Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Accelerating circular IT: this is what needs to be done

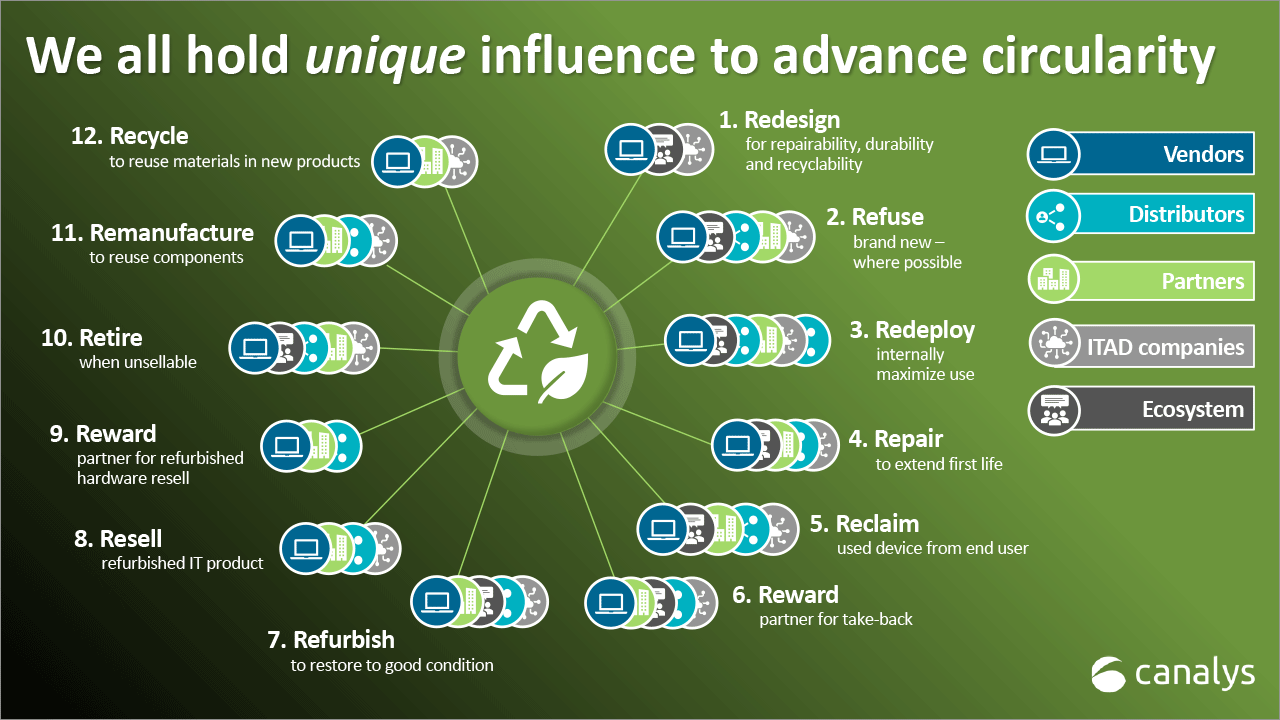

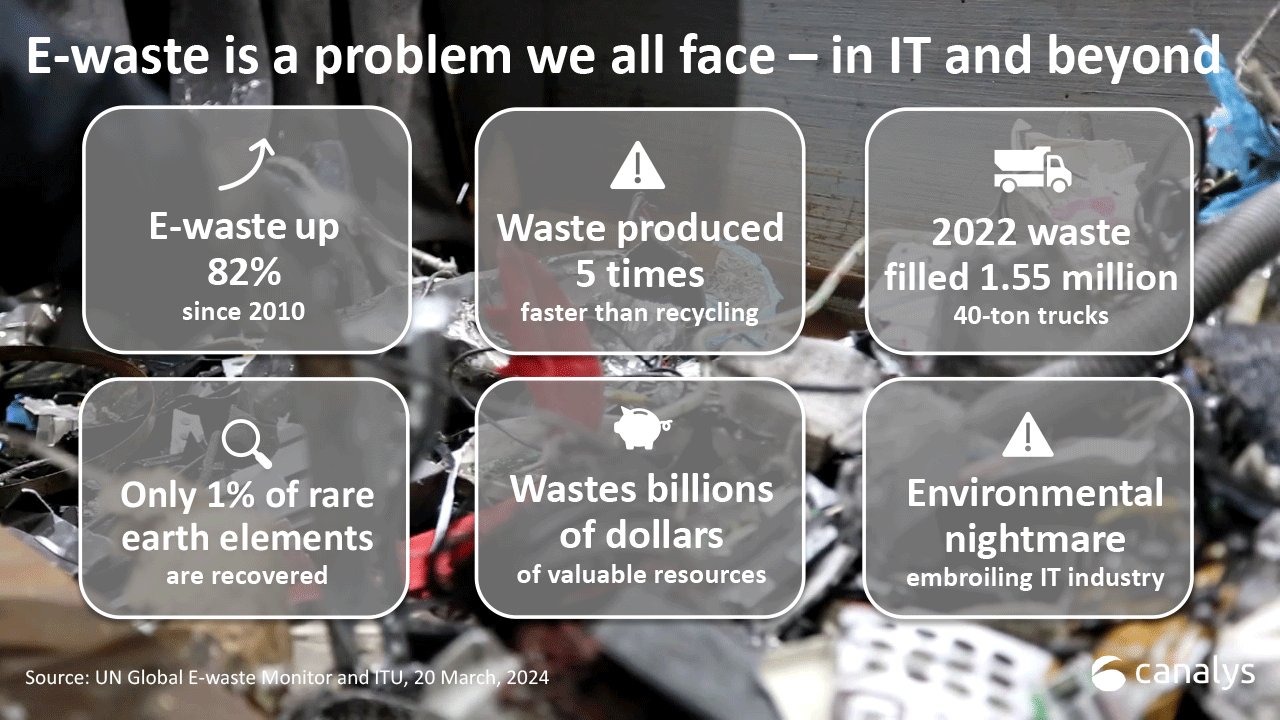

The world of circular IT is at a turning point. We produce five times more e-waste than we recycle. But the Right to Repair Movement is gaining traction, and demand for circular IT has never been higher.

On 23 April 2024, some 120 people filed into a spacious dome tent 60 miles from Dubai. Anticipation filled the room as representatives from more than 60 companies awaited the event speakers to take to the stage.

At 10:00, Circular Computing’s CEO Rod Neale and Director of Sustainability and Client Engagement Stephen Haskew, hosts of the event, took to the stage. The event – RE – was designed to do many things, including, as Rod Neale said, “To distribute knowledge around the benefits of certified remanufacturing. To provide a forum for all the great companies out there building and delivering on sustainable IT.”

What followed was a plethora of presentations – from Circular Computing, the British Standards Institution, Context, Nexthink and Canalys. Canalys attended this event with one main question to answer: what more does the IT industry need to do to ensure circular IT is a success? The feedback given by this audience of technology experts resulted in 14 calls to action. Each action is clear but far from simple. IT circularity is gaining prominence, but only time and genuine investment in the actions below will determine the success of attempts to truly close the loop in IT.

