Expanded Scale and Leadership in B2B: From R&D to ROI

With a combined permissioned audience of 50+ million professionals, TechTarget and Informa Tech’s digital businesses have come together to offer industry-leading, global solutions that enable vendors in enterprise technology and other key industry markets to accelerate their revenue growth at scale.

HONOR expands its reach with an official launch in Indonesia

HONOR has expanded its reach by officially launching in Indonesia, targeting the mid-to-high-end market to establish itself as a strong competitor in the region. The brand’s strategic approach incorporates technological innovation, localization and partnerships to disrupt the market and lead in key categories, signaling ambitious yet pragmatic growth plans in Indonesia’s dynamic smartphone landscape.

.png)

HONOR’s global growth and regional expansion

Globally, HONOR’s shipments grew 17% year to date from Q1 to Q3 2024 compared with the same period in 2023, fueled by substantial marketing investments in the premium segment. The brand has made significant strides in expanding its presence in international markets, where it recorded an impressive 126% year-on-year increase in the first half of 2024. This outstanding performance was driven by successful market launches across Latin America, Southeast Asia and Europe, solidifying the brand’s global expansion efforts.

In Southeast Asia, HONOR has achieved rapid growth over the past year by focusing on flagship devices and optimizing distribution channels. Smartphone shipments nearly doubled in 2023, and the brand is on track to achieve 11% growth in the region in 2024. Building on this success, HONOR is targeting Indonesia as a key market, positioning itself as a strong competitor in the mid-to-high-end segment.

Why Indonesia?

