Expanded Scale and Leadership in B2B: From R&D to ROI

With a combined permissioned audience of 50+ million professionals, TechTarget and Informa Tech’s digital businesses have come together to offer industry-leading, global solutions that enable vendors in enterprise technology and other key industry markets to accelerate their revenue growth at scale.

Boost or challenges? Examining the government subsidy impact on Mainland China’s smartphone market

The government subsidy drives growth and trade-offs for Mainland China’s smartphone market.

Background

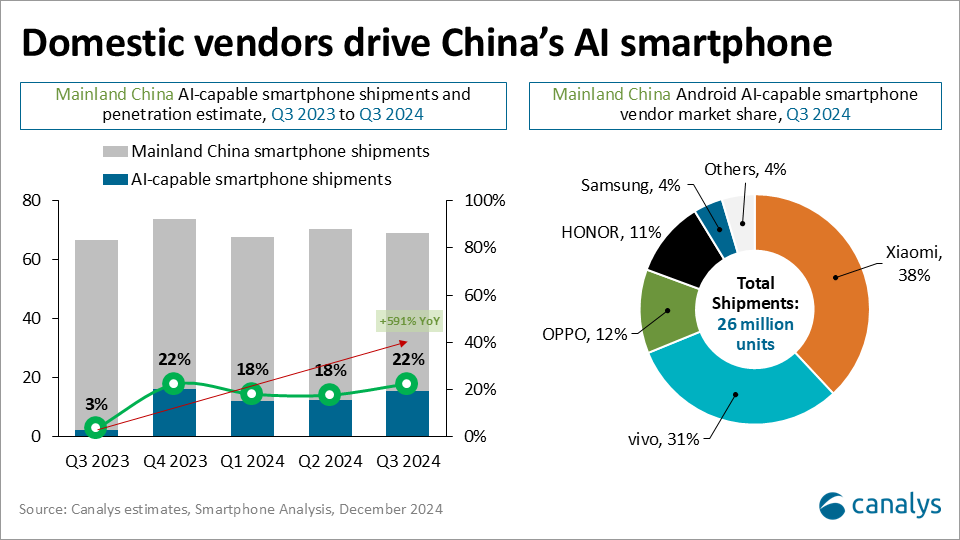

In August 2024, the government of Mainland China introduced subsidy policies targeting eight categories of home appliances, such as computers, televisions and air conditioners, to stimulate consumption and boost domestic demand. Smartphones were not included in the national subsidy program. In the subsequent months, several local governments, like Shenzhen, Jiangsu and Guizhou launched subsidy initiatives offering 10% to 20% discounts on 3C electronic products, including smartphones. From September to November, following the implementation of the policy, the total retail sales of consumer goods saw year-on-year increases of 3.3%, 5.0% and 4.0%, respectively.

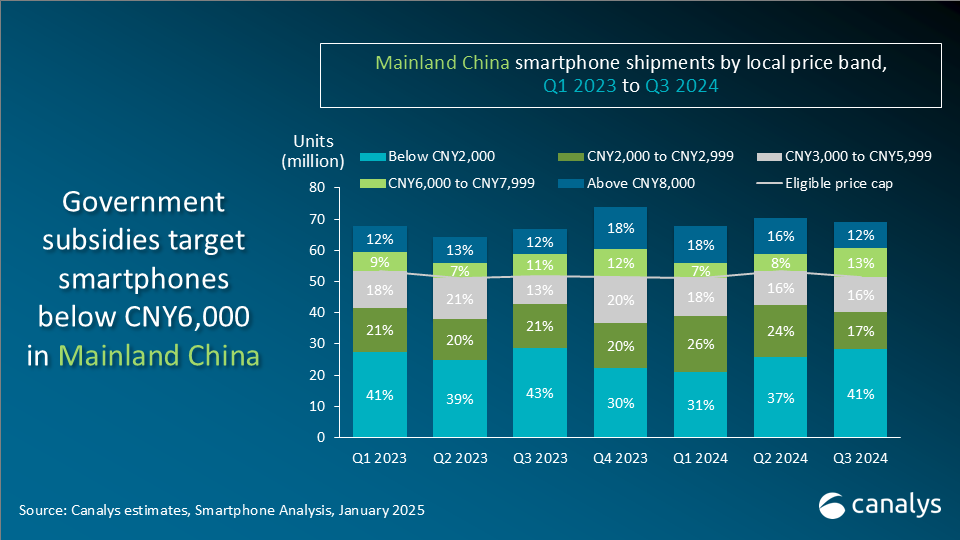

On 8 January 2025, the Chinese government expanded its subsidy program’s scope and coverage. National subsidies now include smartphones, tablets, smart bands and smartwatches, with a 15% subsidy for products priced under CNY6,000 (approximately US$818) and capped at CNY500 per product. According to the requirement, the premium models, including part of local vendors’ flagship and foldable smartphones and Apple’s Pro models, are exempt from the program. In the eligible price range, products priced between CNY3,000 and CNY4,000 can maximize the benefit. Local governments may also introduce local programs based on their fiscal capacities, aligning with the national government’s policy in the coming months.

Impact on consumer sentiment

From the consumer’s perspective, the expanded subsidy program in 2025 will directly stimulate consumption, enhance consumer confidence and drive domestic demand, particularly in the recovering Chinese economy. Still, the requirement for smartphone product pricing and subsidy caps are stricter compared to those for home appliances. Home appliances have no product price restrictions and the subsidy cap per item is set at CNY2,000. The subsidy policy falls short of consumer expectations from late last year, which will impose certain limitations on its stimulative effect.

