Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

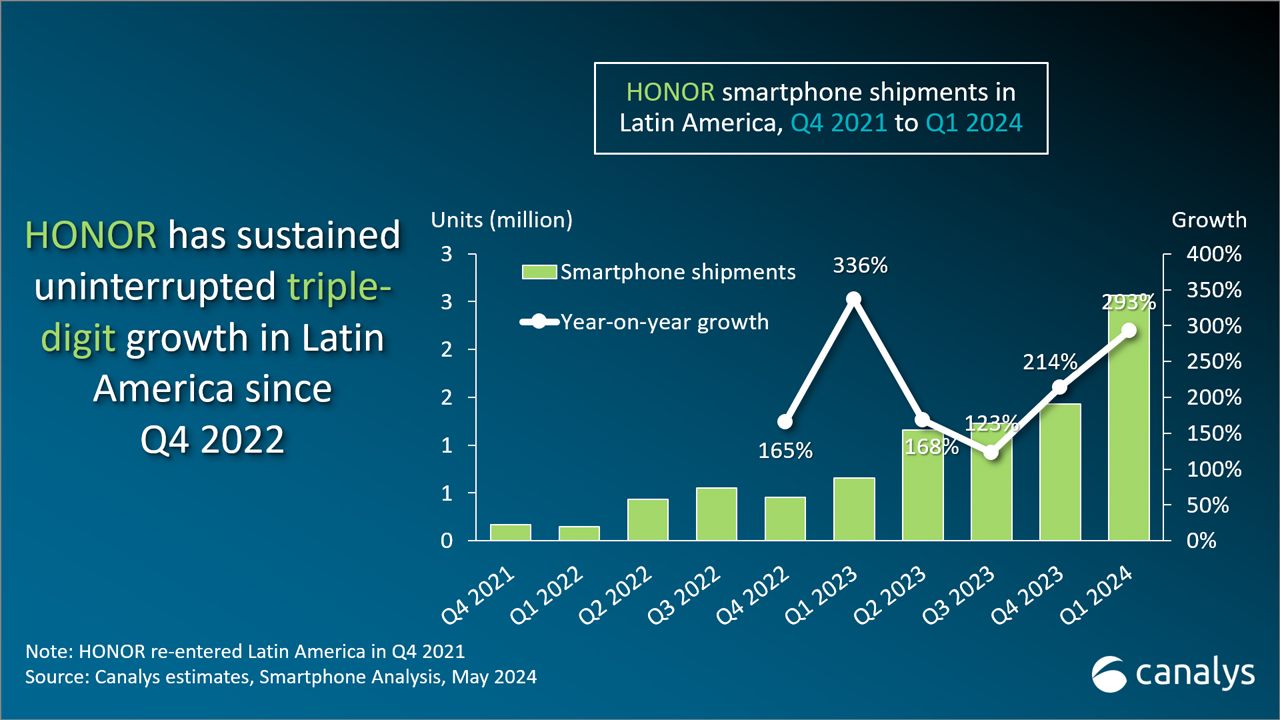

The rise of HONOR in Latin America

A blog analyzing the competitive advantages, key drivers and challenges for the consolidation of HONOR as a key player in the smartphone market in Latin America.