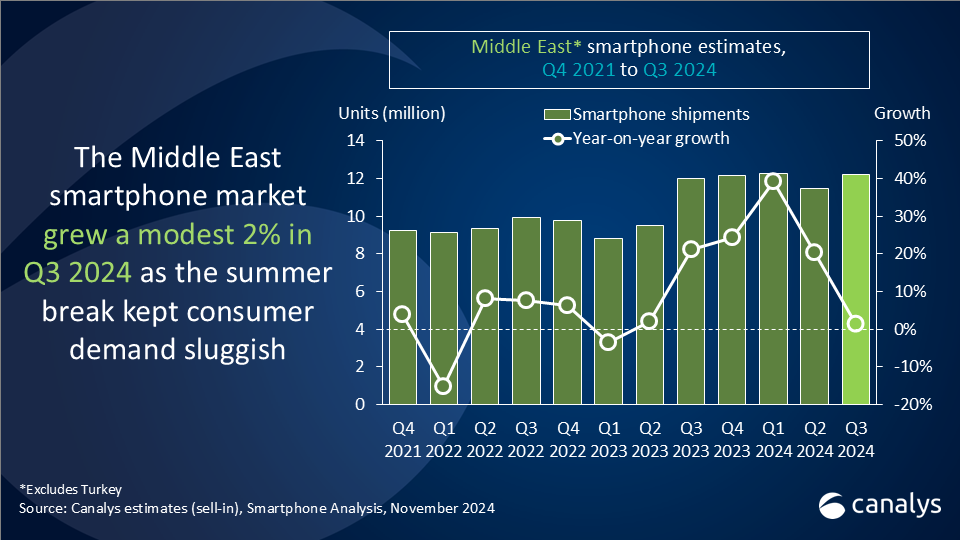

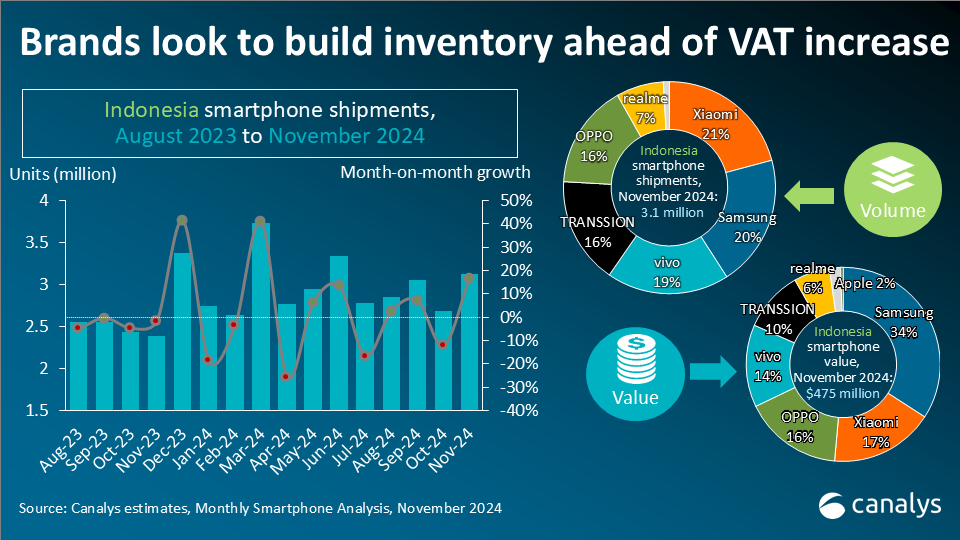

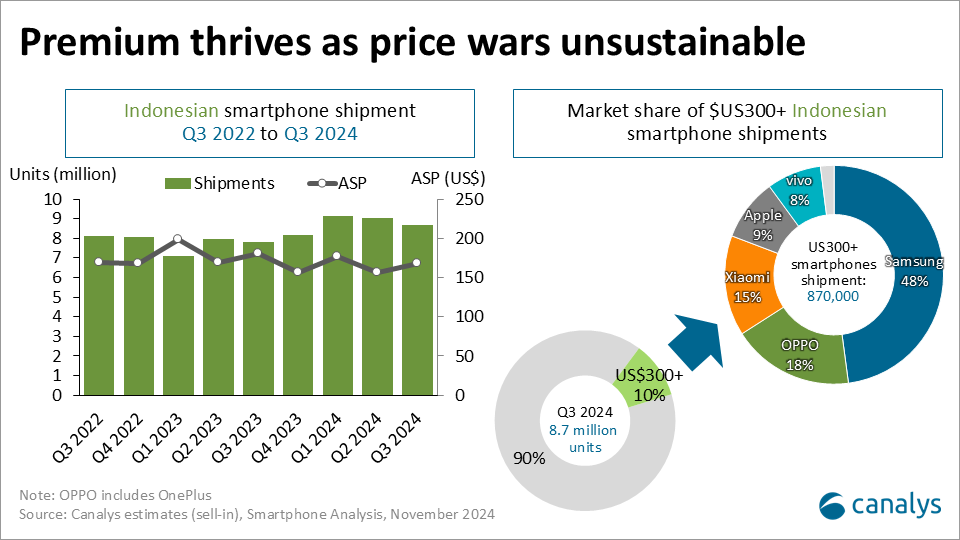

Indonesia is emerging as a key market in Southeast Asia, driven by rapid economic growth and an expanding middle class. According to Canalys, Indonesia accounts for 35% of smartphone shipments in the region. Though 85% of the market is dominated by devices priced under US$200, HONOR aims to carve out a presence in the US$300+ mid-to-high-end segment, which constitutes 10% of the market.

The premium segment, currently dominated by Samsung and Apple, offers HONOR an opportunity to establish a foothold and capitalize on Indonesia’s growing demand for high-quality, innovative devices. As Southeast Asia’s largest and fastest-growing economy, Indonesia presents immense potential for long-term growth. Its young, tech-savvy population aligns with HONOR’s goal of expanding its installed base in markets with favorable demographics. Additionally, long-term production investments could enable HONOR to make its premium devices more affordable, positioning Indonesia as a strategic hub to drive further growth across Southeast Asia.

HONOR looks to replicate Southeast Asia’s high-end success in Indonesia

In Q3 2024, the US$300+ price segment accounted for 20% of smartphone shipments among Android brands in Southeast Asia. HONOR, however, has outperformed in this category, driven by the strong success of its X9b series and HONOR 200. With robust performance in the operator channel, HONOR’s mid-to-high-end segment exceeded market trends, with the US$300+ price range contributing 25% of its smartphone shipments. Additionally, HONOR’s shipments in the US$300+ segment grew by an impressive 184% year on year in Q3 2024 and are expected to grow further due to its diversified, expanded channel investment and above-the-line (ATL) marketing.

HONOR’s entry strategy in Indonesia targets the mid-to-high-end market, with a primary focus on products priced above US$350. Without an entry-level device, HONOR holds the benefit of prioritizing technological advancements and AI-driven user experiences, and it aims to appeal to discerning consumers who value innovation and quality over price. This approach aligns with shifting consumer preferences in Indonesia, which are driven by economic growth and an expanding middle class.

Top challenges in the local market

- Price sensitivity: the prevalence of sub-US$200 models underscores the highly price-sensitive nature of the Indonesian market. With an average selling price of just US$168 – 60% lower than the Southeast Asian average – most established brands in Indonesia rely on entry-level models to maintain volume and market share. This dynamic could present challenges for HONOR, potentially limiting its addressable market within the region.

- Strong competition: the small but attractive premium segment is increasingly competitive, with all brands making aggressive launches in 2024 in the ultra-premium segment. OPPO and Samsung have distinguished themselves by expanding to high-end experience stores, which are critical for brand visibility. Hefty investments in localization and ATL marketing are necessary costs to compete in the high end.

- Localization demands: to meet Indonesia’s TKDN (Domestic Component Level) standards, HONOR must achieve a local content ratio of 35% to 40%. While complying with these regulations is essential, long-term TKDN investments could lead to increased operational costs, potentially affecting profitability.

