Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

The appeal of AI smartphones to Chinese consumers (part one)

Canalys blog on the unique value of mainland China market of AI smartphones and consumers attitude towards the AI smartphone.

Since the end of 2023 AI smartphones have experienced rapid development as highlighted in Canalys' recently released in-depth report "Now and Next AI capable smartphone", which extensively discusses this topic. Thanks to its high-end user base and local regulations, the mainland China market offers unique value and a highly competitive landscape for market players in this next wave of smartphone innovation. A key step in driving success of AI strategies is how GenAI can become a driving factor for consumers to switch brands and upgrade smartphones.

Unique value of AI-capable smartphones in the Chinese Market

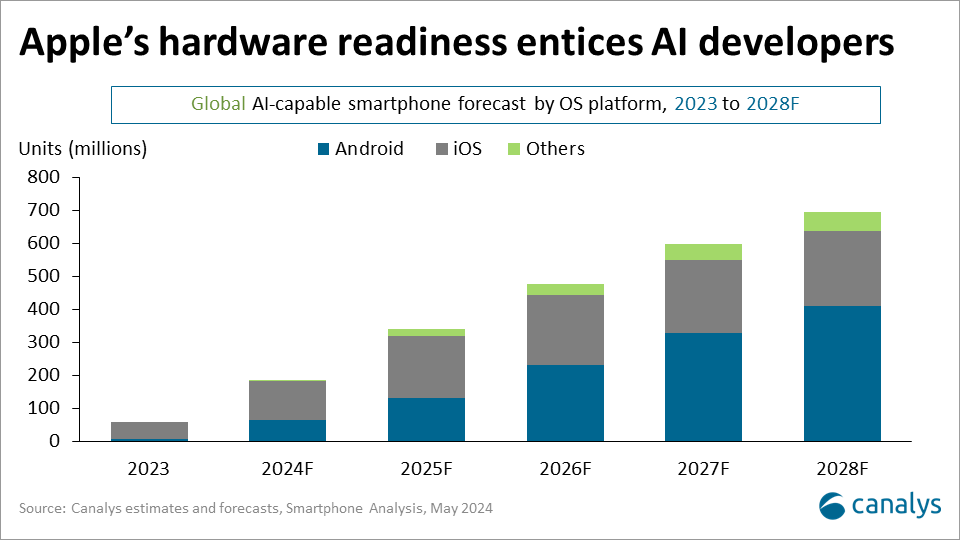

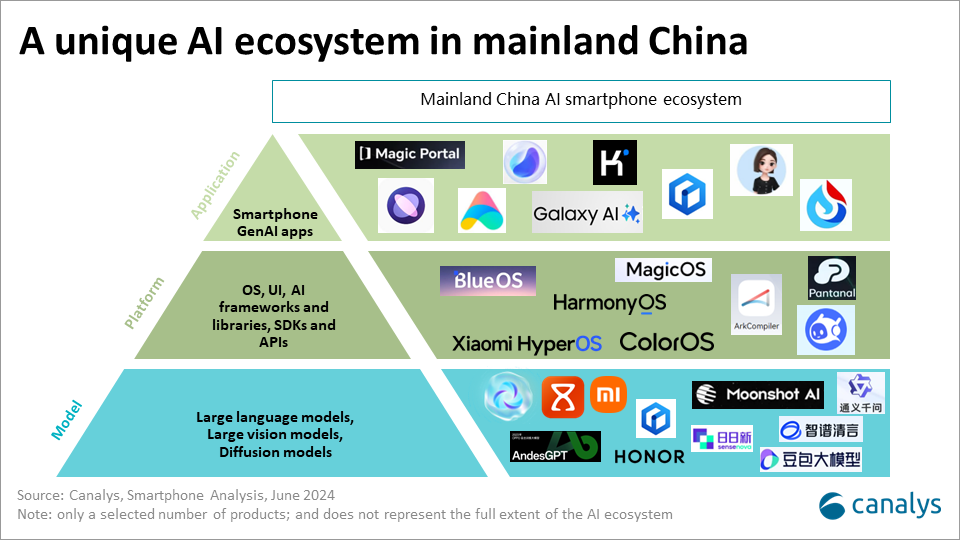

Mainland China was one of the earliest adopters of AI-capable smartphones. Vendors including Xiaomi and vivo launched AI-capable smartphones in Q4 2023, and competitors are quickly following up with their AI smartphone launches. In Q1 2024, Mainland China shipped 11.9 million AI-capable smartphones (5.7 million of those units were AI-capable iPhones), accounting for 25% of global AI smartphone shipments, making it the second-largest AI smartphone market globally following the United States. When it comes to the development of large generative AI models, the Chinese market possesses a huge volume of data from different verticals and segments – crucial for training and inferencing. However, the entry barrier is not low for global players. Due to the Chinese language complexity, and local AI regulatory requirements, global players such as Apple and Samsung, must adopt a localized go-to-market approach, considerably distinctive from international markets.

Major players are all-in AI; what's next?

