Middle Eastern smartphone market gains momentum with 2% growth in Q2 2023

Wednesday, 23 August 2023

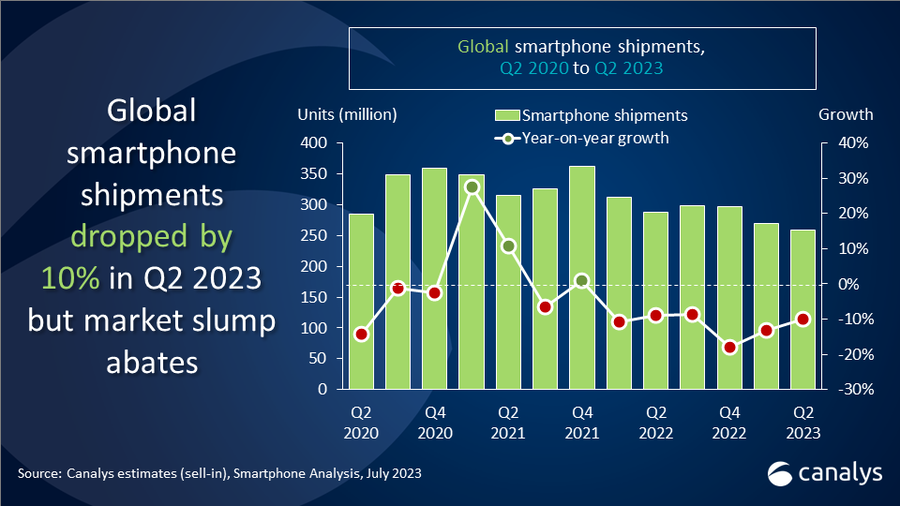

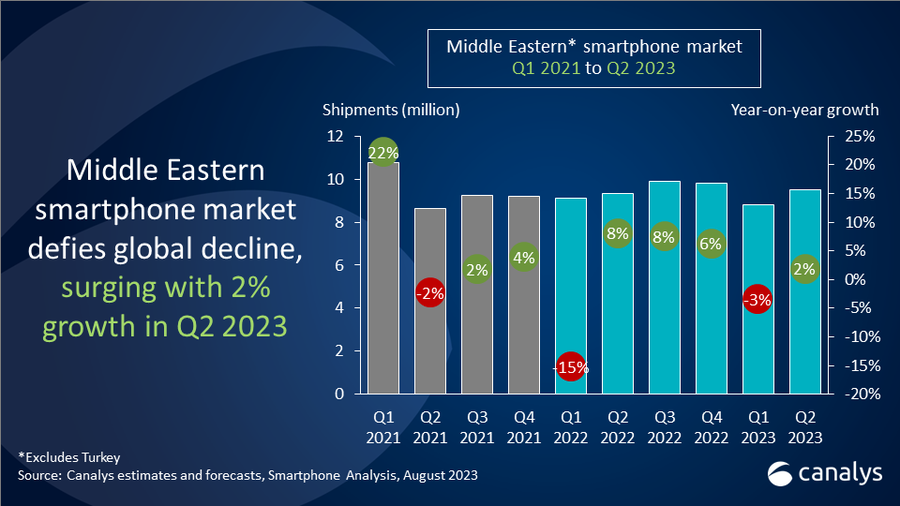

Canalys research reveals that vendors shipped 9.5 million smartphones in the Middle East (excluding Turkey) in Q2 2023, representing 2% annual growth at a time when the worldwide market fell by 10%. The region improved economically, aided by the surge in global oil prices along with record-low unemployment, expansion in non-oil sectors and significant FDI inflows.

