Western Europe’s smartphone market revival is on the cards for 2024

Tuesday, 23 May 2023

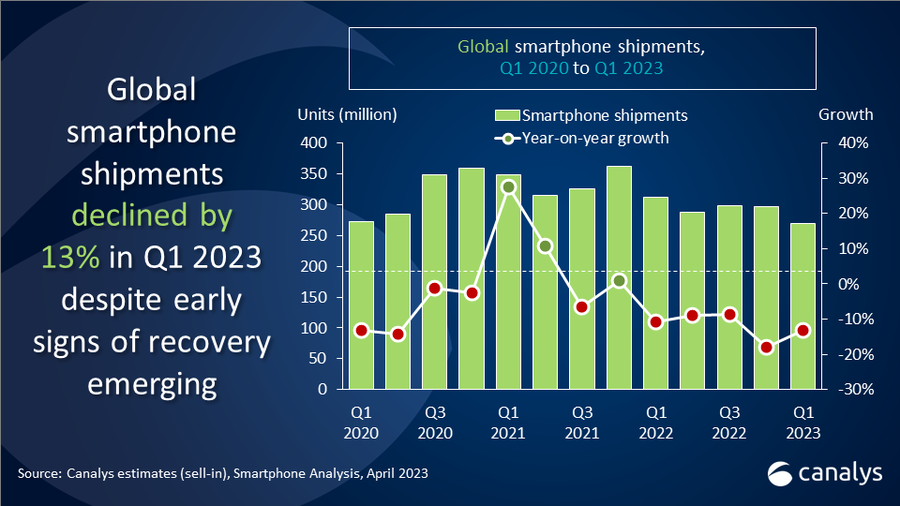

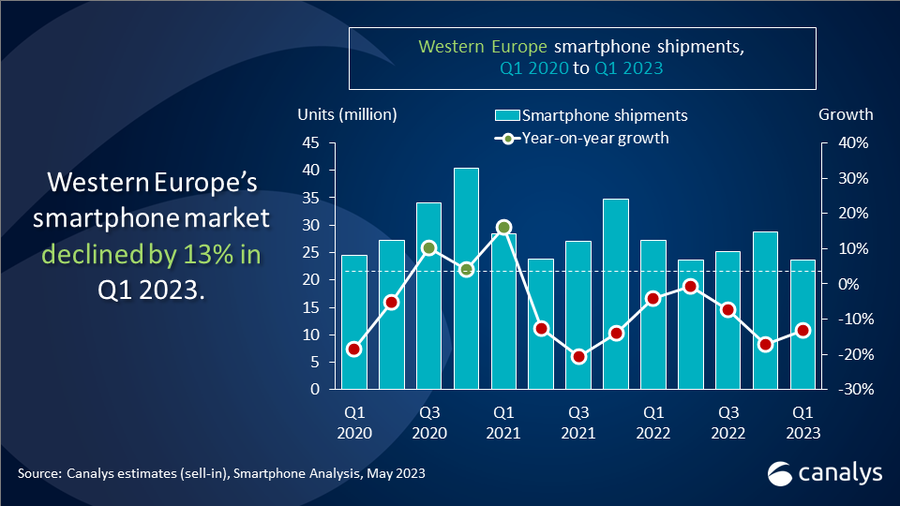

Western Europe's smartphone market faced a continued slump in Q1 2023, dropping 13% to 23.7 million units of shipments, as challenging economic conditions drove lower consumer demand and extended purchasing cycles. However, a glimmer of hope has appeared with Canalys' latest forecast predicting a rebound of 6% growth in 2024, signaling a potential market revival.

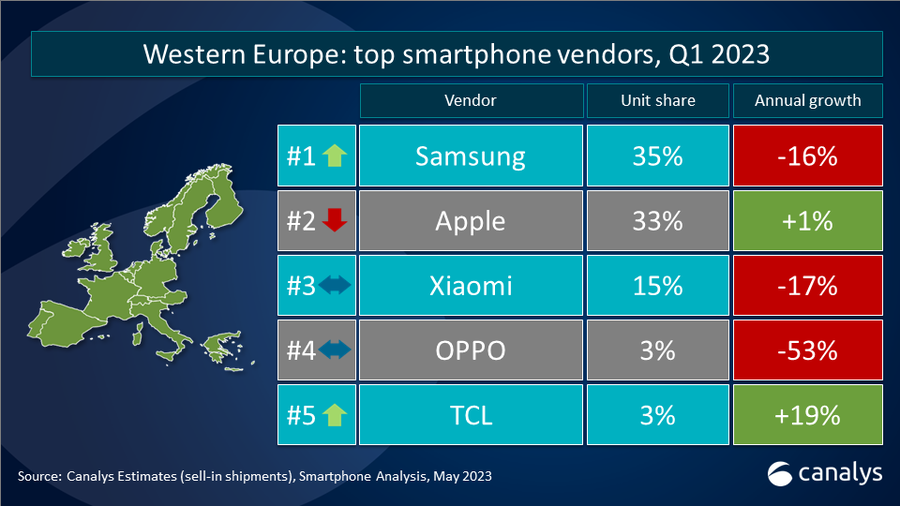

Samsung claimed the top spot in Q1 2023 with a 35% market share, despite a fall of 16% year-on-year. Samsung’s top-performing models were the newly launched S23 Ultra, S23 and A14 models, along with last year’s A53 and A33.

