US PC market set for 5% growth in 2024 amid a healthy recovery trajectory

Wednesday, 26 June 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

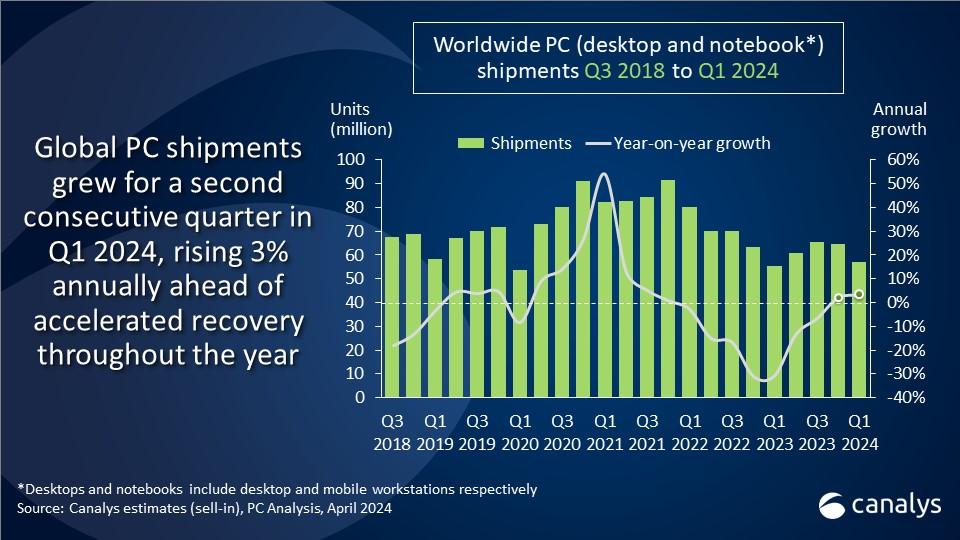

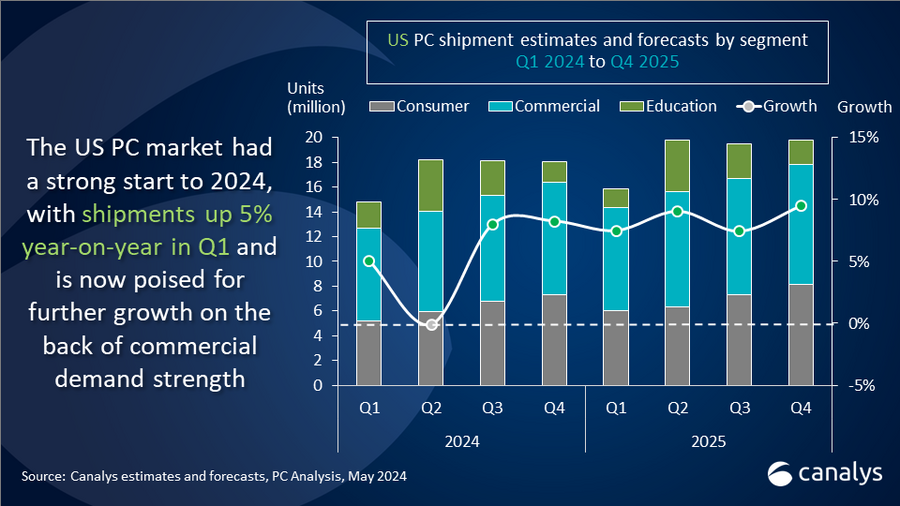

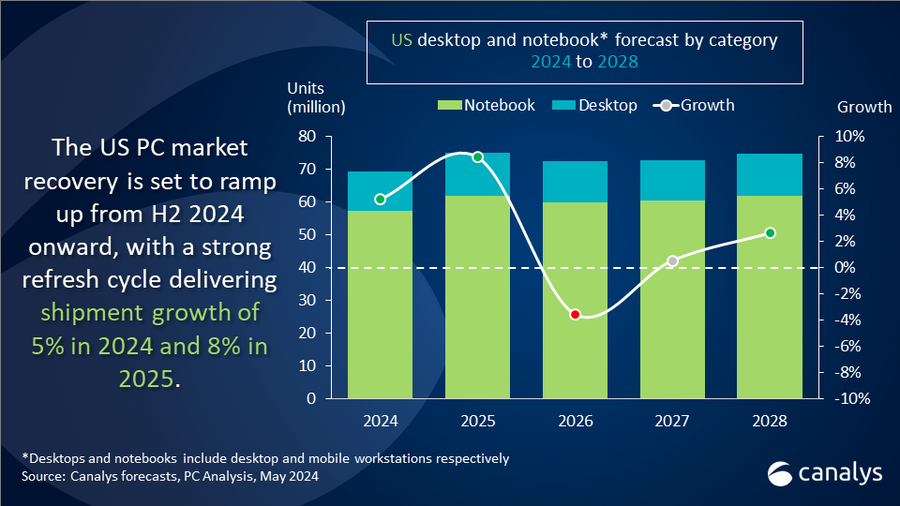

PC (excluding tablets) shipments to the United States grew 5% year-on-year to 14.8 million units in Q1 2024. The consumer and SMB segments were the key growth drivers, both witnessing shipment increases above 9% year-on-year in the first quarter. With a strong start to the year, the market is now poised for a healthy recovery trajectory amid the ongoing Windows refresh cycle. Total PC shipments to the US are expected to hit 69 million units in 2024 before growing another 8% to 75 million units in 2025.

