Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Leveraging technology to build thriving partner recruitment ecosystems

Leverage Ecosystem Recruitment and Visualization tools to more effectively recruit high-quality partners at scale and build thriving partner ecosystems. From AI-powered partner matching to real-time insights and predictive analytics, these tools are essential to efficiently recruit and engage with the right partners for growth.

Partner strategies have evolved from linear reseller and referral models to complex ecosystems with hundreds or thousands of partners. Tech vendors now face the challenge of recruiting and managing a diverse range of partners at scale. The industry’s pursuit of growth is highlighted by ambitious recruitment goals from leaders in the space:

- ServiceNow aims to add 250,000 net new partners by the end of 2024.

- Workday plans to double consulting capacity by fiscal 2026 with existing and new partners.

- IBM reported adding hundreds of partners to accelerate consumption of its hybrid cloud platform.

- Microsoft, with its ecosystem of over 400,000 partners, remains committed to recruiting new partners to support specific products and initiatives, reporting a 250% increase in AI-related transacting partners over the past year.

- Cloud Marketplaces across the board are actively recruiting and onboarding thousands of new ISVs.

With the increasing complexity of partner strategies and the growing demand for specialized partners, vendors must adopt new ways to effectively recruit and grow partner ecosystems. Traditional partner lists and static directories are no longer sufficient as these methods often lack critical details and fail to capture the nuances of dynamic ecosystems. Furthermore, traditional outreach methods, such as email, LinkedIn, and phone calls, are no longer effective. Vendors today need more sophisticated strategies and tools to recruit and mobilize the right partners. This includes deeply understanding the ideal partner profile (IPP) and leveraging data-driven technology to create a hyper-targeted recruitment strategy.

Ecosystem Recruitment and Visualization tools are now a critical component to this strategy; these platforms empower vendors to understand, identify, recruit, and onboard ideal partners to fuel go-to-market strategies.

Ecosystem Recruitment and Visualization platforms:

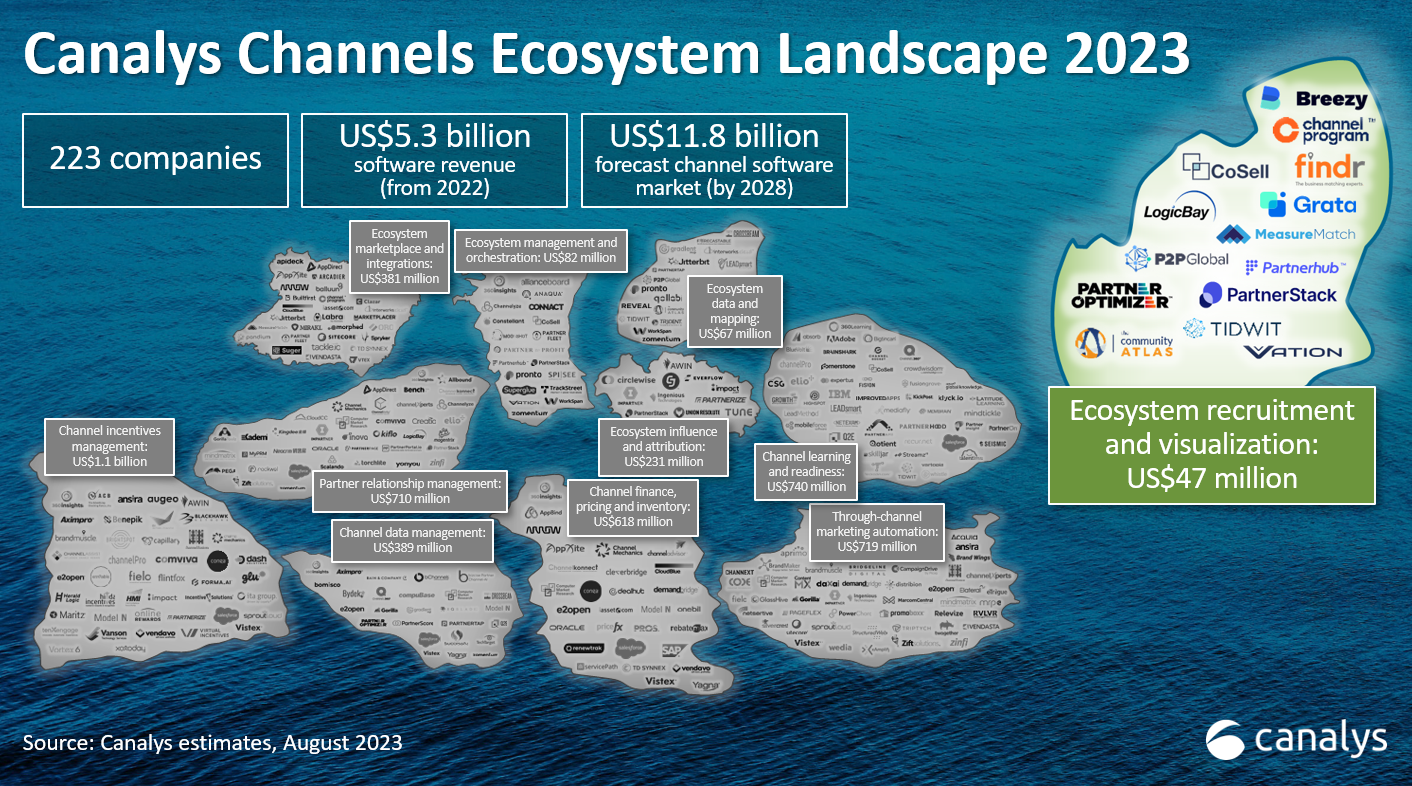

According to Canalys research, the broader ecosystem software industry is valued at US$5.3 billion, and is projected to double by 2028 to US$11.8 billion.

Within this space, the dedicated market for Ecosystem Recruitment and Visualization tools was valued at US$47 million in 2023. This space is relatively immature and Canalys predicts significant growth over the next decade.

What are Ecosystem Recruitment and Visualization tools?

Ecosystem recruitment and visualization tools are technologies that enable vendors to recruit and build thriving partner ecosystems. These platforms go beyond static partner directories or lists by offering advanced functionalities for identifying, and understanding ideal partners, accelerating time to market and vendor-partner success.

There are two primary categories in this space:

- Ecosystem recruitment: These tools help vendors leverage advanced search capabilities and partner matching algorithms to identify compatible partners based on specific criteria including industry focus, business model, complementary offerings, market expertise, solution offerings, resourcing, and geographic reach. Some tools also facilitate communication and collaboration with potential partners through built-in messaging tools, streamlined onboarding processes, and community management features.

- Visualization: This set of tools consolidates and analyzes partner data from various sources, providing a holistic view of the partner ecosystem. They help visualize partner relationships and interdependencies, allowing for strategic planning and targeted program development. Some also provide partner performance tracking and greater insights.

Ecosystem Recruitment and Visualization tools offer a wealth of features to optimize partner identification, partner intelligence, onboarding, and collaboration. By pinpointing the right partners, vendors can utilize their resources more effectively and gain huge advantages down the line. Ultimately, these tools empower vendors to build strategic networks of partners that increase revenue, market reach, and customer success.

Key benefits include:

- Increased efficiency: Identify and onboard the right partners faster, reducing wasted time and resources.

- Improved partner fit: Find partners with complementary offerings and expertise, leading to stronger go-to-market strategies.

- Enhanced collaboration: Foster closer relationships with partners, promoting better communication and joint efforts.

- Data-driven decision-making: Gain insights into target partners, partner performance, and optimize partner programs based on real data.

- Scalability: Build and manage a growing partner ecosystem, supporting future expansion plans.

Key players:

- Breezy (London, UK): Breezy is an AI-powered partner discovery platform that enables businesses to find and build successful, data-driven partnerships.

- Channel Program (Maryland, USA): Channel Program helps companies visualize and communicate with their entire vendor ecosystem from a single login.