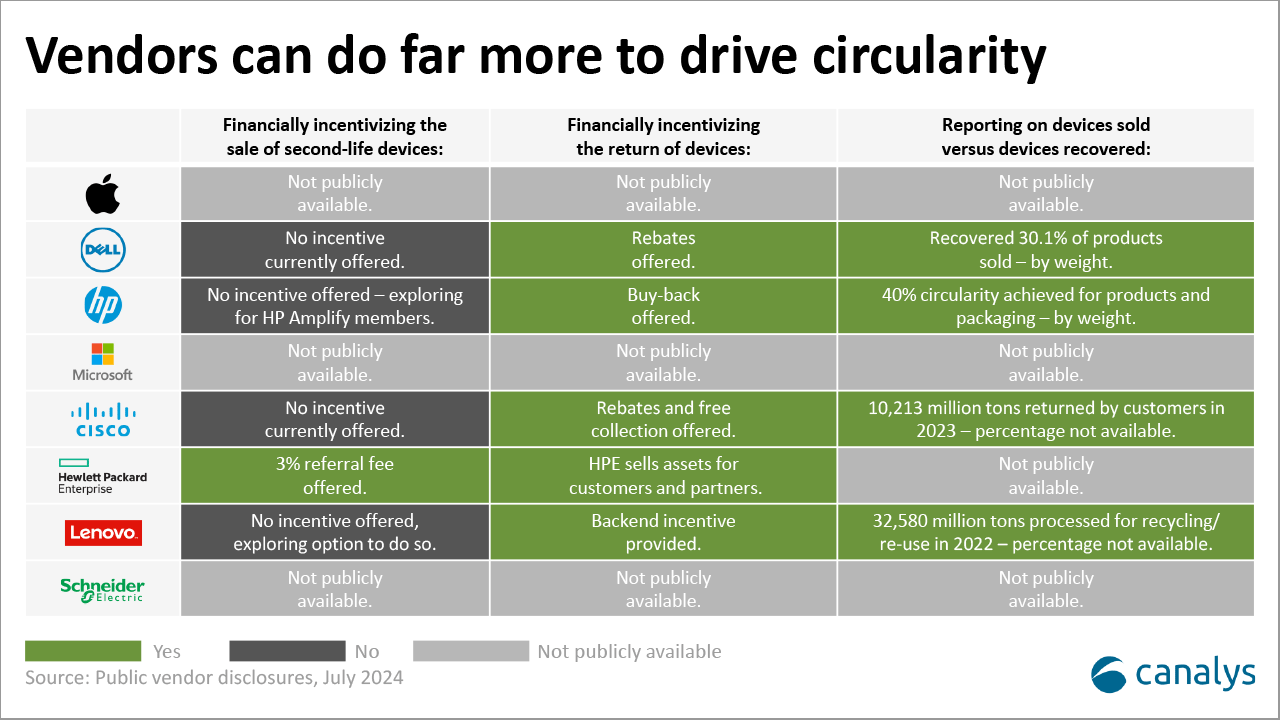

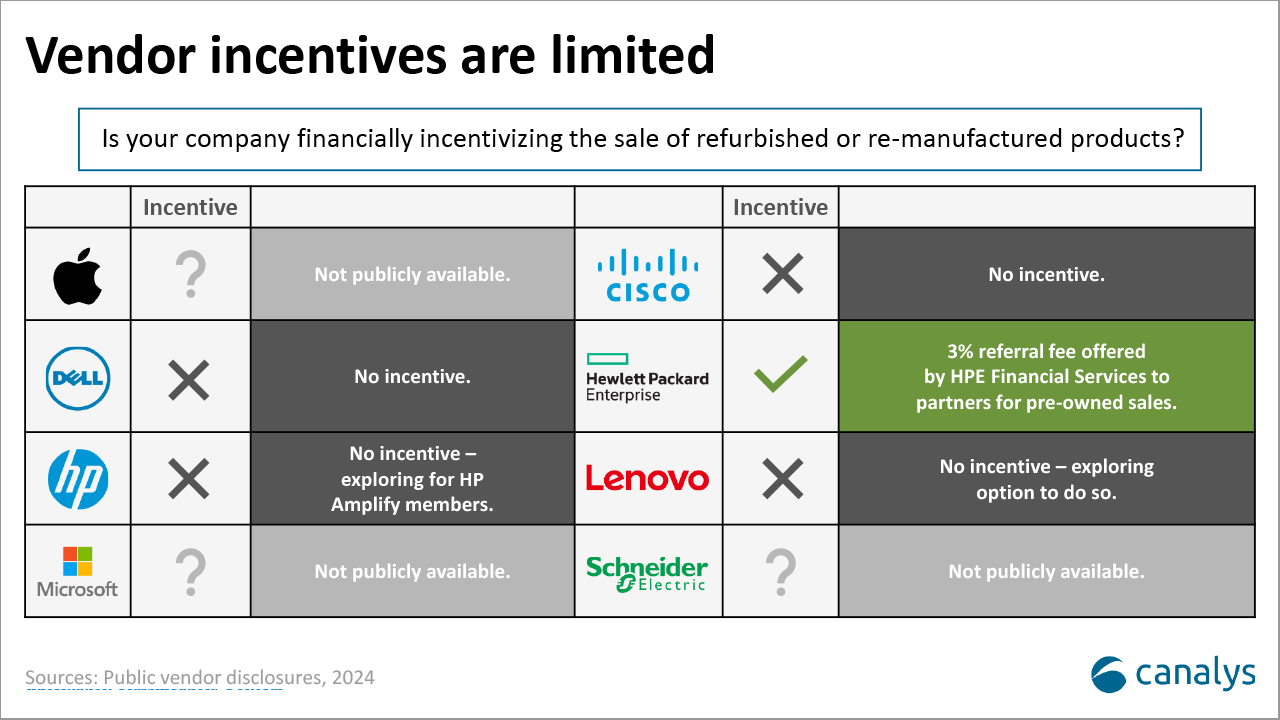

- Vendors: ensure you are financially incentivizing the sale of refurbished devices

The list below is not exhaustive and depends on the transparency shown by vendors.

