Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Cybersecurity platforms of the future – the tyranny of choice

Channel partners face an overwhelming range of cybersecurity platforms to build their businesses around. This excessive choice leads to confusion, uncertainty and, often, dissatisfaction with vendors.

Channel partners face an overwhelming range of cybersecurity platforms to build their businesses around. This excessive choice leads to confusion, uncertainty and, often, dissatisfaction with vendors.

Ransomware attacks continued to surge in the first six months of 2024, with publicly reported incidents up 50% year on year to a record high. Organizations are still leaving themselves exposed to attacks by repeatedly making the same errors – poor patch management and employee training, the use of legacy and unsupported technologies, and siloed IT teams (network, cloud, application, DevOps and security) with different priorities and little coordination. But the biggest issue is the use of too many disparate standalone cybersecurity products, which are typically poorly integrated, too complex to manage and that create an overload of alerts that cannot be investigated and dealt with effectively. Omdia’s latest Cybersecurity Decision Maker survey highlighted this issue. 73% of respondents had more than 20 standalone security products in use within their organizations, while 16% had more than 50. This situation must change. Organizations are re-architecting their IT stacks for cloud and, more recently, AI to transform their businesses. They must also re-architect their cybersecurity to improve resilience and safeguard their businesses.

Consolidation is underway, with 74% of respondents in the same Omdia survey indicating their organizations intend to cut the number of standalone point products over the next 12 months. The adoption of cybersecurity platforms will underpin this shift in strategy. Vendors are driving cross-sell initiatives with customers to buy more of their cybersecurity to eliminate overlapping, redundant and legacy point products from multiple other vendors, while at the same time investing in new areas. But the vendor landscape remains highly fragmented and almost every vendor is positioning their offering as the platform of choice for consolidation. Vendors are also encouraging partners to invest and build their businesses around their platforms. But most partners resell, support and manage up to four cybersecurity vendors, while some work with more than 20. The platform message has already become oversaturated and clichéd for partners, with vendors offering minimal differentiation and few compelling reasons for partners to invest. Standalone point products are not going away either. Organizations are still having to buy more to firefight emergencies, address new vulnerabilities and fill gaps in their defenses that platforms cannot address. This is resulting in more confusion among partners and a growing frustration with vendors.

