Record number of leading distributors to support the Canalys Forum EMEA 2023

11 May 2023

The value of the technology stack is growing for partners building managed services solutions; it is vital to align technology integrations with business outcomes.

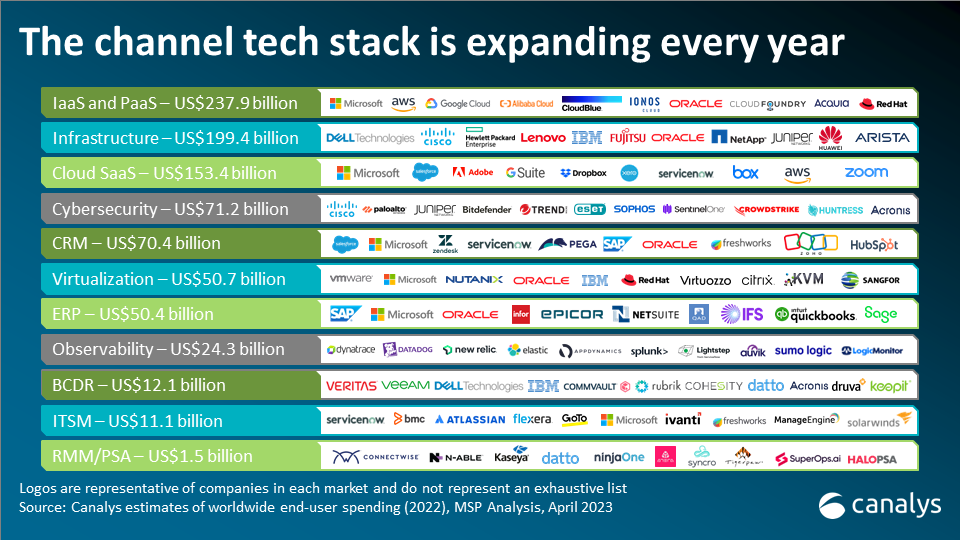

Every year Canalys looks at the stack of technologies most commonly used by channel partners to build professional and managed services for their end-customers. End-customers are, in many cases, not as interested in the technology itself as they are in the solutions it can provide. More directly, customers care about the things which make more money or save it. To deliver a valuable managed service, partners must become experts in the technology and their customers’ businesses, so they can strike that balance. What the tech stack shows us today is the level of complexity partners must contend with. In this blog, we’ll take a quick look at the latest trends, ahead of these important issues getting in-depth scrutiny at the APAC, EMEA, and North American Canalys Forums 2023.

Looking at the total value of end-customer spend in each of the technology areas above tells us only one small part of the picture. For example, the total spend in RMM (remote monitoring and management) and PSA (professional services automation) is dominated by sales to MSPs (managed service providers) because they are also the vast majority of end-customers which use the technology to deliver services to customers.

However, in infrastructure or cloud SaaS, the vast majority of total spend is done by end-customer businesses which are not channel partners, even though the technology may be sourced by partners on behalf of those businesses.

There is, therefore, a need to differentiate between the spending that is generated by ‘sell to’, ‘sell’ through’ or ‘sell with’ motions in the channel, as well as spend generated directly between vendor and end-customer.

The interdependencies of these technologies and the ways in which greater sales of one can impact the other are at the heart of the ecosystem model. Increased sales of RMM technology or observability for networks are an indicator of greater need for other technologies such as backup, cybersecurity, or hybrid infrastructure, for example. Therefore, building alliances with vendors in those interconnected technologies and marketing to those alliances will likely bring about greater opportunities. But it is the ways in which those alliances are marketed towards the business outcomes available to customers, which ultimately close the circle.

In the MSP world, vendors understand integrations and alliances are their biggest assets. But across the technology stack there are many different vendors, at different stages of development and with different channels and partnerships. Startup vendors often look to build brand awareness and sell direct to end-customers (though many established vendors are also primarily selling direct). More established vendors tend to look at consolidating their market positions or gaining points of market share. Competitive advantage can be found in many places, and building managed services-ready product strategies is a vital element in this journey.

Most vendors are operating with a hybrid channel today, whether they are aware of it or not, meaning their partners are often a mix of business models from resell, integration, professional and managed services. However, a reseller with a small percentage of managed services revenue is an addressable managed services partner if viewed through the lens of the interconnected tech stack. Even if they are aware, they may not be leveraging its full capabilities or enabling that channel in the right ways. Much is made of AI and its abilities to automate processes, but the same is true of integrations and their power to enable channel partners by improving workflows, cutting costs and freeing up resources. A technology vendor’s brand is not its own, but the sum of its partnerships.

Understanding one’s position in the tech stack is the first step to increasing the value of that brand. Aligning technology integrations with the best business outcomes, improving alliance partnerships to better automate data flows, sales and billing processes, and tracking successes and failures in an iterative manner all help to build a more virtuous circle for channel partners and their customers.

I’ll be discussing these issues alongside our global teams of channels analysts at the Canalys Channels Forums 2023. Channel partners will be able to hear from their peers as to what is working and what they are planning. To attend, register your interest at: https://www.canalys.com/events

EMEA: 3 – 5 October | NORTH AMERICA: 13 – 15 November | APAC: 5-7 December