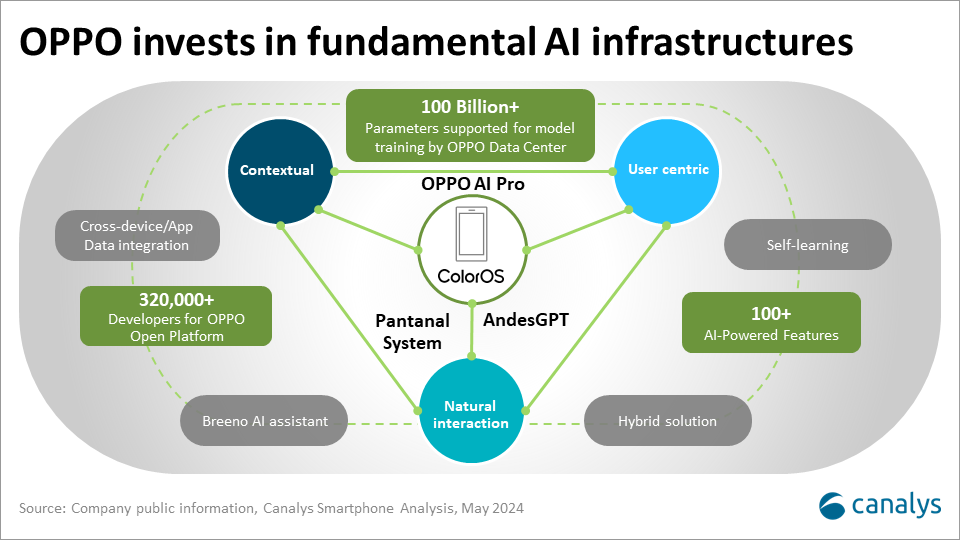

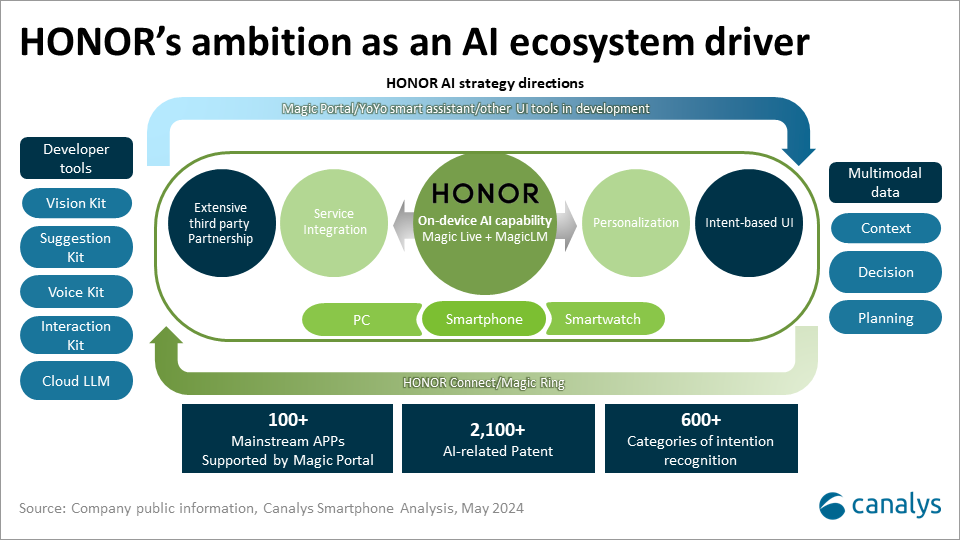

AI smartphones represent the next major growth driver in the smartphone industry. Leading Chinese brands such as Honor, OPPO, vivo, and Xiaomi entered the AI race as pioneers in 2023, unveiling their AI strategies to drive development particularly in mainland China.

Apple and Huawei have been keeping a low-profile despite being put under the spotlight. Apple only launched Apple Intelligence at last week's WWDC. Its core functionalities will face two localization challenges in Mainland China from the outset. One is AI-enhanced Siri's current version is not available for Chinese users. Apple will most likely partner with local language model providers such as Alibaba's Qwen or Baidu's ERNIE, while getting its in-house on-device model and server models approved by local authorities. Meanwhile, Apple will need to establish a local solution hosted on local private cloud servers to enable the Private Cloud Compute functionality. Overcoming these challenges is crucial for Apple to further develop its differential competitive edge – privacy security and ecosystem – in the Chinese Market. Similarly, the industry is watching the AI developments from Huawei in Mainland China, which processes a large loyal high-end user base and strong capabilities to integrate software and hardware developments, along with its wide range of smart IoT products and back-end AI infrastructure. There are certainly high expectations from the recent AI and HarmonyOS announcements from the annual Huawei Developer Conference (HDC).

Despite the rapid development of AI use-cases and smartphone shipments in mainland China, the market is still at an early stage. Localized deployment, business models, and privacy and security remain areas requiring continuous investment and exploration by market players. At this stage, leveraging AI to differentiate products, brands, and ecosystems to encourage users to upgrade devices or switch brands is the primary monetization model for smartphone vendors. Understanding consumers' attitudes towards AI smartphones is the first step in the long journey.

How attractive are AI smartphones to Chinese consumers?

A consumer study by Canalys on AI-capable smartphones (hereinafter referred to as "the survey") reveals key insights about Chinese consumers' interest in AI smartphones:

