AI-capable PCs will transform the way we work

19 September 2023

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

The boom in generative AI was a watershed moment for the technology industry. PCs are the central tool with which businesses and consumers approach modern productivity and leisure, and they are now set to undergo a significant transformation in both hardware and software capability to enable the next wave of large-scale AI usage. Under an initial definition, Canalys expects a rapid trajectory for the penetration of AI-capable PCs into the market over the next four years.

As generative AI tools continue to proliferate, both businesses and consumers are actively integrating AI features to enhance productivity and leisure experiences. PCs, which are central to modern work and life, are now set to evolve in both software and hardware domains to keep pace with this trend.

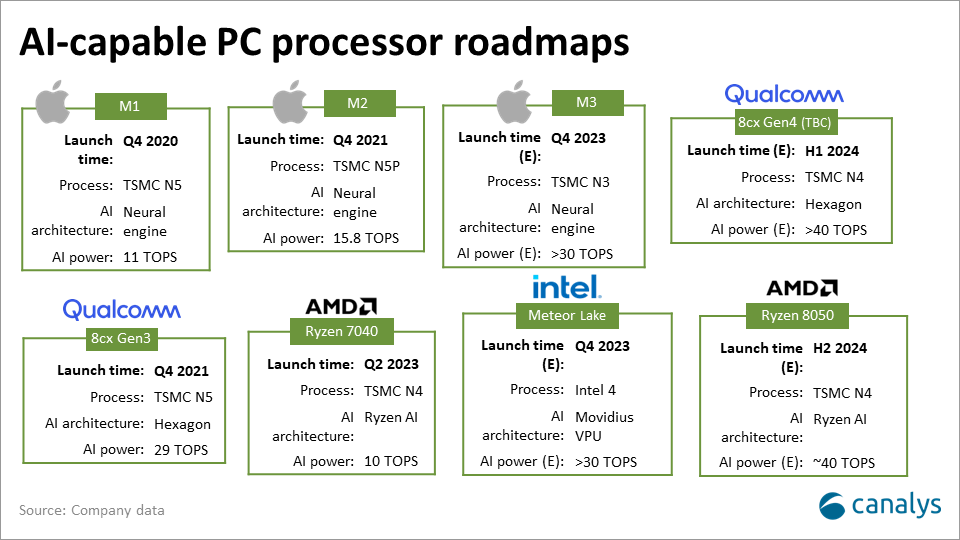

Defining the parameters of this emerging product category is crucial to sizing the market opportunity. Many PCs equipped with powerful CPUs and GPUs can already make use of AI functionality, often through leveraging cloud-based applications. However, truly meaningful AI use cases on PCs must prioritize real-time responsiveness, low latency and enhanced security. Therefore, an "AI-capable" PC must possess a dedicated chipset or block to accelerate AI computing. Prominent examples in the current landscape include Qualcomm's Hexagon Tensor Accelerator, Apple's Neural Engines, Intel's Movidius VPU and AMD's APU.

While this definition provides a starting point, Canalys acknowledges the potential for its future obsolescence. As AI-dedicated chipsets are expected to become commonplace in all mainstream processors in the long term, this sole distinction of an AI-capable PC may lose its meaning. Consequently, we anticipate that the definition will evolve as AI applications diversify, transitioning to a nuanced grading system based on each PC's AI functionalities and capabilities.

A thorough examination of each processor manufacturer's strategic direction and roadmap is essential for evaluating the evolving landscape of AI-capable PCs.

Apple introduced AI integration with its M1 Neural Engine in Q4 2020. By Q2 2023, with the upcoming M3 series and Intel's exit from Mac products, Apple became the first wholly AI-capable PC manufacturer. Meanwhile, Qualcomm enhanced its ARM-based 8cx Gen3 chipset's AI capabilities, aiming for greater market presence with a 2024 upgrade featuring the Nuvia architecture and Windows Copilot integration.

