Middle East smartphone markets had a gloomy start to 2023 with a 3.5% decline

Friday, 19 May 2023

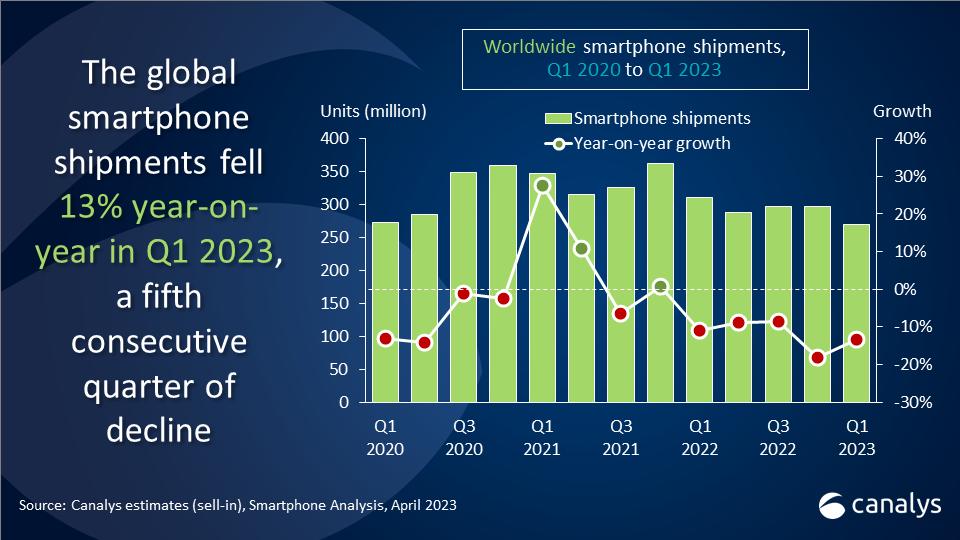

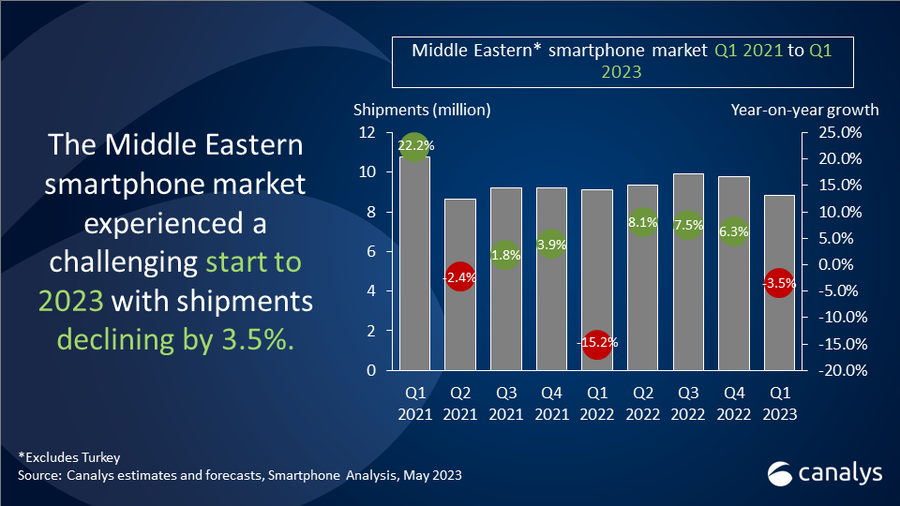

Canalys research shows that the Middle East (excluding Turkey) shipped 8.8 million smartphones, with a 3.5% annual decline in Q1 2023. The region performed better as global shipments experienced an annual decline of 13%. Though the Q1 decline ended the region’s nine-month growth streak, the Middle East was the best-performing sub-region. Smartphone shipments to Saudi Arabia had a modest growth of 1% due to consumers prioritizing spending on food, beverage and entertainment as the economy reopened. Despite economic expansion in the retail industry of the United Arab Emirates (UAE), the smartphone market experienced a 3% year-on-year decline. Limited marketing spending has hindered vendors from capitalizing on the growing trend. Iraq’s 3% annual decline in smartphones was the result of lower demand as consumers moved to conserve cash for essentials. Kuwait’s 11% annual decline added to the region’s woes with consumers holding on to newer upgrades. Israel, on the other hand, has experienced a growth of 26% because of consumers’ demand for premium smartphones and the growing tech industry, giving the region the title of “start-up nation”.

