Global smartphone market declined by 13% in Q1 2023

Thursday, 27 April 2023

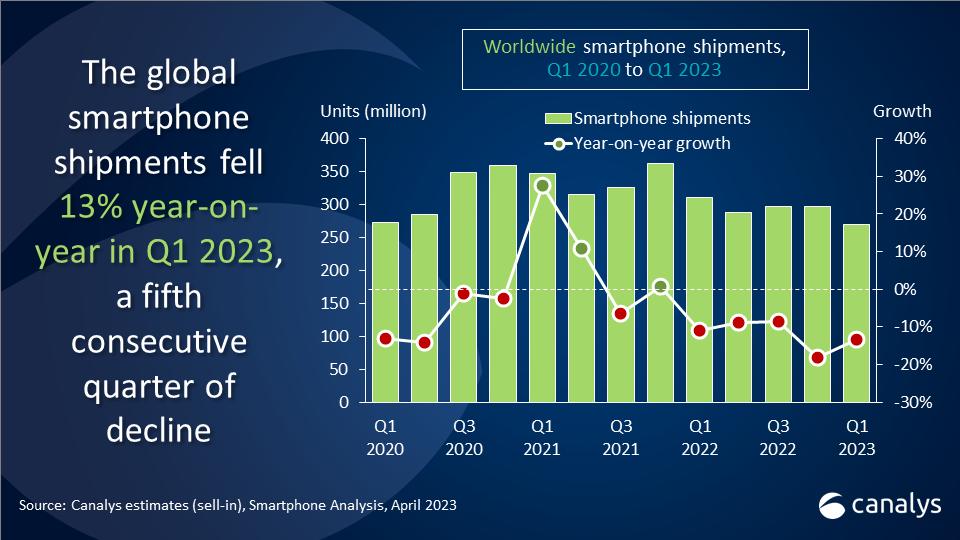

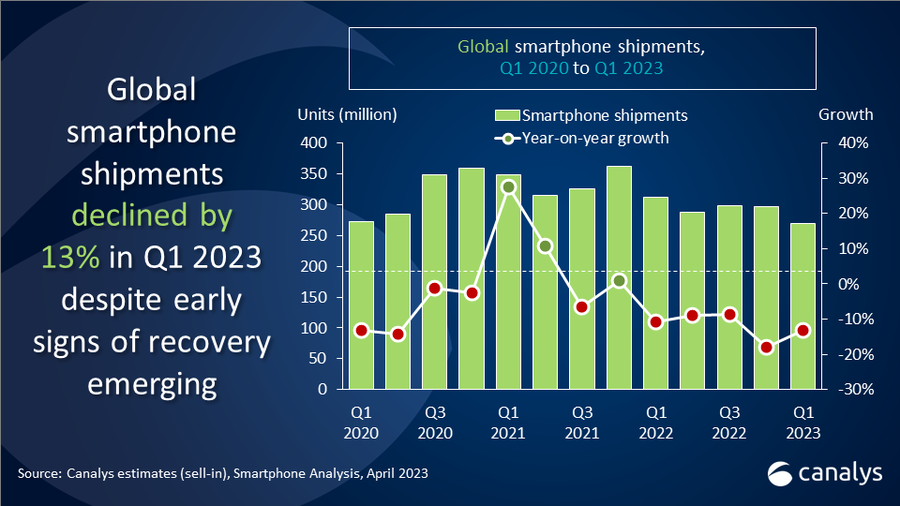

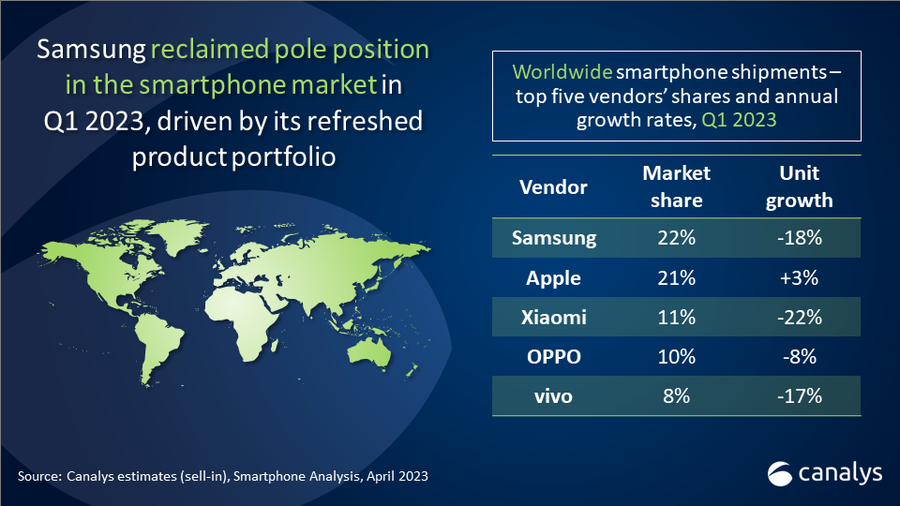

Canalys’ latest research shows that global smartphone shipments fell by 13% to 269.8 million units in Q1 2023. The demand decline has started to flatten, although the contrast between Q1 2022 and Q1 2023 is still stark. Samsung reclaimed its pole position and shipped 60.3 million units, driven by a refreshed product portfolio. Apple came in second with 58.0 million shipments. It was the only top five vendor to grow year-on-year, which gave it a strong 21% market share. Xiaomi defended its number three position with 30.5 million shipments while OPPO and vivo completed the top five, shipping 26.6 million and 20.9 million units, respectively, securing 10% and 8% market share.

“Samsung’s performance shows early signs of recovery after a tough end to 2022,” said Runar Bjørhovde, Canalys Analyst. “The rebound is particularly connected to product launches, which drove an increase in sell-in volume. Still, Samsung will have to navigate through a difficult landscape going forward, particularly as entry-level device inventory remains high. Declining profits from its semiconductor memory business will also trigger a more conservative marketing spend overall. Meanwhile, Apple had robust performance in Q1, particularly in the Asia Pacific region. Here, Apple’s sustained investments into offline channels enabled it to attract a burgeoning middle-class, which places high value on the in-store purchasing experience.”

“The mid-range price segment has started to recover following huge declines last year,” said Canalys Research Analyst Lucas Zhong. “Vendors are leveraging trade-down opportunities with strong value-for-money offers for consumers with limited spending power. This is supported by decreasing component prices and vendors accelerating spec upgrades for mid-range product