Insight bolsters its Google Cloud presence with SADA

08 December 2023

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Last week, Insight announced the US$410m acquisition of SADA, a renowned global cloud services provider and consultancy specializing in Google Cloud. This marks a significant step in Insight’s multi-year plan to reduce its dependence on hardware, and shift more towards software, services, and the cloud. Hardware has declined as a proportion of revenue (thanks in part to the recent slowdown in client and infrastructure business) but remains key, and still represents around 57% of total sales. But Insight expects growth rates of services and the cloud to be double that of hardware over the next few years, and contribute an even greater share of profits. Services, including cloud, only account for around 15% of reported sales but already contribute close to half of Insight’s gross profits. The acquisition of SADA will boost that further.

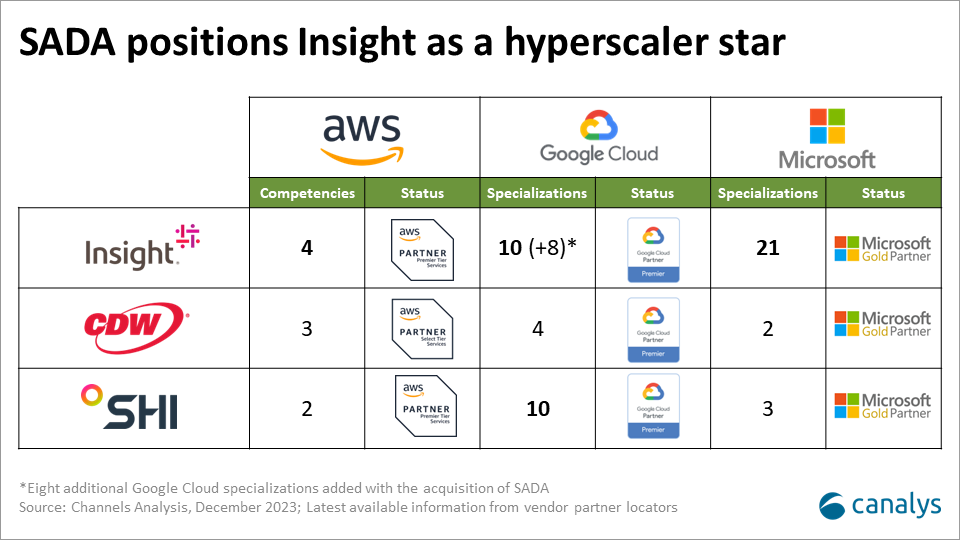

SADA, a six-time Google Cloud Partner of the Year award recipient, adds approximately 850 Google Cloud certified professionals, eight additional Google Cloud specializations (on top of Insight’s existing two), 3,000 new enterprise and public sector customers, and a myriad of advanced Google Cloud services expertise spanning consulting, migration, deployment, cost optimization, change management, and managed services to Insight’s cloud services portfolio.

The acquisition of SADA significantly advances Insight’s new strategy by further empowering its two-pronged approach:

Apart from supporting this transformation, Insight looks to SADA to bring two other important benefits. The first is to accelerate its financial performance. SADA’s strong financial trajectory, including 2022 gross profits of US$200m on net revenue of US$251m, is expected to significantly contribute to Insight’s bottom line. Insight expects SADA will contribute between US$50m and US$60m to EBITDA and US$0.55 and US$0.75 to adjusted diluted EPS in 2024. The second objective is to expand Insight’s delivery capabilities in India. SADA has an established presence in India, with a dedicated office and over 200 skilled Google Cloud specialists in Trivandrum. This will boost Insight’s ability to support cloud customers both in India, and globally. This builds on last year’s acquisition of Hanu, an established Microsoft cloud partner headquartered in India.

The acquisition of SADA represents something of a deviation from Insight’s recent M&A strategy, which has focused on acquiring specialist Microsoft partners, including vNEXT (2020) in France, Hanu (2022), and Amdaris (2023) in the UK. Microsoft remains Insight’s largest vendor, representing 14% of sales in 2022 (and likely a much larger proportion of license and service sales not recognized in revenue) and Insight has achieved 22 Partner of the Year awards with Microsoft. Insight remains focused on enhancing its Microsoft consulting and managed services capabilities globally, particularly in AI, cloud, modern apps and cybersecurity. However it has clearly recognized the importance of balancing its Microsoft focus, particularly in cloud where customers will increasingly rely on partners who are able to support a multicloud approach. Insight has already started to develop a substantial AWS business, but has lagged in building its Google Cloud practice. With SADA, Insight quickly catapults itself as a Google Cloud star, and positions itself as the clearcut frontrunner among primary competitors, CDW and SHI, as the partner with the most specializations and competencies across all three hyperscalers’ partner programs. Specialization has clearly emerged as one of the most important factors determining a customer’s choice of partner to support cloud deployments.

Overall, Insight is taking a big bet with this acquisition. At a closing price of US$410m, this deal represents the second-largest acquisition in Insight's history, just behind the US$581m purchase of PCM four years ago. However, with a potential earnout of US$390m for SADA management over three years tied to performance, this could make it Insight's largest investment. This substantial acquisition underscores Insight's commitment to its five-year strategic plan. It sends a clear message to both vendors and customers about Insight's dedication to leadership in the cloud-native space, and its intention to deliver advanced cloud solutions to its global client base.