India's PC and tablet market poised for 11% growth in 2024

Tuesday, 25 June 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

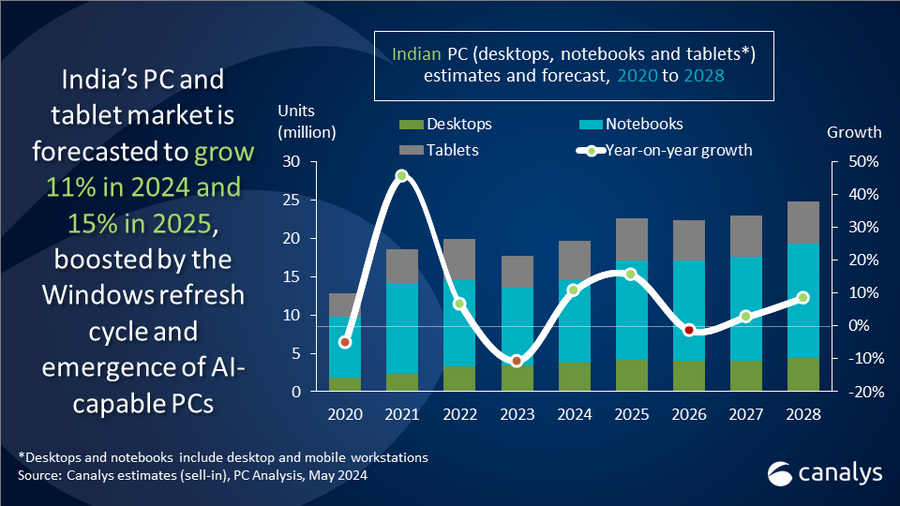

In Q1 2024, the Indian PC market, encompassing desktops, notebooks and tablets, experienced 9% year-on-year growth, with total shipments reaching 4.3 million units. This growth was largely fueled by a 37% surge in tablet shipments, totaling 1.3 million units. Desktops saw a more moderate increase of 9%, with 938,000 units shipped, whereas notebook shipments declined by 4%, falling to 2.0 million units. The positive start to the year bodes well for extended strong recovery, with PC and tablet shipments to India set to grow 11% in 2024 and a further 15% in 2025, according to the latest Canalys forecast.

The Indian PC market (excluding tablets) remained relatively flat as vendors focused on clearing excess inventory and normalizing stock levels. The commercial segment was bolstered by government tenders that were expedited ahead of the elections, while the SMB sector saw growth due to a few deals closing at the end of the quarter. However, the consumer segment struggled with high inventory levels and delayed shipments. In contrast, the tablet market experienced robust growth, driven mainly by education demand. The long-awaited tender from the state of Uttar Pradesh saw partial fulfillment, with Samsung and Acer meeting most of its demands.

Looking ahead, Canalys forecasts 11% growth in 2024 and 15% in 2025 for India’s PC and tablet market, with healthy demand expected across all end-user segments. “India’s commercial sector will be a strong growth driver,” said Ashweej Aithal, Analyst at Canalys. “Customers across enterprises, SMBs and the public sector will contribute to a large refresh cycle spurred by the end of support for Windows 10 devices and the rising availability of AI-capable PCs. The tablet market has a strong pipeline from substantial education tenders that are anticipated to close this year.”