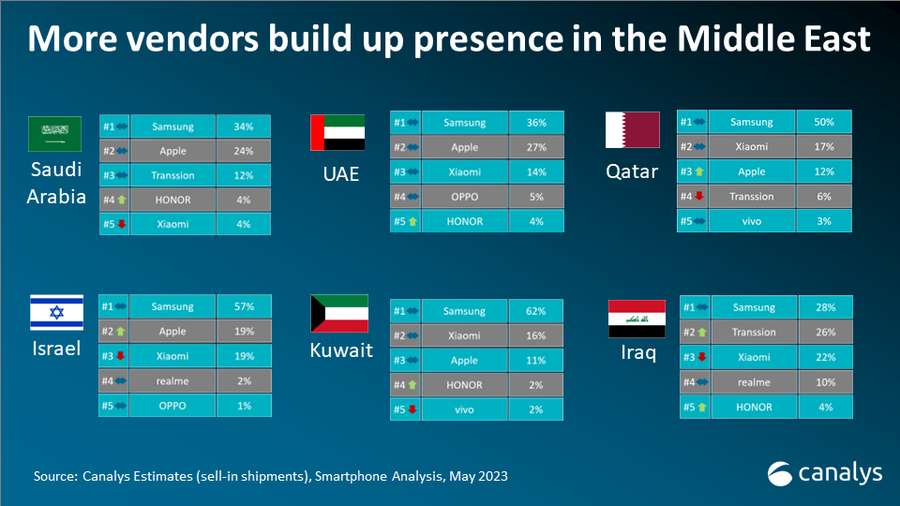

“Despite the economic challenges to consumer spending, Samsung and Apple continue to drive volumes on its after-sale service, brand perception and channel-prioritization,” said Manish Pravinkumar, Senior Consultant at Canalys. “The S23 series is gaining momentum, but the A series still drives market share despite an annual decline in shipments. Apple’s year-on-year growth is fueled by partnerships with local retailers and operators in UAE and Saudi Arabia, and strong popularity among younger generations. Additionally, attractive installment payment options are acting as growth catalysts in the region. On the other hand, Xiaomi, despite being viewed as a mid-range brand with budget-friendly options, is actively striving to penetrate the high-end market by launching new models and making investments in retail, exemplified by the opening of its largest flagship store in Dubai Mall, UAE. Meanwhile, Tecno and Infinix continue to mark their presence in the mid-low segment and increase their footprint in key markets like Saudi Arabia and Iraq.”

“Even with the current difficulties in the region, the long-term potential of the smartphone market remains strong,” said Sanyam Chaurasia, Analyst at Canalys. “The Middle East economy is recovering from the pandemic, particularly in Saudi Arabia, Qatar, and the UAE, where the tourism industry is growing rapidly and achieving new milestones. The Gulf Cooperation Council (GCC) area is relatively shielded due to higher oil prices and strong government strategies. However, in the short term, the broader Middle East region faces challenges such as persistent inflation, increasing interest rates and unpredictable geopolitical developments, which impact the market’s outlook. Canalys expects the region’s market to maintain similar shipments as the previous year in 2023. Brands will focus on their distribution channels and maintain lower inventory levels to manage local product pricing effectively. Additionally, due to potential recessionary pressures, vendors are likely to adopt a more cautious approach to spending and future plans.”

|

Middle East* smartphone shipments and annual growth |

|||||

|

Vendor |

Q1 2023 shipments (million) |

Q1 2023 |

Q1 2022 |

Q1 2022 |

Annual |

|

Samsung |

3.8 |

43% |

4.0 |

45% |

-5.3% |

|

Apple |

1.3 |

15% |

1.0 |

11% |

35.4% |

|

Xiaomi |

1.0 |

11% |

1.0 |

11% |

1.6% |

|

Transsion |

0.9 |

11% |

1.4 |

16% |

-35.0% |

|

OPPO |

0.3 |

4% |

0.4 |

5% |

-31.9% |

|

Others |

1.5 |

17% |

1.3 |

15% |

13.1% |

|

Total |

8.8 |

100% |

9.1 |

100% |

-3.5% |

|

|

|

|

|||

|

Note: Xiaomi estimates include sub-brand POCO and Redmi and OPPO includes OnePlus. Percentages may not add up to 100% due to rounding. Excludes Turkey. |

|

||||

|

Source: Canalys Smartphone Analysis (sell-in shipments), May 2023 |

|

||||

For more information, please contact:

Manish Pravinkumar: manish_pravinkumar@canalys.com

Sanyam Chaurasia: sanyam_chaurasia@canalys.com

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, and detailed analysis of storage, processors, memory, cameras and many other parameters. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.