For the third consecutive quarter, the consumer segment showed the best performance in the US market. “Continued discounting after the holiday season boosted consumer demand for PCs into the start of 2024,” said Greg Davis, Analyst at Canalys. “However, the first quarter also saw an uptick in commercial sector performance. Shipment growth in small and medium businesses indicates that the anticipated refresh brought by the Windows 10 end-of-life is underway. With enterprise customers set to follow suit, the near-term outlook for the market remains highly positive.”

The forecast for the US PC market is strong throughout the rest of this year and is projected to be even stronger in 2025. Canalys expects US PC shipments to grow 5% in 2024 and a further 8% in 2025.

“Macroeconomic conditions in the US have been stable for several months, allowing for healthier consumer spending and business investment in IT,” said Davis. “With a significant portion of the PC installed base still on Windows 10, the next four quarters are expected to bring even stronger momentum to the refresh cycle. This timing also coincides with greater availability of on-device AI capabilities in the market, with new products and user experiences set to excite consumers and businesses across both the Windows and Apple ecosystems. The US is forecasted to be a leader in the adoption of AI-capable PCs as vendors and their partners prioritize go-to-market efforts to capitalize on the significant opportunity to upgrade customers to premium devices.”

|

US desktop and notebook forecast |

|||||

|

Segment |

2023 shipments |

2024 shipments |

2025 shipments |

2024 annual growth |

2025 annual growth |

|

Consumer |

25,351 |

25,236 |

27,785 |

-0.5% |

10.1% |

|

Commercial |

27,183 |

29,313 |

32,475 |

7.8% |

10.8% |

|

Government |

3,817 |

3,877 |

4,211 |

1.6% |

8.6% |

|

Education |

9,424 |

10,766 |

10,527 |

14.2% |

-2.2% |

|

Total |

65,775 |

69,192 |

74,998 |

5.2% |

8.4% |

|

|

|

|

|||

|

Note: Unit shipment in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys forecast, PC Analysis, May 2024 |

|

||||

|

US tablets forecast |

|||||

|

Segment |

2023 shipments |

2024 shipments |

2025 shipments |

2024 annual growth |

2025 annual growth |

|

Consumer |

33,840 |

34,688 |

36,344 |

2.5% |

4.8% |

|

Commercial |

6,323 |

6,554 |

7,204 |

3.7% |

9.9% |

|

Government |

484 |

439 |

371 |

-9.3% |

-15.3% |

|

Education |

1,936 |

1,987 |

1,975 |

2.6% |

-0.6% |

|

Total |

42,583 |

43,668 |

45,894 |

2.5% |

5.1% |

|

|

|

|

|||

|

Note: Unit shipment in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys forecast, PC Analysis, May 2024 |

|

||||

|

US desktop and notebook shipments (market share and annual growth) |

|||||

|

Vendor |

Q1 2024 |

Q1 2024 |

Q1 2023 |

Q1 2023 |

Annual |

|

HP |

3,639 |

24.6% |

3,733 |

26.6% |

-2.5% |

|

Dell |

3,596 |

24.4% |

3,801 |

27.0% |

-5.4% |

|

Lenovo |

2,594 |

17.6% |

2,119 |

15.1% |

22.4% |

|

Apple |

2,102 |

14.2% |

1,723 |

12.3% |

22.0% |

|

Acer |

811 |

5.5% |

787 |

5.6% |

2.9% |

|

Others |

2,024 |

13.7% |

1,890 |

13.4% |

7.1% |

|

Total |

14,766 |

100.0% |

14,053 |

100.0% |

5.1% |

|

|

|

|

|||

|

Note: Unit shipment in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), May 2024 |

|

||||

|

US tablet shipments (market share and annual growth) |

|||||

|

Vendor |

Q1 2024 |

Q1 2024 |

Q1 2023 |

Q1 2023 |

Annual |

|

Apple |

4,928 |

50.8% |

5,404 |

50.0% |

-8.8% |

|

Samsung |

1,800 |

18.5% |

1,765 |

16.3% |

2.0% |

|

Amazon |

1,601 |

16.5% |

2,041 |

18.9% |

-21.5% |

|

TCL |

389 |

4.0% |

602 |

5.6% |

-35.4% |

|

Microsoft |

262 |

2.7% |

375 |

3.5% |

-30.1% |

|

Others |

723 |

7.5% |

625 |

5.8% |

15.7% |

|

Total |

9,703 |

100.0% |

10,812 |

100.0% |

-10.2% |

|

|

|

|

|||

|

Note: Unit shipment in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), May 2024 |

|

||||

For more information, please contact:

Greg Davis: greg_davis@canalys.com

Canalys’ PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities in the market. Canalys PC shipment data is granular, guided by a strict methodology, and is broken down by market, vendor and channel, as well as additional splits, such as GPU, CPU, storage and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.