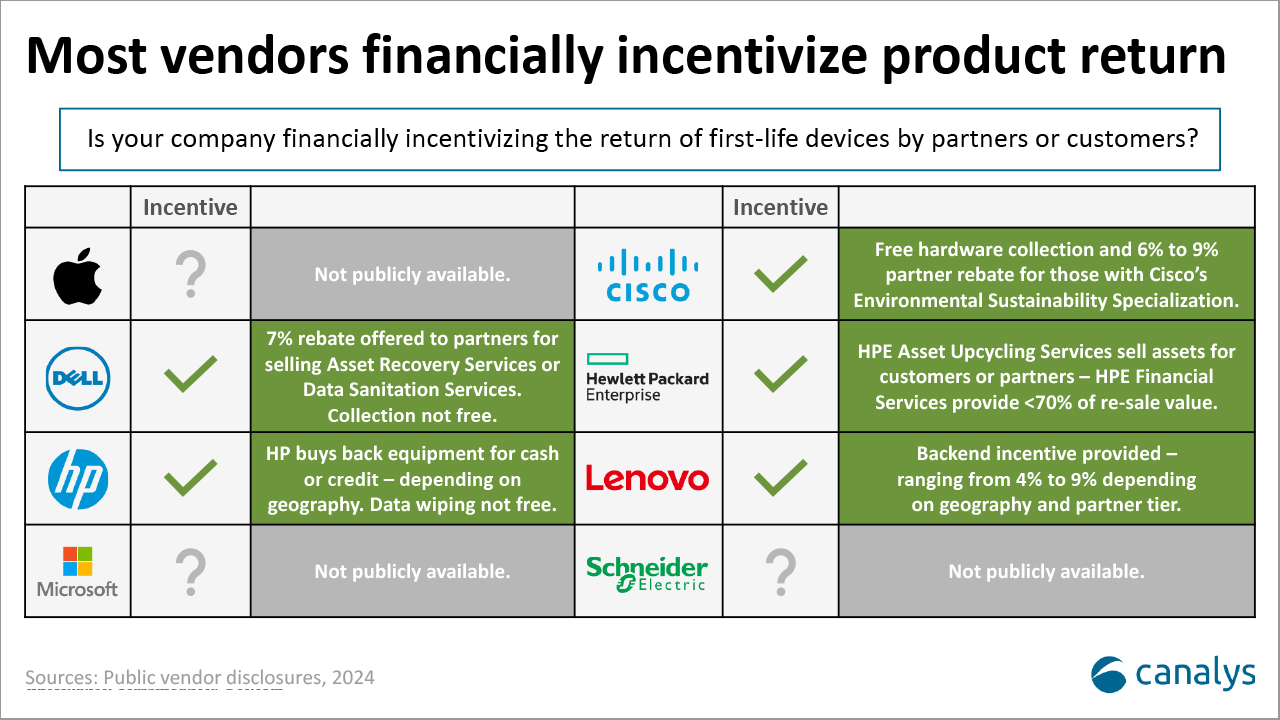

- Vendors: ensure you are financially incentivizing the return of devices by customers and partners

