Mainland China’s smartphone market shrunk by 11% post-reopening

Thursday, 27 April 2023

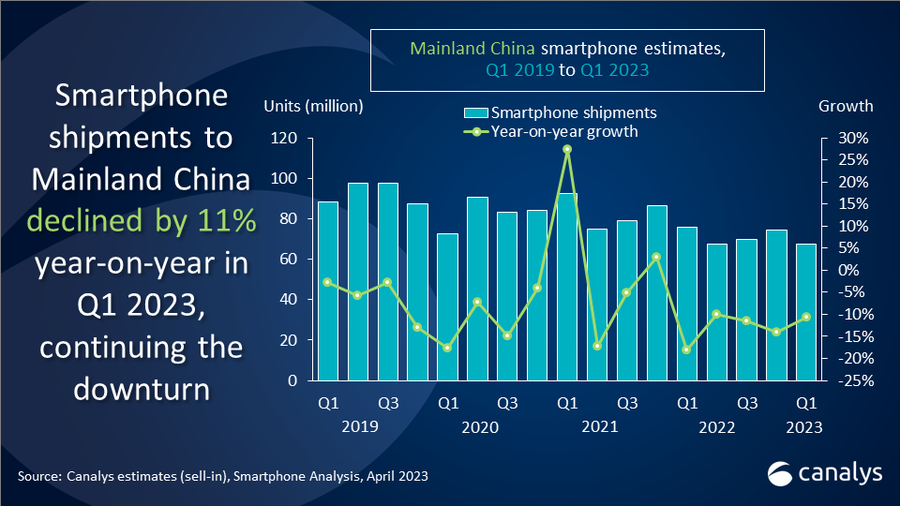

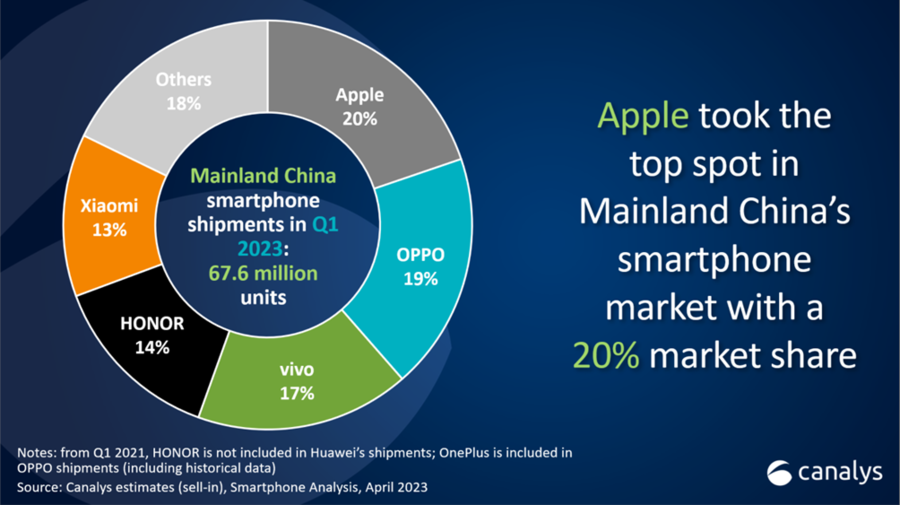

Canalys research indicates that Mainland China’s smartphone market saw a year-on-year decline of 11% in Q1 2023. The shipments dropped to 67.6 million units, the lowest Q1 since 2013. Apple assumed the top spot, due to its popularity with the iPhone 14 series, with a 20% market share, shipping 13.3 million units. The new smartphone launches of OnePlus boosted OPPO's performance. OPPO (including OnePlus) shipped 12.6 million units and ranked second with a 19% market share. vivo and HONOR shipped 11.3 million and 9.7 million units respectively, securing third and fourth places. Xiaomi stabilized its market position in fifth place with a shipment of 8.5 million units.

