Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Hyperscaler emissions continue to surge, as Science Based Targets initiative CEO steps down

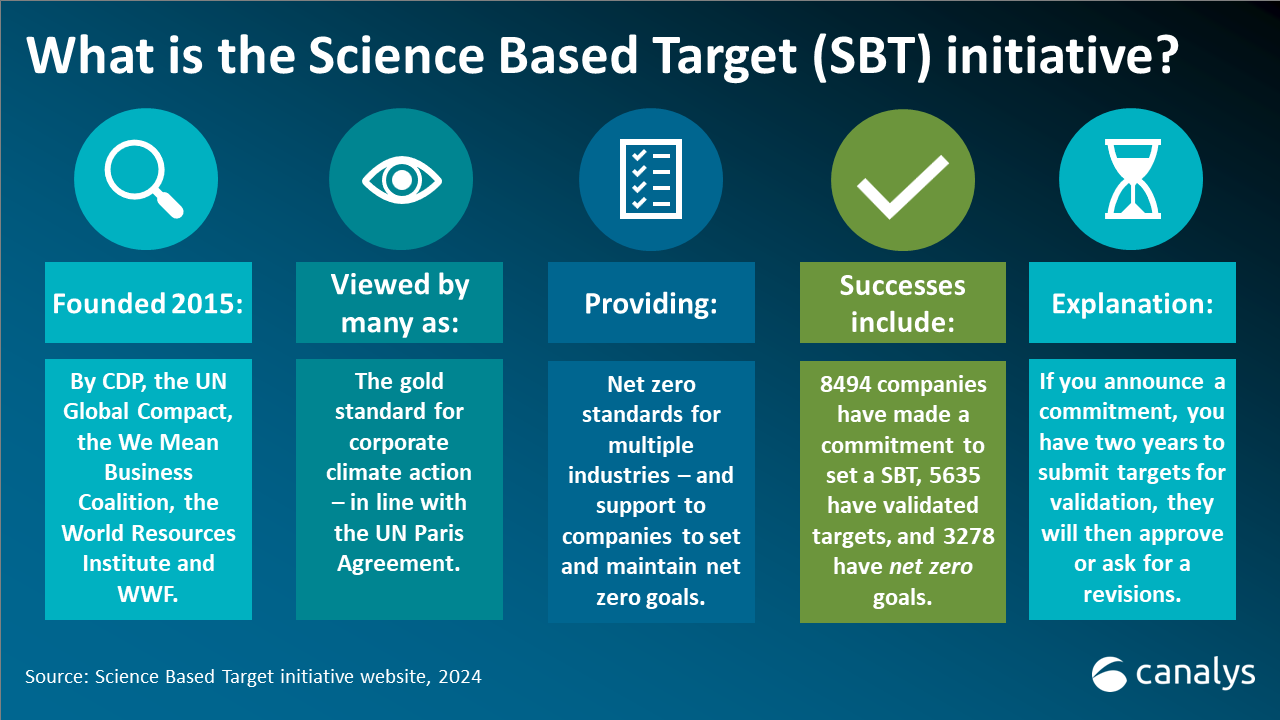

Dr Luiz Amaral, soon to be the former CEO of the Science Based Targets initiative (SBTi), announced this week he will be stepping down from his post for personal reasons. This follows a controversial recent announcement from the UK-based charity that it plans to accept renewable electricity certificates as evidence of corporate value chain decarbonization. On the same day as Amaral’s announcement, Google revealed its greenhouse gas emissions have increased by 48% in the past five years. Microsoft’s having grown by 29.1% since 2020.

The true implications of AI on sustainability are becoming clearer, and more concerning. Its sheer demand on compute power is astronomical – requiring new servers, more data centers, and enormous volumes of energy and water. With AI now here to stay, hyperscalers’ latest sustainability reports tell an unsurprising, yet alarming story: their emissions are skyrocketing due to growing AI business.

On Tuesday 2 July, Google announced a 48% increase in the company’s greenhouse gas emissions in the last five years, and Microsoft already revealed a 29.1% increase since 2020. Largely due to investments into AI training and deployment, these increases will underpin a larger trend among hyperscalers – one where they expand AI efforts, and report significant emission increases, while maintaining they are able to meet their net zero goals.

For these vendors, one option has been to turn to the purchase of renewable electricity certificates. These certificates are often referred to as ‘Energy Attribute Certificates’ (EACs) or 'Renewable Energy Certificates' (RECs). Companies can use these certificates to validate a claim of their carbon neutrality.

The most important distinction to draw here is between carbon neutrality and net zero – which are often confused. If a company is carbon neutral, it can continue to release as many emissions as it likes, it must only verify it has purchased enough EACs to ‘offset’ the emissions released. Whereas, net zero, is a far more difficult goal to achieve: Long-term, a company must avoid releasing almost all emissions altogether – with some small, residual emissions remaining – usually totaling 5% or less of the total.

This brings us to the difficulty SBTi is now facing. The charity has recently been in hot water after an announced a revision to its previous policies on the aforementioned certificates (EACs). Namely, that “SBTi has decided to extend their use for the purpose of abatement of Scope 3 related emissions beyond the current limits”.