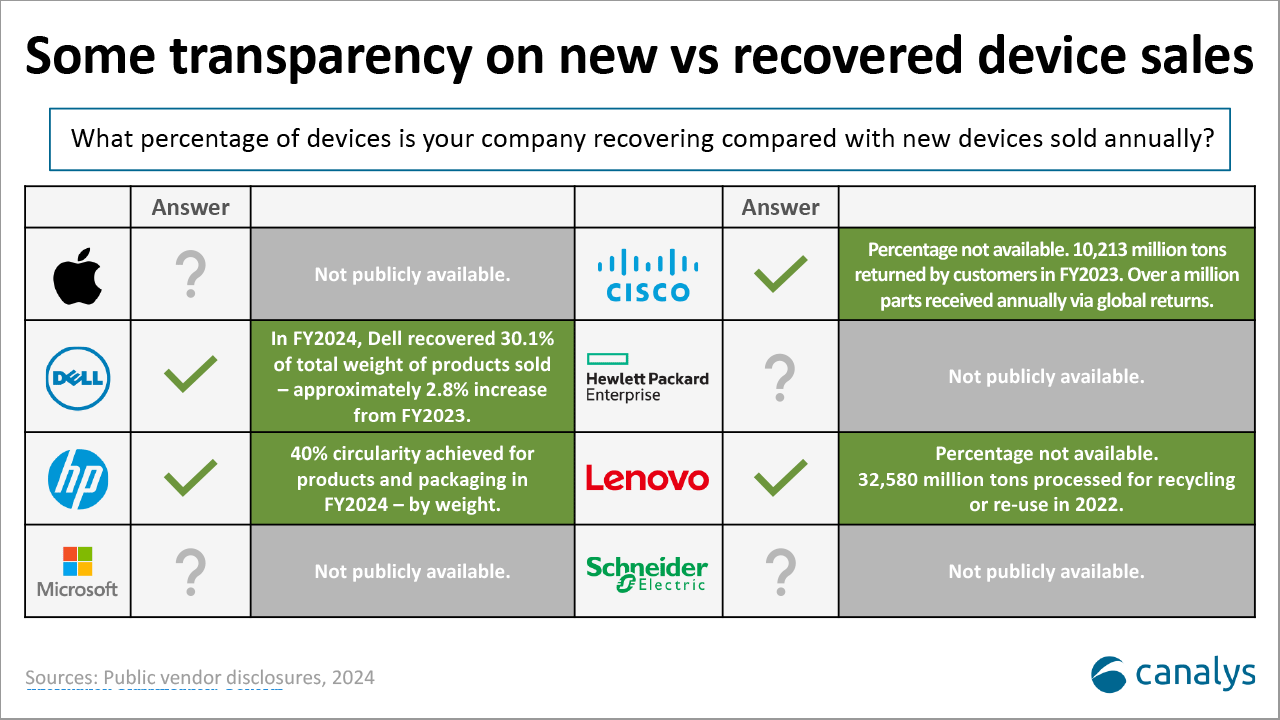

- Vendors and partners: declare the percentage of new versus refurbished devices you are selling

The technology industry does not currently have a reliable methodology for tracking the share of new versus refurbished devices sold by vendors. It is a real challenge (both for analysts and vendors!) to establish a clear assessment of what is new versus refurbished. Vendors need to have much greater visibility of what is refurbished, and as certified refurbishment programs are developed, vendors must start reporting on the quarterly sales of refurbished equipment alongside those of new equipment.

Currently, none of the vendors analyzed are releasing this data in full.

- Vendors and partners: declare the percentage of devices you are recovering compared with the total sold

Again, this sounds simple. But the existing numbers are far from comprehensive. As the flow of e-waste is far greater than that of recycling, we must gain a better overview to better understand the challenge itself.

On one hand, Lenovo and Cisco are reporting on the millions of tons of materials recovered for recycling and re-use. But after not disclosing the percentage of products/materials recovered versus those sold, comparisons can be difficult. In turn, Dell and HP are disclosing the total weight of products sold versus recovered, though HP includes packaging while Dell does not. So, again, this makes comparisons difficult.