- Co-Sell now Hifive (Texas, USA): Hifive is a relationship-led platform that identifies and facilitates compatible partners, influencers, introductions, and endorsements.

- Findr (Bengaluru, India): Findr helps companies discover hidden gems within the partner ecosystem with advanced partner discovery capabilities.

- LogicBay now The Learning Network (North Carolina, USA): The Learning Network bridges the gap between vendors and distributors with their partner recruitment and co-selling solutions.

- Grata (New York, USA): Grata enables vendors to connect with diverse partners and uncover the potential of niche partner segments.

- MeasureMatch (London, UK): MeasureMatch's data-driven partner matching engine enables vendors to match their needs with the perfect partners.

- P2PGlobal (USA): P2PGlobal's comprehensive platform enables customers to build a global network of partners and expand reach.

- PartnerHub (Illinois, USA): PartnerHub is a marketplace, ecosystem management platform, and white label framework wherein SaaS and digital agencies find one another, form strategic partnerships, and manage their partnership strategy.

- PartnerOptimizer (California, USA): PartnerOptimizer enables customers to optimize partner ecosystem performance, discover new partners, and identify inactive or undervalued partners.

- PartnerStack (Ontario, CA): PartnerStack's all-in-one platform helps simplify partner recruitment and management.

- The Community Atlas (Milan, Italy): The Community Atlas uses AI and Big Data to map and rank the world’s most engaged communities to help customers recruit partners.

- Tidwit (Virginia, USA): Tidwit is an AI powered ecosystem enablement platform that automates the partner journey with user-friendly workflows.

- Vation Ventures (Colorado, USA): Vation helps companies understand their landscapes and ecosystems and design partner strategies to accelerate growth.

The future of Ecosystem Recruitment and Visualization tools:

The demand for robust partner ecosystems is accelerating, and Ecosystem Recruitment and Visualization tools will continue to evolve to meet the market’s growing needs. Here are some trends to watch:

- AI-powered partner identification and matching: Machine learning will play a more significant role in identifying ideal partners. AI algorithms will analyze vast amounts of data to create hyper-personalized matches based on compatibility, historical performance, and market trends. This will lead to more efficient partner recruitment and a higher likelihood of successful collaboration.

- Real-time partner insights: Tools will offer real-time data dashboards to track partner performance and engagement. This will allow vendors to proactively identify and address potential issues, maximize partner ROI, and optimize recruitment algorithms and program effectiveness.

- Predictive analytics: Partner recruitment will become more strategic with the adoption of predictive analytics for more accurate modelling. These tools will forecast future partnership success, allowing vendors to prioritize recruitment efforts and allocate resources more effectively.

- Seamless integration: Ecosystem Recruitment and Visualization tools will seamlessly integrate with PRM, CRM, ecosystem management platforms, and marketing automation tools. This will streamline workflows, eliminate data silos, and provide a centralized hub for identifying, recruiting, and managing all aspects of partner relationships.

- M&A activity: As vendors continue to expand their partner strategies and the market continues to grow, there will be seamless integrations and market consolidation into partner and channel platforms.

Conclusion

While tech vendors have invested heavily in tools, data, and modelling to recruit the right sales prospects at scale, partner recruitment has historically been overlooked. This presents a significant opportunity for growth. By leveraging cutting-edge partner technology to identify and recruit the right partners, businesses can increase efficiency and drive more partner business. As the market continues to evolve and companies increasingly rely on partners for scalable growth, these tools will become even more critical to achieving objectives.

Canalys predicts further innovation in this area as major platform ecosystems become core to successful GTM initiatives. Winning within ecosystems such as Microsoft, AWS, Google, Salesforce, and HubSpot requires tailored strategies, targeted partner sets, and focused execution, as each ecosystem is distinct and presents unique opportunities and challenges. Additionally, the rise of digital marketplaces is fostering new ways to collaborate with partners, resulting in increased co-selling, co-marketing, co-servicing, co-innovating, and co-developing opportunities. Ecosystem Recruitment and Visualization tools will help businesses navigate the complexities of modern partner ecosystems and identify the right partners to grow.