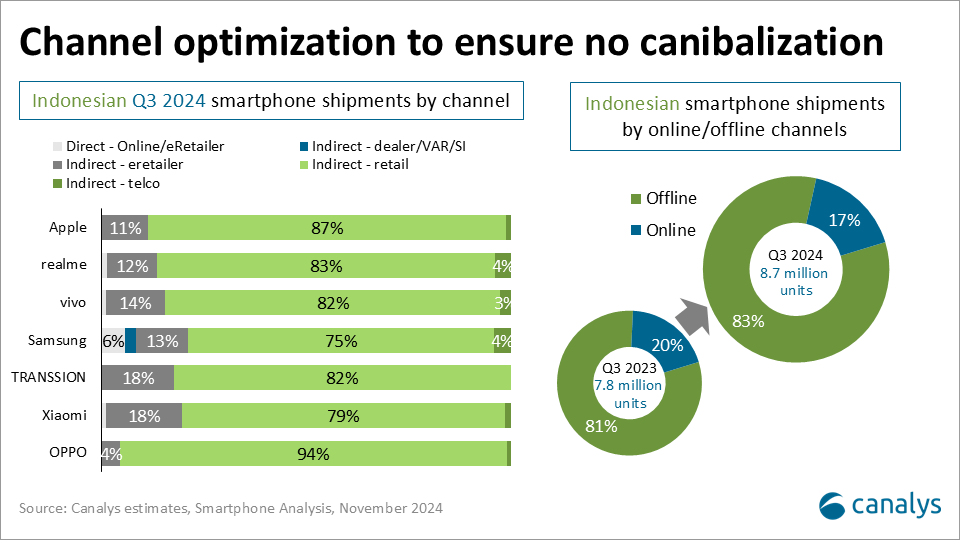

- Channel dynamics difficult for the high-end market: HONOR faces challenges in replicating its success in Malaysia and Thailand, where operator channels play a significant role in driving sales. Telco postpaid bundles are a natural driver of premium device growth; they typically target higher-income users and offer attractive discounts with financing. In Indonesia, the telco channel only contributes 2% of the total market as plans are predominantly prepaid. HONOR will need to work with open-market channel partners to provide affordability options and increase its premium.

HONOR’s local differentiators and market disruption

- Technological edge: HONOR stands out with its focus on AI-driven features and a human-centric design philosophy supported by strict manufacturing quality control processes, which were seen in its successful Magic Fold series globally. Innovations in AI imaging and its IoT portfolio, including PCs, tablets and wearables integration, reinforce its premium market positioning and appeal to tech-savvy consumers.

- Localization strategy: For software, HONOR will partner with top-tier local applications (tier-one apps/top five) to pre-install relevant apps on its devices, offering users a software experience that is more aligned with local needs. Additionally, HONOR will collaborate with global partners, such as Qualcomm and other major companies, for joint marketing, leveraging global technological advantages and addressing local market demands. It is vital for HONOR to understand the needs and wants of premium market consumers to drive upgrades and client retention.

- Strategic channel partnerships: Channel partnerships are vital for HONOR’s entry into the Indonesian market. HONOR is expected to work with an exclusive large key account retailer and e-retailers to ensure its expansion into both the online and offline channels. These platforms are essential to HONOR’s high-end strategy as they provide financing solutions in tandem with above- and below-the-line marketing, which are critical to drive brand presence. HONOR plans to display its brand in 200 to 300 retail stores within the first year, creating a strong offline presence. To fulfil the after-sales requirements of its partners and consumers, HONOR has already established eight service centers and plans to expand this network. Unique offerings, such as a 365-day screen protection plan, will enhance customer loyalty and satisfaction.

Long-term opportunities

HONOR is positioning itself for future growth with a focus on 5G adoption, transitioning its product lineup to align with market trends. The company is expanding into premium IoT products, targeting a market gap left by competitors such as Xiaomi, whose offerings are predominantly low-end devices. Its regional strategy groups in Malaysia, Singapore and Indonesia aim to leverage cross-market synergies by using profits from mature markets to support growth in Indonesia. HONOR’s substantial investment in research and development, over 11% of its revenue globally, suggests a focus on innovation to position itself as a leading brand in the premium segment. The Q1 launch event signals an effort to establish itself as a contender in the market, setting the tone for its broader strategic ambitions.

Building on its global success in the high-end segment – with a remarkable 68% year-on-year growth in the US$600+ price category and a top five position in the market – HONOR aims to replicate this performance in Indonesia. Over the next three years, the brand seeks to become one of the top three by value in Indonesia’s mid-to-high-end market. Additionally, HONOR aspires to lead in key categories, including foldable smartphones, mid-range devices and tablets, further strengthening its presence in the region.

HONOR’s long-term strategy centers solely on premium devices posed as key differentiators

HONOR’s entry into the Indonesian market is a bold move, targeting a niche yet growing segment with high potential. By leveraging technological innovation, strategic localization and strong partnerships, HONOR is poised to disrupt the market and establish itself as a leader in the mid-to-high-end segment. With a clear long-term vision and a commitment to sustainable growth, HONOR’s strategy reflects an ambitious yet pragmatic approach to conquering Indonesia’s dynamic smartphone landscape.