Generative AI will be a US$158.6 billion opportunity for the channel ecosystem by 2028

28 August 2023

The North American channel faces economic challenges and revenue pressures, and hence, leading partners are to prioritize diversifying their offerings. Despite pessimism, partners in North America expect growth in services revenue, particularly in professional services and managed services. For those looking to acquire, trends include a focus on services, cybersecurity and cloud offerings, while market consolidation is emerging. Challenges in establishing service capabilities persist, but partners who broaden their capabilities can protect themselves against economic shocks and access a larger market.

Though inflation has begun to settle in the North American market, channel partners continue to feel the impact of broader macroeconomic volatility on their businesses. In the annual Canalys Partner Pulse survey, 40% of respondents in North America said they did not expect any revenue growth in 2023. Leading partners such as CDW and Insight Enterprises continued their year-on-year revenue decline, posting revenue declines of 8.5% and 16% respectively for Q2 of 2023. Channel partners are diversifying their portfolios, in part to try to minimize the impact of declining hardware revenues on their top and bottom lines. With tightened customer budgets, partners know they must find new ways to help end-users extract the maximum value from their IT investments.

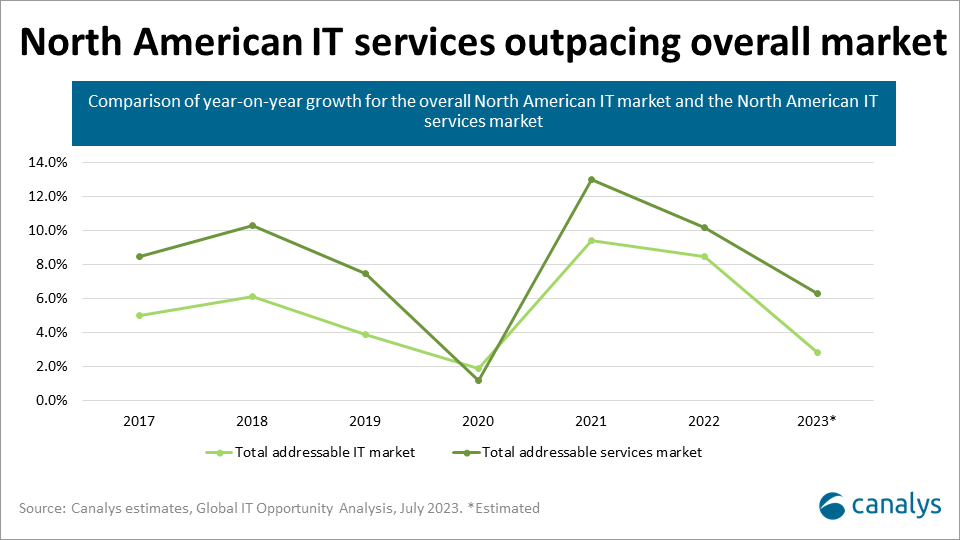

Digging further into the partner survey data, we can see where they are focusing their efforts. 64% expect their professional services revenue to grow, while 62% expect growth in revenue from their managed services offerings. Canalys is forecasting year-on-year revenue growth in the North American services segment of 6.3% in 2023, outstripping the total market growth of 2.8%. It is perhaps no surprise then that two-thirds of partners in the North American market will be looking to prioritize their professional services and managed services strategies in 2023.

The desire to grow services revenue in difficult market conditions is logical, but it can be expensive and takes time. Since 2018, there has been a boom in M&A activity in the channel, led by private equity and venture capital funding which has taken advantage of low interest rates and the (over) supply of new vendors and channel partners who were borne by the same market conditions. Since 2022, interest rates have risen to their highest levels in over two decades, and with it, the cost of M&A activity. These rate rises are both the result and cause of wider economic uncertainty.

While the trend in the first half of 2023 has been damaging for those looking to IPO or even those seeking private equity funding, it presents an opportunity in the channel, especially for non-enterprise partners with healthy balance sheets. Large enterprise competitors and institutional investors have pulled back slightly and valuations have normalized somewhat. This creates an opportunity for smaller channel partners who are looking to grow their own services capabilities through M&A. Valuations for the highest-performing service providers are still high, but there are still gems to be found in the SMB sector. Smaller partners looking to acquire are not facing the same levels of price competition as they have done in previous years. It is this opportunity that perhaps explains why 41% of partners in North America have indicated that they would consider some sort of acquisition in 2023.

For those partners who have acquired other channel companies, there have been a number of clear trends in the North American market:

Despite a 6.1% year-on-year increase in the number of MSPs in the North American market in 2022, 2023 has seen some consolidation among resellers delivering less than 10% of their revenue from managed services as they grew their capabilities organically and through acquisition. MSPs (channel partners making more than 50% of their revenue from managed services) have also been acquiring one another. Notable examples include the 20 MSP group, which has continued its acquisition strategy in 2023, adding six more companies so far within the North American channel, while Intelligent Technical Solutions acquired five MSPs in the western US. Challenges in establishing services capabilities will continue to exist for partners, particularly when it comes to acquiring talent and resources. Despite this, those partners who are able to continue to broaden their services capabilities will better protect themselves against future economic shocks, while also accessing an increased TAM that will strengthen their profitability.