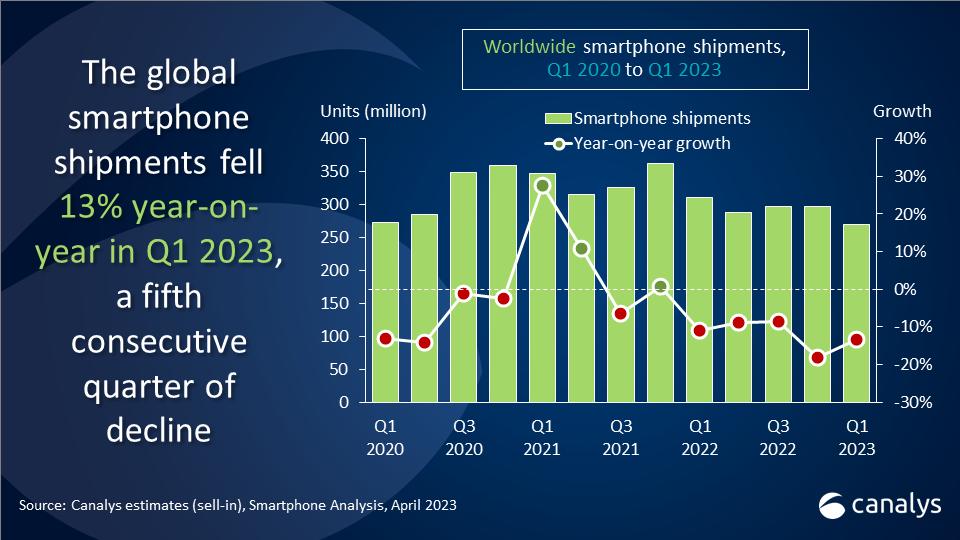

"Economic vitality has rebounded after the ease of COVID-19 restrictions but it has not brought any significant boost to the demand for smartphones," said Lucas Zhong, Research Analyst at Canalys. "The market experienced its fifth consecutive quarter of double-digit decline. The total retail sales of consumer goods in Mainland China in Q1 2023 increased by 5.8%, but demand for communication products faced a decline. The pandemic affected consumer behavior in the medium to long term, where consumers tended to spend their income on necessary expenses and maintain certain savings, showing a rational attitude towards the consumption of electronic goods. Vendors need to offer convincing products to stimulate upgrades."

"Vendors have gradually adjusted their planning to adapt to the 'new normal' of shrinking of Mainland China’s market size and are striving to launch attractive products," said Toby Zhu, Analyst at Canalys. "Cooperating with channel partners to control inventory has become the top priority. Meanwhile, in addition to high-end product upgrades such as the OPPO Find X6 and the Honor Magic5 Pro, the shrinkage of the market has also catalyzed intense competition in the entry-level and mid-range segments. Vendors are launching products with breakthrough specifications such as flagship chips, large storage, imaging performance and fast charging among others, as experienced in Redmi K60, OnePlus Ace 2V, realme GT Neo5 and other new products. In such fierce competition, vendors should avoid any price war and focus on providing differentiated value propositions. Vendors should further establish their competitive advantage over others by enhancing user experience and improving brand loyalty."

"Although there will not be a significant recovery of the Chinese smartphone market in 2023, we have observed signals of consumer confidence returning, which will be a good time for vendors to implement their latest branding and product strategies,” said Amber Liu, Analyst at Canalys. “This year will be an important year for vendors to balance their market share and profitability, while also accumulating technological and brand foundations. While adjusting expectations for 2023, the smartphone industry has already turned its attention to 2024 growth plans, seeking further breakthroughs in hardware technology, and implementing more application scenarios in ecosystem construction and AI algorithm capabilities."

|

People’s Republic of China (Mainland) smartphone shipments and annual growth Canalys Smartphone Market Pulse: Q1 2023 |

|||||

|

Vendor |

Q1 2023 shipments (million) |

Q1 2023 |

Q1 2022 |

Q1 2022 |

Annual |

|

Apple |

13.3 |

20% |

13.7 |

18% |

-3% |

|

OPPO |

12.6 |

19% |

13.9 |

18% |

-10% |

|

vivo |

11.3 |

17% |

12.2 |

16% |

-7% |

|

HONOR |

9.7 |

14% |

15.0 |

20% |

-35% |

|

Xiaomi |

8.5 |

13% |

10.6 |

14% |

-20% |

|

Others |

12.2 |

18% |

10.2 |

13% |

19% |

|

Total |

67.6 |

100% |

75.6 |

100% |

-11% |

|

|

|

|

|||

|

Notes: from Q1 2021, HONOR is not included in Huawei’s shipments; OnePlus is included in OPPO shipments. |

|

||||

For more information, please contact:

Lucas Zhong: lucas_zhong@canalys.com

Toby Zhu:toby_zhu@canalys.com

Amber Liu: amber_liu@canalys.com

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.