Mainland China’s cloud service spend grew by 20% in Q1 2024

Thursday, 27 June 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

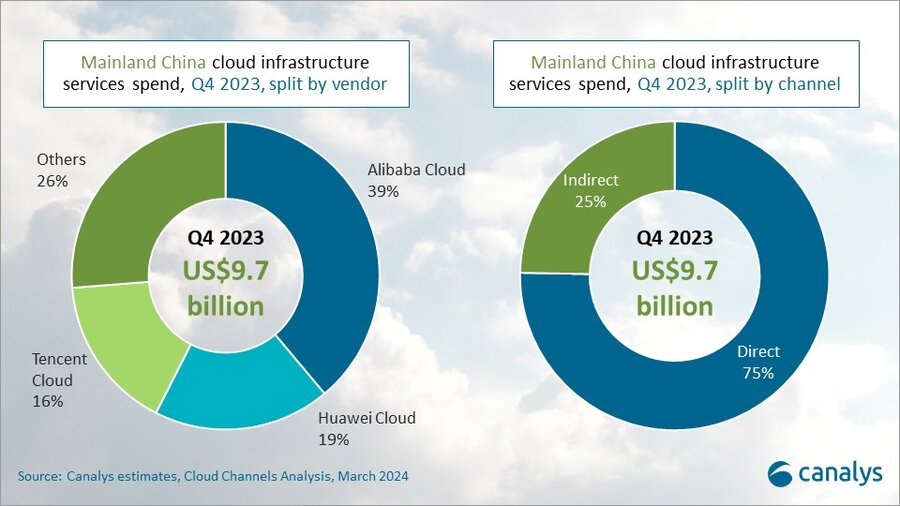

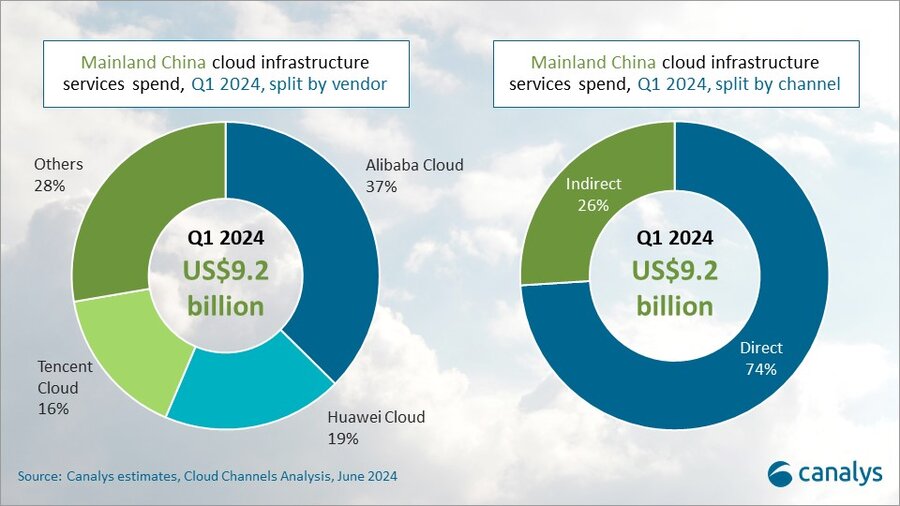

Spending on cloud infrastructure services in Mainland China grew by 20% year on year in Q1 2024, reaching US$9.2 billion, according to Canalys estimates. The leading trio in China’s cloud market – Alibaba Cloud, Huawei Cloud and Tencent Cloud – maintained their dominance, collectively growing 22% and capturing 72% of the total market, though this represents a 2% decrease from last quarter. Cloud services offered by telcos, led by China Telecom, are gradually capturing share. Cloud investments to support AI applications and significant price reductions by the top cloud providers have stimulated customer spending on the cloud.

The Chinese cloud market is entering a new phase of intense price competition. Leading cloud vendors have effectively driven business growth by attracting customers through aggressive pricing strategies. In April 2024, Alibaba Cloud announced price reductions for its core products worldwide, followed by further cuts for its AI foundation model in May 2024. Tencent Cloud quickly followed suit, announcing significant price reductions for its foundation models in May.

“To maintain higher profitability in an intensely competitive market, fostering a robust partner ecosystem is indispensable. Partnerships can enrich customer offerings with value-added services, maintaining competitive pricing strategies while enhancing overall customer satisfaction,” said Canalys Analyst Yi Zhang. “Simultaneously, partnerships enhance market differentiation while mitigating risks through optimized operations and flexible financial support.”

Both Huawei Cloud and Tencent Cloud introduced AI-focused partner programs, seeking to leverage their partner ecosystems to drive AI adoption and speed up time to market. During Q1 2024, cloud revenue generated through partners accounted for 26% of the total Chinese market, and this share is expected to increase further.

Canalys defines cloud infrastructure services as services that provide infrastructure-as-a-service and platform-as-a-service, either on dedicated hosted private infrastructure or shared public infrastructure. This excludes software-as-a-service expenditure directly but includes revenue generated from the infrastructure services consumed to host and operate them.

For more information, please contact:

Yi Zhang: yi_zhang@canalys.com

Alex Smith: alex_smith@canalys.com

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.