The reason this announcement has led to such controversy is down to the very meaning of net zero – emissions must be avoided, not simply compensated.

The reason so many were incensed comes down to SBTi's U-turn on certificate use. This seems to signal to corporations that a continued increase in emissions might be accepted if enough investments were made in the aforementioned certificates. While the announcement was not followed up with specific guidance on usage, this announcement led to claims of an internal SBTi revolt – and considerable external criticism.

That brings us to this week, in which the charity’s Chief Legal Officer, Susan Jenny Ehr, has been announced as interim CEO.

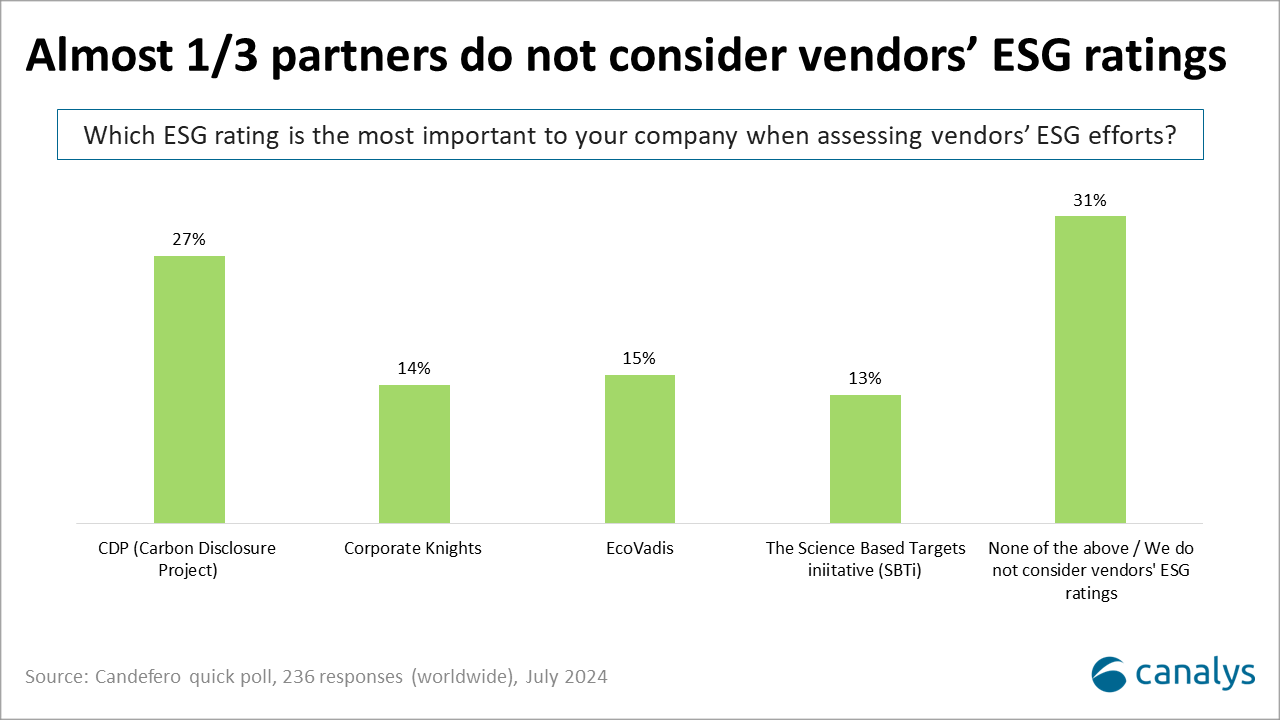

Following SBTi's announcement, this week Canalys released a quick poll to partners.

- The third placed organization from the poll selection is interesting given the relative lack of Corporate Knights' global visibility for more than two to three years previously.

- Possibly colored by the announcement this week, the SBTi was the penultimate choice, receiving only 13% of votes. Although this is because many view the SBTi more as a commitment framework, than an ESG rating.

- Most interesting, however, is the 31% of respondents who selected 'none of the above' or that they simply do not consider a vendor's ESG ratings. This may be good news for the organizations mentioned below whose SBTs have been removed in part, or entirely, by SBTi.

- However, there is clearly a division among partners on the chosen ESG rating, and the importance of these ratings overall.

Most crucial of all is the background against which all this has been unfolding. This year, SBTi began to remove the net zero commitments of specific organizations – typically on the basis that an adequate plan to achieve the reductions had not been produced by the company in question. Indeed, Microsoft had its near-term target removed, Amazon had both its targets removed, alongside Crayon, and others. The core challenge lies largely in the growth of AI investments.

As companies continue to publicize their investments in AI, it becomes increasingly difficult to see how net zero commitments can be achieved alongside such substantial AI investments. Most telling is the stability of Alphabet Inc's share price this week – Google’s parent company. The share price remained unharmed in the days following the announcement.

As the SBTi faces an identity crisis, the same can almost certainly be said about the corporate sustainability teams of the hyperscalers overall, as emissions continue to soar, and AI ambitions seem to grow higher by the day.