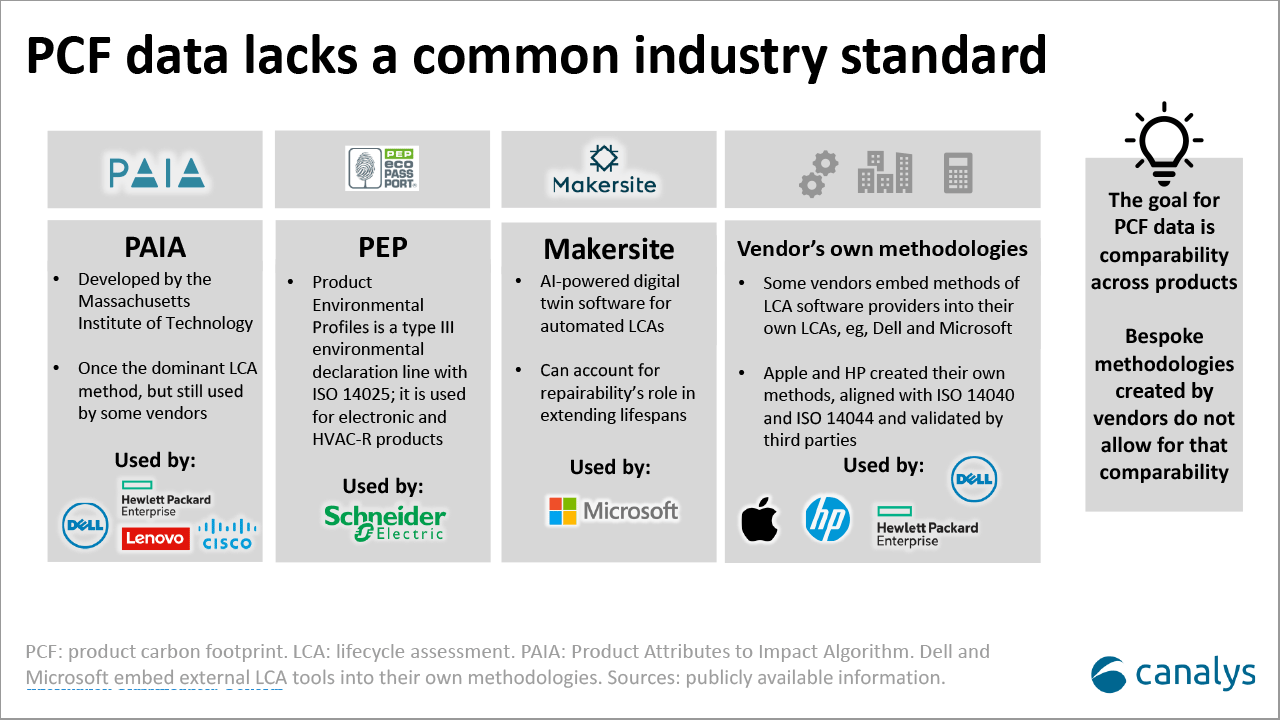

- A common standard for calculating product carbon footprint is long overdue

What does this really mean? In short, it is immensely difficult to ascertain which vendors have the best- and worst-performing products from a circularity perspective. Vendors use an array of different methodologies to calculate product carbon footprints (and these are also frequently tweaked to adjust product lifecycle and expected use). This makes a direct comparison very hard for both customers and partners when assessing different products.

Vendors need to come together to create a single methodology and then communicate this to the entire market. The adoption of a common standard will help drive vendors to reduce product carbon emissions.

- Aside from standards, we need to have clear language around circular IT

“Device takeback” – where a vendor or other parties agree to receive the return of a device, either in-store or via delivery or collection. The aim is often for that device to then be re-used, recycled, refurbished for re-use or disposed of following local legislation.

“Remanufactured” – Circular Computing, known for using this term, stated, “The Circular Computing BSI Kitemark certified Circular Remanufacturing Process is a 360-step, five-plus hour journey per laptop that returns a used product to at least its original performance with a warranty that is equivalent to (or better than) new – as required by the BS standard BS8887-220 and BS8887-211. The standards wrapped around a certified remanufactured product allow a potential purchaser to buy at scale a used product without the usual consideration of risk and/or acceptance of variable quality.”

“Refurbished” – if a device is refurbished, it has been returned or collected by the vendor or another party. The device is often tested for functionality and defects, and defects are remedied, and updates are performed. The extent of the work performed depends on the company’s own definition of “refurbishing”.

“Recycling” – if a device is returned, it must be disassembled wherever possible to ensure individual components can be recycled, in accordance with local law. In some cases, if the device is being sent for recycling, certain components may be kept and sold off as individual parts. Some parts of the device or materials may not be recyclable. If this is the case, they are disposed of in accordance with local law – and often end up in landfill.

- Sales teams must be trained in circular IT – more so than today

One of the key findings from the 2024 Canalys Partner Sustainability Survey is that customers are now asking partners about sustainable product procurement in 92% of cases. This means that partners are acting as advisors on sustainability. Given the challenges raised above about a lack of comparability of products, this is already inherently flawed.

To progress, we need clear industry-understood definitions to describe refurbished devices, and a clear, industry-adopted standard for product-level data so it is possible to compare the sustainability of products.

- Vendors, partners and IT asset disposition (ITAD) companies must build trust in data-wiping

One thing clear from Canalys research is that data security is of top concern to partners. Indeed, when asked about their top impediments to driving take-back services, data privacy was cited as the second largest challenge, after customer awareness.