Impact on smartphone vendors and channels

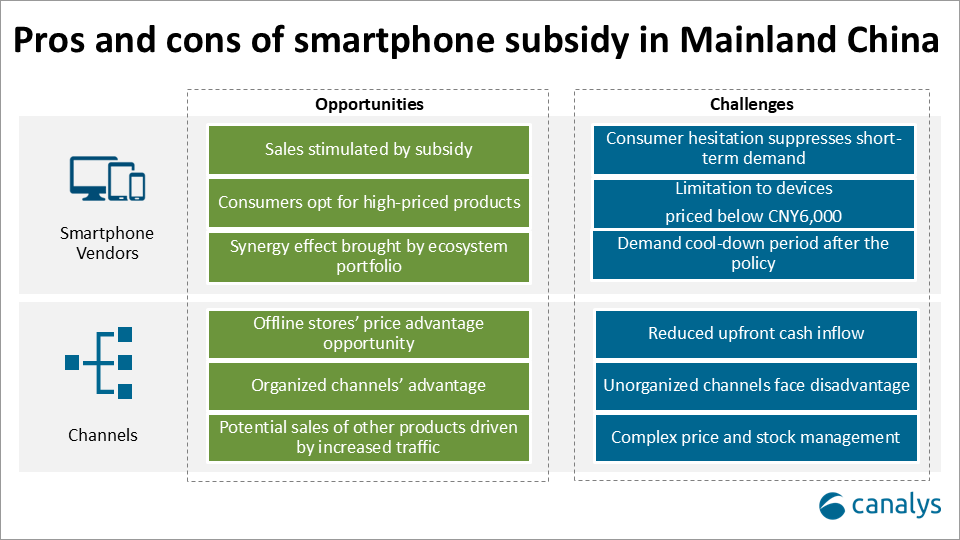

Besides the increased demand for device upgrades driven by subsidies, the subsidy policy brings new opportunities as well as operational and competitive challenges to vendors and channel players, including collaboration with the authority, financial management, pricing strategies and channel resource allocation. The subsidy policy will favor local vendors such as Xiaomi, HONOR, Huawei, vivo and OPPO, which offer comprehensive coverage from entry-level to mid-to-high-end products. Apple, with its high-end positioning, will face greater challenges. To maintain price competitiveness, resource investment and promotional efforts will need to be evaluated.

Canalys identifies the following key opportunities and challenges:

Opportunities:

- Consumers opt for higher-priced products: consumers within their upgrade cycles will be incentivized by subsidies, potentially reconsidering their budgets to purchase higher-priced devices.

- Synergy effects from ecosystem portfolios: subsidy coverage across PCs, tablets, smartphones, smart bands, smartwatches and even EVs offers hardware vendors with diverse product portfolios the potential to drive bundled purchases and attract ecosystem consumers.

- Offline stores’ price advantage: offline channels benefiting from local government subsidies may gain a competitive pricing edge over online channels.

- Organized channels’ advantage: large, organized channels with better financial capabilities and operational alignment with government requirements are likely to secure price advantages over smaller channels.

- Increased traffic drives sales of other products: government promotion of the subsidy program will draw more consumers to stores and online platforms, increasing the visibility and sales of other products.

Challenges:

- Consumer hesitation suppresses short-term demand: policy implementation varies across cities and channels, causing some consumers to delay purchases as they await subsidy activation and price comparisons.

- Limitation to devices price below CNY6,000: the price cap of CNY6,000 limits the benefits for high-end models and brands. It will complicate vendors’ product roadmaps and pricing strategies in 2025, as they strive to maximize subsidy benefits while ensuring product lineup continuity.

- Demand cool-down post-policy: the consumption growth driven by subsidies is not organic but accelerated. Once the subsidies end, a demand cool-down period is inevitable.

- Reduced upfront cash inflows: vendors and channels face reduced cash inflows as subsidies are claimed post-sales through government reimbursement processes.

- Unorganized channels are at a disadvantage: smaller channels with limited financial and operational capabilities are likely to struggle to compete with organized channels.

- Complex price and stock management: vendors and channels must manage pricing and inventory more carefully, ensuring supply, balancing price differences among channels and optimizing stock allocation.

Mainland China’s smartphone market outlook under subsidy policy in 2025

The subsidy program will boost annual smartphone shipments in 2025. However, several limiting factors need consideration:

- As noted, the increased sales will come from accelerated consumption and shortened device upgrade cycles instead of organic growth.

- The reference value of sales growth in cities with local subsidy programs in 2024 is limited, as these were concentrated in Tier 1 and Tier 2 cities. Additionally, regional policy differences mean sales growth includes contributions from surrounding areas.

- Products eligible for subsidies must meet the price requirement of below CNY6,000.

- The subsidy policy covers a wide range of products, from home appliances and automobiles to consumer electronics, which may affect consumers’ purchasing decisions and spending for smartphones.

Based on the assumptions above, Canalys has modestly raised the shipment forecast for Mainland China’s smartphone market in 2025. Annual shipments are expected to exceed 290 million units, representing nearly 3% to 5% annual growth from 2024.

Upcoming focus areas for forecasts

Canalys will closely monitor updates to the national subsidy scope, local government policies and vendors who are planning for channel investment.