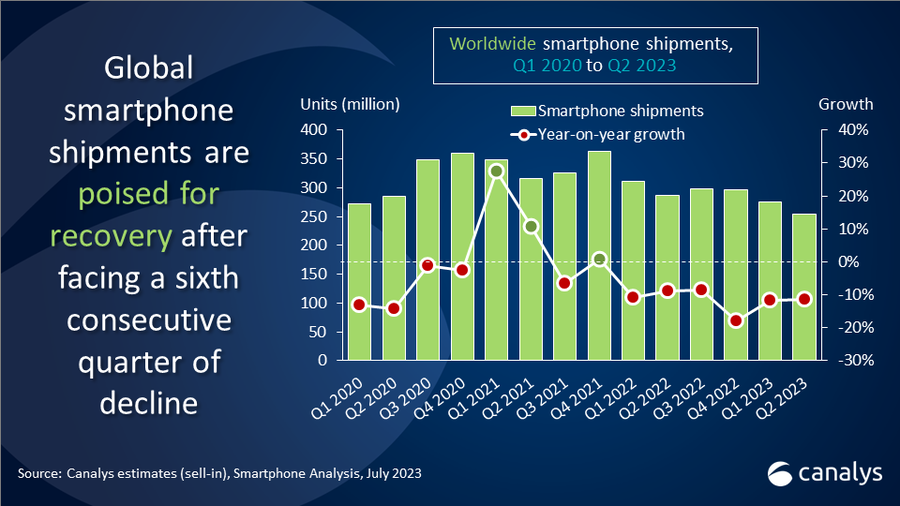

Recovery in sight after global smartphone market declined by 11% in Q2 2023

Tuesday, 18 July 2023

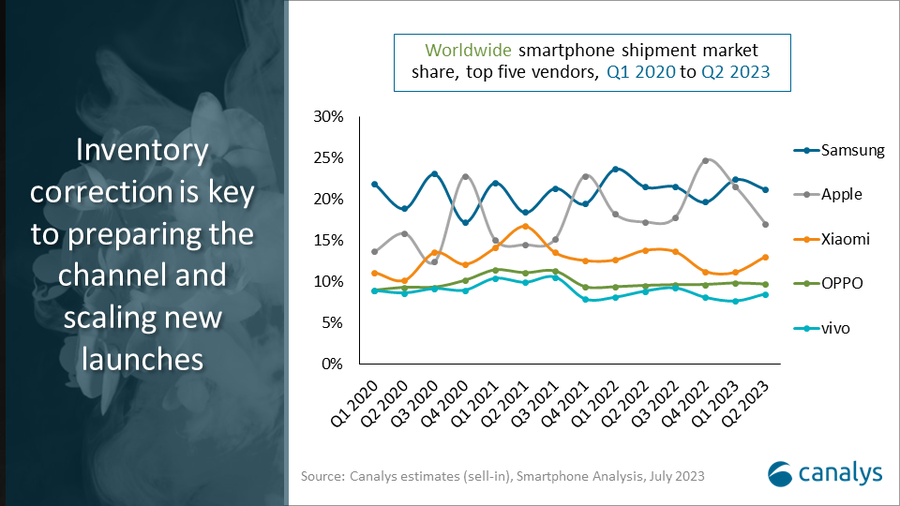

The global smartphone market declined by 11% year on year in Q2 2023 as gloomy demand started to impact market leaders like Samsung and Apple which had to reduce their sell-in the same quarter. Samsung maintained the leading position with a 21% market share, while Apple held second place with a 17% market share. Outside of the top two, the decline in smartphone shipments reveals signs of improvement as most vendors' inventory returns to healthier levels while macroeconomic conditions stabilize. Xiaomi secured third place with a 13% market share as supply for its newly launched Redmi series recovered. OPPO (including OnePlus) secured fourth place with a market share of 10% after a strong performance in the core markets of Asia Pacific, while vivo came in fifth with an 8% market share, driven by the new Y-series launches.