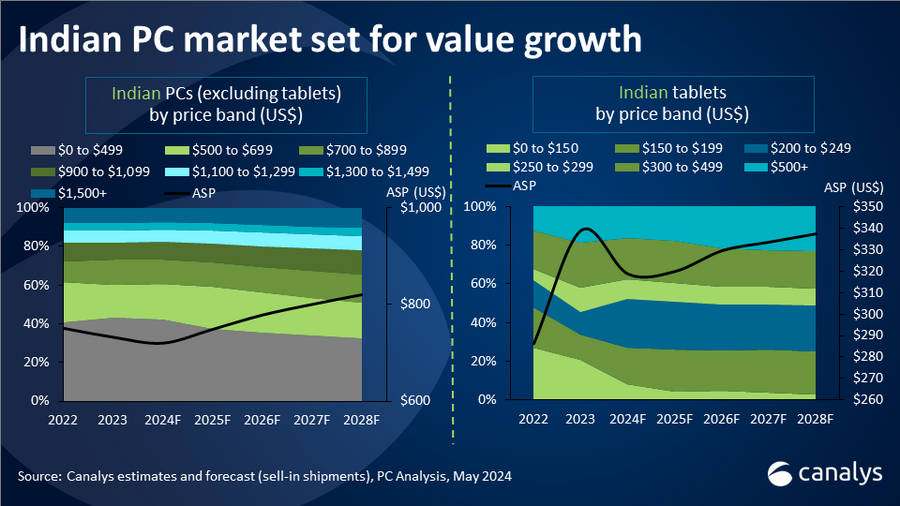

The consumer PC market will also see a boost as devices purchased during the pandemic will soon need refreshing – presenting an opportunity for upgrades. “India’s appetite for higher-end PCs is expected to expand in the coming years,” said Aithal. “The introduction of on-device AI capabilities from chipset manufacturers and OEMs will buoy this transition. The rise of other use cases like gaming and content creation will also help support a push toward premiumization. For tablets, the rollout of 5G infrastructure will act as a tailwind supporting longer-term device refreshes. Although use-cases for 5G tablets are currently limited, the desire to future-proof devices will contribute to the growth of premium devices.”

Local manufacturing has been a focal point in India for over a year, with major players actively collaborating with Production Linked Incentive (PLI) approved OEM partners. “The reliance on foreign-sourced components has pushed the Indian government to introduce initiatives that boost the domestic semiconductor industry,” said Aithal. “Self-sufficiency in this sector is a long way off and will require substantial investment in research, capacity building, and the development of supporting industries. However, any progress in this area will provide a boost not only to meeting local demand but also in positioning India as a rising player in the global export market.”

|

India desktop and notebook forecast |

|||||

|

Segment |

2023 |

2024 |

2025 |

2024 |

2025 |

|

Consumer |

6,017 |

6,250 |

7,564 |

4% |

21% |

|

Commercial |

6,824 |

7,585 |

8,811 |

11% |

16% |

|

Government |

236 |

253 |

306 |

7% |

21% |

|

Education |

430 |

457 |

473 |

6% |

3% |

|

Total |

13,507 |

14,545 |

17,154 |

8% |

18% |

|

|

|

|

|||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. |

|

||||

|

India tablets forecast |

|||||

|

Segment |

2023 |

2024 |

2025 |

2024 |

2025 |

|

Consumer |

2,786 |

2,806 |

3,209 |

1% |

14% |

|

Commercial |

649 |

575 |

698 |

-11% |

21% |

|

Government |

189 |

140 |

149 |

-26% |

6% |

|

Education |

598 |

1,555 |

1,423 |

160% |

-8% |

|

Total |

4,222 |

5,076 |

5,479 |

20% |

8% |

|

|

|

|

|||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. |

|

||||

|

India desktop and notebook shipments (market share and annual growth) |

|||||

|

Vendor |

Q1 2024 |

Q1 2024 |

Q1 2023 |

Q1 2023 |

Annual |

|

HP |

923 |

31.3% |

1,012 |

34.2% |

-8.8% |

|

Acer |

474 |

16.1% |

379 |

12.8% |

25.1% |

|

Lenovo |

464 |

15.7% |

470 |

15.9% |

-1.3% |

|

Dell |

440 |

14.9% |

477 |

16.1% |

-7.9% |

|

Asus |

181 |

6.1% |

195 |

6.6% |

-7.3% |

|

Others |

471 |

16.0% |

427 |

14.4% |

10.4% |

|

Total |

2,953 |

100.0% |

2,960 |

100.0% |

-0.2% |

|

|

|

|

|

|

|

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. |

|

||||

|

India tablet shipments (market share and annual growth) |

|||||

|

Vendor |

Q1 2024 |

Q1 2024 |

Q1 2023 |

Q1 2023 |

Annual |

|

Samsung |

464 |

34.4% |

312 |

31.6% |

48.5% |

|

Acer |

290 |

21.5% |

67 |

6.8% |

332.3% |

|

Apple |

128 |

9.5% |

166 |

16.8% |

-22.7% |

|

Lenovo |

107 |

8.0% |

130 |

13.2% |

-17.4% |

|

Xiaomi |

100 |

7.4% |

31 |

3.1% |

226.5% |

|

Others |

258 |

19.2% |

281 |

28.5% |

-8.1% |

|

Total |

1,347 |

100.0% |

987 |

100.0% |

36.6% |

|

|

|

|

|

|

|

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. |

|

||||

For more information, please contact:

Ashweej Aithal: ashweej_aithal@canalys.com

Ishan Dutt: ishan_dutt@canalys.com

Canalys' PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities in the market. Canalys PC shipment data is granular, guided by a strict methodology and broken down by market, vendor and channel, as well as additional splits, such as GPU, CPU, storage and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.