“Samsung has shifted its focus further toward the mid-to-high-end segment in Western Europe, motivated by better revenue drivers, higher profit margins and stronger potential for ecosystem integration,” said Runar Bjørhovde, Analyst at Canalys. “According to Canalys estimates, in Q1 2023, Samsung’s ASP rose by 11%, resulting in a 6% decline in the total value of devices shipped. Samsung has invested heavily in brand and product advertising, as well as in MDFs and co-marketing initiatives with operators and retail chains to strengthen its presence. These investments are also targeted at challenging Apple, which grew its market share to 33%. Apple’s shipments this quarter grew by 1% compared to Q1 2022, driven by the sale of iPhone 14 Pro and Pro Max devices. According to Canalys Consumer Insights research, Apple remains the most resilient vendor in Western Europe, supported by the most loyal user base in the region combined with high popularity among switchers.”

Xiaomi defended third place with a 15% market share, despite a 17% year-on-year decline. Xiaomi's performance was driven by its Redmi and Redmi Note models, with Spain, Italy and Germany being its key markets. Xiaomi remains focused on the low-to-mid-range segment, which helps it to sustain its ranking ahead of other Chinese vendors. Xiaomi has focused on profitability, with a smaller sales team focused on key operators and retail chains.

OPPO and TCL completed the top five, with each taking a 3% market share, declining 53% and increasing 19% year-on-year respectively.

“The market situation is getting incredibly competitive beyond the top three vendors,” said Kieren Jessop, Research Analyst at Canalys. “In Q1 2023, OPPO, TCL, Google Pixel, Motorola, HONOR and HMD Global were closely positioned, and several of these brands have ambitions and capital to invest in the region. There will be significant changes in the ranking table before the end of 2023.”

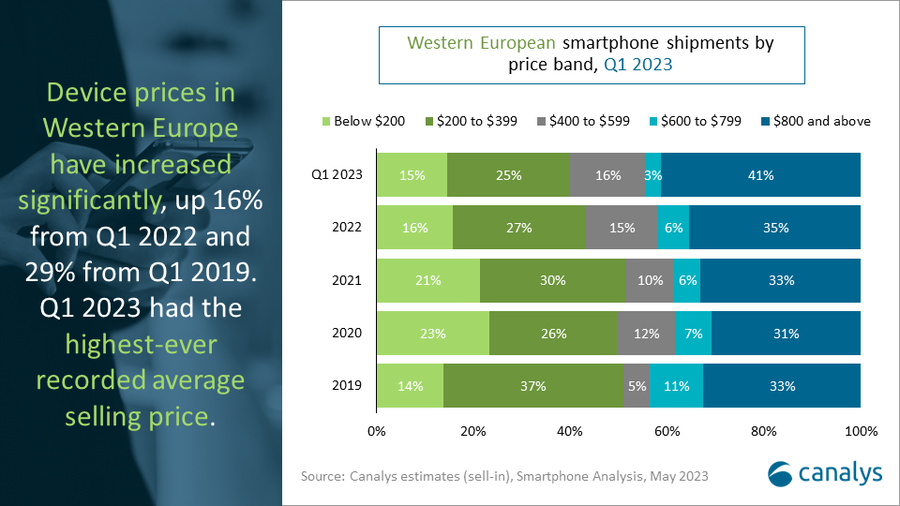

Canalys data indicates a surge in the US$800+ price segment, which now accounts for 41% of the market in Q1 2023, an increase from 35% as achieved the previous year. “Dominated by Apple and Samsung, this segment demands massive, sustained investment to penetrate,” added Jessop. “However, to secure short-term growth, vendors may need to cater to lower-priced segments and leverage robust promotions. Particularly, the sub US$400 market presents a more accessible opportunity to vendors.”

“The recent economic climate has allowed operators to regain share of the channel to just over 50%, recovering from a pandemic-induced dip,” noted Bjørhovde. “This revival owes much to appealing finance plans and bundled offers tailored for a market increasingly interested in mid-to-high-end devices. Meanwhile, device prices in Western Europe have climbed significantly, up by 16% from Q1 2022 and 29% from Q1 2019, resulting in the highest-ever recorded average selling price in Q1 2023.”

Additionally, operators are expanding their consumer reach by integrating further into retail chain stores, often offering device-subscription bundles. In an intricate channel structure, where a retail chain store might sell a device and subscription as a package on behalf of an operator, vendors must foster close relationships with both parties to distinguish themselves and support their partners' in-store differentiation. As device purchases become more complicated, savvy vendors can capitalize on these complexities by forging strong partnerships across the channel, increasing their market appeal.

Growth in 2024 will hinge on vendors' ability to skillfully manage inventory, minimize costs and optimize routes to market. Additionally, localizing marketing efforts and providing solid customer and channel support will be vital.

|

Western Europe smartphone shipments and annual growth

|

|||||

|

Vendor |

Q1 2023 |

Q1 2023 |

Q1 2022 |

Q1 2022 |

Annual |

|

Samsung |

8.3 |

35% |

9.9 |

36% |

-16% |

|

Apple |

7.8 |

33% |

7.7 |

28% |

1% |

|

Xiaomi |

3.5 |

15% |

4.2 |

15% |

-17% |

|

OPPO |

0.7 |

3% |

1.4 |

5% |

-53% |

|

TCL |

0.7 |

3% |

0.6 |

2% |

19% |

|

Others |

2.7 |

11% |

3.5 |

13% |

-20% |

|

Total |

23.7 |

100% |

27.3 |

100% |

-13% |

|

|

|

|

|||

|

Note: Xiaomi estimates include sub-brand POCO, and OPPO includes OnePlus. Percentages may not add up to 100% due to rounding. |

|

||||

For more information, please contact:

Runar Bjørhovde: runar_bjorhovde@canalys.com

Kieren Jessop: kieren_jessop@canalys.com

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.