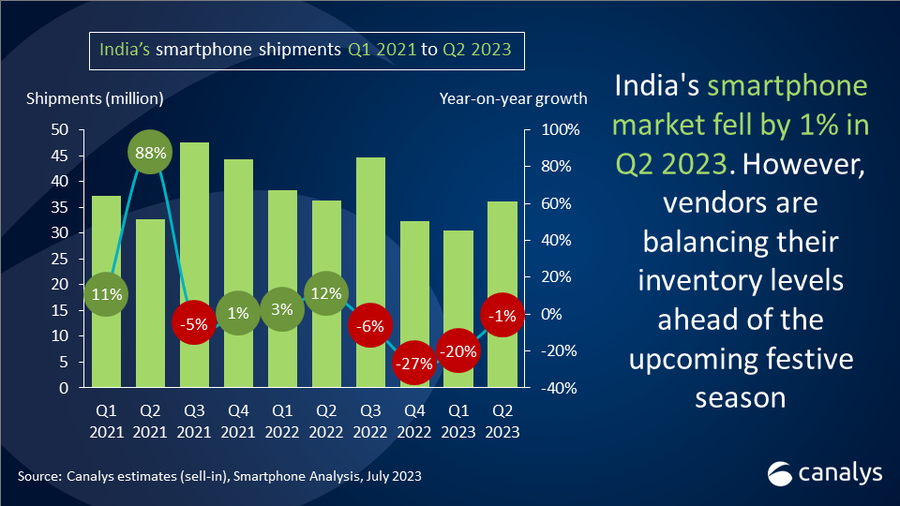

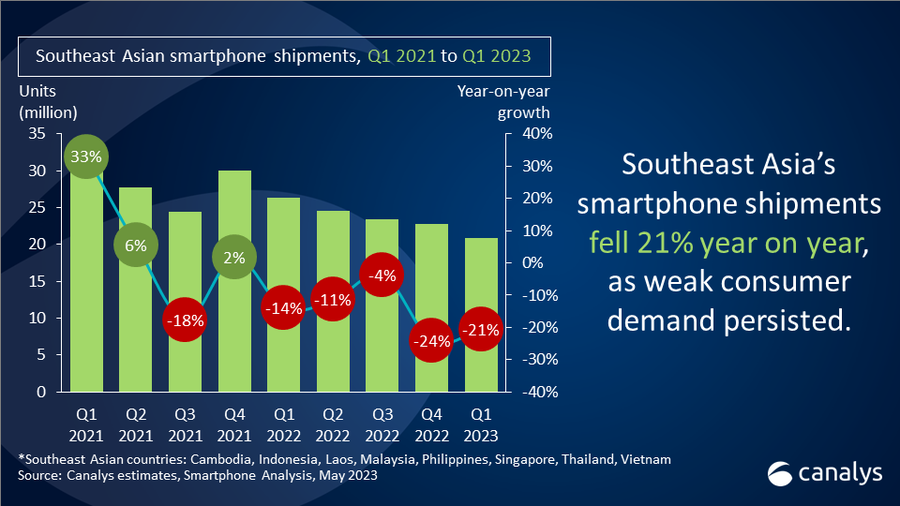

“The smartphone market is sending early signals of recovery after six consecutive quarters of decline since 2022,” said Le Xuan Chiew, Analyst at Canalys. “Smartphone inventory has begun to clear up as smartphone vendors prioritized cutting inventory of old models to make room for new launches. In a few key markets, Canalys noticed growing investments in the channel in the form of channel incentives and targeted marketing campaigns to stimulate consumer demand for new launches, driving channel activity. For example, OPPO, vivo, Transsion and Xiaomi are growing their market share in the sub-$US200 price band through stronger sales incentives and retail aggression. There are indications that vendors are preparing for market recovery in the further future. They are looking to hedge key component prices to combat potential prices hike, given the present inflationary conditions, leading to the recent increase in component orders. On the other hand, vendors have not stopped investing in manufacturing and have a direct presence in emerging markets like Southeast Asia and India, which will be a strong driving force for sustainable growth.”