- Some argued that there was simply a lack of supply of second-life devices in Europe – clearly, this needs to change

Experience of supply versus demand for second-life devices will differ greatly depending on a large number of factors. But at the RE event, it was clear that audience members felt supplies were higher in Asia and North America and lacking in Europe. With the Right to Repair Movement taking hold, and countries such as France mandating the public sector procure circular devices in 20% of cases, the need for more second-life devices grows.

- Some claim there is caution to invest in circular IT

This is a complicated point that requires nuance. This was the anecdotal experience of audience members, as opposed to a representative study. But if we examine the preference of certain country cultures for privacy, especially Germany, for example, this might give some indication.

Therefore, there might be a reticence, both to invest in second-life devices, but also to allow for the takeback of first-life devices, for privacy reasons. These concerns require a more comprehensive effort to mitigate. But as one audience member said, “You only need to convince a company to invest in second-life devices once and they will then become repeat customers of circular IT again and again.”

- End-user education on the benefits of circular IT is vital: second-life device deployment in education is a driver

This is something that vendors, partners and distributors could orchestrate with the help of the public sector and educational institutions.

- Device-as-a-Service models need further exploration

While the term DaaS is contested, the DaaS model was felt to help aid device recovery. Why? Because a DaaS model rarely allows customers to retain the devices at the end. It is at this point that an ITAD company or similar could work with the DaaS provider to re-manufacture and re-purpose the devices.

- Educate users and decision-makers on the true environmental and social costs of procuring only new IT devices

When we consider e-waste, end users and companies are starting to recognize the staggering amount of e-waste produced when we only buy new IT devices. In turn, awareness of the resulting emissions produced here, when only new devices are purchased, is also starting to become clearer.

But many don’t recognize the social impact of not investing in second-life devices. For one, there are deeply troubling accusations, from Amnesty International among others, about the potential forced labor/modern slavery and associated child labor used to procure rare earth elements and materials for technology products overall.

Currently, only 1% of rare earth elements are recovered. Therefore, financial waste aside, this also creates far higher demand for resources that are potentially causing untold harm to society. Therefore, if we are focusing only on risk mitigation and durability, it will pay to use resources more carefully.

