Partners are ready to capture AI opportunities

18 May 2023

The demand for cybersecurity-managed services is expected to grow by 16% to US$70.2 billion in 2023, providing partners with significant growth opportunities. This blog suggests ways for partners to adapt to the changing landscape and meet the changing needs of their customers.

Channel partners play a vital role in the cybersecurity ecosystem by improving the cyber-resilience of their customers. Over 90% of the US$223.8 billion cybersecurity spend (on technology and services) in 2023 will go through the partner community. Advising customers on technology selection remains an essential function fulfilled by partners, given the highly fragmented vendor landscape and the need for organizations to consolidate supplier relationships. But providing 24/7 monitoring, threat hunting and incident response, as well as other cybersecurity managed services, is now more important as threat levels rise and the skills shortage widens.

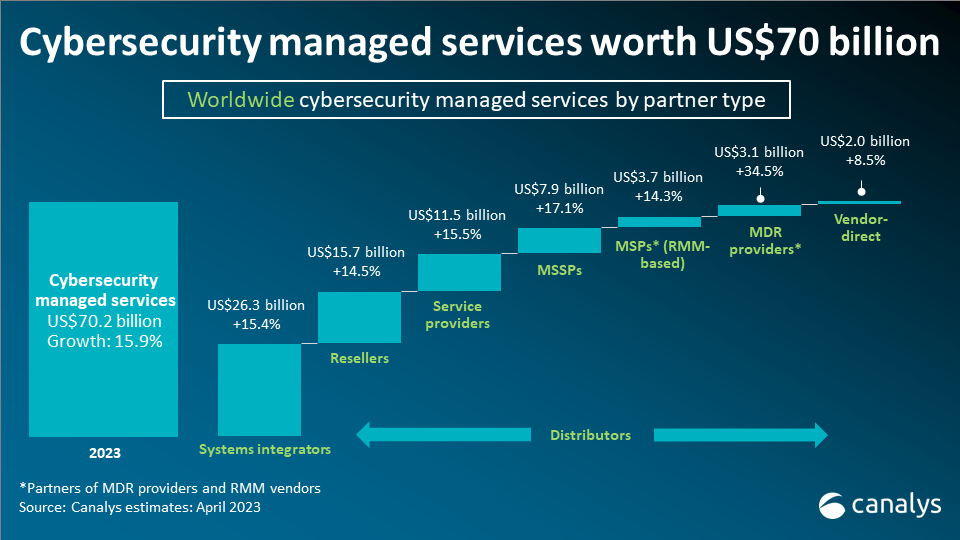

The demand for cybersecurity managed services will grow 16% to US$70.2 billion in 2023, according to Canalys estimates. Managed services represent the most significant growth opportunity for the cybersecurity channel, but capitalizing on it is not guaranteed for all partners. Customer requirements have diversified beyond just managing the administration of cybersecurity technology used for protection in terms of setting up, modifying rules and configurations, patching, updating, operating and monitoring, as well as backup and disaster recovery. More operational-focused managed services delivered via SOCs are in high demand as organizations struggle with the complexity of integrating multiple technologies, dealing with too many alerts and trying to manage the workforce gap. Identifying, classifying, prioritizing and remediating vulnerabilities, external attack surface reduction, penetration testing, security information and event management (SIEM) as a service, and awareness training are all key areas of growth. But customers need more holistic XDR-managed services that provide detection and response to deal with the entire lifecycle of incidents, which are increasing in frequency, complexity and severity.

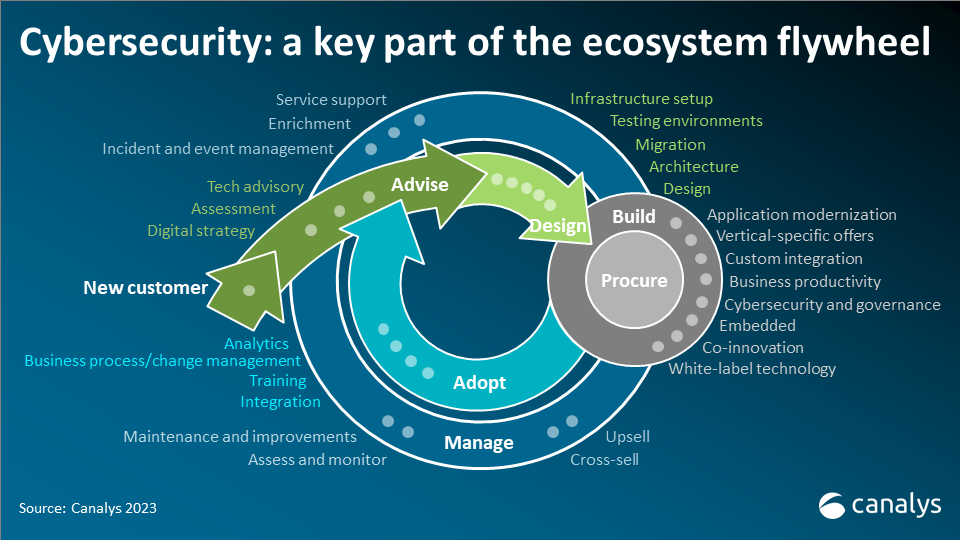

The cybersecurity-managed service provider landscape is highly diverse, consisting of a range of partner types with different capabilities, business models and customer focus. They also play different but essential roles in the Partner Ecosystem Multiplier economy, with cybersecurity acting as a catalyst for revenue opportunities within each segment of the Canalys Partner Ecosystem Flywheel.

The cybersecurity channel is facing several challenges, including keeping up-to-date on the constantly shifting threat landscape, recruiting and retaining skilled SOC analysts and engineers, managing complexity within their vendor portfolio, scaling their capabilities, as well as increasing competition. However, there are also huge growth opportunities, especially managed services, despite the uncertain economic environment and increased customer scrutiny on spending.

Partners that can adapt to the changing landscape and provide customers with the technology and services to increase their cyber-resilience will be best placed to succeed. This will require a focus on innovation, collaboration and customer service.

If you are a cybersecurity partner, we encourage you to register for Canalys Forums 2023 at: https://www.canalys.com/events. The events will provide channel partners with the opportunity to learn more about these latest trends in cybersecurity and address how they can swiftly adapt to meet the changing needs of their customers alongside top distributors and channel-committed vendors.

EMEA: 3 – 5 October | NORTH AMERICA: 13 – 15 November | APAC: 5-7 December

This research is taken from the much more in-depth client report 'Now and Next for the cybersecurity ecosystem in 2023'. Do get in touch if you're interested in accessing this.