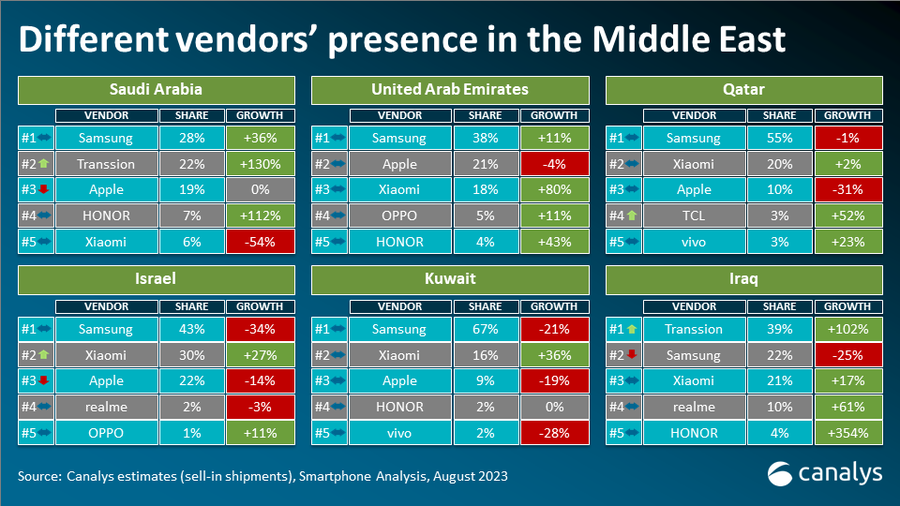

Saudi Arabia’s smartphone shipments in Q2 2023 grew by an impressive 19% year on year due to strong macroeconomics, non-oil sector expansion and vendors replenishing distribution channels for the Eid and Ramadan sales season. The United Arab Emirates (UAE) grew by a modest 6% in Q2 2023, driven by an influx of tourists. The country’s airports saw a surge in the arrival of passengers amid festivities. Iraq, notably, is emerging steadily, overcoming economic challenges and currency fluctuations to achieve substantial 24% growth in smartphone shipments.

On the other hand, Israel suffered a 19% drop in smartphone shipments due to rising inflation and cautious consumer spending. Families, dealing with higher living costs, are using their current devices for longer. Kuwait and Qatar, smaller markets that received less than half a million smartphone shipments each, were hit by declines of 15% and 23% year on year respectively, due to low consumer demand.

“In Q2 2023, both Apple and Samsung saw a decrease in shipments of premium segment smartphones in the Middle East, a result of cautious consumer spending and increased interest in budget alternatives,” said Manish Pravinkumar, Senior Consultant at Canalys. “Despite a 9% drop, Samsung retained its top spot, largely thanks to the success of its A series models, including the A24 and A14, in the more budget-friendly segment. Meanwhile, Apple continued to dominate the premium market, but saw most of its shipments concentrated on the iPhone 12 and 13 models due to budget-conscious consumers.”

“The downturn in the high-end segment was offset by a rise in entry-level shipments in the Middle East in Q2 2023. Transsion notably climbed to second place, driven by its expansion in lower ASP markets in the region. Brands such as Infinix and Tecno, with their emphasis on low-to-mid range pricing, boosted their shipments in countries such as Iraq and Saudi Arabia. Xiaomi held its ground in market share, supported by a wide variety of smartphones and a strong presence both online and in physical stores. Both HONOR and Motorola experienced significant growth. HONOR’s surge can be attributed to targeted marketing strategies, impactful product launches and a diverse mid-to-high-end product range. Motorola’s growth was bolstered by its extensive product availability, especially its new models, coupled with strong brand recognition and key retail partnerships with Lulu in the UAE and Xtra in Saudi Arabia.”

“Amid strong economic performance post-pandemic, the smartphone market outlook in the Middle East remains resilient,” said Sanyam Chaurasia, Analyst at Canalys. “With easing geopolitical tensions in the Middle East, FDI inflows are set to rise. The recovery in Gulf Cooperation Council (GCC) countries will be powered by non-oil sectors, driven by a strong domestic market. The travel and tourism industry is making a robust comeback, boosting non-oil activities. Canalys expects the Middle Eastern smartphone market to maintain 2022’s shipment levels in 2023. Smartphone brands will target middle-income consumers seeking to upgrade from their lower-tier devices, with a key emphasis on improving visibility through offline retail engagement.”

|

Middle Eastern* smartphone shipments and annual growth |

|||||

|

Vendor |

Q2 2023 |

Q2 2023 |

Q2 2022 |

Q2 2022 |

Annual |

|

Samsung |

3.4 |

36% |

3.7 |

40% |

-9% |

|

Transsion |

1.7 |

18% |

1.3 |

14% |

29% |

|

Xiaomi |

1.3 |

14% |

1.3 |

14% |

0% |

|

Apple |

1.2 |

12% |

1.2 |

13% |

-5% |

|

realme |

0.4 |

4% |

0.2 |

2% |

98% |

|

Others |

1.5 |

15% |

1.6 |

16% |

-2% |

|

Total |

9.5 |

100% |

9.3 |

100% |

2% |

|

|

|

|

|||

|

Note: Xiaomi estimates include sub-brand POCO and Redmi. Transsion includes Tecno, Infinix and iTel. |

|

||||

Our analysts will be attending GITEX Global in Dubai from 16 to 20 October 2023 and we would love to meet old and new contacts, vendors, channel partners and operators. Contact us to find out more.

For more information, please contact:

Manish Pravinkumar: manish_pravinkumar@canalys.com

Sanyam Chaurasia: sanyam_chaurasia@canalys.com

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, and detailed analysis of storage, processors, memory, cameras and many other parameters. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.