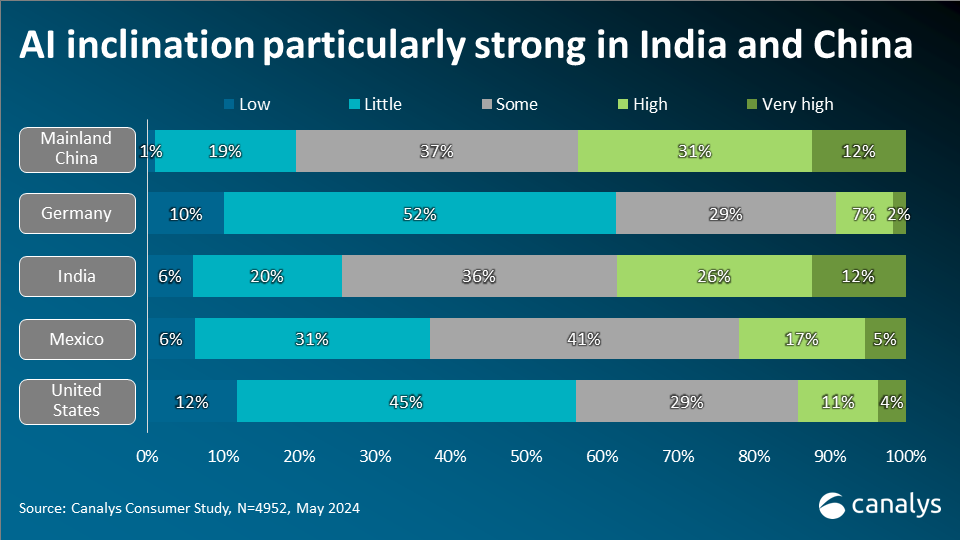

Mainland China is the market with the strongest AI inclination among the top three global smartphone markets. Among mainland China, India, and the United States, Chinese consumers have the highest proportion of "high" to "very high" AI inclination, at 31% and 12% respectively, with only 1% showing no interest in AI. Chinese consumers demonstrated a more open attitude towards new technology in the survey, partly due to early and more extensive AI consumer education and marketing efforts by vendors, providing a rich foundation for the development of AI smartphones in mainland China.

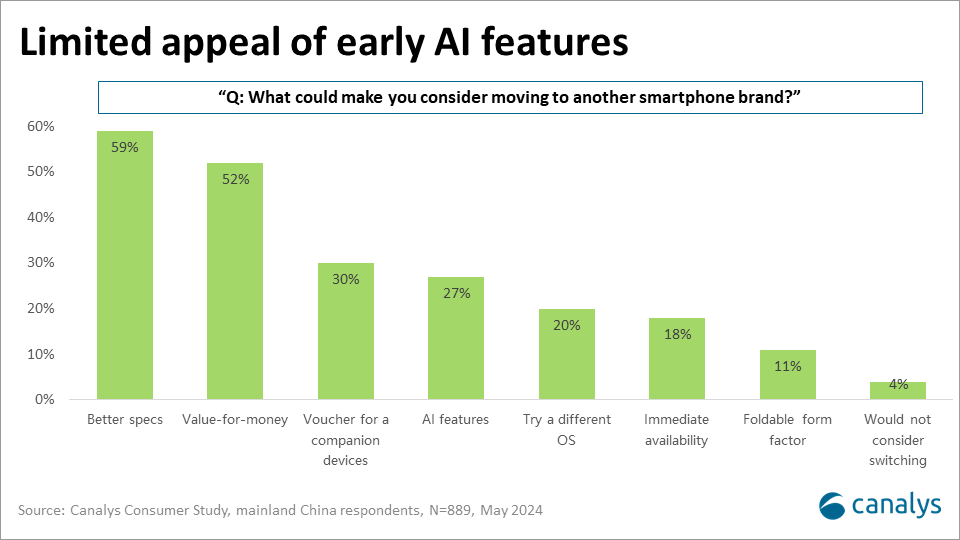

AI features are currently the fourth largest driver for Chinese consumers to switch brands. The survey shows that 27% of consumers consider switching brands due to the latest AI features. AI's potential to attract brand switchers ranks after "better specs," "value for money," and "voucher for companion" and it surpassed emerging technologies such as foldable screens in attracting brand-switching consumers. Among these consumers, over 60% plan to upgrade their phones within a year, meaning smartphone vendors that can quickly establish a differentiated AI competitive edge along with other switching factors stand a good chance of attracting these brand-switching consumers.

Despite no smartphone vendor directly monetizing their AI features from consumers, the survey found 71% of Chinese users are willing to pay extra for smartphones with advanced AI features, including higher device prices, AI app subscription fees, and increased data costs. This rate is also higher than other markets including the United States and India. Thanks to the rapid popularization of various paid applications and the generative AI use-case experiences provided by early entrants, Chinese consumers' willingness to pay displays a rosy picture for vendors to look for multiple revenue models from this product category.

In summary, the survey highlights the mainland Chinese market has a strong awareness of AI-capable smartphones. It is also important for vendors to expand user bases and increase device prices while exploring AI use-cases and best practices for overseas markets. Canalys will discuss these key topics in upcoming blog posts and client exclusive reports.