Import restrictions trigger inventory build-up in India

5 January 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

A forward-looking analysis of the electric vehicle (EV) landscape in India, specifically focusing on 2024, by examining the current market dynamics, government initiatives, key players and emerging trends.

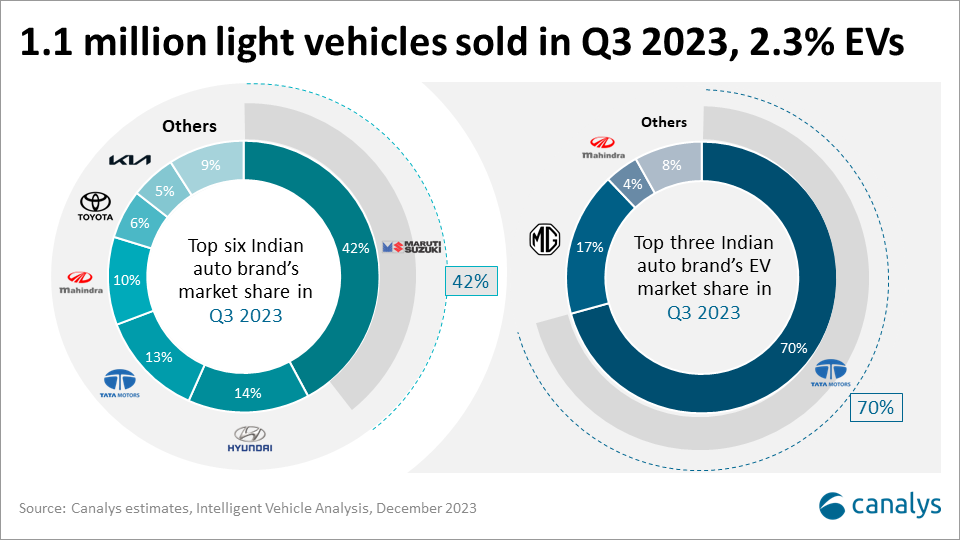

The latest Canalys research reveals that India’s light vehicle market grew by 20% in Q3 2023, reaching 1.1 million units, compared to 0.92 million units in Q2 2023. Electric vehicles (EVs) constituted 2.3% of the market share, experiencing a decline of 15% compared to Q2 2023, with 25,000 EVs sold.

India, the fourth-largest light vehicle market globally, observed continued sales momentum in Q3 2023. Consumers have a wide range of choices, including CNG and BEVs. The government’s emphasis on moving away from fossil fuels to alternatives is evident. The ongoing festive season and strong demand from the growing middle class with increased disposable income resulted in exceptional sales. However, the EV market experienced a slowdown.

Tata Motors continued to dominate the EV market in Q3 2023. It sold over 17,000 units, representing 70% market share, but witnessed a decline in EV sales of 15% compared to the preceding quarter. Meanwhile, MG observed a healthy 6% growth led by good sales from the affordable MG Comet, taking a 17% market share.

Many players, including Mahindra, Citroen and Kia, had slowed down sales due to the price of the EV being higher than that of the ICE engine vehicles. Thus, buyers traded off EVs for higher variants of ICE engine cars. Mahindra, which sold over 2,200 units of XUV400 sales in Q2 2023, dropped to just 900 units in Q3 2023, whereas Citroen eC3, which sold over 1,100 units in Q1 2023, could sell only around 400 units in Q3 2023.

Hyundai and Kia, led by Ioniq5 and EV6, sold 430 and 200 units, respectively, commanding a combined 3% market share. BYD, aiming for a 30% market share by 2030, made strides with a 2% share from the Atto 3 during Q3 2023.

Despite India being a major global auto market with several government incentives, it remains a laggard in EVs. The government aims for 30% of vehicles sold to be EVs by 2030, but the market is slow to catch up. Domestic sales of EVs have more than doubled, but they barely represent 2.6% of the total light-vehicle sales from Q1 to Q3 2023.

As India strives to overcome its lag in EV adoption, significant initiatives and product strategies shape the landscape for a transformative 2024.

The government is reaffirming its commitment to the EV sector, proposing reforms like the FAME (Faster Adoption and Manufacturing of Electric Vehicles) India, tax reductions and production-linked incentives to boost EV market penetration. With a budget of Rs 10,000 crores (US$1.2 billion), the current FAME II scheme has already disbursed Rs 5,228 crores (US$0.62 billion) in subsidies as of December 2023. FAME II is set to end in March 2024 and discussions are underway to extend or replace it with a modified production-linked incentive (PLI) scheme for the auto sector, including passenger EVs. This new auto PLI 2.0 would cover all types of EVs, creating a level playing field for all players and potentially aiding negotiations with Tesla for a manufacturing plant in India. The scheme will be open to existing and new players, allowing flexibility and inclusivity.

