Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

TD SYNNEX reports encouraging Q2 2024, but shareholders miss the point

TD SYNNEX, a leading IT distributor, revealed an improving performance in its fiscal Q2, marked by gross sales growth driven by increased demand in PCs, data centers and strategic technologies. Despite the positive financial indicators, confusion surrounding revenue recognition rules for software subscriptions and cloud services led to a significant drop in share price, highlighting the challenges faced by distributors in accurately portraying their financial performance to investors.

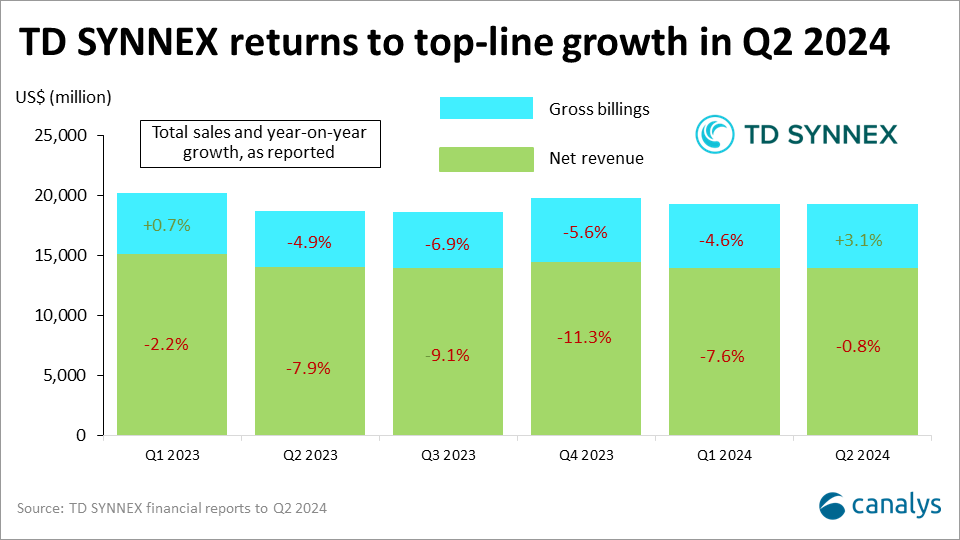

TD SYNNEX, the world's largest distributor and a bellwether of the wider IT industry, reported a strengthening fiscal Q2 (ending May 2024), on the back of improving demand and recovery across PCs, data centers, and an acceleration in “strategic technologies” (cybersecurity, cloud, data, software and others). Gross billings (total sales) were up by over 3% year-on-year to US$19.3 billion, while gross, operating and net profits all saw single-digit improvements. This was TD SYNNEX's first quarter of gross billings growth for five straight quarters.

Despite the positive trajectory, investors hammered TD SYNNEX, with share price slumping 9%. Q2 EPS and second-half guidance were slightly behind earlier expectations, but a key factor is the confusion among investors (and some press) about revenue recognition rules for software subscriptions, SaaS, and cloud services. Under US and European accounting standards such as ASC-606 and IFRS 15, pass-through revenue for subscriptions (including some cybersecurity), SaaS, cloud and support services are recognized only as gross profit, not top-line sales. TD SYNNEX reports this as “revenue” - a clearly recognized metric - which declined by almost 1%. Yet this misrepresents actual top-line performance, which increased by over half a billion dollars (US$589 million) on Q2 last year. Much of this came from growth in software, SaaS, cybersecurity and cloud sales, which are netted down in reported revenue. As TD SYNNEX sees the share of these technologies increase every quarter (which also typically attract higher gross margins), it risks being punished further by investors.

This is an increasingly important issue for quoted distributors and channel partners reporting “net revenue” such as Arrow (in its ECS division), whose strong growth in software and cybersecurity is being masked by net reporting models. Leading cybersecurity distributor Exclusive Networks, which reports both gross and net revenue, has struggled to grow its valuation since its IPO. There are some attractions of net reporting - particularly the ability to “boost” gross and operating margins (by reporting profits as a percentage of net rather than gross sales), but this can equally create an artificial view of profit metrics.

From the start of last year, TD SYNNEX began reporting gross billings to reflect its “true” top-line performance and provide a more accurate view of the business. A growing number of channel partners and distributors are following a similar approach, but a lack of consistent terminology (gross invoiced income/GII, business volume and gross sales among others) is unhelpful and adds to the confusion. Greater standardization is needed.

TD SYNNEX saw a 1% rise in Q2 gross billings for Endpoint Solutions, thanks to the mounting rebound in PCs. Advanced Solutions' performance (including data center infrastructure, software, cybersecurity and cloud) was even more encouraging, up by 5% year-on-year. Strategic Technologies, which span both of these divisions and include cybersecurity, specific cloud services, data and AI, accelerated by 15%, and now contribute 25% of total gross billings. The company is optimistic about continued improvements in all these areas.

Reporting gross billings also has the advantage of reflecting a company's true size and market share. With 2023 full-year gross billings of US$77.2 billion, TD SYNNEX generated almost US$20 billion more in total sales than its reported net revenue of US$57.6 billion. Revenue may be vanity, but scale and share are also important measures of relevance and stability, particularly for vendors as they seek to engage with partners that deliver the broadest customer reach and highest ROI.

Distribution faces many pressures in the coming quarters and years, as the evolution of the market accelerates, and the value of distribution changes. But TD SYNNEX is well positioned to capture growth and bolster profitability as the IT industry recovers, given its massive global scale, portfolio and solution breadth and investments in digital platforms. It’s worth noting that 75% of TD SYNNEX’s gross sales still come from hardware, which will contribute to top and bottom line growth as the hardware market recovers. It has successfully completed a major system upgrade in Europe. Patrick Zammit, who replaces Rich Hume as CEO, is a seasoned and proven leader who can navigate the company through an increasingly complex market environment. An appetite for targeted acquisitions, such as the Q2 purchase of specialist cybersecurity distributor Orca Technology in ANZ, strengthens its focus on strategic technologies and accelerates its integration with hyperscaler marketplaces across the globe. Like other public distributors and channel players, raising awareness and educating investors to look beyond arbitrary financial metrics will be key to better reflect its value.