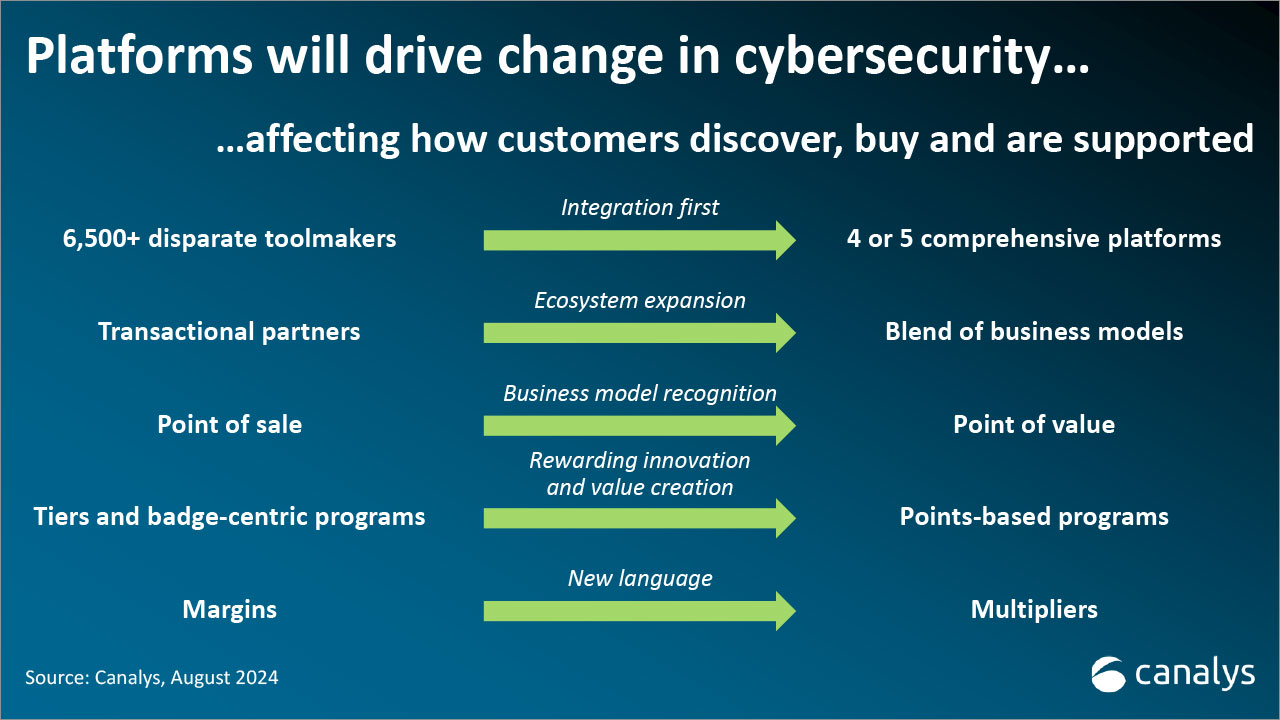

Canalys predicts only four or five comprehensive platforms will dominate the cybersecurity market in the large enterprise and government sectors within the next decade. An equal number but different set of platforms will dominate among SMBs, which will serve their specific customer needs. But cybersecurity platforms are more than just the single vendor solutions that most are pushing today, with expanded product features and functions across different segments of the stack. Specialist vendors and startups will not just disappear. Instead, most will gravitate toward and integrate with larger platforms. An integration-first approach is vital for vendors to succeed in a platform ecosystem. A broad set of technology alliances is important, but strategies must go beyond API integration to enable co-development and co-selling. Platform vendors must also enable an expanded ecosystem of both transactional and service-led partners, particularly GSIs, MSSPs, MSPs and new types of partners, such as cyber-insurers, which fulfil different customer needs. They must reward their partners for innovation and value creation, which will ultimately drive customer demand for their platforms, and not just for exceeding traditional volume targets.

Platforms will fundamentally change the customer journey, influencing the processes of cybersecurity technology discovery, procurement and service delivery. Partners must make important decisions to evolve their businesses to gravitate toward cybersecurity platforms. This will be discussed in the “Cybersecurity platforms of the future – the tyranny of choice” Expert Hub at the upcoming Canalys Forums 2024, with a panel of vendors and top channel partners. Key themes and questions covered during the sessions at the three events will include the following:

- Platform of choice: Partners must select a cybersecurity platform that aligns with their business objectives – resell, services or both. Their path to success more than likely lies with new vendors. But what makes a successful platform strategy? How should partners evaluate which platforms to invest in?

- Retooling for the future: Skills shortages remain a major concern. How will the shift to platforms address this issue? What skills should partners prioritize? How can platforms improve talent? How can partners balance the need for specialized cybersecurity skills with customers’ broader business requirements?

- Business model evolution: Platforms should have an equal pull for transactional and service-led partners to build their business on. How should vendors measure success and reward different partner types? Where should partners invest to enhance service delivery and profitability?

- Collaboration initiatives: Platforms will expand the cybersecurity ecosystem with new types of partners. What new partnering strategies are required? How can partners create compelling joint value propositions? How can co-sell partnerships deliver enhanced value to customers?

- Adding value to platform strategies: Differentiation is vital in this fragmented and competitive ecosystem. How can partners deepen customer relationships? Where should partners specialize and differentiate? What role will custom integrations play in cybersecurity platform adoption?

The Canalys Forums 2024 events will feature leading channel-focused vendors, their partners and the industry-leading Canalys team. These events will give senior executives at partner companies the opportunity to address how they can swiftly adapt to meet the changing needs of their customers. Be sure to register to ensure you can be among them.

EMEA: 8-10 October, Berlin, Germany

NORTH AMERICA: 22-24 October, Miami, Florida

APAC: 3-5 December, Bali, Indonesia