portfolios. However, mid-range demand in 2023 will remain limited due to the macroeconomic challenges and missing differentiators within this price band. Furthermore, with supply inventories starting to clear, component prices may quickly start to increase, making great specs for lower prices less sustainable in the long-term.”

“The market remains challenging and Canalys maintains its forecast of marginal declines for 2023,” added Zhong. “Shipments will stabilize around the levels from 2022 as we move into the middle of 2023. Decline rates will start to improve soon, although this is more connected to the stark contrast between 2022 and 2023 shrinking. Canalys expects the smartphone market will gain momentum in the second half of the year as channel inventories reach healthier levels. Vendors are cautiously approaching the market with profitability targets, lean operations and inventory clearing as top priorities. However, for vendors with long-term ambitions and capital to invest, challenging market conditions provide an excellent environment to capture market share, showcase commitment and intentions to new markets, and establish close partnerships with the channel.”

|

Global smartphone shipments and annual growth |

|||||

|

Vendor |

Q1 2023 shipments (million) |

Q1 2023 |

Q1 2022 |

Q1 2022 market |

Annual |

|

Samsung |

60.3 |

22% |

73.7 |

24% |

-18% |

|

Apple |

58.0 |

21% |

56.5 |

18% |

3% |

|

Xiaomi |

30.5 |

11% |

39.2 |

13% |

-22% |

|

OPPO |

26.6 |

10% |

29.0 |

9% |

-8% |

|

vivo |

20.9 |

8% |

25.1 |

8% |

-17% |

|

Others |

73.4 |

27% |

87.6 |

28% |

-16% |

|

Total |

269.8 |

100% |

311.2 |

100% |

-13% |

|

|

|

|

|||

|

Note: Xiaomi estimates include sub-brand POCO, and OPPO includes OnePlus. Percentages may not add up to 100% due to rounding. |

|

||||

For more information, please contact:

Runar Bjørhovde: runar_bjorhovde@canalys.com

Lucas Zhong: lucas_zhong@canalys.com

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.