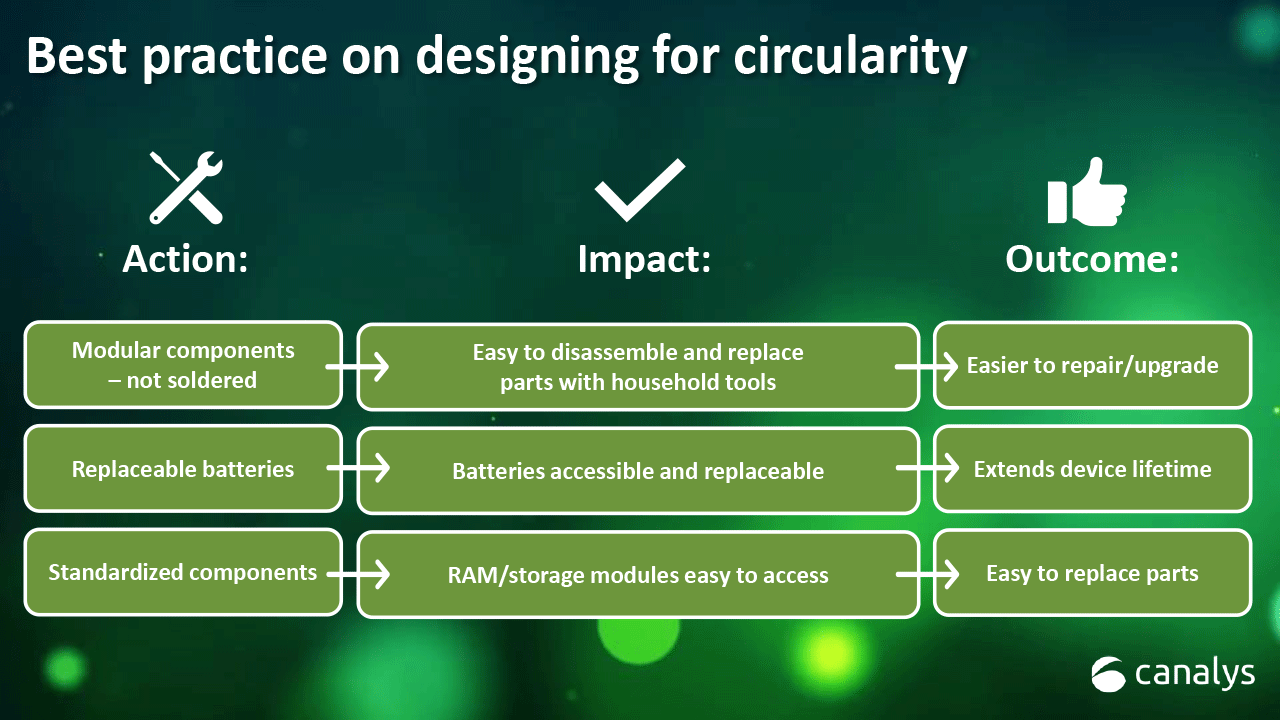

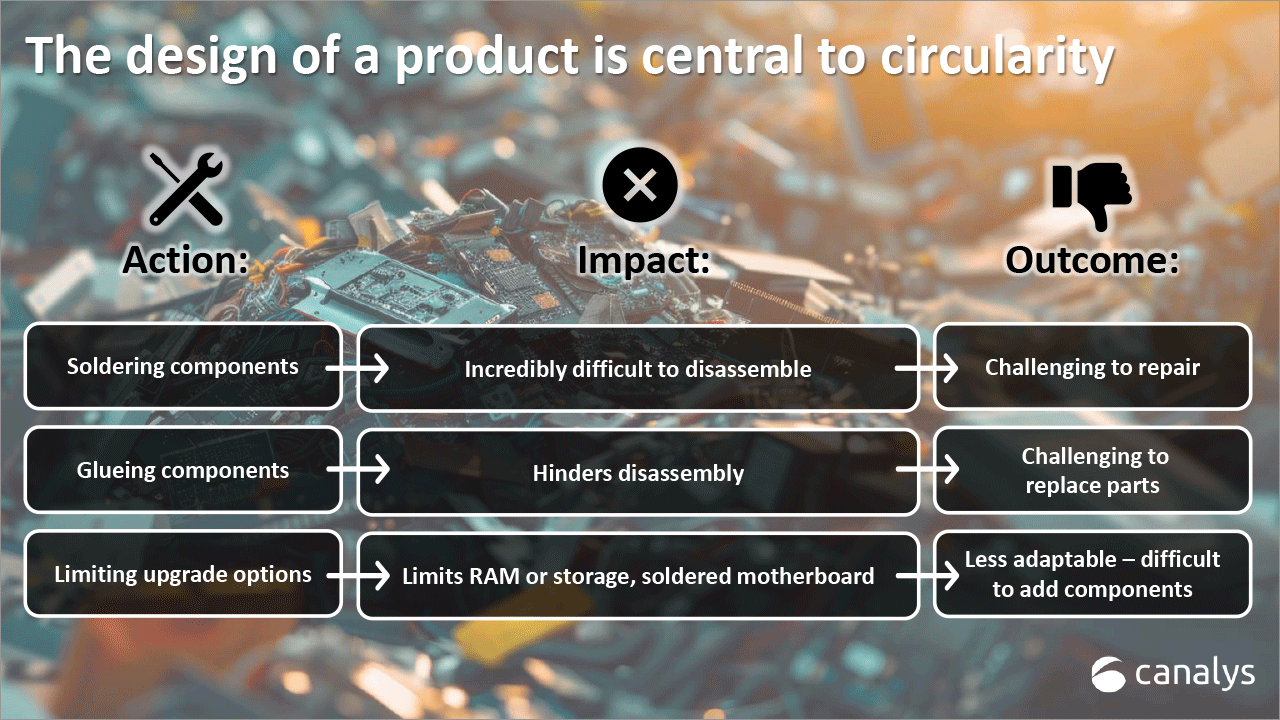

- Designing for circularity cannot be forgotten – and that responsibility sits with vendors

This is the last but certainly not the least important challenge. In fact, at the Circular Computing RE event, this was cited again and again. Partners and distributors have little influence on the design of an IT product. If vendors release a product that has a higher degree of recyclability and is easier to disassemble, then partners must do what they can to sell it. But, as this report outlines, the incentives to do so must exist.