Global PC market decline eases as shipments drop 12% in Q2 2023

Tuesday, 11 July 2023

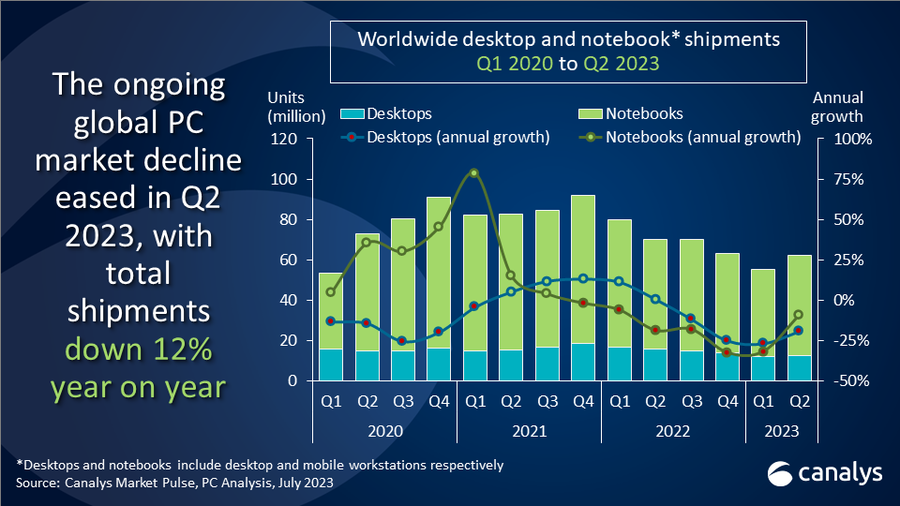

The latest Canalys data reveals that the worldwide PC market decline slowed in Q2 2023, with total shipments of desktops and notebooks down 11.5% year on year to 62.1 million units. This follows two consecutive quarters where shipments declined by over 30%. The second quarter volume represents a sequential increase in shipments by 11.9% and is a sign that the market is on track for accelerated recovery in the second half of this year. Notebook shipments were down 9.3% annually, landing at 49.4 million units, while desktops faced a larger decline of 19.3% to 12.6 million units of shipments.

“The PC market is showing early signs of a bounce back following a difficult period,” said Ishan Dutt, Principal Analyst at Canalys. “An annual shipment decline was expected in the second quarter of 2023, but there are indications that many of the issues that have affected the sector are beginning to abate. While the global macroeconomic situation remains difficult, key industry players have been pointing to the fact that end-user activation rates have been tracking stronger than sell-in shipments. As conditions improve, we expect businesses to reallocate dormant spending back toward IT upgrades. In Q2 2023, the return of public sector funding helped fuel strong back-to-school demand for PCs.”

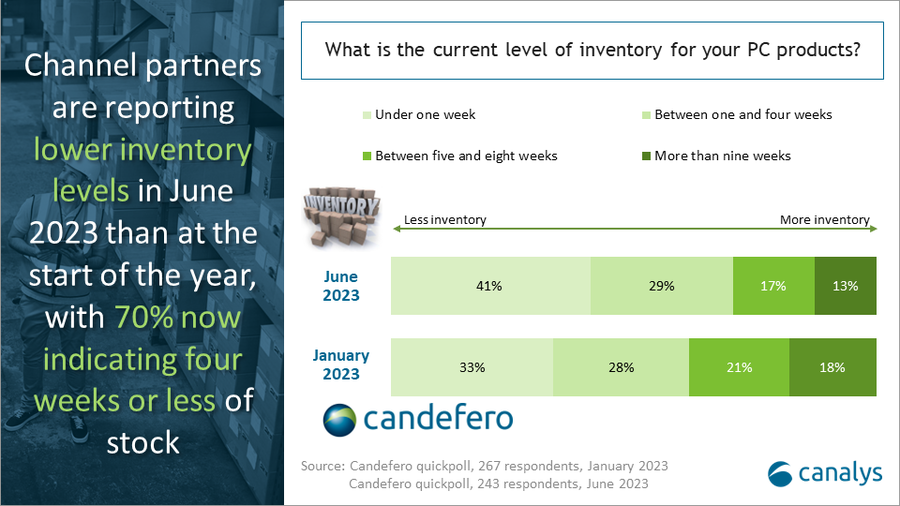

“Positive market signals suggest a further improvement for the PC industry in 2023,” said Kieren Jessop, Research Analyst at Canalys. “Inventory levels reduced further in Q2, as 41% of channel partners surveyed by Canalys in June reported that they have less than one week of PC inventory. All customer segments are set to improve sequentially for the remainder of 2023 amid a final push of inventory corrections and stronger seasonality in the latter half of the year. However, full-year 2023 shipments will be lower than 2022 as consumers relegate spending on PCs behind other categories in a post-pandemic environment.”

|

Worldwide desktop and notebook shipments (market share and annual growth) |

|||||

|

Vendor (company) |

Q2 2023 |

Q2 2023 |

Q2 2022 |

Q2 2022 |

Annual |

|

Lenovo |

14,202 |

22.9% |

17,340 |

24.7% |

-18.1% |

|

HP |

13,433 |

21.6% |

13,493 |

19.2% |

-0.4% |

|

Dell |

10,329 |

16.6% |

13,233 |

18.9% |

-21.9% |

|

Apple |

6,811 |

11.0% |

4,515 |

6.4% |

50.9% |

|

Acer |

3,998 |

6.4% |

5,085 |

7.2% |

-21.6% |

|

Others |

13,297 |

21.4% |

16,473 |

23.5% |

-19.3% |

|

Total |

62,061 |

100.0% |

70,139 |

100.0% |

-11.5% |

|

|

|

|

|

||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), July 2023 |

|

||||

Lenovo continued to lead the worldwide PC market, but underwent a large shipment decline of 18% year on year, dropping to 14.2 million units. Second-placed HP enjoyed a strong quarter, aided by healthy sales of Chromebooks in the US. It posted a flat performance by shipping 13.4 million units globally. Dell maintained third place but lost over two points of market share as its shipments declined 22%. Apple achieved the highest growth among the major vendors in Q2 2023, with shipments up 51% year on year. While it was boosted by the launch of the new 15-inch Macbook Air, its strong performance was mostly driven by a favorable comparison quarter due to the supply chain disruption it faced last year. Acer sealed the fifth spot in the rankings, with shipments at just under four million units.

For more information, please contact:

Ishan Dutt: ishan_dutt@canalys.com

Kieren Jessop: kieren_jessop@canalys.com

Canalys’ PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities in the market. Canalys PC shipment data is granular, guided by a strict methodology, and is broken down by market, vendor and channel, as well as additional splits, such as GPU, CPU, storage and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.