Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Android brands' direction to compete in India’s premium smartphone segment

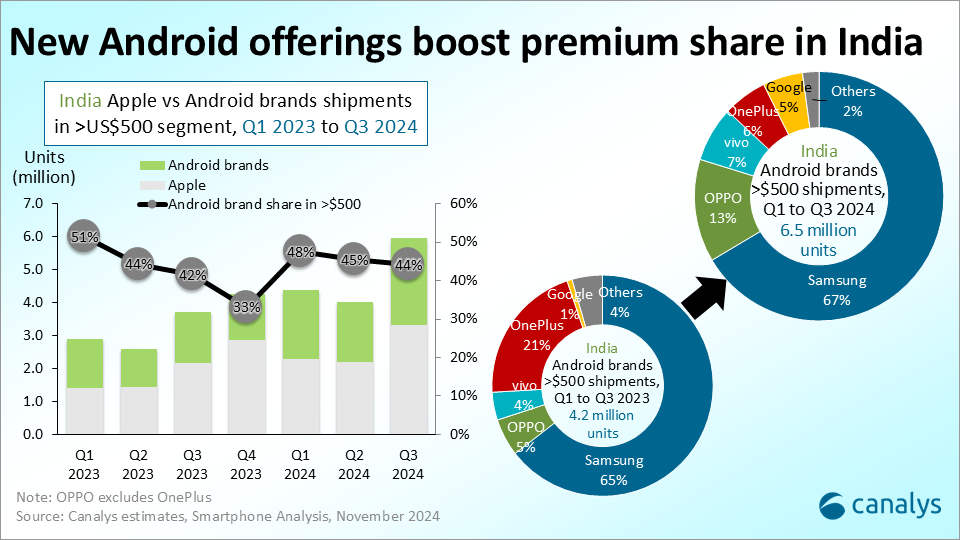

The premium smartphone segment in India, dominated by Apple and Samsung, is becoming increasingly competitive as Android brands aim to solidify their presence. While Samsung leads among Android players, leveraging its Galaxy AI strategy, other brands are exploring premiumization opportunities driven by rising disposable incomes, financing options and consumer aspirations.

The premium smartphone segment (over US$500) in India remains dominated by Apple which holds a 54% share, followed by Samsung at 30%, while the remaining share is held by other Android brands during YTD 2024 (Q1 to Q3). Among Android brands, Samsung led the segment driven by its aggressive Galaxy AI strategy this year. But other Android brands have struggled to gain traction despite market trends favoring premiumization through easy financing, enhanced offerings and rising disposable incomes, even in lower-tier cities. For these brands, premium devices primarily serve to showcase technological advancements and build a holistic portfolio, but this has not translated into sustained shipment growth beyond initial launch quarters. Investments in channels, cutting-edge products and branding are yet to deliver tangible results.

Samsung’s S24 series drove momentum, but premium share growth remained modest: in 2024, Samsung’s Galaxy S24 series maintained strong momentum but premium share growth has been limited. Samsung stood out in educating consumers about the Galaxy S24 Ultra’s AI capabilities, leveraging brand experience stores, targeted AI messaging and multiple campaigns in Tier-1 cities. However, the focus on the Ultra model overshadowed the Galaxy S24 and S24+ models, leading to limited shipment volumes for these variants.

It should also emphasize creating replacement and previous-generation model demand to further boost share growth in the premium segment. Maintaining competitive pricing for flagship models beyond the launch quarter will be crucial while shifting its ecosystem strategy to emphasize standalone value and advanced features rather than bundling. Additionally, Samsung will remain instrumental in terms of driving AI use cases for Indian consumers. It will look to further enhance its privacy and productivity messaging via AI in the future.

