The top 218 industry events for MSPs, VARs and tech channel professionals

18 May 2023

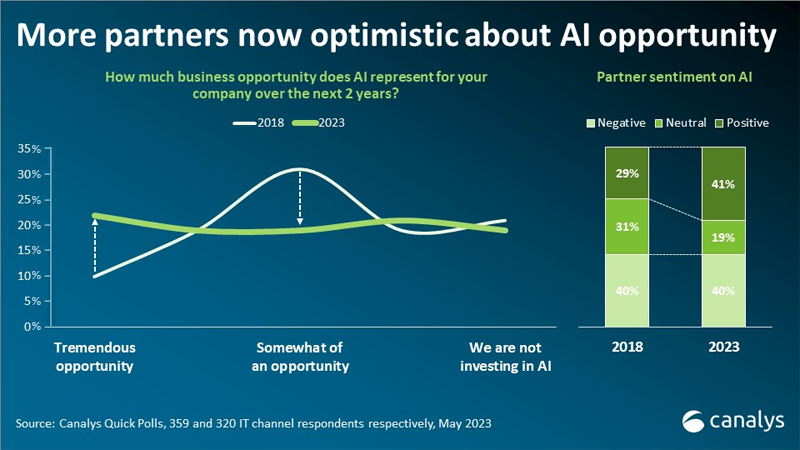

A Canalys poll reveals that 41% of partners are now optimistic about the opportunities associated with AI, indicating a significant shift in momentum and an increase in optimism within the partner community. Vendors need to focus on partners building service practices around AI and engaging with marketing and sales collateral that focuses on AI. In contrast, negative partners need dialogue and education to address concerns about fear, complexity and assumptions.

More partners are now optimistic than pessimistic about the business opportunities they can generate with AI. Earlier this month, we highlighted how one such partner, Slalom, was designing a service practice to help customers prepare to adopt Microsoft Copilot. Today, we unveil the latest Canalys poll, which shows that 41% of partners are now optimistic about the opportunities associated with AI.

It is interesting to see the shifts in momentum across the partner community. We ran this same poll back in 2018 and what we now see is a large decline in the number of partners that are neutral on the opportunities, replaced by an influx of partners that are now feeling largely positive. It is safe to infer that ChatGPT is the primary driver behind this massive shift, and this is more recent evidence that 2023 is a turning point in AI adoption.

Whenever we run polls of this nature, we see a distribution of responses across the landscape – those that are positive, those that are neutral and those that are negative. The 2018 graph is typically what we see with a new technology, with most respondents sitting on the fence and taking a neutral stance. They are aware of the technology, are engaged in conversations and may have been involved in a few opportunities that are closely associated with the topic in question. But for the most part, they are reserving judgment to see how it plays out. AI was certainly prevalent in the market in 2018. After all, this was seven years after IBM’s Watson won a game of Jeopardy, two years after Salesforce.com launched Einstein and a few months ahead of Juniper buying Mist (a WLAN vendor that leaned on its AI credentials). Yet, according to Google search trends, “Artificial Intelligence” only generated a tenth of the amount of search traffic in 2018 as it does today.

Fast forward to 2023 and the partner ecosystem is a much more split camp, with roughly the same number of partners that are positive as those that are negative. Positive partners are those that see either “tremendous” or “significant” opportunity – essentially, those that can see a path to generating strong growth on the back of AI. This is understandable given the recent industry developments following ChatGPT’s explosion onto the scene. Microsoft announced plans for Copilot; Google announced Bard and made AI the central theme at its latest developer conference; AWS announced a slew of AI innovations that partners can take advantage of. The opportunities for the technology industry are starting to materialize. But it’s also worth noting that there remains a camp of partners (about 40% across both the 2018 and 2023 polls) that does not expect to have a strong AI business. Unfortunately, the polls don’t yet tell us why that is, but Canalys will continue research into this field to understand how partners are truly feeling about this transformative topic.

In the meantime, vendors need to separate the wheat from the chaff when it comes to driving their AI strategies through partners. That means focusing on those partners that are building services practices around AI; are engaging with marketing and sales collateral that focuses on AI; are producing their own thought leadership and case studies around AI uses; and are selling solutions that are embedded with AI capabilities. These partners will be at the forefront to help companies become leaders in this field.

For the remaining negative partners, it is a matter of dialogue and education. Does the skepticism stem from fear and complexity, and an idea that AI is only reserved for the most resourced companies on the planet? ChatGPT alone should have allayed those fears. Or does the skepticism come from an assumption that AI will become so pervasive that it doesn’t become a differentiator anymore? Former Cisco CEO, John Chambers, has long been saying that “every company will be a digital company” and is now stating that “every company will be an AI company.” But if that is the case, it will drive a whole cycle of technology investment – from compute needs to connectivity to new devices to cybersecurity to professional services. Whatever the doubts, we are in an exciting age of discovery and of accelerated investment. We expect that those partners that are skeptical about the opportunities now will soon begin to sing a different tune.

If you are a channel partner keen to learn about the opportunities in AI, we encourage you to register for Canalys Forums 2023. These events will provide partners with the opportunity to learn more about the latest trends in AI and address how they can swiftly adapt to meet the changing needs of their customers alongside top distributors and channel-committed vendors. See you there!

EMEA: 3 – 5 October | NORTH AMERICA: 13 – 15 November | APAC: 5 – 7 December