In the x86 realm, AMD introduced its AI offering with the "Phoenix" Ryzen 7040 series in Q2 2023, stealing a march over Intel’s Meteor Lake debut. This move encouraged PC OEMs to adopt AMD's technology early, capitalizing on the market's momentum. By H2 2024, AMD's anticipated 8050 series to promise further AI enhancements. Intel, despite its late entry, emphasized AI by embedding the Movidius VPU in its Meteor Lake range. Given Intel's market dominance, this strategy is set to drive more significant AI-PC adoption from 2024 onward. With its forthcoming Arrow Lake and Lunar Lake editions, Intel will up the ante with regard to AI chipsets, positioning itself at the forefront of the AI-capable PC revolution.

Moreover, vendors with substantial shipment volumes may consider developing their own processors using ARM or RISC-V architectures. While this approach would involve higher initial costs, it offers optimized performance, power efficiency and enhanced security. Over time, as shipment volumes grow, this strategy can lead to reduced costs, granting vendors greater resilience and ownership over their technology.

Our current definition of an AI-capable PC represents a foundational benchmark. With the most basic specifications, these PCs can manage basic functions such as running digital assistants like Cortana and Siri, real-time background blurring in video conferencing tools, and performing voice-to-text conversions.

For advanced AI software and tools, enhanced component performance becomes vital. Canalys expects that AI functionality available to users will undergo a rapid evolution over the coming years, ramping up in complexity. These advancements will amplify the need for components such as memory, storage and GPUs, eventually tailored to specific use cases. For instance, as optimized Large Language Models (LLMs) become pre-installed on PCs, a combination of increased storage capacity with high-speed interfaces becomes essential. Similarly, running these LLMs will necessitate more memory and a robust GPU.

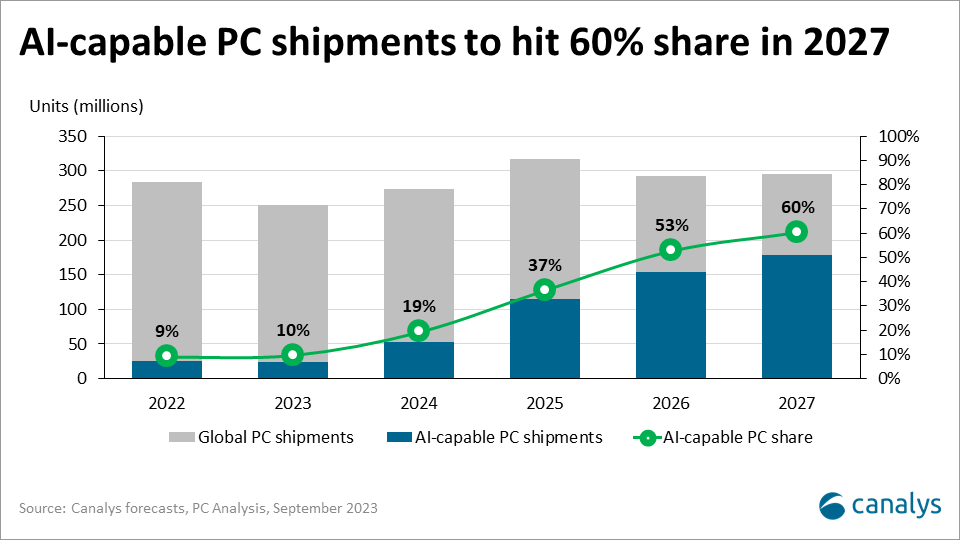

Based on our initial definition and the level of investment signaled across the industry, Canalys' projects a robust upward trajectory for AI-capable PCs. As of Q2 2023, driven by Apple's aggressive integration of Neural Engines, the AI-capable PC market witnessed shipments exceeding 5 million units. As x86 architectures enhance their AI capabilities, Canalys foresees a drastic surge in new AI-enabled models, beginning in the first half of 2024. By Q4 2024, shipments are expected to rise to around 20 million units, capturing over 25% of global PC shipments.

With the anticipated release of AI-enhanced features in the latest version of Windows by late 2024 and the widespread integration of AI tools in commercial and productivity software, the AI-capable PC market is set for substantial growth in 2025 and 2026. By 2027, shipments are forecasted to exceed 175 million units, constituting over 60% of total PC shipments. Between now and then, this sector is set to rise at a compound annual growth rate (CAGR) of 94%.