Unleashing the power of Chinese EVs in the global market

31 July 2023

Iraq's abundant oil reserves and young population create a favorable environment for vendors looking to tap into the smartphone market. Building strong relationships throughout the distribution value chain remains critical for vendors to gain market share.

Iraq holds vast oil reserves and a young population, making it an attractive investment prospect in the Middle East, despite the challenges posed by historical wars. To capitalize on this potential and promote economic growth, the Iraqi government should prioritize implementing reforms in investment-related laws and regulations. Notably, Saudi Arabia and the UAE have pledged to invest US$6 billion to support the expansion of international trade and investment in Iraq. Iraq's strategic geographical location further enhances its competitive advantage and positions it as a key market in global trade, particularly along trade routes linking Europe and Asia. All these factors will post opportunities for the domestic consumer market to grow. However, attracting foreign brands expansion will require effective implementation of administrative policies.

Continual investments in telecom infrastructure in Iraq have yielded significant outcomes, particularly in the smartphone sector, leading to a revolution in communication. This transformation has made smartphones more affordable and accessible, allowing the diverse population to connect instantly regardless of their location. As a result, this transformation transcended societal boundaries, fostering connectivity across demographics, bringing in female consumers as well. Overcoming mobility constraints, smartphones have now become lifelines for many, granting access to the outside world, educational resources and transforming lives.

In recent years, the Iraqi smartphone market has experienced an influx of various brands, some of which are excessively expensive for most of the population, particularly students. However, the introduction of Chinese smartphones has led to a significant shift in the market dynamics, as these brands have gained popularity and trust among Iraqi consumers. The success of Chinese vendors can be attributed to their focus on product engineering and design, which has resonated well with the local audience.

Vendors such as Transsion are vigorously concentrating on the budget segment by aiming to sell to consumers seeking better specifications at prices below US$150 through the Infinix and Tecno brands. Transsion has recently shifted the regional head of Tecno to Iraq. On the other hand, Xiaomi is maintaining its offline presence, having more than eight stores across various cities including Baghdad, Erbil, Slemani, Kirkuk and Basra. Its models like the Note 12 (8+128) are capturing the interest of consumers. HONOR, which has experienced substantial growth in this region, attributes its achievements to its association with Huawei. Apart from that, models like the HONOR X6, priced at IQD 159,000 (US$119), have received positive feedback from many customers. The C53 model from realme has helped the brand's share in the Iraqi smartphone market to reach an all-time high.

It is essential to acknowledge that distribution strategies cannot be approached with a "one-size-fits-all" mindset. To ensure successful distribution in Iraq, engaging with partners at every level of the value chain is crucial. Several key components contribute to the distribution cost in the country, including:

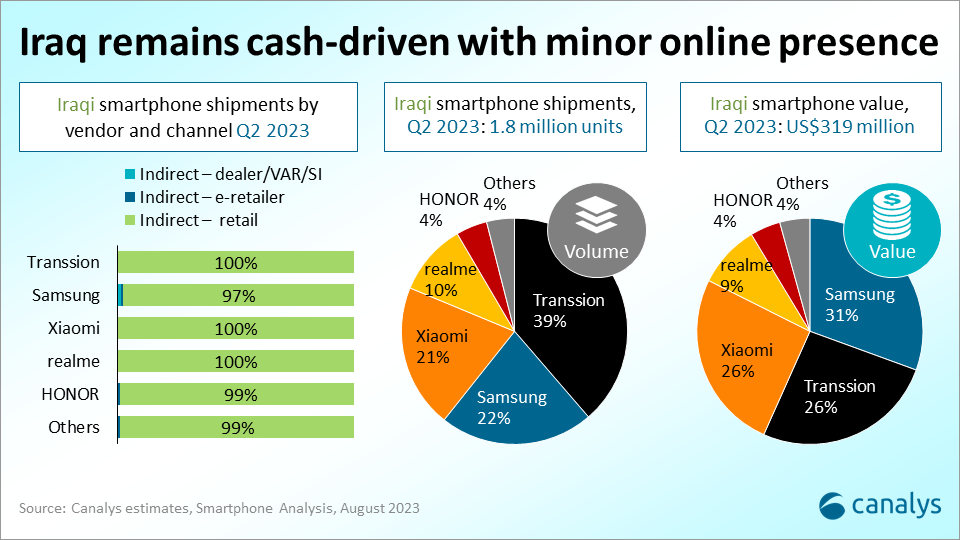

Offline channels overwhelmingly dominate Iraq's retail trade, accounting for more than 95% of all transactions. The smartphone industry follows a similar trend, with approximately 85% of sales occurring through unorganized retail channels, while established retailers like A-class chain stores contribute to around 15% of sales. Notably, online channels are non-existent in the country. Moreover, credit card ownership among Iraqis is less than 5%, highlighting the limited accessibility of this payment method. The lack of a robust banking system means that cash remains the primary mode of trade, prompting individuals to be cautious in their spending decisions.

The current market landscape presents challenges that could impede seamless vendor operations. From a macro perspective, Iraq lacks a diversified source of revenue, relying heavily on oil, generating 87% of state revenues according to the latest budget. This leaves the nation vulnerable to oil price fluctuations, affecting the economy directly. Additionally, environmental concerns further compound issues, including water scarcity, pollution and rising temperatures. While overall security has improved, specific regions within disputed territories remain prone to acts of terrorism. As Iraq grapples with these multifaceted challenges, its ability to navigate and adapt will play a pivotal role in shaping future vendor operations in the market.

Overall, Iraq's youthful population coupled with substantial oil reserves presents a promising opportunity for vendors seeking to enter the market. To succeed, vendors should prioritize a cash-centric approach, provide competitive products and employ local manpower with expertise in the industry. Developing robust relationships across the distribution chain will continue to be pivotal for establishing a significant presence and capturing market share in this dynamic market. Understanding and effectively managing these factors are crucial for vendors to optimize their operations and ensure successful market penetration in Iraq. Going forward, Canalys expects the Iraqi smartphone market to remain relatively stable and reach 7.3 million shipments by the end of 2027.