On the other hand, the rest of the Android brands face a key challenge in overcoming their perception as “value-for-money” players to achieve premiumization. To break this barrier, they must craft aspirational narratives that highlight how their products enhance lifestyle through superior performance, design and user experience. These Android brands will look to strengthen their positioning in the segment and should look to implement strategies around:

- Consumer education: other Android brands also offer strong features such as superior camera technology, AI-driven capabilities and seamless ecosystem integration. However, user education about these features remains inadequate, limiting their potential to attract premium consumers. Brands must highlight unique features in UI, design and ecosystem through experience stores and roadshows specific to locals. Hosting consumer workshops on advanced camera features for low-light photography, a critical need for Indian consumers during festivals and weddings, or regional language support in the UI, will help resonate strongly. Brands like Xiaomi, realme and Motorola, heavily reliant on ecommerce and social media marketing, must boost their ATL presence to attract younger, aspirational consumers. Experiential marketing, collaborations with influencers or celebrities, and campaigns aligned with regional festivals will deepen connections and reinforce their premium positioning.

- Retail-driven premium messaging: despite building a strong offline retail network in the market, these Android brands often struggle to sustain flagship model shipments beyond the launch quarter. To address this, they must leverage their offline channel networks by incentivizing retailers for consistent promotion, prime placement and target fulfilment. Staff training on device capabilities is essential to educate consumers and foster strong after-sales relationships. Indirect retail efforts also need bolstering, following the success of OPPO and vivo in large-format retail stores (LFRs), and other Android brands must increase their presence with dedicated booths and brand promoters. Additionally, offering exchange bonuses during key festivals like Diwali will drive demand in the premium segment, enhancing trade-in replacements and increasing after-sales value for flagship models.

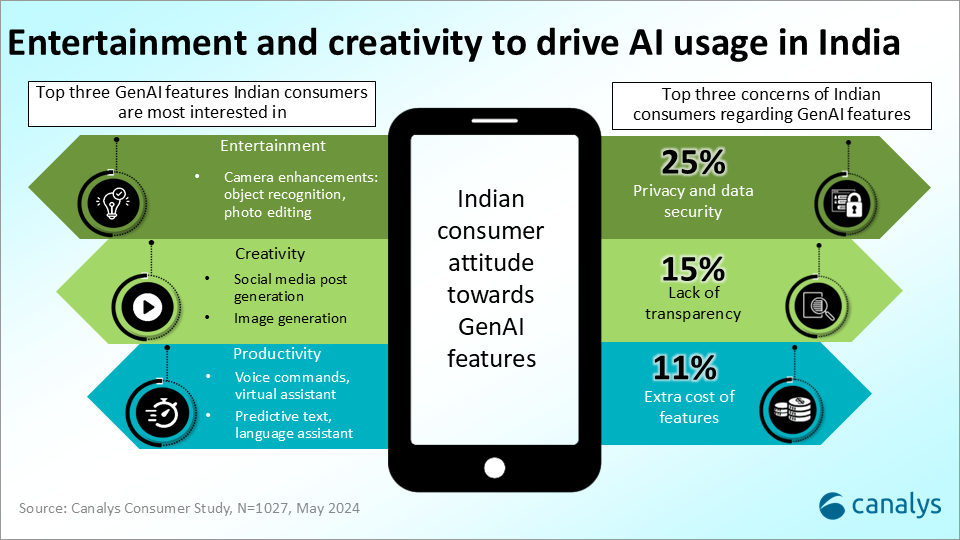

- Leveraging AI to drive upgrades: in 2025, Android brands will leverage AI to gain a competitive edge in the premium segment, focusing on the “3Ps” – personalization, privacy and productivity. India is a diverse market with consumer needs varying across language, culture, purchasing power and technological preferences, creating unique challenges and opportunities for brands to tailor their strategies effectively. Using AI to provide hyper-personalized experiences via regional language support, voice assistants and camera optimizations, will cater to premium experience. According to a recent Canalys consumer survey, 25% of consumers raised concerns about privacy and security regarding the GenAI features. By prioritizing edge AI for enhanced privacy and faster processing, brands must meet the security needs of premium consumers.

In 2024, foldable devices in the premium segment, led by Samsung, Motorola, OPPO and OnePlus, have gained traction. But book-style foldables face challenges around durability and app optimization, while flip-style devices struggle with limited innovation. While foldables will not drive significant volume in India in 2025, they will serve as marketing tools for Android brands.

To succeed in the premium segment, Android brands must shift from just showcasing tech advancements to crafting aspirational narratives that align with Indian consumer lifestyles. Focusing on competitive pricing, offline presence and brand loyalty will be key for growth in India’s premium smartphone market.