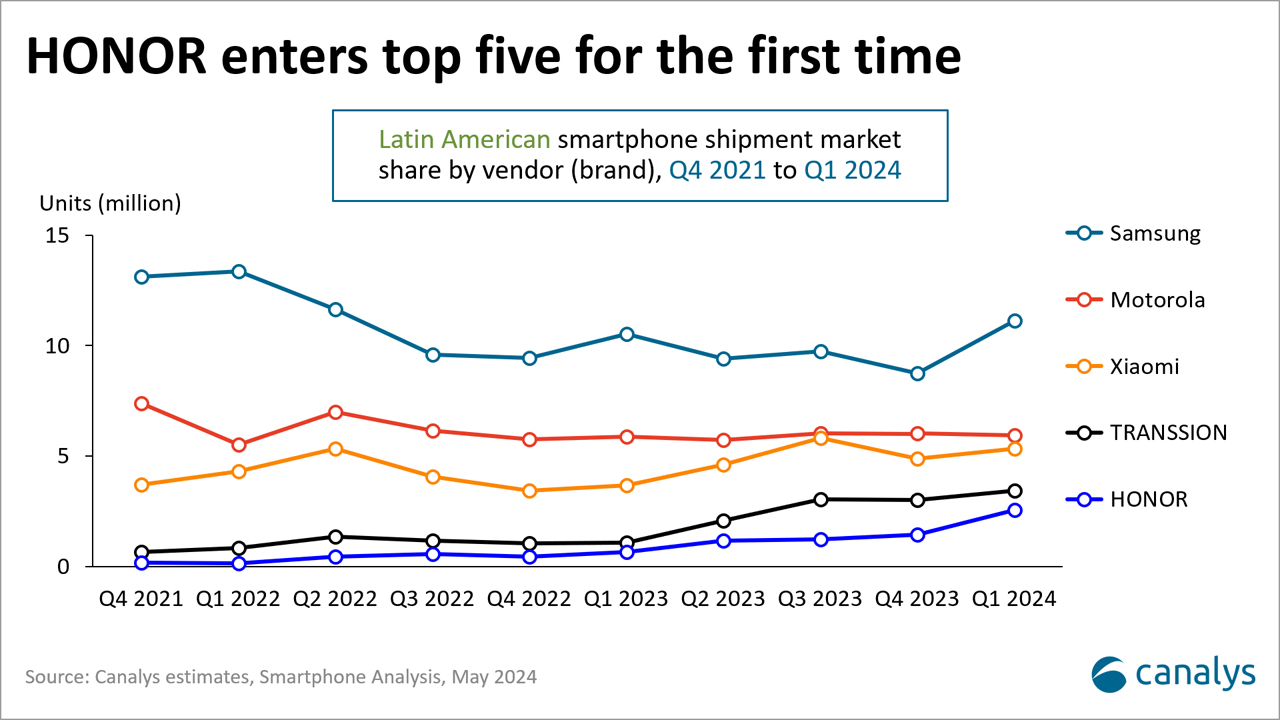

In Q1 2024, HONOR reached a major milestone by breaking into the top five brands in Latin America for the first time. It achieved a 7% market share and an impressive 293% year-on-year growth rate. This achievement is no coincidence – HONOR has maintained triple-digit quarterly growth in Latin America continuously since 2022. In Q2 2023, the company shipped over a million units, driven by Mexico, where it approached half a million units for the first time. As a result, Latin America has become HONOR’s second-largest market globally after Mainland China during this period.

Key growth drivers

Leveraging Huawei’s legacy

Initially, HONOR entered the Mexican market as a sub-brand under Huawei, focusing on the low-end and mid-range open market of some local retailers. As an independent company, HONOR capitalized on Huawei’s established commercial structures, sales channel relationships and go-to-market strategies. This legacy gave HONOR a competitive advantage, allowing it to avoid starting from zero like many new market entrants.

Developing traditional channels

HONOR quickly advanced its commercial strategy by partnering with major traditional channels – major carriers as tier one partners and leading local retailers as tier two. This granted HONOR extensive visibility and presence in key markets, boosting its brand positioning and market penetration. While requiring substantial financial investment in areas like logistics, promotions and marketing, this strategy has proven more stable in the long term than relying purely on distributors.

Differentiating in mid and high-end ranges

Although its volume focus is on low and mid-range segments, HONOR targeted differentiation in mid and high-end ranges since entering Latin America. For example, it spotlighted its Magic series in communications. HONOR delivers superior device specifications unlike some of its competitors in areas like camera quality, memory, processors and build. The X8b outperforms rivals like Samsung’s Galaxy A35 5G and Oppo’s A78 on memory, cameras, and processors. Despite intense competition, this established HONOR as a quality brand, not just price-driven.

Competitive advantages and challenges

There are a few areas that have helped HONOR differentiate itself from its competitors:

- Leveraging Huawei’s established structures and relationships has allowed HONOR a more efficient and effective market entry.

- Unlike other emerging brands that have rapidly increased their volume in the open market through distributors, focusing on telecom operators and local retailers has allowed HONOR to establish itself as a trusted brand, as well as rapidly expand its visibility and penetration in key markets.

- Superior specifications and build quality in the mid-range and high-end segments can help HONOR in its aspirations to position itself as an emerging premium brand.

- HONOR is one of the emerging brands that has been continuously developing and expanding its ecosystem in the region. It has managed to bring to the market a fairly complete portfolio of smart bands, tablets, personal audio devices and headphones, and even some notebooks. This can help the brand capture users on its platform, increase its average ticket value, and increase the penetration of its products and brand in sales channels.

These competitive advantages shall prove sustainable due to HONOR’s strategic approach and perceived product quality. However, the company must overcome important challenges before establishing itself as a top brand in the region in the long term.

- Expanding consumer base and loyalty: HONOR must continue to increase its consumer base and strengthen loyalty to maintain and increase its market share. For this, it still needs to develop its key differentiators and work hard to make them recognized by the market.

- Financial base: consolidate a sufficient financial critical mass or ensure the monetary support of its headquarters to withstand the socioeconomic ups and downs that the region faces, which can lead to a slowdown in the market, as has been seen recently.

- Adaptability: being able to face possible market changes, such as market saturation in the face of the current recovery in shipment volumes, where most brands are struggling to place the greatest amount of inventory in the sales channels that have resumed demand for devices.

- Premium segment growth: although HONOR is effectively building quality perception, it still faces the challenge of growing and gaining share in the high-end and premium segments. While its flagship models, HONOR Magic6 Pro and HONOR Magic V2 have enough features to compete in the premium segment, they still need to capture the attention of more high-income consumers. In 2023, only 6% of HONOR’s shipments were for devices priced above US$500, with a 2% market share in that price band, compared to 4% and 10% for Xiaomi and Lenovo, respectively.

Looking to the near future, the Latin American smartphone market is expected to be positive in 2024, with Canalys projecting a 9% growth. Factors such as the expansion of 5G and the growing interest in devices with AI capabilities could be interesting to be explored by HONOR's premium ambitions. Though launched a couple of months ago, HONOR's MagicOS 8.0 operating system and features like MagicLM and Magic Portal represent significant marketing opportunities to capture interest in the brand at a time when market leaders such as Apple and Samsung continue to maintain the industry's interest in any announcement about AI features, which could be well used by HONOR in Latin America.