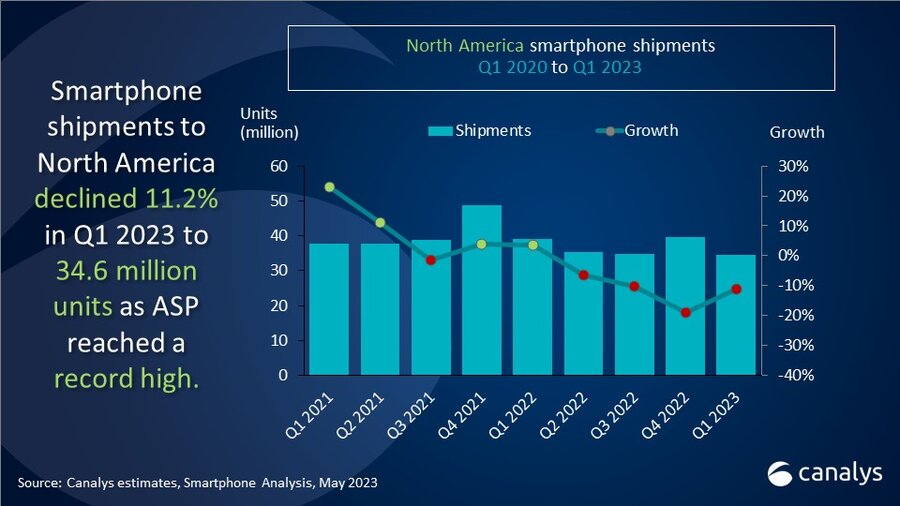

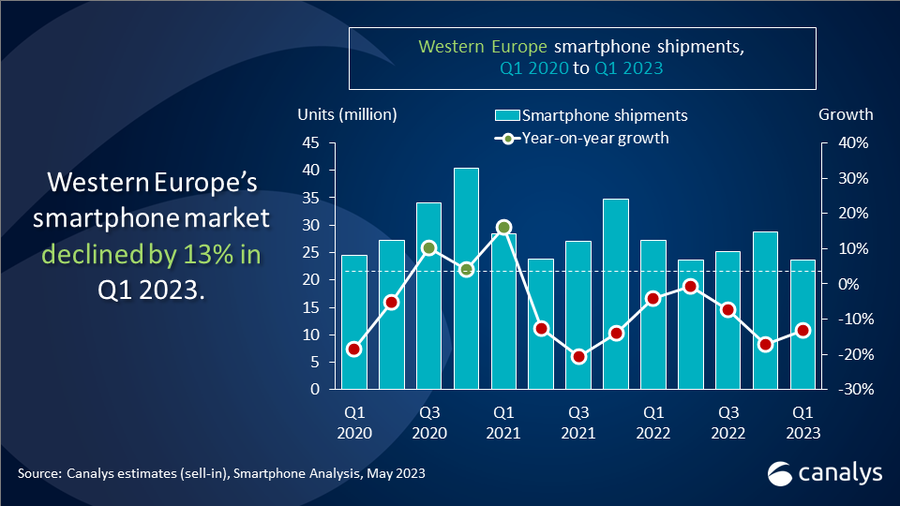

“Vendors must pay closer attention than ever to significant differences in market conditions as the speed and scale of recovery is highly variable,” commented Toby Zhu, Analyst at Canalys. “It is vital for smartphone vendors to stay agile to react to new market signals and allocate their resources effectively. Despite being plagued by uncertainties in consumer demand, vendors are still looking for some short-term opportunities while trying to maintain their top-level strategy. Eyes are on the upcoming Android players such as Transsion and HONOR, which are determined to act fast in product refreshment and indulge in strategic go-to-market tactics to win over market share, especially in open markets such as the Middle East, Latin America and Southeast Asia,” added Zhu.

|

Worldwide smartphone shipments and growth |

|||

|

Vendor |

Q2 2023 |

Q2 2022 |

|

|

Samsung |

21% |

21% |

|

|

Apple |

17% |

17% |

|

|

Xiaomi |

13% |

14% |

|

|

OPPO |

10% |

10% |

|

|

vivo |

8% |

9% |

|

|

Others |

31% |

29% |

|

|

|

|

|

|

|

Preliminary estimates are subject to change on final release |

|

||

For more information, please contact:

Le Xuan Chiew: lexuan_chiew@canalys.com

Toby Zhu: toby_zhu@canalys.com

Canalys' worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys' unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.