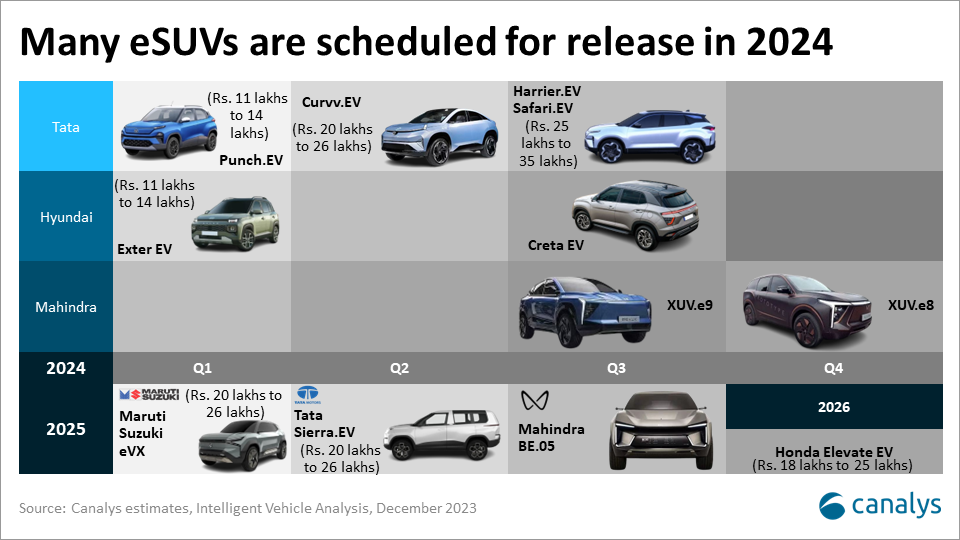

India’s SUVs and Crossovers segment has expanded organically in recent years. The inherent preference for SUVs is due to their spaciousness and perceived safety, which is now coupled with the rising appeal of electric mobility. Many automakers have launched SUVs and Crossovers in various sizes and price ranges, and more will be added in the coming time, the most popular being the small and sub-compact SUVs such as the Tata Nexon and compact SUVs such as Mahindra XUV 700. EVs will follow this trend, too.

Currently, SUVs represent about 38% of the light EVs. The launch of new entrants, such as Tata Punch EV and Hyundai Exter EV in early 2024, will compete with Citroen e C3 and fall in the price range of Rs 11 lakhs to 14 lakhs (US$13,200 to US$16,800), significantly expanding this segment. On the other hand, Maruti Suzuki eVX, Hyundai Creta EV and Honda Elevate EV are due to launch their SUV, which will acquire a significant market share in 2024-2025.

While the current e-SUV market is nascent, with an estimated 30,500 units sold in Q1 to Q3 2023, Canalys forecasts that the EV market in India will grow to over 300,000 units in 2025, representing over a 6% market share of the total light vehicle market, achieving a CAGR of 59%. This exponential trajectory underscores the immense potential of this segment.

Tesla’s plans to set up a plant in India will be made public in January 2024. Tesla will invest up to US$2 billion to set up a local factory in India and seek a tariff concession of 15% on imported vehicles during its first two years of operations in India, aiming for early access to the market. Tesla will start selling Model 3 and Model Y in 2024, and the first made-in-India models will be priced as low as Rs 17 lakhs (US$20,000).

VinFast, Vin Group’s EV arm, will enter India in 2024, initially importing and establishing local manufacturing in 2025. The aim to launch VF7, VF8 and VF6 models in 2023-2024, priced between Rs. 35 lakhs to Rs. 60 lakhs (US$42,000 to US$72,000), signifies an ambition to not only cater to the Indian market but also to export and gain a foothold in the expanding EV sector in India.

JSW Group entered a joint venture with SAIC Motors, which owns MG Motors India, and will hold a 35% market share. It aims to focus on manufacturing EVs and will launch seven models by 2025, which include hybrids and EVs, along with updating its existing ICE vehicles. This will help MG Motors to expand in India amid constraints due to Chinese investments.

In conclusion, despite rising competition in 2023, Canalys anticipates Tata to maintain market dominance, especially with the Tiago standing out as the most affordable EV, while MG is gaining ground. The momentum is expected to persist in 2024 as Tata and Hyundai introduce Punch EV and Exter EV. Their success in capturing significant volumes will depend on competitive pricing. Despite the present slowdown, there is potential to increase EV market share to over 3.5% in 2024.

The government is keen on promoting electric mobility and the FAME scheme plays a pivotal role in promoting sustainable growth by providing subsidies for the purchase of EVs. The government can extend the Fame II scheme for a few more years, a decision which will be made during the budget 2024. It can focus on leveraging policies to encourage new entrants, such as Tesla, to manufacture and export from India.