Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Smartphone players enter the sports watch market – strategies and challenges

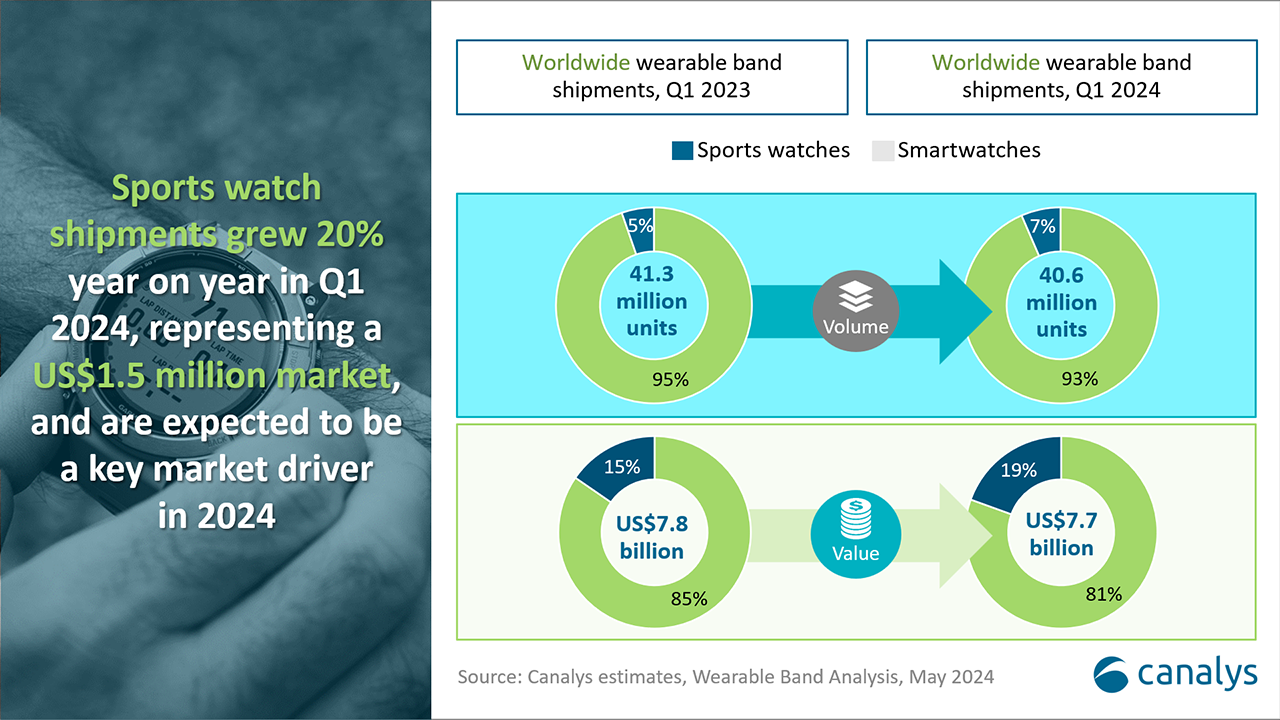

In 2023, the global wearable device market suffered from stagnant overall shipments, but specialized sports watch brands such as Garmin, Coros and Suunto bucked the trend.

In 2023, the global wearable device market suffered from stagnant overall shipments, but specialized sports watch brands such as Garmin, Coros and Suunto bucked the trend. They showed stronger profitability and growing market acceptance, thanks to a greater consumer focus on health and fitness post-pandemic, particularly in specialized sports equipment.

While there is some functional overlap, we can see what makes sports watches different by analyzing their product features and hardware specifications. Canalys defines sports watches as devices specifically engineered for endurance and high-intensity training, equipped with advanced integrated sensor suites that are more sensitive and effective (such as thermometers for accurate skin and environment temperature sensing) and support for external sensors, tailored to meet the demands of more rigorous activities. They also integrate advanced data analysis platforms and sport-specific tools to enhance performance and training in specialized athletic pursuits.

Differences between smartwatches and sports watches

- Smartwatches, such as the Apple Watch and Samsung Galaxy Watch, emphasize smart connectivity and stylish design. They appeal broadly as lifestyle aids and fashion accessories and include features such as cellular connectivity.

- Sports watches, such as models from Garmin and Suunto, are designed for precision and performance. Equipped with advanced sensors and specialized components, they excel in tracking sports metrics and providing detailed analysis, particularly in demanding conditions.

Why the sports watch market is vital for smartphone vendors

Consumer familiarity with mainstream wearables has set clear expectations for their features and performance. As the market has matured, there has been a noticeable shift toward specialized features, underscoring the strategic importance of the sports watch market for smartphone vendors. Apple, Samsung, Huawei and Xiaomi, leveraging their strong brand presence and smartwatch expertise, are aggressively entering this space. Apple, a leader in the smartwatch market, has successfully introduced its Ultra series sports watches, expanding significantly into the premium segment, with models costing over US$700. Similarly, Huawei’s Ultimate series has enhanced the company’s position in the high-end market. Samsung and Xiaomi have also entered the fray with their own sports watches, aiming to capitalize on growth in this emerging sector. So what benefits do these vendors hope to achieve?

- Capturing niche markets: professional-grade sports watches cater to specialist groups, such as running enthusiasts, swimmers and outdoor adventurers, broadening target markets but also enhancing a brand’s reputation as a leading professional provider of specialized devices.

- Expanding partnerships: success in the sports watch market can facilitate new and diverse partnership opportunities, strengthening distribution networks by offering products that appeal to specific sales channels, such as telecoms operators or sports-related retailers. By leveraging sports watches, vendors forge closer relationships with partners, enhancing market access and distribution efficiency.

- Enhancing ecosystem connectivity: users expect seamless and integrated smart experiences from an enhanced, well-connected ecosystem. Smartphone vendors can leverage sports watches to extend their ecosystem’s boundaries, enhance integration across devices and foster greater brand loyalty.

- Generating new revenue streams: in a fiercely competitive hardware market with slowing profit margins, exploring new business models is vital. As high-value wearable devices, sports watches can generate additional income through software services and subscription models. This includes professional sports coaching, health management and data analysis services, which enjoy strong consumer demand. The dual revenue streams of hardware sales and supplementary services can sustain smartphone vendors’ growth and profitability.

But entering the sports market poses significant challenges for smartphone vendors.

- Rebuilding brand perception: overcoming consumer skepticism toward smartphone brands in the sports watch domain demands robust marketing and innovative product designs.

- Overcoming technological barriers: competing with established brands requires smartphone vendors to innovate in sports monitoring and health features.

- Addressing market segmentation: understanding diverse user needs across different sports is vital for tailoring products and standing out in a crowded market.

- Ensuring data security: with more advanced functionality comes heightened concerns about data security, necessitating robust privacy measures to build user trust.

Outlook and market entry strategies

The wearable device market is increasingly specialized and driven by personalized user experiences, with vendors focusing on refining operating systems, apps and domain-specific expertise to cater to diverse consumer demands. Sports watches, while offering advanced metrics, struggle with usability due to complex interfaces, limiting their accessibility. Smartphone manufacturers have an opportunity to leverage their expertise in user interface design to simplify the experience, integrate advanced analytics and introduce AI-powered coaching features, potentially expanding their market reach beyond athletes.

But entering this competitive market poses challenges for smartphone vendors, particularly in building consumer trust, ensuring data reliability and delivering superior capabilities compared with established brands, such as Garmin. To succeed, vendors must prioritize enhancing data accuracy, bolstering privacy measures and applying cutting-edge sports science to provide personalized recommendations.