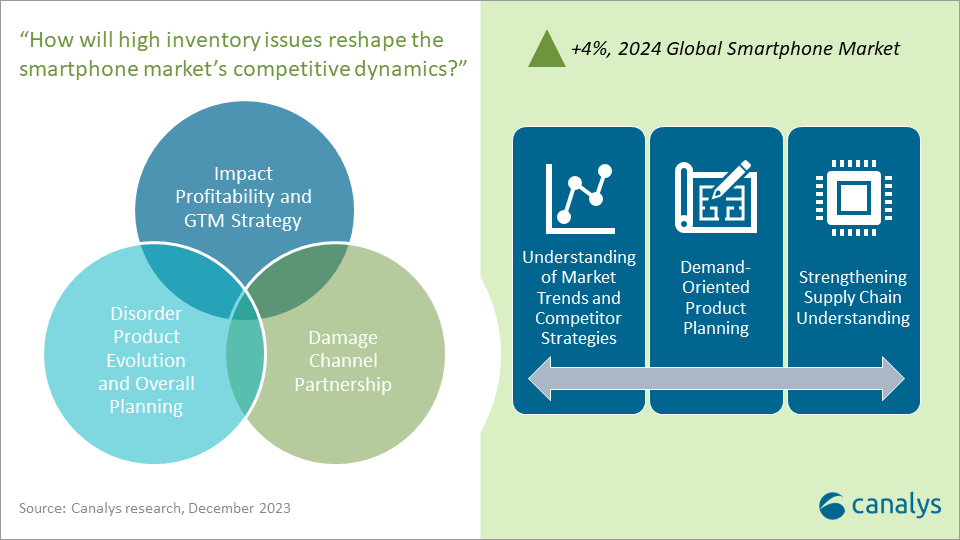

The inventory crisis has reshaped the competitive dynamics

Most smartphone vendors have adopted conservative shipment targets and sales strategies in the past two years, faced with challenging market conditions and high inventory pressures. However, vendors' different strategic responses to these high inventory conditions have resulted in a change in the competitive landscape as we approach the end of the financial year 2023. We must reflect on these impacts of the inventory crisis in the past two years to prepare for the ongoing uncertainties in the market in the new year.

- Vendor profits were severely impacted by high inventory. The majority of the inventory in the past two years came from products built and launched when component costs were elevated. These products with high BOM (bill of material) costs could not sell in a declining market, becoming less competitive when new products with improved hardware specifications entered the market at similar or lower prices. Vendors were compelled to enhance promotions and subsidies to clear out the high-cost inventory, adversely hurting their margins.

- High inventory disrupts product roadmap and overall planning. High inventory of older-generation products led to significant price reductions by channels and vendors, which impacted the sale of newer models. Some vendors, therefore, postponed product launches. Those with manageable inventory levels have swiftly introduced new products, creating a technological and generational advantage over competitors' older stock. Even if those vendors caught up in product and technology, they have missed the product-to-market timing. We have noticed vendors affected by an inventory crisis have adopted a very conservative approach to market expansion and product planning. They wanted to minimize inventory risk, so chose to limit their market spending and product lines which means they lost market agility which enables them to respond to temporary demand surges quickly. As a result, vendors adopting this strategy will likely see their market presence shrink further.

- Channel partnerships suffer. Excessively high inventory ties up considerable capital for distributors, wholesalers, and retailers, leading to cash flow shortages and operational challenges. Even if vendors' inventory situations improve, the recovery of business conditions for channel partners may be delayed, reducing their willingness to order and exacerbating market downturns. More commonly, vendors have overstocked channels without adequate support for stock clearance, affecting partnerships and even brand reputation. In this case, new entrants and market challengers would have ample opportunities to establish key channel partnerships as channels seek to increase their bargaining power and reduce dependence on single vendors.

Inventory management remains a critical subject

Smartphone vendors have developed more robust inventory management mechanisms and product planning strategies in response to these challenges. Given the market and demand volatility, inventory management will continue to be a long-term challenge. Vendors need to devise clearer, differentiated strategies to mitigate potential risks.

- Develop an in-depth understanding of local market conditions and competitor strategies. In the context of the market's ongoing rebound, vendors must align their understanding of market trends across headquarters and regional offices. Targets and incentives set by headquarters misaligned with market competition will result in high channel inventory levels. At the same time, overly cautious region-level policies might miss short-term market opportunities. Vendors need adequate operational flexibility to adapt to market fluctuations, depending on the communication between headquarters and regional operations.

- Demand-oriented product planning. The supply chain side often drove many vendors' products and technical strategies. However, when it comes to various regional markets, there are often mismatches between supply and demand, leading to inventory build-up. Vendors must ensure their product planning teams incorporate a comprehensive understanding of local consumer trends with the internal technological roadmap for product launches.

- Strengthening communication within the supply chain. The recent increase in component prices is mainly due to vendors restocking, a temporary surge in consumer demand, and limited supply chain capacity. Vendors must be cautious of the temptation to aggressively stockpile, which could easily lead to a high inventory of raw materials and finished products. In addition, vendors must be aware of fluctuations in component prices in the next 12 months, as it could also add complexity to managing inventory between generations of products.